Australia Pharmacy Retail Market Size, Share, Trends and Forecast by Market Structure, Product Type, Therapeutic Area, Drug Type, Pharmacy Location, and Region, 2025-2033

Australia Pharmacy Retail Market Overview:

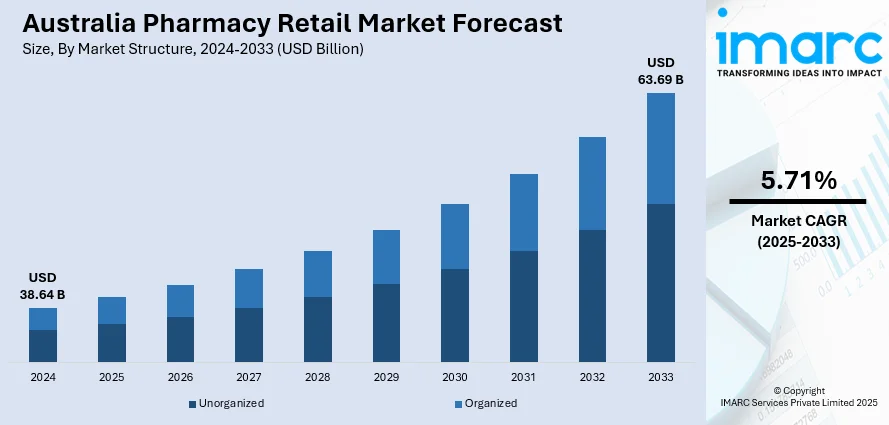

The Australia pharmacy retail market size reached USD 38.64 Billion in 2024. Looking forward, the market is projected to reach USD 63.69 Billion by 2033, exhibiting a growth rate (CAGR) of 5.71% during 2025-2033. Key factors driving the market include an aging population with increasing chronic disease prevalence, government healthcare initiatives, digital transformation through e-pharmacy platforms, expanded pharmacist roles, and growing consumer demand for convenient and accessible healthcare services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.64 Billion |

| Market Forecast in 2033 | USD 63.69 Billion |

| Market Growth Rate 2025-2033 | 5.71% |

Key Trends of Australia Pharmacy Retail Market:

Rising Prevalence of Chronic Diseases and an Aging Population

One of the strongest drivers behind the Australian pharmacy retail market is the growing prevalence of chronic diseases, particularly among the aging population. As the Australian Bureau of Statistics points out, the nation is witnessing a demographic shift, with persons aged 65 years and older expected to account for almost 20% of the overall population by 2030. This population trend is coupled with the rising prevalence of age-related chronic illnesses like diabetes, cardiovascular disease, arthritis, and respiratory illnesses. The propelling demand for ongoing treatment and medication compliance for these conditions is fueling prescription drug, medical supply, and routine health consultation demand, all of which are largely accessed through pharmacies. Pharmacy retailers are reacting by moving beyond the standard dispensing function to offer medication management programs, home delivery, telepharmacy services, and chronic care counseling. The Pharmaceutical Benefits Scheme (PBS) operated by the Australian government also guarantees subsidized access to necessary medicines so that a larger population can meet the cost of continuous treatment. Pharmacies are thus critical points of health access, particularly in rural and disadvantaged areas.

To get more information on this market, Request Sample

Expansion of Digital Health and E-Pharmacy Platforms

Another factor driving the market is the high rate of development and up-take of digital health products and solutions as well as e-commerce platforms is yet another significant factor driving expansion in the pharmacy retail market in Australia. There has been a noticeable change in consumer behavior in the Australian market as a result of high internet penetration, smartphone adoption, and affinity for convenient and contactless services, a process accelerated by the COVID-19 pandemic. Customers are extensively shopping online at pharmacy websites for prescription drugs, over-the-counter medicines, supplements, and wellness products. This has driven investments towards developing advanced e-pharmacy platforms that provide one-stop-shop integrated services such as online consultations, digital prescriptions, automatic refill reminders, and tracking of delivery. Startups as well as old pharmacy chains have started innovating to offer glitch-free digital consumer experiences, complemented by high-quality supply chain and logistics infrastructures. The regulatory reforms introduced, for instance, the acceptance of electronic prescriptions in all the states and territories, have complemented this transition to digital.

