Australia Polyols Market Size, Share, Trends and Forecast by Type, Application, Industry, and Region, 2026-2034

Australia Polyols Market Summary:

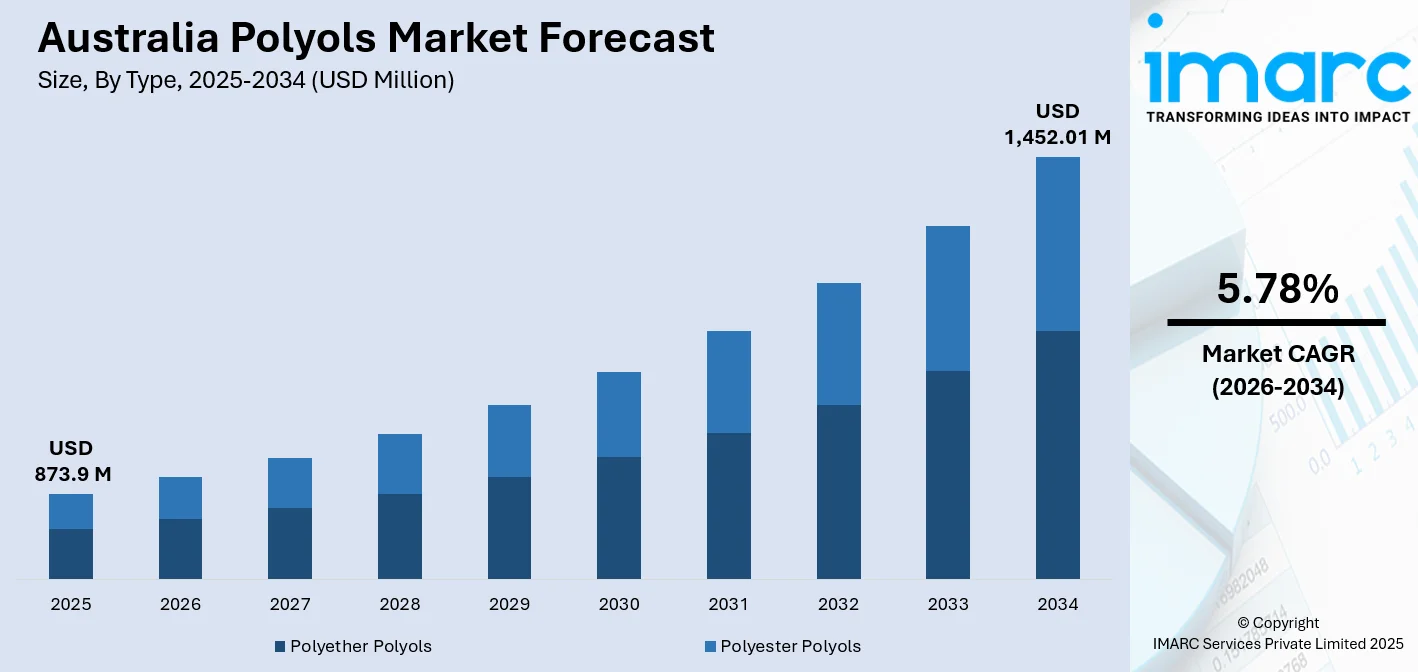

The Australia Polyols market size was valued at USD 873.9 Million in 2025 and is projected to reach USD 1,452.01 Million by 2034, growing at a compound annual growth rate of 5.78% from 2026-2034.

The Australia polyols market is witnessing sustained expansion driven by rising demand for energy-efficient insulation materials, lightweight automotive components, and comfort-oriented furniture applications. Growing environmental consciousness is accelerating adoption of sustainable polyol formulations across key end-use industries. Favorable government initiatives supporting green building practices and evolving manufacturing capabilities are positioning the market for significant long-term growth throughout the forecast period.

Key Takeaways and Insights:

- By Type: Polyether polyols dominate the market with a share of 59% in 2025, owing to its exceptional versatility, low viscosity, and superior compatibility with isocyanates for polyurethane production. Increasing applications in flexible foam manufacturing for furniture and automotive interiors are fueling the segment expansion.

