Australia Pharmaceutical Labeling Market Size, Share, Trends and Forecast by Label Type, Material, Application, End Use, and Region, 2025-2033

Australia Pharmaceutical Labeling Market Overview:

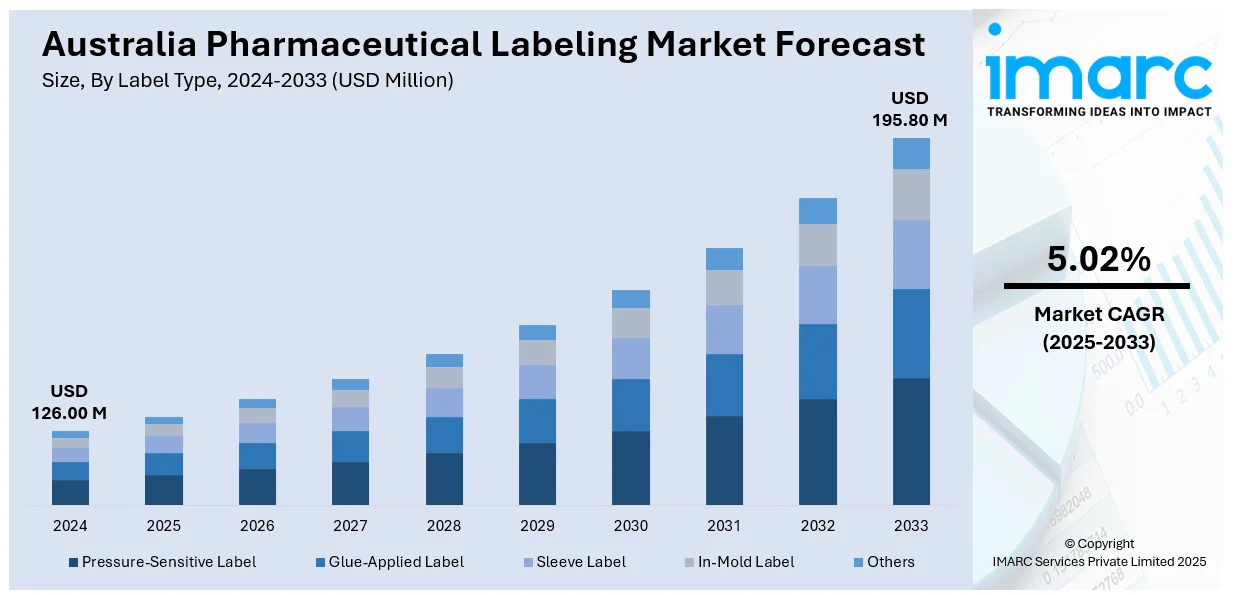

The Australia pharmaceutical labeling market size reached USD 126.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 195.80 Million by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. The market is being driven by the elevating demand for regulatory-compliant and accurate labels, stricter regulations, the rise of biopharmaceuticals, the proliferation of personalized medicines, advancements in labeling technologies such as RFID and smart labels, and increasing consumer demand for transparency and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 126.00 Million |

| Market Forecast in 2033 | USD 195.80 Million |

| Market Growth Rate 2025-2033 | 5.02% |

Australia Pharmaceutical Labeling Market Trends:

Integration of Advanced Technologies in Pharmaceutical Labeling

The Australian pharmaceutical industry is increasingly embracing advanced technologies to improve labeling accuracy, security, and efficiency. One key development is the integration of smart packaging solutions, such as track-and-trace systems and tamper-evident features, which not only ensure compliance with strict regulatory standards but also address rising concerns about counterfeit medications. The growth of the pharmaceuticals packing and labelling services industry in Australia reflects a significant investment in these technologies, aimed at meeting evolving regulatory requirements and enhancing patient safety. The adoption of variable data printing for personalized labeling also helps improve patient engagement and medication adherence. The industry's shift to sustainable and eco-friendly labeling materials supports worldwide environmental initiatives and meets customer demand for ethical products. A survey found that about 80% of Australian customers consider package composition when making purchase decisions, with 62% prepared to pay more for eco-friendly packaging. This shift is driving pharmaceutical companies to invest in biodegradable and recyclable labeling materials, boosting the labeling market's overall growth.