Expansion of In-Store Healthcare Services

Pharmacies throughout Australia are transforming into community healthcare centers by broadening their in-store clinical offerings. Historically focused on dispensing medications retail pharmacies now deliver services such as vaccinations, blood pressure monitoring, diabetes screenings, and medication reviews. This transition is alleviating the strain on general practitioners and hospital systems particularly in regional and underserved areas. By providing accessible, walk-in health services pharmacies are bolstering customer trust and increasing foot traffic. This evolution enhances healthcare accessibility and contributes to a rise in the overall Australia pharmacy retail market share. As consumer expectations shift toward integrated care, pharmacies that prioritize professional services are gaining a competitive advantage and becoming crucial points in the healthcare delivery system.

Growth Factors of Australia Pharmacy Retail Market:

Government Reforms

The Australian government is actively facilitating the transformation of pharmacies into community-oriented healthcare providers. Recent regulatory changes have broadened pharmacists’ roles to encompass services such as medication reviews, chronic disease monitoring, and even limited prescribing authority. These adjustments improve patient access to care especially in underserved or remote areas and reinforce pharmacies' status as an essential component of the primary healthcare framework. Furthermore, government funding for preventive health initiatives and community pharmacy programs is bolstering the sector. This policy-driven shift is significantly enhancing Australia pharmacy retail market demand by enabling pharmacies to address wider healthcare needs while providing more integrated and accessible services to local communities.

Consumer Focus on Preventive Healthcare

Consumer preferences are increasingly leaning toward preventive healthcare which is driving a rise in demand for wellness-oriented products and services. Australians are actively seeking out supplements, immunity boosters, vitamins, and over-the-counter (OTC) remedies to promote long-term health. Pharmacies are adapting to this trend by broadening their health and wellness product selections and investing in staff training for improved customer guidance. The heightened health awareness particularly in the wake of the pandemic has reinforced the role of pharmacies as primary destinations for comprehensive care. This evolving consumer mindset is significantly impacting Australia pharmacy retail market growth as pharmacies become reliable partners in not just treatment but also prevention and daily wellness support.

Digital Health Adoption

The integration of digital health tools is swiftly reshaping the pharmacy retail environment in Australia. E-prescriptions, online medication ordering, and telehealth consultations are making healthcare more accessible and convenient for consumers. Pharmacies offering digital platforms can streamline service delivery, minimize wait times, and enhance patient engagement. These advancements are especially beneficial in rural regions where physical access to healthcare may be restricted. Additionally, digital systems aid in better medication adherence through reminders and online refill notifications. According to Australia pharmacy retail market analysis, the technology adoption enhances operational efficiency and opens new growth avenues by aligning with contemporary consumer expectations.

Opportunities of Australia Pharmacy Retail Market:

Rural and Regional Market Penetration

Australia’s rural and remote areas often experience restricted access to healthcare services, which presents a notable opportunity for pharmacy retailers. By extending operations into these underserved regions, pharmacies can address critical healthcare needs while tapping into unserved demand. Initiatives such as mobile pharmacy units, satellite outlets, and telepharmacy services are being considered to deliver essential medications and healthcare support closer to remote communities. This geographic expansion enhances public health outcomes and aligns with national objectives aimed at achieving healthcare equity. With a growing population and increasing prevalence of chronic diseases in regional locations, pharmacy retailers can solidify their presence and develop lasting customer relationships, making rural penetration a vital strategic growth factor in the evolving Australian pharmacy retail sector.

Collaboration with Telehealth Providers

Partnering with telehealth platforms offers a strategic avenue for pharmacy retailers to broaden their healthcare services and simplify service delivery. By integrating virtual consultations with in-pharmacy medication dispensing, pharmacies can provide a seamless experience for patients particularly for those with mobility issues or residing in remote areas. These collaborations facilitate prompt diagnosis, prescription management, and treatment, enhancing both convenience and health outcomes. Additionally, telehealth partnerships can assist pharmacies in diversifying their revenue streams through offerings such as subscription services, chronic care plans, or virtual health monitoring. As digital healthcare gains traction, incorporating telehealth into pharmacy operations will be crucial to meet contemporary patient expectations and enhance accessibility, further solidifying pharmacies' role as reliable access points for healthcare.