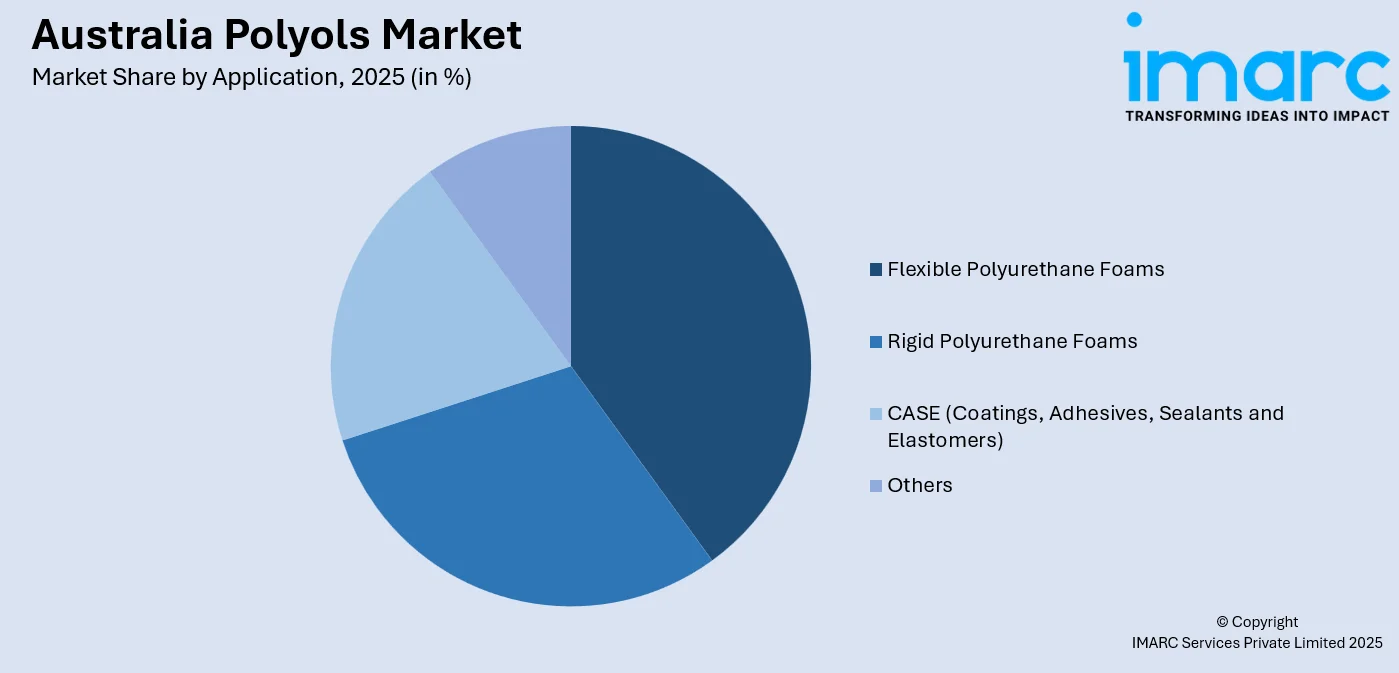

- By Application: Flexible polyurethane foams lead the market with a share of 32% in 2025. This dominance is driven by extensive utilization in bedding, furniture cushioning, and automotive seating applications where comfort, durability, and lightweight properties are essential requirements.

- By Industry: Building and construction exhibits a clear dominance in the market with 19% share in 2025, reflecting strong demand for rigid polyurethane insulation materials that enhance thermal efficiency and support sustainable construction practices aligned with evolving energy efficiency standards.

- By Region: Australia Capital Territory & New South Wales represents the largest region with 29% share in 2025, driven by concentrated industrial manufacturing activities, significant construction sector development, and higher population density requiring substantial polyurethane-based products across diverse applications.

- Key Players: Key players drive the Australia polyols market by expanding product portfolios, investing in sustainable bio-based polyol development, and strengthening distribution networks. Their focus on innovation, technical support services, and partnerships with downstream polyurethane manufacturers ensures consistent product availability and accelerates market penetration across diverse industrial applications.

