Australia Pouches Market Size, Share, Trends and Forecast by Material, Treatment Type, Product, Closure Type, End Use, and Region, 2026-2034

Australia Pouches Market Summary:

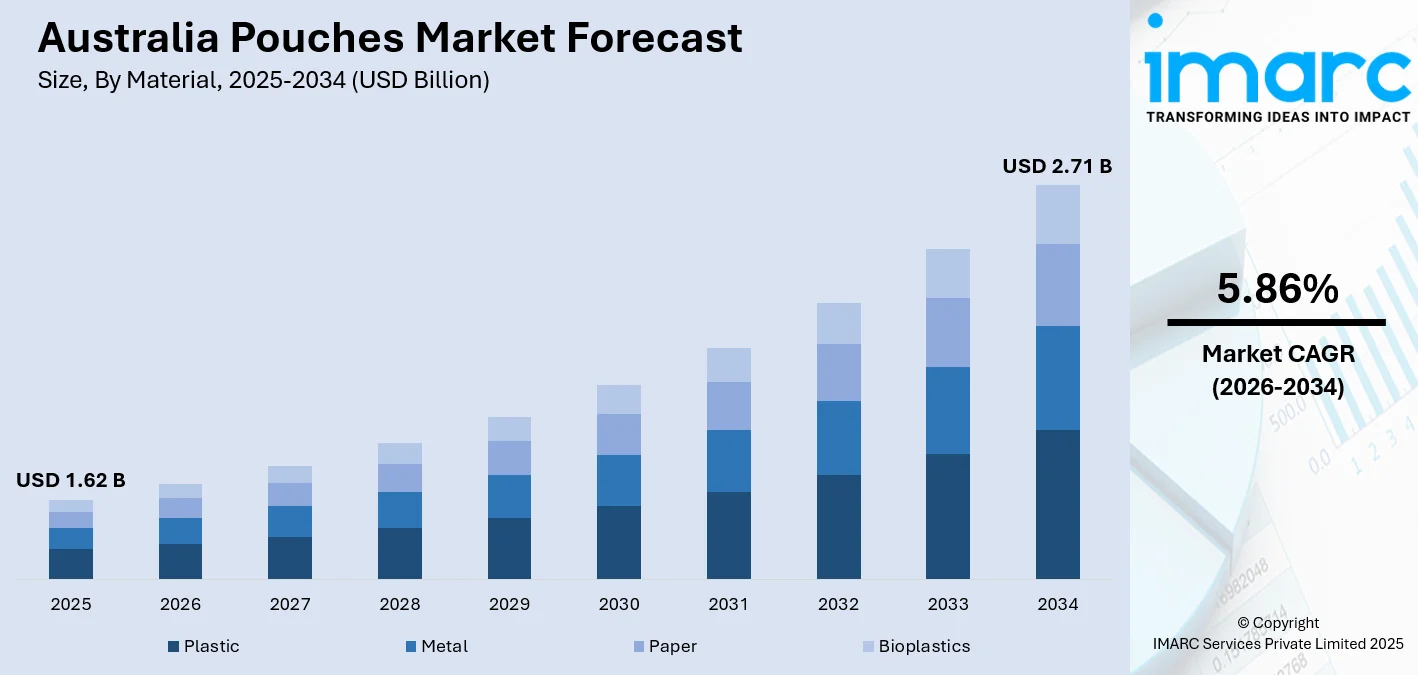

The Australia pouches market size was valued at USD 1.62 Billion in 2025 and is projected to reach USD 2.71 Billion by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

The Australia pouches market is experiencing robust expansion driven by increasing consumer preference for lightweight, convenient, and sustainable packaging solutions across diverse industries. Rising environmental consciousness among Australian consumers is accelerating demand for recyclable and compostable pouch formats. The proliferation of on-the-go consumption patterns, coupled with growing e-commerce penetration, continues to strengthen market momentum. Technological advancements in barrier films and closure mechanisms are enhancing product preservation capabilities while supporting extended shelf life requirements. Government initiatives promoting circular economy principles and the phasing out of single-use plastics are compelling manufacturers to innovate with eco-friendly materials and designs. The expansion of organized retail channels and quick-service restaurant sectors further bolsters demand for flexible pouch packaging that combines functionality with attractive shelf presentation. Evolving dietary habits favoring portion-controlled and ready-to-eat products are reshaping packaging preferences, positioning pouches as the preferred choice for brands seeking differentiation in competitive consumer markets across Australia pouches market share.

Key Takeaways and Insights:

- By Material: Plastic dominates the market with a share of 58% in 2025, because of its exceptional flexibility, lightweight features, and affordability for large-scale production. Widespread adoption across food packaging applications continues driving segment expansion.

- By Treatment Type: Standard leads the market with a share of 45% in 2025. This dominance is driven by versatile applications across ambient temperature products, lower processing costs, and broad compatibility with diverse product categories requiring reliable barrier protection.

