Australia Pizza Market Size, Share, Trends and Forecast by Type, Crust Type, Distribution Channel, and Region, 2026-2034

Australia Pizza Market Summary:

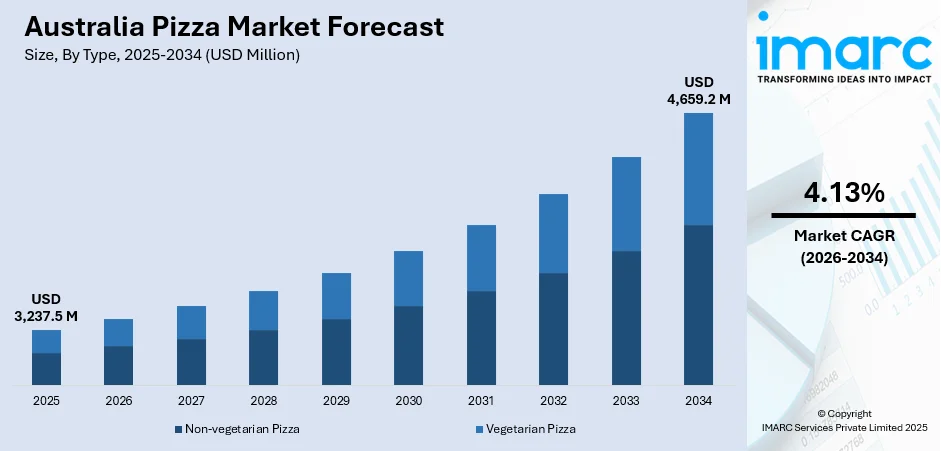

The Australia pizza market size was valued at USD 3,237.5 Million in 2025 and is projected to reach USD 4,659.2 Million by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034.

The Australia pizza industry is experiencing a robust growth rate because of the changing preferences of consumers for convenient meal options and the popularity of digital ordering platforms. The increasing pace of city development, fast-paced lifestyle, and increasing purchasing power are contributing significantly towards increasing demand for quick meal options. Innovations in menu items by large chain operators and independent pizzeria operators, along with a rise in delivery services, is boosting market development. The increasing emphasis on high-quality ingredients, variety topping items, and regional flavor profile is attracting health-conscious and more adventurous consumers, contributing towards a favorable Australia pizza market share.

Key Takeaways and Insights:

-

By Type: Non-vegetarian pizza dominates the market with a share of 56.1% in 2025, driven by strong consumer preference for meat-based toppings, strategic partnerships between pizza chains and livestock producers, and continuous introduction of premium protein offerings that cater to diverse taste preferences.

-

By Crust Type: Thick crust leads the market with a share of 48.07% in 2025, owing to its ability to support generous toppings, satisfying texture that appeals to family dining occasions, and widespread availability across quick-service restaurants and takeaway outlets nationwide.

-

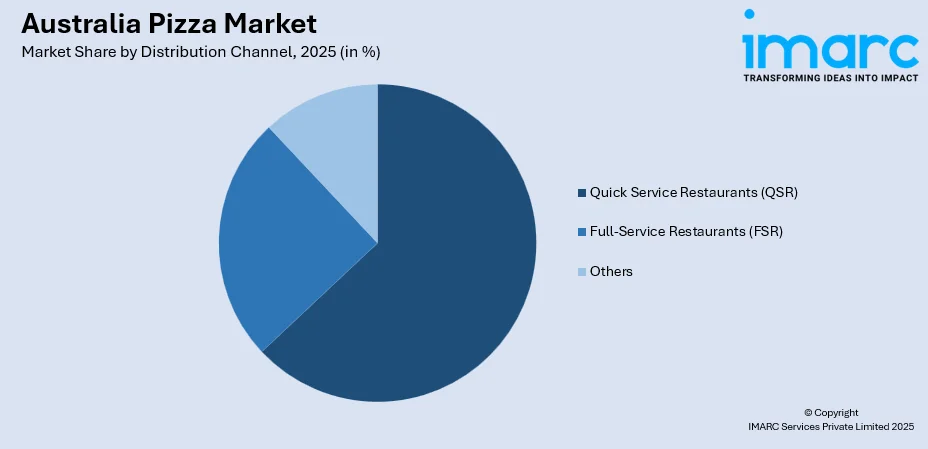

By Distribution Channel: Quick service restaurants (QSR) represent the largest segment with a market share of 62.05% in 2025, reflecting the dominance of established pizza chains, consumer preference for speed and convenience, and extensive store networks providing accessible dining options across urban and suburban locations.

-

By Region: Australia Capital Territory & New South Wales is the biggest region with 29% share in 2025, driven by high population density, significant concentration of pizza outlets in Sydney and surrounding metropolitan areas, and elevated consumer spending on hospitality services.