To get more information on this market Request Sample

The Australia polyols market is experiencing robust growth propelled by multiple converging factors across key end-use industries. The construction sector's increasing emphasis on energy-efficient building materials has significantly elevated demand for rigid polyurethane insulation foams, where polyols serve as essential raw materials. Simultaneously, the furniture and bedding industry continues driving flexible foam demand as consumers prioritize comfort and durability in home furnishings. The automotive sector's shift toward lightweight materials for improved fuel efficiency further bolsters polyol utilization in seating components and interior applications. Rising environmental consciousness has accelerated interest in bio-based polyol alternatives, with manufacturers increasingly exploring sustainable feedstock sources. Government initiatives supporting green building practices and stricter energy efficiency regulations continue reshaping market dynamics and driving innovation throughout the polyols value chain.

Australia Polyols Market Trends:

Growing Adoption of Bio-Based and Sustainable Polyol Formulations

Environmental sustainability concerns are reshaping the Australia polyols landscape as manufacturers and end-users increasingly prioritize renewable alternatives to petroleum-based products. Bio-based polyols derived from vegetable oils, including castor, soybean, and palm sources, are gaining significant traction across construction and automotive applications. This transition aligns with broader corporate sustainability objectives and regulatory frameworks promoting reduced carbon footprints. The trend encompasses development of novel formulations offering comparable performance characteristics while minimizing environmental impact throughout product lifecycles. In April 2024, Econic Technologies and Sanyo Chemical Industries signed a memorandum of understanding (MOU) to advance CO₂-based polyols for sustainable polyurethane production. Sanyo Chemical is able to generate polyols with a 30% lower carbon footprint than traditional petroleum-based alternatives because to Econic's exclusive catalyst and process technology, which enables manufacturers to replace up to 30% of fossil-based components in their polyols with collected CO2.

Rising Demand for Cold Chain and Protective Packaging Solutions

The expansion of e-commerce and pharmaceutical distribution networks across Australia is driving increased polyol consumption in temperature-controlled packaging applications. Polyurethane foam insulation systems derived from polyol formulations provide superior thermal protection for transporting vaccines, biologics, and perishable goods. The cold chain packaging sector's growth trajectory, coupled with stringent pharmaceutical storage regulations, is accelerating adoption of high-performance polyurethane shippers. Online grocery delivery services and meal kit providers increasingly rely on polyol-based foam solutions ensuring product integrity throughout distribution channels.

Expanding Electronics and Semiconductor Protection Applications

Australia's growing electronics manufacturing and semiconductor assembly sectors are driving demand for specialized polyurethane foams in protective and functional applications. Conductive polyurethane foams derived from polyol formulations provide essential electromagnetic interference shielding and electrostatic discharge protection for sensitive electronic components. The proliferation of consumer electronics, telecommunications equipment, and data center infrastructure requires advanced cushioning materials offering both physical protection and electrical properties. Miniaturization trends in electronic devices further amplify requirements for versatile, lightweight polyol-based protective solutions.

Market Outlook 2026-2034:

The Australia polyols market outlook remains highly favorable through the forecast period, supported by sustained infrastructure development, manufacturing sector expansion, and evolving consumer preferences for sustainable materials. Strategic investments in production capacity enhancement and sustainable product development are anticipated to strengthen competitive positioning. Continued government support for energy-efficient construction practices and automotive lightweighting initiatives will further stimulate demand. The industry's transition toward bio-based alternatives presents significant growth opportunities while addressing environmental sustainability imperatives throughout the polyols value chain. The market generated a revenue of USD 873.9 Million in 2025 and is projected to reach a revenue of USD 1,452.01 Million by 2034, growing at a compound annual growth rate of 5.78% from 2026-2034.

Australia Polyols Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Polyether Polyols |

59% |

|

Application |

Flexible Polyurethane Foams |

32% |

|

Industry |

Building and Construction |

19% |

|

Region |

Australia Capital Territory & New South Wales |

29% |

Type Insights:

- Polyether Polyols

- Polyester Polyols

Polyether polyols dominate with a market share of 59% of the total Australia polyols market in 2025.

