Australia Pharmaceutical Packaging Market Size, Share, Trends and Forecast by Material, Product, End User, and Region, 2025-2033

Australia Pharmaceutical Packaging Market Overview:

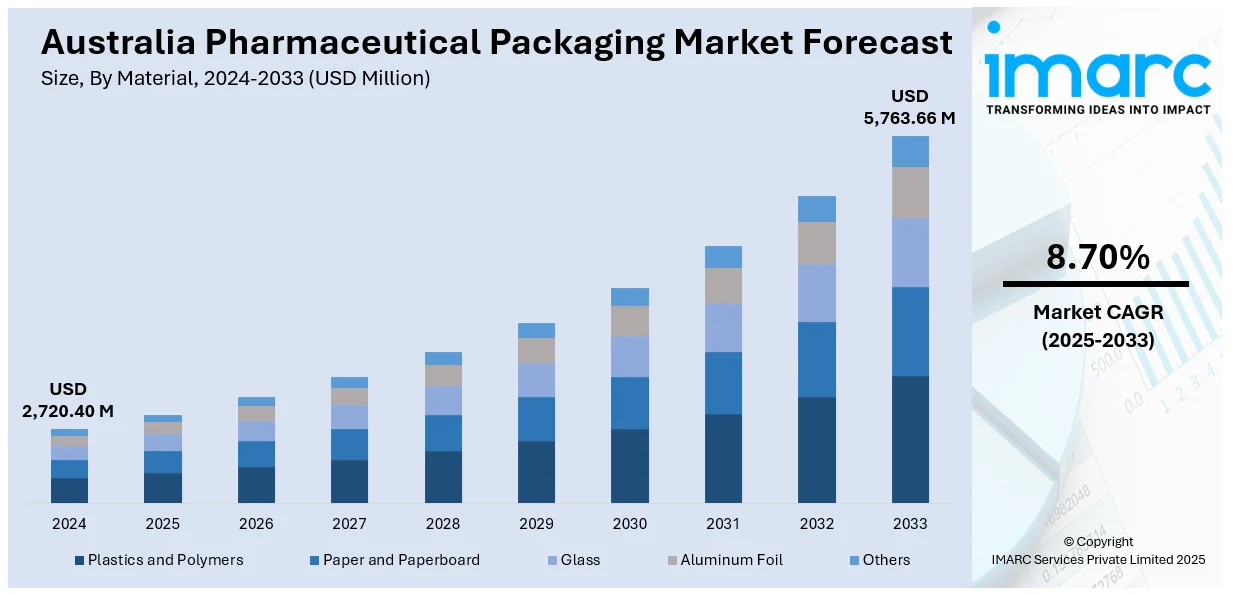

The Australia pharmaceutical packaging market size reached USD 2,720.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,763.66 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is influenced by heightening healthcare demand, regulatory compliance requirements, and innovation in sustainable, smart, and patient-focused packaging solutions throughout pharmaceutical manufacturing and distribution.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,720.40 Million |

| Market Forecast in 2033 | USD 5,763.66 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Key Trends of Australia Pharmaceutical Packaging Market:

Rise of Sustainable and Recyclable Packaging Solutions

Australia's pharmaceutical industry is making a strategic shift toward recyclable and sustainable packaging material as environmental legislation and consumer awareness increasingly escalate. Growing implementation of environmentally friendly packaging materials like recyclable plastics, biodegradable paperboard, and compostable laminates evidences the sector's drive to reduce its footprints on the environment. Companies are reengineering packaging to minimize the use of materials while preserving drug integrity and adherence to safety regulations. This movement is further backed by state-led sustainability efforts and carbon footprint savings in supply chains from pharma stakeholders. Adding minimalist designs and single-material constructs not only makes recyclability effortless but also resonates with the world's move toward circular economies. As additional pharmaceutical industry players embrace such green practices, Australia pharmaceutical packaging market outlook is set to be positively impacted by this green shift, solidifying the nation as a forward-thinking and environmentally responsible healthcare market poised for long-term, sustainable growth. For instance, in May 2024, EMBALL'ISO began full operations in Australia and New Zealand, extending its supply of environmentally friendly isothermal pharmaceutical packaging through its newly created subsidiary, EMBALL'ISO Australia.

