Australia Popcorn Market Size, Share, Trends and Forecast by Type, Distribution Channel, End Consumer, and Region, 2025-2033

Australia Popcorn Market Overview:

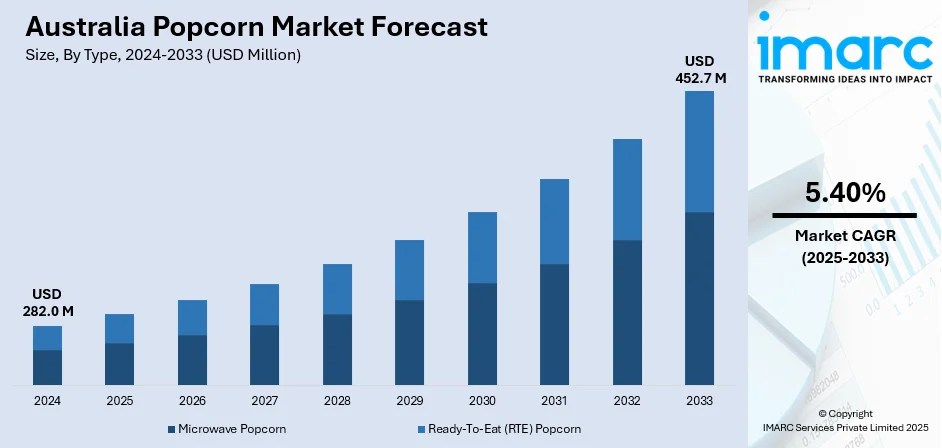

The Australia popcorn market size reached USD 282.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 452.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The growing demand for convenient and healthier snack options is driving the Australian popcorn market, with consumers increasingly seeking low-calorie and natural ingredients. Additionally, the rise of premium flavored popcorn and the expansion of retail distribution channels, including supermarkets and online platforms, further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 282.0 Million |

| Market Forecast in 2033 | USD 452.7 Million |

| Market Growth Rate 2025-2033 | 5.40% |

Australia Popcorn Market Trends:

Growing Health Consciousness

The Australia popcorn market is experiencing high growth in healthy consumers choosing more nutritious snack products. Popcorn is being consumed more and more as a lower-calorie, higher-fiber snack compared to conventional snacks such as chips and sweets. Demand is being influenced by increasing concern for the necessity of healthier food consumption, as consumers increasingly opt for clean-label, organic, and air-popped products. Producers are reacting by providing products made from natural ingredients, without artificial additives or preservatives. The demand for healthier snacks is a key component of the broader shift toward low-calorie, nutritious alternatives, positioning popcorn as a favored option among health-conscious consumers. As awareness of wellness continues to rise, this trend is expected to contribute to the Australia popcorn market growth.

To get more information on this market, Request Sample

Popcorn as a Convenient Snack

The convenience element is the major contributor to the expansion of the Australia popcorn market share, with hectic, busy lifestyles fueling demand for RTE snack foods. RTE, single-serving popcorn products have become increasingly popular since they provide instant, convenient consumption, in line with the overall consumer trend toward convenience. This movement is strongly reflected as Australians look to consume easily accessible snacks because of busy lifestyles. The portability and versatility of popcorn make it a perfect fit for both kids and adults. Stores are reacting by broadening their selection, with popcorn coming in multiple forms such as microwave packs and single-serve snack packets. In the 2023-24 period, per capita consumption of popcorn averaged just over 1,550 grams per person per day, marking a 0.7% increase from the previous year, further emphasizing the growing demand for convenient snack options.

Premium and Gourmet Popcorn

One of the emerging trends in the Australia popcorn market is the growth in demand for gourmet and premium popcorn. People prefer to pay higher prices for popcorn products that provide distinctive flavors and better quality ingredients. Gourmet popcorn products typically include foreign flavors like truffle, cheese, caramel, and spicy, appealing to individuals looking for a more premium snacking experience. Demand for premium products is also fueled by increasing popularity of artisanal snacks with focus on complexity of flavors and higher quality. As consumers grow bolder in snacking behavior, they are seeking gourmet popcorn as a gift or treat. This trend is inspiring brands to innovate and differentiate their products, further increasing the Australia popcorn market outlook.

Australia Popcorn Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end consumer.

Type Insights:

- Microwave Popcorn

- Ready-To-Eat (RTE) Popcorn

The report has provided a detailed breakup and analysis of the market based on the type. This includes microwave popcorn and ready-to-eat (RTE) popcorn.

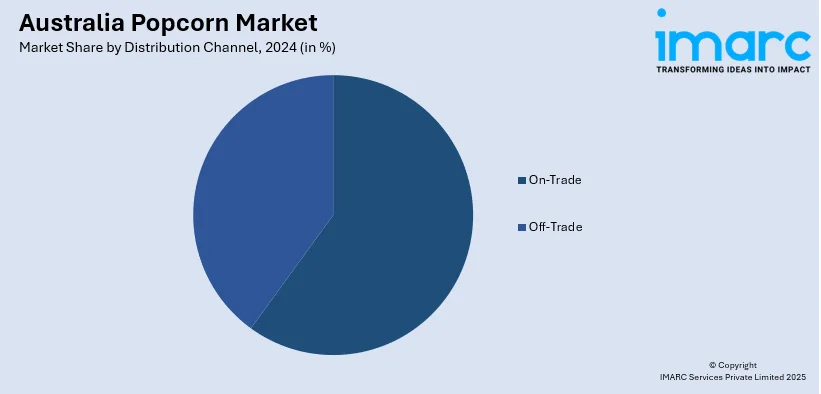

Distribution Channel Insights:

- On-Trade

- Off-Trade

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channel

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade (supermarkets and hypermarkets, convenience stores, online channel, and others)

End Consumer Insights:

- Households

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end consumer. This includes microwave households and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Popcorn Market News:

- In December 2024, PopCorners, the air-popped corn snack, is launching its first global campaign in collaboration with VCCP. The "Familiar, But Different" platform introduces the snack to audiences worldwide, including Australia, Brazil, and Mexico. Targeting Millennials and Gen Z, the campaign emphasizes PopCorners as an adventurous yet familiar snack, combining the excitement of trying something new with the comfort of a reliable snack choice. The campaign follows PopCorners' successful U.S. launch.

- In June 2024, PopBox launched a new popcorn flavor, Caramel Crunch, available in Woolworths stores across Australia. Sourced from 100% Aussie-grown corn, the new flavor adds to PopBox’s existing range, including Mega Butter, Sweet and Salty, and more. The brand highlights that its products are free from palm oil, gluten, dairy, and GMOs, vegan-friendly, and packaged in recyclable materials. The Caramel Crunch is priced at RRP $4.

Australia Popcorn Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Microwave Popcorn, Ready-To-Eat (RTE) Popcorn |

| Distribution Channels Covered |

|

| End Consumers Covered | Households, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia popcorn market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia popcorn market on the basis of type?

- What is the breakup of the Australia popcorn market on the basis of distribution channel?

- What is the breakup of the Australia popcorn market on the basis of end consumer?

- What is the breakup of the Australia popcorn market on the basis of region?

- What are the various stages in the value chain of the Australia popcorn market?

- What are the key driving factors and challenges in the Australia popcorn market?

- What is the structure of the Australia popcorn market and who are the key players?

- What is the degree of competition in the Australia popcorn market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia popcorn market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia popcorn market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia popcorn industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)