Polyether polyols command the Australia market owing to their exceptional versatility and widespread utilization across flexible and rigid polyurethane foam applications. These compounds demonstrate superior hydrolytic stability, low viscosity characteristics, and excellent rebound properties making them ideal for furniture cushioning, automotive seating, and bedding applications. The segment benefits from established manufacturing processes and cost-effective production methodologies. Several Australia's flexible polyurethane foam manufacturers are also extensively utilizing polyether polyols across its bedding, furniture, and medical product ranges.

The dominance of polyether polyols reflects their broad application spectrum spanning insulation materials, coatings, adhesives, and elastomeric compounds. Their molecular structure enables formulation flexibility allowing manufacturers to customize properties for specific end-use requirements. The segment continues benefiting from technological advancements in production processes that enhance efficiency while reducing environmental impact. Growing demand from construction and automotive sectors for energy-efficient solutions sustains polyether polyol consumption growth throughout Australia's industrial landscape.

Application Insights

Access the comprehensive market breakdown Request Sample

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- CASE (Coatings, Adhesives, Sealants and Elastomers)

- Others

Flexible polyurethane foams lead with a share of 32% of the total Australia polyols market in 2025.

Flexible polyurethane foams represent the largest application segment driven by extensive utilization in furniture, bedding, and automotive industries where comfort and durability requirements are paramount. These foams offer exceptional cushioning properties, pressure distribution characteristics, and long-term resilience that consumers and manufacturers increasingly value. The Australian furniture industry's growth trajectory directly correlates with flexible foam consumption patterns. Foamco, with over 25 years of manufacturing experience, supplies polyurethane foams to Australian furniture and bedding businesses emphasizing quality and value.

The flexible foam segment continues expanding as automotive manufacturers integrate lightweight polyurethane components into vehicle interiors for enhanced passenger comfort and noise reduction. Bedding applications represent substantial consumption volumes with mattress manufacturers utilizing advanced foam formulations for superior sleep surfaces. The segment benefits from ongoing innovation in foam technologies delivering improved performance characteristics while addressing sustainability considerations through bio-based polyol incorporation and recyclability enhancements across production processes.

Industry Insights:

- Carpet Backing

- Packaging

- Furniture

- Automotive

- Building and Construction

- Electronics

- Footwear

- Others

Building and construction exhibits a clear dominance with a 19% share of the total Australia polyols market in 2025.

The building and construction industry leads polyol consumption driven by substantial demand for rigid polyurethane insulation materials that enhance thermal efficiency in residential and commercial structures. Updated National Construction Code energy efficiency requirements mandate improved building insulation performance, directly stimulating polyol demand. Polyurethane-based insulation systems offer superior thermal resistance and space efficiency compared to traditional alternatives. In September 2024, the recent revisions to the National Construction Code (NCC) have been praised by the Green Building Council of Australia, which has noted the notable advancements in energy efficiency throughout the nation.

Construction applications extend beyond insulation to encompass adhesives, sealants, and protective coatings where polyol-based polyurethane formulations deliver essential performance characteristics. The sector benefits from sustained infrastructure investment and government housing initiatives stimulating construction activity across Australia. Green building certification requirements increasingly favor polyurethane solutions meeting stringent environmental and performance criteria. The industry outlook remains positive as urbanization trends and climate-responsive building practices continue driving demand for advanced polyol-based construction materials.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the leading region with a 29% share of the total Australia polyols market in 2025.

The Australia Capital Territory and New South Wales region dominates the polyols market owing to concentrated industrial manufacturing activities, substantial construction sector development, and higher population density requiring diverse polyurethane-based products. Sydney's position as Australia's largest metropolitan area drives significant demand across furniture, automotive, and construction applications. The region benefits from established supply chain infrastructure, proximity to major end-use manufacturing facilities, robust economic activity, and strong government investment in infrastructure development projects.