-

Key Players: Leading pizza operators are intensifying market competition through aggressive store expansion, digital platform enhancements, menu diversification, and strategic partnerships with delivery aggregators. Investment in operational efficiency, loyalty programs, and localized product development continues to strengthen brand positioning across consumer segments.

To get more information on this market Request Sample

As businesses adjust to changing consumer demands for convenience, quality, and variety, the Australian pizza market is changing. Ordering habits are changing due to digital change, and online meal delivery services are expanding significantly. In response, pizza chains are innovating their menus to offer superior ingredients, healthier substitutes, and flavor combinations influenced by local culture. The competitive environment is still changing, with independent pizzerias setting themselves apart with artisanal methods and distinctive eating experiences while well-known chains are growing their footprints. Expanding into neglected rural regions, investing in consumer engagement technologies, and increasing the use of delivery applications are opening up new growth opportunities for industry players.

Australia Pizza Market Trends:

Digital Ordering and Delivery Platform Expansion

The rapid proliferation of online food ordering and delivery services is fundamentally transforming how Australians consume pizza. Mobile applications and digital platforms are enabling seamless ordering experiences, personalized recommendations, and real-time tracking capabilities. Major pizza operators are investing heavily in proprietary digital infrastructure while partnering with third-party aggregators to expand customer reach. In July 2024, Google Wing launched its drone delivery service in Melbourne's eastern suburbs, enabling approximately 250,000 residents to receive orders through delivery applications, demonstrating technological advancement in last-mile delivery that benefits the Australia pizza market growth.

Rising Awareness Amongst Consumers

Growing consumer awareness about nutrition and ingredient quality is influencing major menu reinventions across the pizza industry. Gluten-free crusts, vegan cheeses, plant-based protein, and reduced-calorie options are being introduced by pizza businesses to meet consumer demands. High-end customer segments who value healthy eating and premium pizza variants are also beginning to embrace upscale pizza varieties with locally grown fruit, organic, and specialty cheeses. The rising demand for customized pizza gives consumers the flexibility to choose their pizza to fulfill individual needs, requirements, or preferences.

Gourmet and Artisanal Pizza Experiences

The rising consumer interest in upmarket restaurant experiences is driving the need for gourmet and artisanal pizza. Wood-fired pizzeria restaurants, focusing on traditional Neapolitan-style pizza, artisanal dough, and indigenous Italian ingredients, appeal to connoisseur customers who value quality over convenience. Artisanal pizzerias began to distinguish themselves with creative pizza combinations, seasonal menus, and immersive experience settings. Award-winning, Sydney-based Fratelli Pulcinella, identified as a master pizzeria of World and European titles, is reflective of the recent importance of artisanal pizza makers in broadening the industry.

Market Outlook 2026-2034:

The Australia pizza market is positioned for sustained expansion throughout the forecast period, supported by ongoing digital transformation, evolving consumer preferences, and strategic investments by market participants. Operators are expected to continue expanding store networks, particularly in underserved regional areas, while enhancing delivery capabilities and menu offerings. The market generated a revenue of USD 3,237.5 Million in 2025 and is projected to reach a revenue of USD 4,659.2 Million by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034. Innovation in plant-based alternatives, premium frozen retail products, and personalized digital experiences will create additional growth opportunities across consumer segments.

Australia Pizza Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Non-vegetarian Pizza |

56.1% |

|

Crust Type |

Thick Crust |

48.07% |

|

Distribution Channel |

Quick Service Restaurants (QSR) |

62.05% |

|

Region |

Australia Capital Territory & New South Wales |

29% |

Type Insights:

- Non-vegetarian Pizza

- Vegetarian Pizza

Non-vegetarian pizza dominates with a market share of 56.1% of the total Australia pizza market in 2025.

The Australian preference for meat-based pizza varieties reflects the nation's strong culinary tradition centered on protein consumption. Non-vegetarian pizzas featuring toppings such as pepperoni, ham, bacon, chicken, and specialty meats continue commanding significant consumer demand across quick-service and full-service restaurant channels. Operators are actively developing partnerships with domestic producers to introduce premium meat offerings that differentiate their menus while supporting local agricultural industries. In January 2024, Domino's Australia partnered with Meat and Livestock Australia to launch a premium lamb pizza range, demonstrating robust consumer appetite for innovative meat-based offerings.

The segment benefits from ongoing product innovation as operators introduce premium protein options, locally-sourced meats, and creative flavor combinations appealing to diverse consumer preferences. Strategic collaborations between pizza chains and agricultural producers are strengthening supply chain relationships while promoting domestic ingredients and supporting Australian farmers. Marketing campaigns emphasizing quality, provenance, and authentic preparation methods resonate with consumers seeking satisfying meal experiences. The combination of established favorites and innovative new protein offerings ensures continued segment dominance throughout the forecast period.