To get more information on this market, Request Sample

Innovations in Smart and Tamper-Evident Packaging

The growth in smart packaging technology is changing the pharmaceutical packaging industry in Australia at a very fast rate. Addition of tamper-evident seals, QR codes, RFID tags, and NFC systems has greatly improved security, trackability, and patient involvement in drug use. The technologies improve authenticity guarantee and assist in prevention of the flow of spurious medicines, which is an important aspect for patient safety and regulatory adherence. Moreover, intelligent packaging allows real-time data exchange between patients and medical professionals, making it easier to monitor drug compliance and enhance treatment efficacy. Interactive packaging formats are also finding increased acceptance in outpatient and homecare environments, further boosting market penetration. Such capabilities are anticipated to observe heightened adoption across prescription and over-the-counter (OTC) markets. As intelligent technologies become part of packaging formats, Australia pharmaceutical packaging market share is expected to amplify, mirroring a wider trend toward intelligent healthcare systems in the country.

Increased Customizable and Patient-Focused Packaging Formats

There is an intensifying focus on creating customizable pharmaceutical packaging solutions in Australia that are tailored to patient requirements. As per the sources, in January 2024, Merck Life Science began utilizing Woolpack insulation in Australia, substituting EPS and removing 3.6 tonnes of non-recyclable waste each year, aiding its SMASH Packaging and sustainability goals. Moreover, this trend is strongest in pediatric and elderly segments, where convenience of access, clarity of dosage, and ease of handling top the list. Examples include innovations like blister packs with label instructions, unit-dose packaging, ergonomic lid systems, and calendar-oriented packaging. Personalization efforts in clinical trial packaging have also introduced adaptable formats that can be adjusted according to trial protocols, dosage modifications, or patient demographics. Design for such user-friendly and accessible packs guarantees regulatory acceptance while improving patient experience overall. Such innovations symbolize not just a move toward patient empowerment but also buying behavior in hospitals and pharmacies. As convenience needs and user-friendliness needs increase, Australia pharmaceutical packaging market growth is bound to mount on the back of a consumer-centered approach to therapy support.

Growth Drivers of Australia Pharmaceutical Packaging Market:

Rising Demand for Medicines

The rise in chronic diseases such as diabetes, heart disease, and respiratory conditions is greatly driving the demand for pharmaceuticals in Australia. Coupled with an aging population that requires ongoing medication management, this demand underscores the necessity for reliable and innovative packaging solutions. Packaging plays a crucial role in the secure storage and transportation of medicines while also enhancing patient adherence through user-friendly designs and clear labeling. The rise in both prescription and over-the-counter medication consumption has intensified the need for efficient packaging systems throughout the supply chain. This trend directly enhances Australia pharmaceutical packaging market demand as manufacturers strive to address the growing healthcare requirements with secure and high-quality packaging formats.

Expansion of Biopharmaceuticals

Biopharmaceuticals, which encompass biologics and specialty medications, are becoming crucial in contemporary healthcare in Australia due to their effectiveness in managing complex and chronic conditions. Such products frequently necessitate highly specialized packaging that maintains drug stability, guarantees sterility, and protects against environmental influences. Packaging solutions for biologics require precise temperature control methods, including vials, pre-filled syringes, and cold-chain compliant containers. As the production of biopharmaceuticals expands, packaging manufacturers are investing in cutting-edge technologies to satisfy these needs while adhering to global quality standards. This growth is generating new avenues for packaging innovation and significantly propelling the advancement of the pharmaceutical packaging sector in Australia.

Regulatory Standards

Strict regulatory mandates are influencing the pharmaceutical packaging sector in Australia by enforcing high standards of quality, safety, and traceability. Packaging must adhere to guidelines that safeguard drugs from contamination, tampering, and counterfeiting throughout the entire supply chain. Essential elements include clear labeling, serialization, and tracking systems that meet compliance and enhance patient safety. These regulations are driving packaging companies to embrace modern technologies such as smart labeling, anti-tamper features, and environmentally friendly materials while maintaining functionality. Compliance fosters greater consumer trust and ensures global competitiveness for Australian pharmaceutical exports. According to Australia pharmaceutical packaging market analysis, regulatory frameworks remain a key driver ensuring innovation, reliability, and long-term market sustainability.