The regional dominance reflects New South Wales's broader economic significance and industrial concentration within Australia's manufacturing landscape. Major polyurethane foam manufacturers maintain production facilities serving regional construction, furniture, and automotive industries. Government infrastructure investments and housing development initiatives continue stimulating construction material demand including polyol-based insulation products. The region's leadership position is expected to persist throughout the forecast period supported by sustained population growth, urbanization trends, and evolving building performance requirements.

Market Dynamics:

Growth Drivers:

Why is the Australia Polyols Market Growing?

Increasing Demand for Energy-Efficient Building Insulation Materials

The Australia polyols market is experiencing substantial growth driven by escalating demand for energy-efficient building insulation materials, particularly rigid polyurethane foams derived from polyol formulations. Government regulatory frameworks emphasizing thermal performance standards are compelling construction industry stakeholders to adopt advanced insulation solutions that minimize energy consumption while maintaining occupant comfort. The updated National Construction Code provisions establishing minimum energy efficiency requirements have directly stimulated polyol consumption across residential and commercial construction sectors. The National Construction Code (NCC) 2022's domestic energy efficiency requirements for new homes came into effect in Queensland on May 1, 2024. The Queensland Development Code 4.1-Sustainable Buildings has been amended to incorporate these standards (PDF, 371.03 KB). Rigid polyurethane insulation offers superior thermal resistance per unit thickness compared to traditional alternatives, enabling architects and builders to maximize usable interior space while achieving stringent performance targets. The growing emphasis on sustainable construction practices aligns with polyurethane insulation characteristics including long-term durability, moisture resistance, and structural integrity. Building owners increasingly recognize lifecycle cost advantages associated with polyurethane-based insulation systems that reduce heating and cooling energy requirements over extended periods. Climate change considerations and evolving consumer awareness regarding environmental sustainability continue reinforcing demand for high-performance insulation materials throughout Australia's construction industry.

Expanding Furniture and Bedding Industry Driving Flexible Foam Consumption

The flourishing furniture and bedding sector represents a significant growth driver for the Australia polyols market as manufacturers increasingly utilize flexible polyurethane foams for cushioning, seating, and mattress applications. Consumer preferences for comfort-oriented home furnishings and premium bedding products continue stimulating demand for high-quality foam materials derived from specialized polyol formulations. The housing market's sustained activity generates downstream furniture demand as new homeowners furnish residential spaces with contemporary seating, bedding, and upholstered products. According to the industry report, Australia's national hotel occupancy rates reached 71%, up 2% year-on-year, with Revenue per Available Room (RevPAR) increasing 3.8% to AUD 171. Sydney achieved a record RevPAR of AUD 215 with 78% occupancy. The hospitality sector recovery, combined with 5,700 hotel rooms currently under construction and set to open within two years, is driving substantial commercial mattress and bedding procurement demand, directly supporting flexible polyurethane foam consumption across the furniture and hospitality sectors. Innovation in foam technologies enables development of specialized formulations addressing diverse consumer needs including hypoallergenic properties, temperature regulation, and pressure relief characteristics. The bedding industry's evolution toward enhanced sleep surfaces utilizing advanced foam technologies sustains polyol consumption growth throughout Australia's furniture manufacturing ecosystem.

Automotive Lightweighting Initiatives Accelerating Polyurethane Component Adoption

The automotive industry's strategic focus on vehicle lightweighting to enhance fuel efficiency and reduce emissions is significantly driving polyol demand across Australia. Polyurethane materials derived from polyol formulations increasingly feature in automotive seating, interior trim components, dashboards, headliners, and sound insulation applications where weight reduction delivers measurable performance benefits. The transition toward electric vehicles amplifies lightweighting imperatives as manufacturers seek to extend driving range through comprehensive weight optimization strategies. According to the industry report, Australia recorded 72,758 BEV and PHEV sales in the first six months of 2025, representing a 24.4% increase compared to the same period in 2024. Electric vehicles now account for 12.1% of all new car sales in Australia, up from 9.61% in 2024, with the national EV fleet exceeding 410,000 vehicles as of September 2025. This accelerating EV adoption is driving demand for lightweight polyurethane components in vehicle interiors, seating systems, and structural applications to optimize driving range and energy efficiency. Moreover, Australian automotive suppliers and component manufacturers maintain capabilities serving domestic assembly operations and export markets where polyurethane applications continue expanding. The industry's evolution toward advanced materials positions polyols as essential raw materials supporting automotive manufacturing transformation. Continued development of specialized polyol formulations meeting demanding automotive specifications ensures sustained consumption growth throughout the transportation sector.

