Australia Polypropylene Market Size, Share, Trends and Forecast by Type, Process, Application, End User, and Region, 2025-2033

Australia Polypropylene Market Overview:

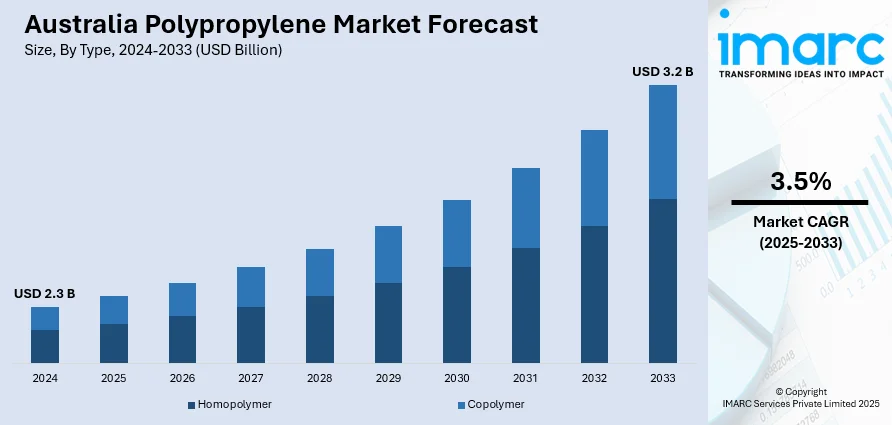

The Australia polypropylene market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The growing demand from the packaging, automotive, and construction sectors, increasing infrastructure development, rising consumer preference for lightweight and durable materials, advancements in recycling technologies, and expanding applications in healthcare and electrical industries, favorable government policies and rising investments in domestic manufacturing capabilities are some of the key factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

Australia Polypropylene Market Trends:

Expansion of the Packaging Industry as a Key End-Use Sector

The packaging sector remains one of the most prominent sectors expanding the Australia polypropylene market share. Polypropylene’s versatility, cost-effectiveness, and lightweight nature make it highly suitable for a wide array of packaging applications, ranging from food and beverage containers to pharmaceutical and consumer goods packaging. As per industry report, the e-commerce sector in Australia is expected to reach USD 1,568.60 Billion by 2033, exhibiting a CAGR of 12.70% from 2025-2033. The ongoing growth in e-commerce, fast-moving consumer goods (FMCG), and retail sectors is leading to increased demand for durable, protective, and attractive packaging solutions. Australian consumers are showing a trend towards convenient and sustainable packaging, which is prompting businesses to innovate with polypropylene films, rigid containers, and flexible packaging. Further, the stringent hygiene and preservation needs of the food industry support the use of polypropylene as it has superior barrier properties, resistant to moisture, and is food-grade compliant. Moreover, advances in polymer processing technology are facilitating the creation of upgraded polypropylene grades that provide better performance qualities such as clarity, heat resistance, and recyclability, thereby solidifying its position in rigid and flexible packaging forms nationwide.

To get more information on this market, Request Sample

Increasing Demand for Sustainable and Recyclable Polypropylene Products

The national focus on sustainability and environmental responsibility is positively impacting Australia polypropylene market growth. According to industry reports, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) has set an ambitious target to reduce plastic waste entering the Australian environment by 80% by 2030. This national objective reflects a broader environmental shift that is directly influencing the polypropylene market in Australia. One of the most prevalent thermoplastics, polypropylene, is now subject to closer examination in terms of end-of-life management and environmental footprint. In response, both the private and public sectors are speeding up initiatives to increase the recyclability of polypropylene and develop sustainable alternatives. This is resulting in a sharp rise in the creation and utilization of recyclable and eco-friendly polypropylene variants across all industries. Apart from this, the Australian government is launching various regulations and initiatives that will curb the use of single-use plastics and foster a circular economy, forcing manufacturers to change their more environmentally friendly production methods. As a result of this, industries are investing in new recycling technologies, such as chemical recycling and mechanical sorting, to make polypropylene more recyclable. This, in turn, is creating a positive Australia polypropylene market outlook. Additionally, research and development (R&D) efforts are directed toward bio-based polypropylene alternatives, which offer a reduced carbon footprint while maintaining the desirable properties of traditional polypropylene. Consumer preferences are also shifting toward eco-labeled and low-impact products, which in turn influences supply chains and product offerings.

Australia Polypropylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, process, application, and end user.

Type Insights:

- Homopolymer

- Copolymer

The report has provided a detailed breakup and analysis of the market based on the type. This includes homopolymer and copolymer.

Process Insights:

- Injection Molding

- Blow Molding

- Extrusion

- Others

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes injection molding, blow molding, extrusion, and others.

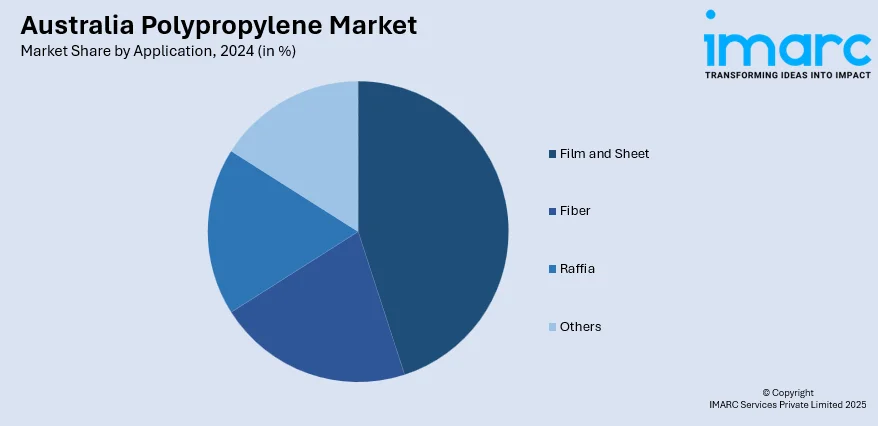

Application Insights:

- Film and Sheet

- Fiber

- Raffia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes film and sheet, fiber, raffia, and others.

End User Insights:

- Packaging

- Automotive

- Building and Construction

- Medical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes packaging, automotive, building and construction, medical, electrical and electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Polypropylene Market News:

- April 3, 2025: Viva Energy and Cleanaway are planning Australia’s first large-scale advanced recycling facility for soft plastics, aiming to convert waste into food-grade recycled materials. The project will leverage Cleanaway’s national waste network and Viva Energy’s Geelong Refinery, which houses the country’s only polypropylene plant. This refinery will process pyrolysis oil derived from soft plastics into new polypropylene, enabling circular reuse in packaging. The initiative supports upcoming government regulations on packaging sustainability and recycled content.

Australia Polypropylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Homopolymer, Copolymer |

| Processes Covered | Injection Molding, Blow Molding, Extrusion, Others |

| Applications Covered | Film and Sheet, Fiber, Raffia, Others |

| End Users Covered | Packaging, Automotive, Building and Construction, Medical, Electrical and Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia polypropylene market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia polypropylene market on the basis of type?

- What is the breakup of the Australia polypropylene market on the basis of process?

- What is the breakup of the Australia polypropylene market on the basis of application?

- What is the breakup of the Australia polypropylene market on the basis of end user?

- What is the breakup of the Australia polypropylene market on the basis of region?

- What are the various stages in the value chain of the Australia polypropylene market?

- What are the key driving factors and challenges in the Australia polypropylene market?

- What is the structure of the Australia polypropylene market and who are the key players?

- What is the degree of competition in the Australia polypropylene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia polypropylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia polypropylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia polypropylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)