Crust Type Insights:

- Thick Crust

- Thin Crust

- Stuffed Crust

Thick crust leads with a share of 48.07% of the total Australia pizza market in 2025.

Thick crust pizza maintains its dominant position owing to its ability to accommodate generous topping quantities while providing a satisfying, substantial eating experience. The robust base appeals particularly to family dining occasions and group gatherings where value perception and portion size influence purchase decisions. Quick-service restaurants predominantly feature thick crust options as their standard offering, leveraging familiar textures and consistent preparation methods that ensure operational efficiency across high-volume store networks serving millions of customers weekly. The crust style's durability during delivery also makes it ideally suited for takeaway and home delivery services, which represent a significant portion of pizza consumption in Australia.

Consumer preference for thick crust varieties reflects traditional pizza consumption patterns established through decades of market development by major chains. The crust style facilitates customization with multiple toppings without structural compromise, supporting the trend toward loaded and specialty pizzas that deliver perceived value to consumers. Innovations in dough formulation, including options incorporating wholegrains or alternative flours, are expanding thick crust appeal among health-conscious consumers while maintaining the satisfying characteristics driving segment leadership.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Quick Service Restaurants (QSR)

- Full-Service Restaurants (FSR)

- Others

Quick service restaurants (QSR) exhibit a clear dominance with a 62.05% share of the total Australia pizza market in 2025.

Quick service restaurants (QSR) commanding market position reflects extensive store networks, established brand recognition, and operational models optimized for speed and convenience. Domino's Pizza Enterprises maintains leadership as the largest pizza chain in Australia by both store count and sales volume, operating an extensive nationwide network. In June 2023, Flynn Restaurant Group acquired Pizza Hut Australia's 260-store network, marking international investment interest in strengthening competitive positioning against established market leaders through strategic acquisitions and expansion plans. Flynn, recognized as the largest restaurant franchisee in the United States and operator of multiple prominent food service brands, has since continued expanding the Pizza Hut network across Australia.

Quick-service pizza operators continue investing in digital ordering infrastructure, delivery fleet expansion, and store network growth to capture increasing consumer demand for convenient meal solutions. The segment benefits from standardized operations enabling consistent quality and service across locations while promotional strategies and loyalty programs drive customer retention. Ongoing franchise development, particularly in regional and suburban markets, positions QSR operators for sustained growth as pizza consumption patterns increasingly favour accessibility and speed.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the leading segment with a 29% share of the total Australia pizza market in 2025.

The region's market leadership stems from concentrated population density, particularly within Sydney and surrounding metropolitan areas, combined with elevated household spending on food services. The Australian Capital Territory and New South Wales host the highest concentration of pizza outlets nationwide, with major chains maintaining extensive store networks across urban centers, suburban communities, and regional towns. Consumer spending patterns in the region demonstrate strong appetite for hospitality services, reflecting the economic vitality and lifestyle preferences characteristic of Australia's most populous state.

The region benefits from diverse consumer demographics, including significant multicultural populations driving demand for varied pizza offerings and international flavor profiles. High urban density supports extensive delivery network coverage, enabling operators to efficiently serve customers across densely populated residential and commercial districts. Affluent consumer segments sustain premium and gourmet pizza segment growth, supporting both established chains and independent artisanal pizzerias. Major pizza chains continue prioritizing network expansion within the region, recognizing the substantial customer base and established consumption patterns that underpin regional market dominance throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Australia Pizza Market Growing?

Expansion of Digital Ordering and Food Delivery Platforms

The proliferation of online food delivery platforms is fundamentally reshaping pizza consumption patterns across Australia. Digital ordering systems enable consumers to browse menus, customize orders, and track deliveries through intuitive mobile applications, enhancing convenience and accessibility. Major operators are investing in proprietary digital platforms while partnering with third-party aggregators including Uber Eats and DoorDash to expand customer reach. Enhanced delivery logistics, including emerging drone delivery services and optimized routing algorithms, are reducing wait times and expanding serviceable areas, particularly benefiting pizza operators whose products suit delivery models.

Strategic Chain Expansion and International Investment

Leading pizza operators are aggressively expanding store networks to capture growing consumer demand across metropolitan and regional Australia. International investment is strengthening competitive dynamics and introducing operational expertise from established global markets. Major global restaurant groups are acquiring Australian pizza businesses, recognizing the market's growth potential and seeking to leverage their operational capabilities to accelerate expansion. These investors bring substantial capital resources, proven franchise management systems, and marketing expertise developed across multiple international markets. Acquired brands are implementing transformation strategies focused on store network expansion, menu innovation, and operational improvements designed to strengthen competitive positioning against established market leaders. This investment activity signals confidence in Australia's pizza market potential while introducing capital and management capabilities supporting accelerated growth trajectories. The influx of international expertise is elevating industry standards, intensifying competition, and driving innovation across product offerings, customer service, and digital engagement platforms throughout the Australian pizza sector.

