Australia Plastic Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Australia Plastic Furniture Market Overview:

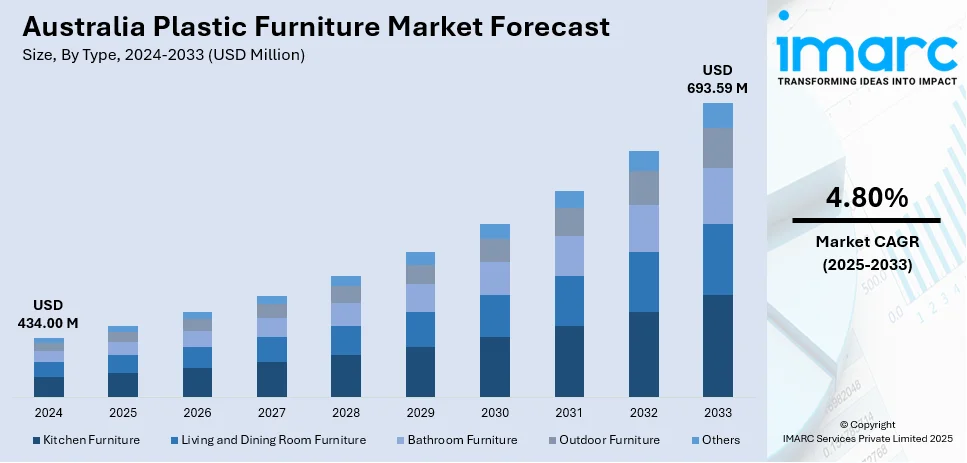

The Australia plastic furniture market size reached USD 434.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 693.59 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market involves increasing consumer demand for affordable, durable, and lightweight furniture, growing environmental awareness leading to a preference for sustainable materials, and the rise of e-commerce, which offers convenience, customization options, and wider product access, impelling the Australia plastic furniture share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 434.00 Million |

| Market Forecast in 2033 | USD 693.59 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Australia Plastic Furniture Market Trends:

Technological Innovation and Smart Features

Technology advancements are transforming the design and application of plastic furniture in Australia. New consumers demand that furniture not just be fashionable but also functional and technologically integrated. Some recent designs feature practical features such as wireless charging locations, lighting, or modular components that adjust to various spaces. Production methods are also evolving, allowing for the production of more complex and bespoke furniture designs. Technologies like three dimensional (3D) printing are presenting new avenues of shape, texture, and materials. As residences and workplaces are getting smarter and more integrated, plastic furniture is changing to cater to these requirements, merging comfort, innovation, and contemporary aesthetics into daily living.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Materials

The Australia market for plastic furniture is increasingly adopting sustainability, inspired by the rising awareness of consumers about the environment. With 95% of 30,000 tonnes of commercial furniture waste produced every year going into landfills, there is a definite change towards greener operations. Consumers now value products that reflect green lifestyles, inspiring furniture manufacturers to employ recycled plastics and seek out biodegradable materials. This trend is forcing brands to create long-lasting, recyclable products that reduce waste, with a particular emphasis on minimizing carbon footprints. As sustainability becomes a primary consumer concern, it affects product design, marketing, and packaging strategies. Companies are reacting by highlighting their commitment to environmental stewardship, so that sustainability is no longer an added feature but an integral part of success thus aiding the Australia plastic furniture market growth.

E-Commerce Growth and Customization

Online shopping is significantly changing how Australians buy plastic furniture. Consumers now expect the convenience of browsing, customizing, and purchasing furniture from the comfort of their homes. This has encouraged brands to focus heavily on improving their digital presence, offering a wide range of customization options like color choices, material finishes, and modular designs. Many online retailers are enhancing their platforms with tools like virtual visualization, helping customers see how products would look in their space before buying. This personalized shopping experience not only meets customer expectations but also helps companies better cater to individual tastes, driving stronger engagement and loyalty in the growing digital marketplace.

Australia Plastic Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Kitchen Furniture

- Living and Dining Room Furniture

- Bathroom Furniture

- Outdoor Furniture

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes kitchen furniture, living and dining room furniture, bathroom furniture, outdoor furniture, and others.

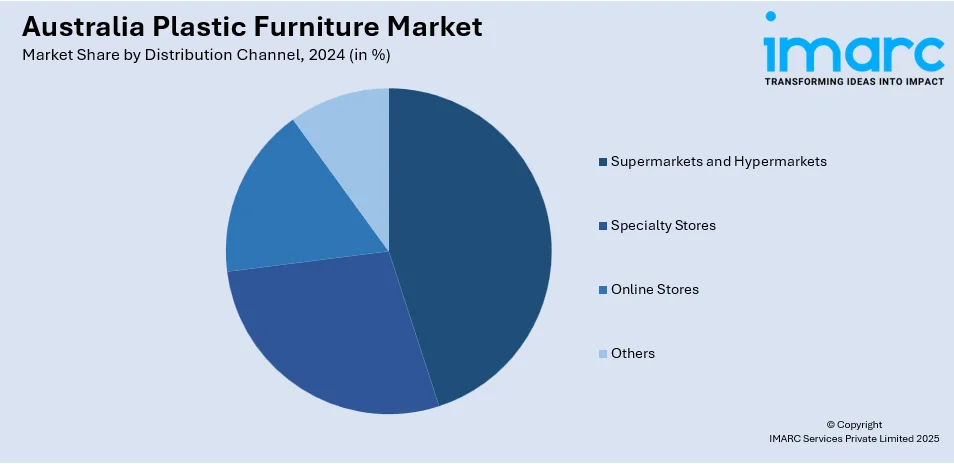

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plastic Furniture Market News:

- In February 2025, UnoPick Outdoor launched its 2025 collection of sustainable outdoor furniture in Australia. Featuring eco-friendly materials like recycled plastics, durable fabrics, and responsibly sourced wood, the new range includes seating, dining sets, and lounge furniture designed for comfort and style. The collection is available for purchase online with customization options, easy returns, and delivery across Australia, reflecting the brand’s commitment to quality and sustainability in outdoor living solutions.

- In December 2024, Circular Beds launched Australia’s first bed base made from 100% recycled plastic. Developed by ROBOVOID with support from Swinburne University and Sustainability Victoria, the bed base uses around 22 kilograms of recycled plastic, sourced from items like milk crates and garden pots. The design promotes sustainability by being fully recyclable, durable, and resistant to mold and pests. It supports a circular economy by reducing waste and extending product lifespan, with trials in various sectors, including student housing and social enterprises.

Australia Plastic Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Furniture, Living and Dining Room Furniture, Bathroom Furniture, Outdoor Furniture, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia plastic furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia plastic furniture market on the basis of type?

- What is the breakup of the Australia plastic furniture market on the basis of distribution channel?

- What is the breakup of the Australia plastic furniture market on the basis of end user?

- What is the breakup of the Australia plastic furniture market on the basis of region?

- What are the various stages in the value chain of the Australia plastic furniture market?

- What are the key driving factors and challenges in the Australia plastic furniture market?

- What is the structure of the Australia plastic furniture market and who are the key players?

- What is the degree of competition in the Australia plastic furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plastic furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plastic furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plastic furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)