Australia Plasma Fractionation Market Size, Share, Trends and Forecast by Product, Sector, Application, End User, and Region, 2025-2033

Australia Plasma Fractionation Market Overview:

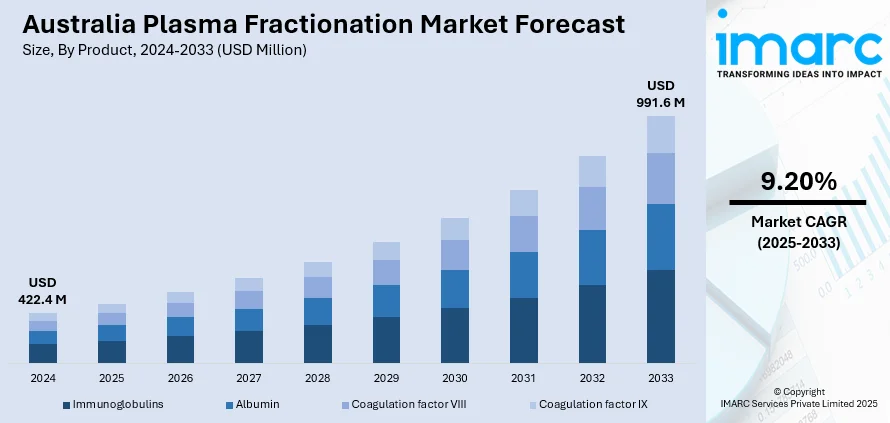

The Australia plasma fractionation market size reached USD 422.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 991.6 Million by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The growing demand for immunoglobulins and albumin therapies across aging and immunocompromised populations, coupled with the increasing adoption of advanced blood plasma processing technologies, is driving market growth in Australia. In addition to this, rising awareness regarding plasma-derived therapies, expanding public and private healthcare infrastructure, and government support for blood donation and plasma collection initiatives are some key factors augmenting the Australia Plasma Fractionation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 422.4 Million |

| Market Forecast in 2033 | USD 991.6 Million |

| Market Growth Rate 2025-2033 | 9.20% |

Australia Plasma Fractionation Market Trends:

Government Support and National Self-Sufficiency Initiatives

The market is significantly influenced by national policies aimed at achieving self-sufficiency in plasma-derived medicinal products (PDMPs). The National Blood Authority (NBA), operating under the Commonwealth government, plays a central role in overseeing blood and plasma product supply through the National Fractionation Agreement for Australia (NFAA). Under this framework, locally donated plasma is sent to CSL Behring’s Melbourne-based facility for fractionation, ensuring that most products used domestically are manufactured within the country. This reduces reliance on imported products and stabilizes national supply chains, which is supporting the Australia plasma fractionation market growth. Moreover, the government’s consistent investments in donation campaigns and processing infrastructure reinforces the domestic collection and fractionation ecosystem. According to industry reports, Lifeblood received more than 1.6 million donations in 2023–2024 and sent 869.1 tonnes of plasma to CSL Behring for processing. Continued support for voluntary donation systems and domestic manufacturing aligns with global best practices in healthcare sovereignty. These efforts are making Australia one of the few countries that meets a significant portion of its plasma product demand through national collection and fractionation operations.

To get more information on this market, Request Sample

Rising Demand for Immunoglobulins and Chronic Disease Management

The market is experiencing a marked increase in demand for immunoglobulin (Ig) therapies, largely attributed to the growing prevalence and improved diagnosis of conditions such as primary immunodeficiency diseases, chronic inflammatory demyelinating polyneuropathy (CIDP), and other neurological disorders. As awareness and clinical recognition of these disorders expand, the need for Ig-based treatments continues to rise across both hospital and outpatient settings. According to industry data, approximately 828,980 grams of immunoglobulin were dispensed in January 2025 across the country. Immunoglobulins are among the costliest and in-demand PDMPs, and their utilization is tightly managed through programs like the National Immunoglobulin Governance Program (NIGP). Rising awareness, improved diagnostics, and an aging population contribute to higher prescription volumes. In addition, the COVID-19 pandemic further underscored the importance of immunoglobulin therapies in treating secondary immunodeficiencies and post-viral syndromes. This trend places continued pressure on domestic plasma collection and processing capacity, reinforcing the role of efficient supply management, clinical justification protocols, and real-time demand forecasting systems in stabilizing Australia’s immunoglobulin supply chain. Therefore, public sector stakeholders and industry players are intensifying efforts to expand plasma collection, optimize fractionation throughput, and refine Ig distribution frameworks to meet long-term national healthcare needs.