Pharmacist-Led Health Programs

The rising acceptance of pharmacist-led health services is shifting the role of community pharmacies in Australia. Pharmacists are increasingly authorized to provide a variety of health programs such as medication therapy management, smoking cessation assistance, blood pressure monitoring, and diabetes assessments. These services contribute to the early detection and ongoing management of chronic conditions, alleviating the pressure on hospitals and general practitioners. As public confidence in pharmacist expertise grows, so does the willingness of patients to participate in regular in-store health consultations. This clinical expansion allows pharmacies to boost patient loyalty, set themselves apart from competitors, and generate additional revenue. The transition from a transactional to a service-oriented approach highlights the pharmacy sector’s evolution into a frontline care provider.

Government Initiatives of Australia Pharmacy Retail Market:

Community Pharmacy Agreement (CPA)

The Community Pharmacy Agreement (CPA) serves as a foundational initiative between the Australian Government and the pharmacy sector, designed to ensure stability, quality of service, and community access to pharmacy services. It allocates funding for professional programs, dispensing fees, and infrastructure support, significantly benefiting independent and regional pharmacies. Through subsequent CPA agreements, pharmacies receive support for expanded health services, enhanced workflow systems, and workforce training. The CPA also guarantees fair pricing and medication accessibility under the Pharmaceutical Benefits Scheme (PBS). This government-supported framework has reinforced pharmacy sustainability, encouraged public health delivery, and facilitated innovation within the sector. Consequently, the CPA continues to play a crucial role in maintaining pharmacy viability and driving strategic growth across Australia.

Incentives for Expanded Clinical Roles

The Australian government has rolled out various incentives to encourage the expansion of pharmacists' clinical duties. These initiatives motivate pharmacists to provide services traditionally performed by physicians, including immunizations, health screenings, medication reviews, and management of minor ailments. By financially supporting these offerings, the government aims to alleviate pressure on general practitioners and hospitals, particularly in regions facing healthcare access difficulties. This backing also fosters patient convenience, faster interventions, and improved healthcare outcomes. For pharmacy retailers, it opens new revenue opportunities and fortifies their position within the healthcare ecosystem. Ultimately, these expansions in clinical roles are transforming the pharmacy model from a product-centric retail environment to an integrated healthcare destination.

Digital Health Strategy Implementation

Australia’s Digital Health Strategy is transforming the pharmacy landscape through technological innovations that focus on patient-centered care. Key initiatives include electronic prescriptions, real-time prescription monitoring (RTPM), and integration with My Health Record. These tools allow for better medication tracking, minimize errors, and enhance coordination among healthcare providers. For pharmacies, this results in more efficient operations, improved customer service, and stronger engagement with both patients and medical professionals. The push for digital adoption also helps in addressing challenges in rural access and chronic care management. By embracing this national strategy, pharmacies are well-positioned to meet future demands, enhance compliance, and contribute to a safer, more connected healthcare system across Australia.

Australia Pharmacy Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on market structure, product type, therapeutic area, drug type, and pharmacy location.

Market Structure Insights:

- Unorganized

- Organized

The report has provided a detailed breakup and analysis of the market based on the market structure. This includes unorganized and organized.

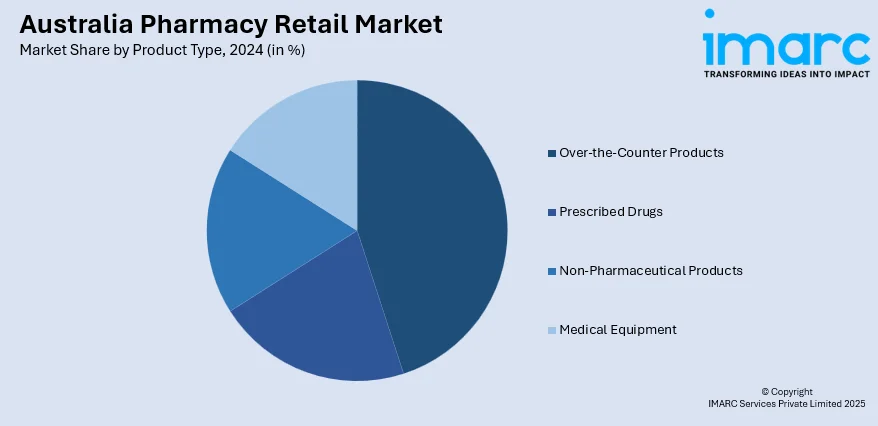

Product Type Insights:

- Over-the-Counter Products

- Prescribed Drugs

- Non-Pharmaceutical Products

- Medical Equipment

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes over-the-counter products, prescribed drugs, non-pharmaceutical products, and medical equipment.

Therapeutic Area Insights:

- Cardiovascular

- Pain Relief/Analgesics

- Vitamins/Minerals/Nutrients

- Anti-Infective

- Anti-Diabetic

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular, pain relief/analgesics, vitamins/minerals/nutrients, anti-infective, anti-diabetic, and others.

Drug Type Insights:

- Generic

- Patented

A detailed breakup and analysis of the market based on the drug type have also been provided in the report. This includes generic and patented.

Pharmacy Location Insights:

- Street/Mall Based

- Hospital Based

A detailed breakup and analysis of the market based on the pharmacy location have also been provided in the report. This includes street/mall based and hospital based.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pharmacy Retail Market News:

- April 2025: EZZ Life Science partnered with Direct Chemist Outlet (DCO) to expand its pharmacy retail presence across Australia. EZZ's flagship wellness products, including Bone Growth Chews and Heart Health Capsules, will be available in DCO's 130 stores. This initiative complements EZZ's existing distribution in over 700 pharmacies and online platforms, enhancing its footprint in the Australian pharmacy retail sector.

- April 2025: Retail pharmacy group Chemist Warehouse, in collaboration with Banked and ShopBack, launched Australia's first in-store 'Pay by Bank' system across all its locations. This initiative allows customers to make direct bank payments via QR codes using the ShopBack app, effectively bypassing traditional card surcharges.

- March 2025: Australian biopharmaceutical company Immuron partnered with Sweden's Calmino to distribute ProIBS, a certified medical device targeting Irritable Bowel Syndrome (IBS), across pharmacies in Australia and New Zealand. ProIBS, containing AVH200 from Aloe barbadensis Miller, supports intestinal health and is suitable for long-term use.

- February 2025: Sigma Healthcare and Chemist Warehouse finalized a merger, creating an AUD 8.8 billion pharmacy retail and wholesale giant in Australia. The combined entity, now trading on the ASX, encompasses over 1,800 stores, including Chemist Warehouse, Amcal, and Discount Drug Stores. This merger integrates Sigma's distribution infrastructure with Chemist Warehouse's retail expertise, positioning the group for domestic and international expansion.

Australia Pharmacy Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Market Structures Covered | Unorganized, Organized |

| Product Types Covered | Over-the-Counter Products, Prescribed Drugs, Non-Pharmaceutical Products, Medical Equipment |

| Therapeutic Areas Covered | Cardiovascular, Pain Relief/Analgesics, Vitamins/Minerals/Nutrients, Anti-Infective, Anti-Diabetic, Others |

| Drug Types Covered | Generic, Patented |

| Pharmacy Locations Covered | Street/Mall Based, Hospital Based |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pharmacy retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pharmacy retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pharmacy retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmacy retail market in Australia was valued at USD 38.64 Billion in 2024.

The Australia pharmacy retail market is projected to exhibit a compound annual growth rate (CAGR) of 5.71% during 2025-2033.

The Australia pharmacy retail market is expected to reach a value of USD 63.69 Billion by 2033.

The market is witnessing a shift toward personalized wellness, digital prescriptions, and pharmacist-led clinical services. There is a rising demand for OTC and preventive products, growth in express urban formats, and closer integration with telehealth platforms to improve accessibility and streamline patient care.

Key drivers include an aging population, rising lifestyle-related diseases, and increasing health awareness. Government support for expanded pharmacist roles, growth in regional healthcare needs, and the adoption of digital health infrastructure are also propelling demand and strengthening the retail pharmacy network across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)