Market Restraints:

What Challenges the Australia Polyols Market is Facing?

Raw Material Price Volatility and Supply Chain Dependencies

The Australia polyols market faces challenges from raw material price volatility, particularly petroleum-derived feedstocks that constitute primary inputs for conventional polyol production. Fluctuations in crude oil prices directly impact manufacturing costs, potentially compressing margins and creating pricing uncertainty throughout the supply chain. Australia's geographic isolation intensifies supply chain vulnerabilities as most polyol raw materials require importation from overseas production facilities. These dependencies expose domestic manufacturers and end-users to currency exchange fluctuations and international logistics disruptions that can affect product availability and pricing stability.

Environmental and Regulatory Compliance Requirements

Stringent environmental regulations governing polyurethane production processes present compliance challenges that can constrain market growth. The National Industrial Chemicals Notification and Assessment Scheme has tightened scrutiny on isocyanate-based polyurethane systems, indirectly influencing polyol formulation requirements and manufacturing practices. Compliance obligations necessitate investments in emission control technologies, waste management systems, and documentation processes that increase operational complexity and costs. These regulatory considerations particularly affect smaller manufacturers lacking resources for comprehensive compliance infrastructure.

Competition from Alternative Insulation and Cushioning Materials

The polyols market encounters competitive pressure from alternative materials serving similar end-use applications in insulation and cushioning segments. Fiberglass, mineral wool, and cellulose insulation products compete with polyurethane-based solutions in construction applications where cost considerations often drive material selection decisions. Natural fiber and latex alternatives present competition in furniture and bedding applications, particularly among environmentally conscious consumers prioritizing perceived sustainability attributes. These competitive dynamics require polyol manufacturers and polyurethane processors to demonstrate clear value propositions justifying material selection.

Competitive Landscape:

The Australia polyols market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational chemical corporations alongside specialized regional manufacturers serving specific application segments. Market participants compete primarily on product quality, technical support capabilities, supply chain reliability, and pricing strategies tailored to diverse customer requirements. Innovation in sustainable polyol formulations represents an increasingly important competitive differentiator as environmental considerations influence purchasing decisions across key end-use industries. Strategic partnerships between polyol suppliers and downstream polyurethane processors strengthen market positioning through integrated value chain relationships. Distribution network expansion and localized technical support services enable market participants to effectively serve geographically dispersed customer bases throughout Australia. The competitive landscape continues evolving as sustainability imperatives drive investment in bio-based polyol development and circular economy initiatives addressing end-of-life product management considerations.

Australia Polyols Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyether Polyols, Polyester Polyols |

| Applications Covered | Flexible Polyurethane Foams, Rigid Polyurethane Foams, CASE (Coatings, Adhesives, Sealants and Elastomers), Others |

| Industries Covered | Carpet Backing, Packaging, Furniture, Automotive, Building and Construction, Electronics, Footwear, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia polyols market size was valued at USD 873.9 Million in 2025.

The Australia polyols market is expected to grow at a compound annual growth rate of 5.78% from 2026-2034 to reach USD 1,452.01 Million by 2034.

Polyether polyols dominated the market with a share of 59%, owing to their exceptional versatility, low viscosity characteristics, and superior compatibility with isocyanates across flexible and rigid polyurethane foam manufacturing applications.

Key factors driving the Australia polyols market include increasing demand for energy-efficient building insulation materials, expanding furniture and bedding industry consumption, automotive lightweighting initiatives, and growing adoption of sustainable bio-based polyol formulations.

Major challenges include raw material price volatility and supply chain dependencies, stringent environmental and regulatory compliance requirements, competition from alternative insulation and cushioning materials, and limited domestic production capacity necessitating import reliance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)