Rising Consumer Preference for Convenience and Quick-Service Dining

Evolving lifestyle patterns characterized by time constraints, dual-income households, and urbanization are driving sustained demand for convenient meal solutions. Pizza's inherent suitability for takeaway and delivery consumption positions it favourably within Australia's quick-service restaurant landscape, where speed, accessibility, and value represent key purchase drivers. Quick-service restaurants command a substantial share of Australia's foodservice market, with pizza representing a significant and growing category within this segment. Consumer spending on hospitality services demonstrates resilience despite broader economic pressures, reflecting ongoing willingness to allocate discretionary income toward convenient dining options. Busy professionals, young families, and time-poor consumers increasingly prioritize meal solutions requiring minimal preparation, driving consistent demand for pizza delivery and takeaway services. The alignment between pizza's convenient format and contemporary lifestyle demands ensures sustained consumer engagement, benefiting operators positioned to meet evolving expectations through efficient service, accessible ordering platforms, and reliable delivery capabilities throughout the forecast period.

Market Restraints:

What Challenges the Australia Pizza Market is Facing?

Intense Competitive Pressure and Market Saturation

The Australian pizza market faces significant competitive pressure from numerous operators competing for consumer attention. Market saturation in metropolitan areas creates challenges for new entrants and existing operators seeking store network expansion. Aggressive promotional activity and price competition compress profit margins, while alternative food categories including Asian cuisine, Mexican offerings, and health-focused options intensify competition for consumer spending.

Rising Operational Costs and Inflationary Pressures

Increasing costs associated with ingredients, labor, energy, and logistics are pressuring operator profitability across the pizza sector. Supply chain disruptions and commodity price volatility affect input costs, while minimum wage increases impact labor expenses. Operators face challenges balancing cost absorption with price increases that risk consumer resistance, particularly amid broader cost-of-living pressures affecting discretionary spending patterns.

Shifting Consumer Health Perceptions and Dietary Preferences

Growing consumer awareness regarding nutrition, caloric intake, and ingredient quality presents challenges for traditional pizza offerings. Health-conscious consumers increasingly scrutinize food choices, potentially limiting pizza consumption frequency. Operators must invest in menu innovation, healthier alternatives, and transparent ingredient communication to address evolving consumer expectations while maintaining product appeal and profitability.

Competitive Landscape:

The Australia pizza market exhibits a competitive structure dominated by established chain operators while independent pizzerias maintain significant presence in localized markets. Leading national chains hold substantial market share through extensive store networks, brand recognition, and operational scale advantages. Competition is intensifying as international investors strengthen rival chains, introducing substantial resources and operational expertise for enhanced competitive positioning. Operators are differentiating through menu innovation, digital capabilities, delivery speed, and promotional strategies to attract and retain customers. Independent and gourmet pizzerias compete through quality positioning, unique offerings, and experiential dining, contributing to market diversity and segmentation across consumer preferences.

Recent Developments:

-

In March 2025, Australian pizza chain Bubba Pizza introduced its ham-and-orange pizza across select stores in Victoria and South Australia, featuring a tomato base, smoked leg ham, fresh orange chunks, and mozzarella. The unconventional offering generated widespread social media attention and national media coverage, demonstrating ongoing menu innovation and consumer engagement strategies within Australia's pizza sector.

Australia Pizza Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Non-vegetarian Pizza, Vegetarian Pizza |

| Crust Types Covered | Thick Crust, Thin Crust, Stuffed Crust |

| Distribution Channels Covered | Quick Service Restaurants (QSR), Full-Service Restaurants (FSR), Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia pizza market size was valued at USD 3,237.5 Million in 2025.

The Australia pizza market is expected to grow at a compound annual growth rate of 4.13% from 2026-2034 to reach USD 4,659.2 Million by 2034.

Non-vegetarian pizza dominated the market with a share of 56.1%, driven by strong consumer preference for meat-based toppings, partnerships between operators and livestock producers, and continuous introduction of premium protein offerings.

Key factors driving the Australia pizza market include expansion of digital ordering and food delivery platforms, strategic chain expansion supported by international investment, rising consumer preference for convenient quick-service dining options, and ongoing menu innovation.

Major challenges include intense competitive pressure and market saturation in metropolitan areas, rising operational costs from ingredient inflation and labour expenses, shifting consumer health perceptions affecting consumption patterns, and maintaining profitability amid promotional pricing activity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)