Government Support for Australia Pharmaceutical Packaging Market:

Stringent Quality Regulations

The Australian government imposes stringent quality regulations to guarantee that pharmaceutical packaging meets the highest standards of safety, authenticity, and reliability. These protocols are aimed at protecting patients by averting contamination, tampering, and counterfeiting. The regulatory frameworks also require clear labeling and dosage instructions, which improve patient adherence and lessen the chances of errors. Packaging companies must adhere to stringent guidelines concerning material safety, sterility, and traceability throughout the supply chain. By enforcing strict oversight, the government ensures that packaging maintains the integrity of medicines from production through to end-use. This dedication to quality strengthens consumer trust and reinforces Australia’s standing for dependable healthcare products in both domestic and global markets.

Encouragement of Sustainable Practices

Sustainability has emerged as a significant focus in Australia’s pharmaceutical packaging industry, with governmental policies actively promoting the adoption of eco-friendly and recyclable materials. Regulations and initiatives advocate for decreased dependence on single-use plastics, encouraging a transition to biodegradable alternatives and lightweight designs. These efforts are in line with broader environmental objectives, addressing concerns about packaging waste and carbon emissions. Companies are increasingly embracing green innovations, including compostable films, recyclable cartons, and energy-efficient manufacturing processes, bolstered by supportive policy frameworks. This movement toward sustainability benefits the environment and resonates with consumers who prioritize responsible practices. Government support for eco-friendly solutions is transforming the pharmaceutical packaging industry with a strong emphasis on long-term environmental responsibility.

Support for Innovation

The Australian government offers financial incentives, research grants, and collaborative programs to drive innovation in pharmaceutical packaging. This backing empowers companies and research institutions to create advanced solutions such as smart packaging with digital tracking, anti-counterfeit technologies, and novel barrier materials that enhance product shelf life. By fostering R&D, the government helps the sector stay competitive in addressing the increasing requirements of modern pharmaceuticals, particularly for biologics and sensitive medications. These initiatives also facilitate partnerships between industry and academia, promoting ongoing improvement and the commercialization of state-of-the-art technologies. By supporting innovation, the government is laying the groundwork for a resilient, future-ready packaging sector that balances safety, efficiency, and sustainability.

Australia Pharmaceutical Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on material, product, and end user.

Material Insights:

- Plastics and Polymers

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo

- Random

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polystyrene (PS)

- Others

- Paper and Paperboard

- Glass

- Aluminum Foil

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastics and polymers, [polyvinyl chloride (PVC), polypropylene (PP), (homo and random,) polyethylene terephthalate (PET), polyethylene (PE), (HDPE, LDPE, and LLDPE), polystyrene (PS), others], paper and paperboard, glass, aluminum foil, and others.

Product Insights:

- Primary

- Plastic Bottles

- Caps and Closures

- Parenteral Containers

- Syringes

- Vials and Ampoules

- Others

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes primary [plastic bottles, caps and closures, parenteral containers (syringes, vials and ampoules, and others), blister packs, prefillable inhalers, pouches, medication tubes, others], secondary (prescription containers and pharmaceutical packaging accessories), and tertiary.

