Australia Point-of-Care Diagnostics Market Size, Share, Trends and Forecast by Product Type, Platform, Prescription Mode, End-User, and Region, 2025-2033

Australia Point-of-Care Diagnostics Market Overview:

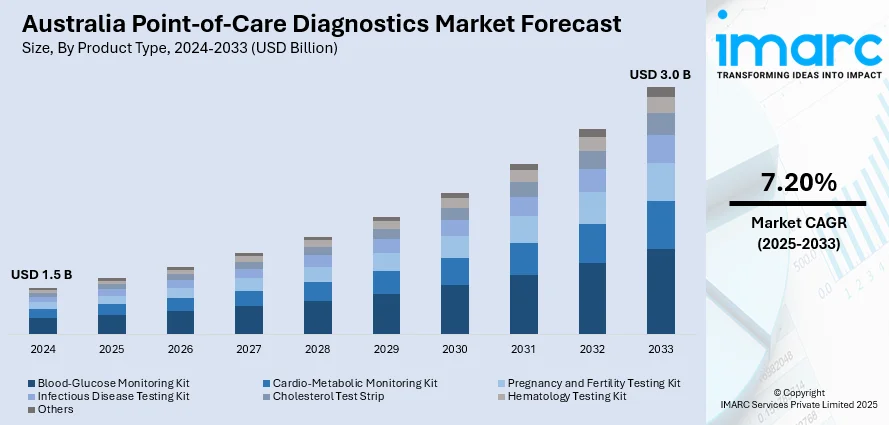

The Australia point-of-care diagnostics market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Rising chronic disease cases, burgeoning ageing population, rural healthcare development, early disease detection awareness, escalating demand for home-based testing, digital integration, biosensor advancements, regulatory support, and increased product availability are some of the factors fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

Australia Point-of-Care Diagnostics Market Trends:

Rising Prevalence of Chronic Diseases

The growing burden of chronic illnesses such as diabetes, cardiovascular diseases (CVDs), and respiratory conditions is a significant factor contributing to the Australia point-of-care diagnostics market growth. The Australian Burden of Disease Study 2024 reported that Australians lost 5.8 million years of healthy life due to illness, injury, or premature death. Notably, the rate of people living with illness or injury increased by 7% since 2003, even though the overall disease burden decreased by 10% during the same period. These conditions often require continuous monitoring and timely diagnosis to prevent complications, making rapid diagnostic solutions increasingly valuable. In line with this, the demand for glucose monitoring, cardiac biomarker testing, and pulmonary function tests has surged in both primary care and home settings, which is another growth-inducing factor. The Australian Institute of Health and Welfare reports a steady increase in lifestyle-related diseases, prompting a shift in focus toward early intervention and disease management. Point-of-care testing provides immediate results, reducing reliance on central laboratories and enabling quicker clinical decision-making.

To get more information on this market, Request Sample

Aging Population and Associated Healthcare Needs

The aging demographic structure in the country is accelerating the need for accessible and efficient diagnostic solutions, particularly in long-term care facilities and community health environments, which is further boosting the Australia point-of-care diagnostics market share. As the proportion of individuals aged 65 and above continues to rise, healthcare systems face increased pressure to manage age-related illnesses, including hypertension, chronic kidney disease, and dementia-related complications. In 2025, approximately 433,300 Australians are living with dementia. Without significant intervention, this number is projected to rise to around 812,500 by 2054, marking an 88% increase over three decades. Point-of-care diagnostics offer timely assessments and reduce the need for frequent hospital visits, which can be logistically challenging for elderly patients. These tools support more responsive care by enabling real-time diagnostics at the patient’s bedside or within residential care settings. The high incidence of comorbidities in older adults necessitates frequent testing, and portable diagnostic devices cater to this demand with minimal clinical infrastructure. Additionally, home-based diagnostic options align with the preferences of many older Australians for ageing in place, making such technologies a strategic fit for improving geriatric healthcare outcomes while easing the burden on centralized health facilities.

Strengthening of Rural and Remote Healthcare Services

The enhancement of healthcare infrastructure in rural and remote areas is fostering demand for decentralized diagnostic solutions that can function independently of traditional laboratory systems. Geographic isolation and limited access to specialist facilities have historically presented barriers to timely diagnosis in Australia’s outlying regions. In line with this, government initiatives under programs such as the Rural Health Multidisciplinary Training (RHMT) and telehealth expansion have prioritized the deployment of point-of-care diagnostics in community clinics and Aboriginal Medical Services, which is creating a positive Australia point-of-care market outlook. These devices allow frontline healthcare providers to perform rapid tests for infections, chronic diseases, and maternal health indicators without relying on distant laboratories. Additionally, portable diagnostic platforms help reduce patient travel and expedite treatment initiation, which is critical for populations that face significant access barriers. The utility of these tools in emergency response, public health screening, and antenatal care also strengthens their adoption across diverse care settings in underserved regions of the country.