Australia Plasma Fractionation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, sector, application, and end user.

Product Insights:

- Immunoglobulins

- Albumin

- Coagulation factor VIII

- Coagulation factor IX

The report has provided a detailed breakup and analysis of the market based on the product. This includes immunoglobulins, albumin, coagulation factor VIII, and coagulation factor IX.

Sector Insights:

- Private Sector

- Public Sector

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes private sector and public sector.

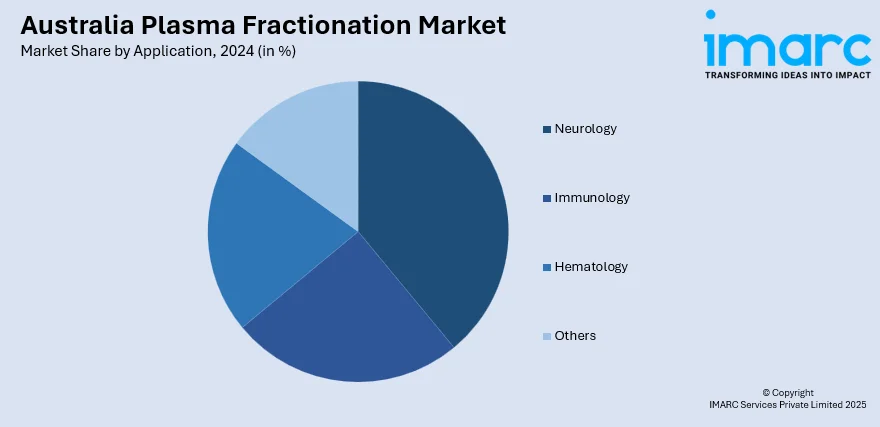

Application Insights:

- Neurology

- Immunology

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the Application. This includes neurology, immunology, hematology, and others.

End User Insights:

- Hospitals and Clinics

- Clinical Research Laboratories

- Academic Institutes

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, clinical research laboratories, and academic institutes.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plasma Fractionation Market News:

- On December 14, 2024, CSL opened a $900 Million plasma fractionation facility in Broadmeadows, Victoria. This state-of-the-art facility enhances CSL’s plasma processing capacity to 9.2 million liters annually, addressing the global demand for plasma-derived therapies used in treating immunodeficiencies, neurological disorders, and critical care patients. The investment is part of CSL’s broader $2 billion-plus capital initiative in Australia, which also encompasses a next-generation influenza vaccine facility and new global headquarters, reinforcing the company’s commitment to advanced biopharmaceutical manufacturing and the Australian workforce.

Australia Plasma Fractionation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Immunoglobulins, Albumin, Coagulation factor VIII, Coagulation factor IX |

| Sectors Covered | Private Sector, Public Sector |

| Applications Covered | Neurology, Immunology, Hematology, Others |

| End Users Covered | Hospitals and Clinics, Clinical Research Laboratories, Academic Institutes |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia plasma fractionation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia plasma fractionation market on the basis of product?

- What is the breakup of the Australia plasma fractionation market on the basis of sector?

- What is the breakup of the Australia plasma fractionation market on the basis of application?

- What is the breakup of the Australia plasma fractionation market on the basis of end user?

- What is the breakup of the Australia plasma fractionation market on the basis of region?

- What are the various stages in the value chain of the Australia plasma fractionation market?

- What are the key driving factors and challenges in the Australia plasma fractionation market?

- What is the structure of the Australia plasma fractionation market and who are the key players?

- What is the degree of competition in the Australia plasma fractionation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plasma fractionation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plasma fractionation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plasma fractionation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)