Australia Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2025-2033

Australia Photonic Integrated Circuit Market Overview:

The Australia photonic integrated circuit market size reached USD 381.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,771.20 Million by 2033, exhibiting a growth rate (CAGR) of 16.59% during 2025-2033. The growing demand for high-speed broadband, rising investments in quantum and optical communication, and government-backed R&D initiatives are among the key factors driving the market growth. Besides this, the increasing product adoption in sectors, such as defense, healthcare, and data centers, is also supporting the market growth, aligning with Australia’s push toward digital transformation and technological self-reliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 381.60 Million |

| Market Forecast in 2033 | USD 1,771.20 Million |

| Market Growth Rate 2025-2033 | 16.59% |

Australia Photonic Integrated Circuit Market Trends:

Expansion of High-Speed Data Infrastructure

Australia's strong commitment to digital transformation has resulted in substantial investments in telecommunications and data center infrastructure, establishing the country as a regional leader in photonic innovation. The broad deployment of 5G technology has been a significant driver of this advancement, with main telecom companies such as Telstra, Optus, and Vodafone extending their networks across the country. By mid-2025, Australia plans to provide 5G coverage to more than 95% of its population, up from 85% in 2024. While household adoption is progressing rapidly, industry uptake is still developing, presenting further growth opportunities. The rollout of 5G necessitates advanced optical technologies, and photonic integrated circuits (PICs) emerge as a key enabler, offering superior performance, scalability, and low-latency data transmission. In parallel, Australia's data center landscape is expanding rapidly, with 255 facilities across 26 markets, driven by surging data consumption. PICs are critical to modern data centers, enabling higher bandwidth and operational efficiency. These developments not only support Australia’s digital ambitions but also position it as a regional leader in PICs.

.webp)

To get more information on this market, Request Sample

Integration of PICs in Healthcare and Smart City Applications

PICs are playing an increasingly pivotal role in advancing healthcare and smart city initiatives across Australia, aligning with the nation's broader objectives of technological innovation and economic diversification. PICs are transforming medical diagnostics by allowing for accurate, real-time data processing, which greatly improves patient outcomes. Notably, researchers are creating silicon photonics-based biosensors that can detect many biomarkers at the same time, allowing for earlier and more accurate illness detection. In parallel, Australia's smart city ambitions are being propelled by a USD 50 million investment under the Smart Cities and Suburbs Program. This initiative supports local governments through competitive grants, fostering collaboration between public and private sectors. In the program’s first round, 52 projects received USD 28.5 million in federal funding, supplemented by USD 40 million from partners, including local governments, research institutions, and private industry. These projects range from 3D planning tools and smart parking systems to community open data platforms and Wi-Fi. PICs are essential to this infrastructure, enabling high-speed, reliable communication networks that support the proliferation of IoT devices and efficient data management, thereby driving smarter, more connected urban environments.

Australia Photonic Integrated Circuit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, raw material, integration, and application.

Component Insights:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

The report has provided a detailed breakup and analysis of the market based on the component. This includes lasers, MUX/DEMUX, optical amplifiers, modulators, attenuators, and detectors.

Raw Material Insights:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes indium phosphide (InP), gallium arsenide (GaAs), lithium niobate (LiNbO3), silicon, and silica-on-silicon.

Integration Insights:

- Monolithic Integration

- Hybrid Integration

- Module Integration

The report has provided a detailed breakup and analysis of the market based on the integration. This includes monolithic integration, hybrid integration, and module integration.

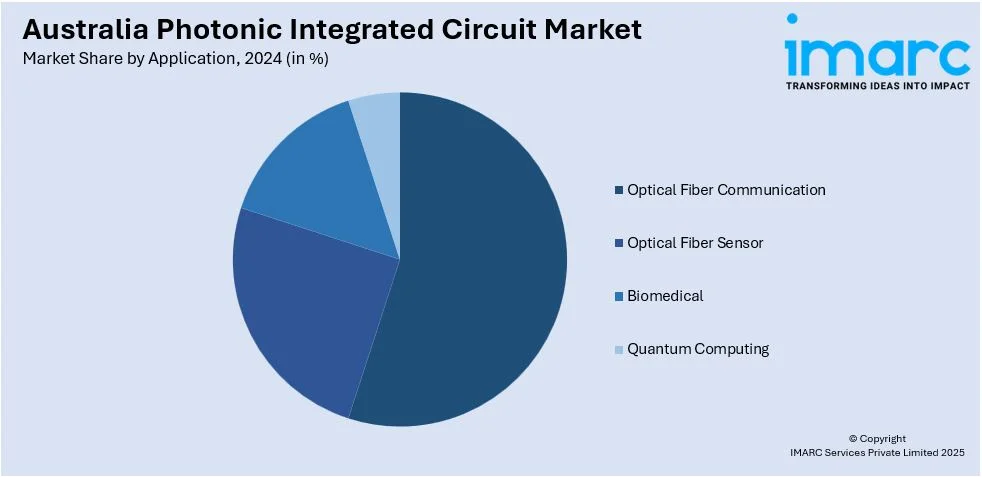

Application Insights:

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes optical fiber communication, optical fiber sensor, biomedical, and quantum computing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Photonic Integrated Circuit Market News:

- March 2025: Keysight Technologies launched Photonic Designer, a photonic design automation (PDA) solution to address challenges in photonic circuit design. By simplifying the design process and reducing go-to-market time, it aims to support engineers with a unified platform for precise and reliable PIC development.

- November 2024: OKI developed an ultracompact PIC chip using silicon photonics technology, enabling miniaturization, energy efficiency, and cost reduction. This chip reportedly supports optical sensors, laser vibrometers, optical biosensors, and optical transceivers, expanding applications in social infrastructure, biotechnology, and communications.

- December 2023: Researchers at the University of Sydney announced that they had developed a compact silicon semiconductor chip integrating electronics and photonics. This PIC reportedly boosted bandwidth and enabled advanced filter control, supporting applications in radar, satellite systems, and wireless networks.

Australia Photonic Integrated Circuit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia photonic integrated circuit market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia photonic integrated circuit market on the basis of component?

- What is the breakup of the Australia photonic integrated circuit market on the basis of integration?

- What is the breakup of the Australia photonic integrated circuit market on the basis of raw material?

- What is the breakup of the Australia photonic integrated circuit market on the basis of application?

- What are the various stages in the value chain of the Australia photonic integrated circuit market?

- What are the key driving factors and challenges in the Australia photonic integrated circuit market?

- What is the structure of the Australia photonic integrated circuit market and who are the key players?

- What is the degree of competition in the Australia photonic integrated circuit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia photonic integrated circuit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia photonic integrated circuit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia photonic integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)