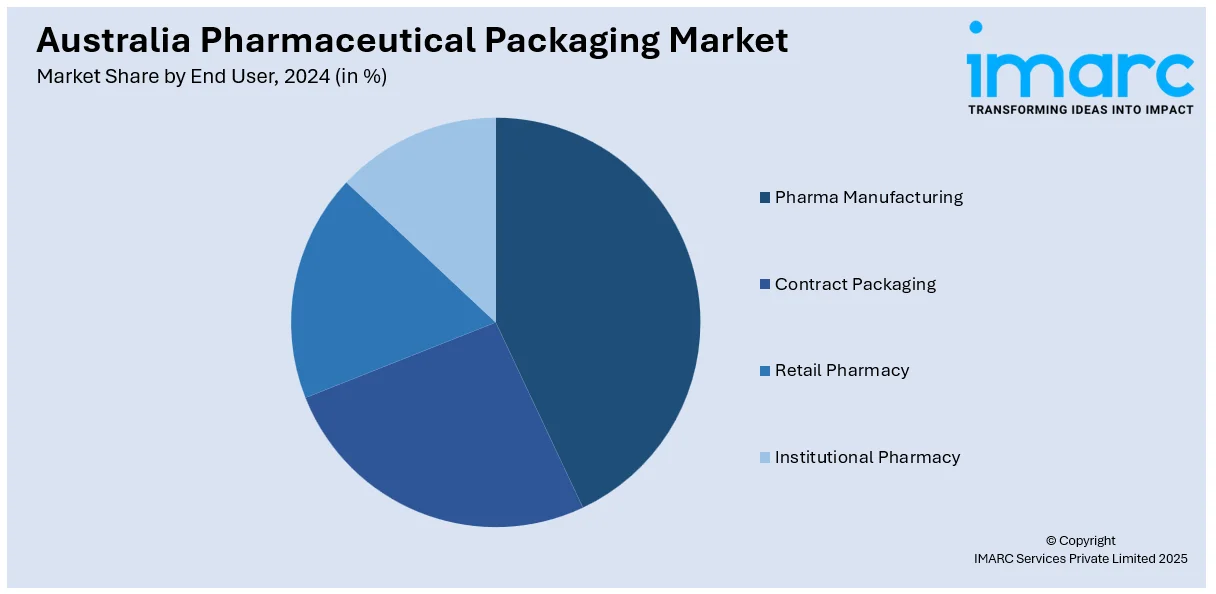

End User Insights:

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

The report has provided a detailed breakup and analysis of the market based on the end user. This includes pharma manufacturing, contract packaging, retail pharmacy, and institutional pharmacy.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Australian Pharmaceutical Manufacturers

- CGS Pharma

- Finishing Services

- Nupac Industries Pty Ltd

- Origin Pharma Packaging

- Platypus Print Packaging

- Rawson Print & Packaging

- TricorBraun Australia

- Tripak Pharmaceuticals

Australia Pharmaceutical Packaging Market News:

- In May 2024, TricorBraun acquired UniquePak and Alplas Products, two significant Australian packaging distributors. UniquePak is engaged in high-quality glass packaging to pharmaceutical, amongst others, industries. Alplas is in the business of industrial packaging. With this acquisition, TricorBraun strengthens its network in the markets of Australia and New Zealand with a widened array of products.

- In April 2024, PCI Pharma Services has finalized its acquisition of Pharmaceutical Packaging Professionals (PPP) in Melbourne, Australia. This move expands PCI’s capabilities in early-phase clinical drug manufacture and Cold Chain services. PPP’s Melbourne office will become PCI’s Asia-Pacific regional headquarters, supporting clinical trials across the region.

Australia Pharmaceutical Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered |

|

| Products Covered |

|

| End Users Covered | Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Australian Pharmaceutical Manufacturers, CGS Pharma, Finishing Services, Nupac Industries Pty Ltd, Origin Pharma Packaging, Platypus Print Packaging, Rawson Print & Packaging, TricorBraun Australia, Tripak Pharmaceuticals, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pharmaceutical packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pharmaceutical packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical packaging market in Australia was valued at USD 2,720.40 Million in 2024.

The Australia pharmaceutical packaging market is projected to exhibit a compound annual growth rate (CAGR) of 8.70% during 2025-2033.

The Australia pharmaceutical packaging market is expected to reach a value of USD 5,763.66 Million by 2033.

The Australia pharmaceutical packaging market is shaped by trends such as the adoption of smart packaging with digital tracking, rising use of eco-friendly and biodegradable materials, growing demand for patient-friendly designs, and increased focus on lightweight, cost-efficient solutions that enhance both safety and sustainability.

Growth is driven by rising demand for biologics requiring specialized packaging, expanding pharmaceutical exports, higher consumption of over-the-counter medicines, and technological advancements in packaging formats. Increased healthcare spending and focus on extending drug shelf life are further fueling the expansion of the pharmaceutical packaging industry in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)