Australia Point-of-Care Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, platform, prescription mode, and end-user.

Product Type Insights:

- Blood-Glucose Monitoring Kit

- Cardio-Metabolic Monitoring Kit

- Pregnancy and Fertility Testing Kit

- Infectious Disease Testing Kit

- Cholesterol Test Strip

- Hematology Testing Kit

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes blood-glucose monitoring kit, cardio-metabolic monitoring kit, pregnancy and fertility testing kit, infectious disease testing kit, cholesterol test strip, hematology testing kit, and others.

Platform Insights:

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Immunoassays

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes lateral flow assays, dipsticks, microfluidics, molecular diagnostics, and immunoassays.

Prescription Mode Insights:

- Prescription-Based Testing

- OTC Testing

The report has provided a detailed breakup and analysis of the market based on the prescription mode. This includes prescription-based testing and OTC testing.

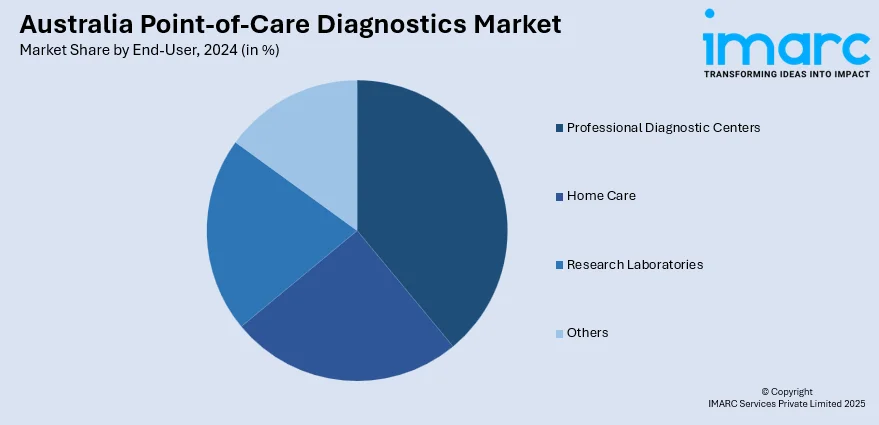

End-User Insights:

- Professional Diagnostic Centers

- Home Care

- Research Laboratories

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes professional diagnostic centers, home care, research laboratories, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Point-of-Care Diagnostics Market News:

- In 2024, Katherine Hospital in the Northern Territory became the first in Australia to deploy Siemens Healthineers’ Atellica VTLi system. This point-of-care technology delivers cardiac biomarker results in under eight minutes, enabling faster diagnosis and treatment decisions for patients at risk of cardiac arrest in emergency settings.

Australia Point-of-Care Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blood-Glucose Monitoring Kit, Cardio-Metabolic Monitoring Kit, Pregnancy and Fertility Testing Kit, Infectious Disease Testing Kit, Cholesterol Test Strip, Hematology Testing Kit, Others |

| Platforms Covered | Lateral Flow Assays, Dipsticks, Microfluidics, Molecular Diagnostics, Immunoassays |

| Prescription Modes Covered | Prescription-Based Testing, OTC Testing |

| End-Users Covered | Professional Diagnostic Centers, Home Care, Research Laboratories, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia point-of-care diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia point-of-care diagnostics market on the basis of product type?

- What is the breakup of the Australia point-of-care diagnostics market on the basis of platform?

- What is the breakup of the Australia point-of-care diagnostics market on the basis of prescription mode?

- What is the breakup of the Australia point-of-care diagnostics market on the basis of end-user?

- What is the breakup of the Australia point-of-care diagnostics market on the basis of region?

- What are the various stages in the value chain of the Australia point-of-care diagnostics market?

- What are the key driving factors and challenges in the Australia point-of-care diagnostics market?

- What is the structure of the Australia point-of-care diagnostics market and who are the key players?

- What is the degree of competition in the Australia point-of-care diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia point-of-care diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia point-of-care diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia point-of-care diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)