To get more information on this market, Request Sample

Regulatory Compliance and Standardization in Pharmaceutical Labeling

In Australia, stringent regulatory frameworks, particularly enforced by the Therapeutic Goods Administration (TGA), mandate strict adherence to labeling standards to ensure patient safety and effective drug use. In 2024, the Australian government allocated c. AUD 43 billion to the Pharmaceutical Benefits Scheme (PBS), underscoring its commitment to accessible and safe medications. The rise of personalized medicine and biologics has introduced new complexities in labeling, requiring precise, detailed information to guide both healthcare professionals and patients. This complexity fuels the demand for specialized labeling solutions capable of accommodating variable data while meeting evolving regulatory requirements. Additionally, the growing prevalence of chronic diseases and an aging population highlights the need for accurate labeling to manage increasingly complex medication regimens. As Australia's pharmaceutical market is projected to grow at a CAGR of 2.60% (2025-2033), reaching USD 31.1 billion by 2033, the demand for compliant, standardized labeling solutions is expected to surge. This trend is driving investments in labeling technologies that enhance accuracy, patient safety, and regulatory compliance, further bolstering the growth of the pharmaceutical labeling market.

Australia Pharmaceutical Labeling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on label type, material, application, and end use.

Label Type Insights:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

The report has provided a detailed breakup and analysis of the market based on the label type. This includes pressure-sensitive label, glue-applied label, sleeve label, in-mold label, and others.

Material Insights:

- Paper

- Polymer Film

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paper, polymer film, and others.

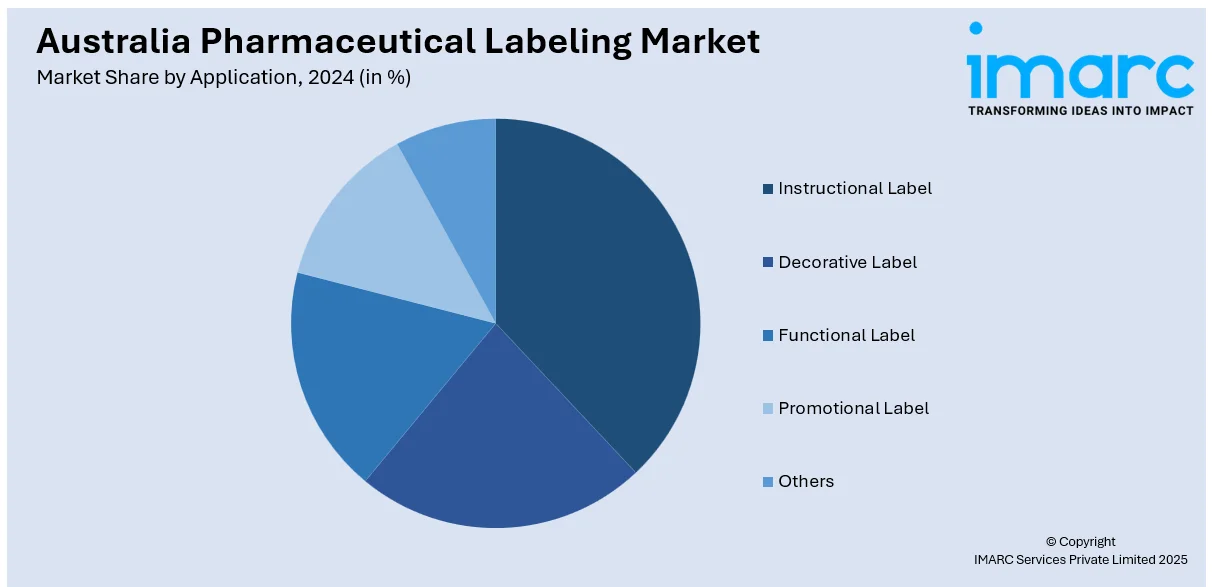

Application Insights:

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes instructional label, decorative label, functional label, promotional label, and others.

End Use Insights:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pharmaceutical Labeling Market News:

- January 2025: Schreiner MediPharm introduced the Cap-Lock label for prefilled syringes, a functional label that combined the Schott Topac infuse COC syringe with a specialty cap. The cap design was the same diameter as the syringe barrel, allowing the label to be reliably applied to the syringe. The Cap-Lock label offered an irreversible first-opening indication, ensuring the integrity of the prefilled syringe from production to use.

- August 2024: Avery Dennison launched AD Minidose U9XM UHF RFID high memory inlays and tags for the unique identification of smaller pharmaceutical and healthcare goods. Additionally, Auburn University's RFID lab authorized these inlays for usage in healthcare applications.

Australia Pharmaceutical Labeling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Instructional Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pharmaceutical labeling market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pharmaceutical labeling market on the basis of label type?

- What is the breakup of the Australia pharmaceutical labeling market on the basis of material?

- What is the breakup of the Australia pharmaceutical labeling market on the basis of application?

- What is the breakup of the Australia pharmaceutical labeling market on the basis of end use?

- What are the various stages in the value chain of the Australia pharmaceutical labeling market?

- What are the key driving factors and challenges in the Australia pharmaceutical labeling market?

- What is the structure of the Australia pharmaceutical labeling market and who are the key players?

- What is the degree of competition in the Australia pharmaceutical labeling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pharmaceutical labeling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pharmaceutical labeling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pharmaceutical labeling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)