- By Product: Stand-up exhibits a clear dominance in the market with 61% share in 2025, reflecting strong retailer preference for enhanced shelf visibility and consumer appeal through self-standing capability that maximizes brand presentation and product differentiation.

- By Closure Type: Tear notch represents the biggest segment with a market share of 50% in 2025, motivated by ease of use, economical production methods, and extensive use in single-serve portions that need easy-open functionality.

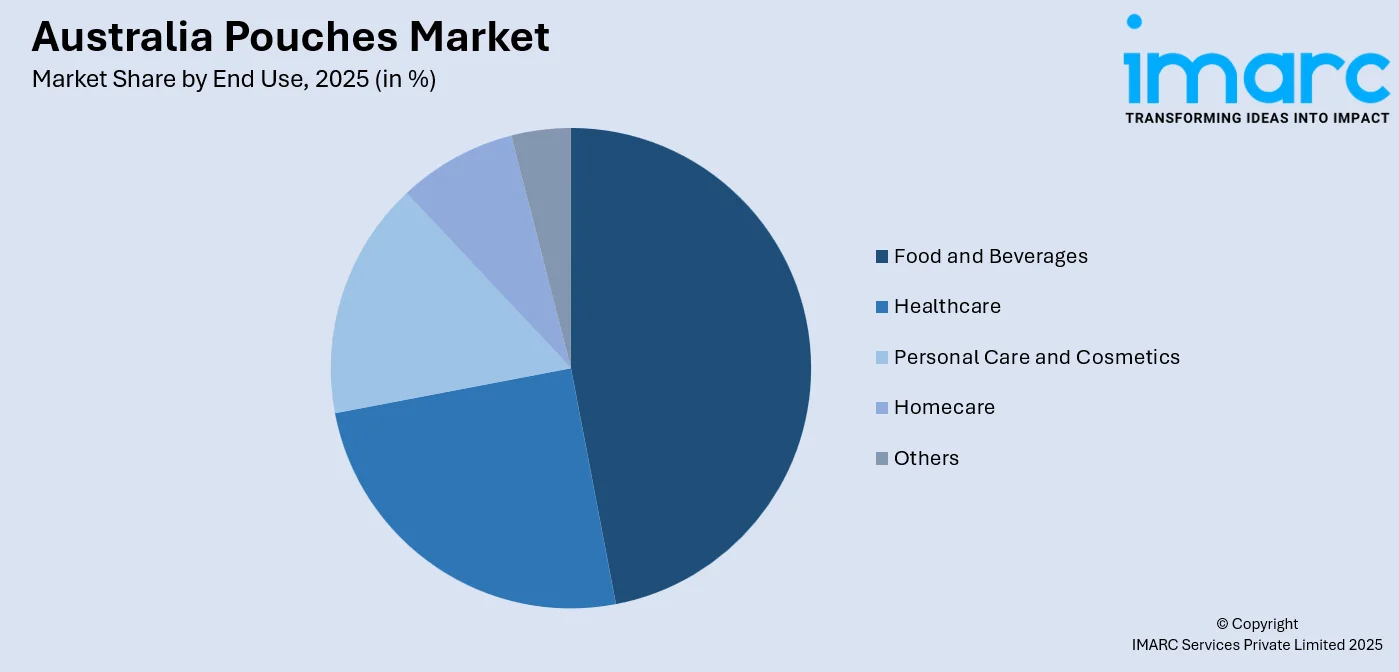

- By End Use: Food and beverages dominate the market with a share of 47% in 2025, owing to expanding processed food consumption, rising demand for convenient meal solutions, and growing preference for lightweight packaging that extends product freshness.

- By Region: Australia Capital Territory & New South Wales is the largest region with 25% share in 2025, driven by concentration of food processing facilities, established retail networks, and high population density supporting robust packaging demand.

- Key Players: Key players drive the Australia pouches market by investing in sustainable packaging technologies, expanding production capacities, and developing innovative closure systems. Their focus on recyclable materials, strategic partnerships with brand owners, and adoption of advanced barrier technologies accelerate market penetration while addressing evolving environmental regulations.

To get more information on this market Request Sample

The Australia pouches market continues to evolve as manufacturers respond to shifting consumer expectations and regulatory pressures driving sustainable packaging adoption. The transition toward circular economy principles is reshaping product development priorities, with leading converters investing in mono-material structures that facilitate recycling while maintaining performance standards. In September 2024, Detpak launched Australia's largest range of more than twenty commercially compostable and recyclable PBS-lined cartons, trays, and lunchboxes, demonstrating industry commitment to sustainable alternatives that comply with single-use plastics legislation. The market benefits from strong domestic manufacturing capabilities concentrated in eastern states where proximity to major food processors enables responsive supply chain partnerships. Flexible pouch formats increasingly replace rigid containers across retail categories as brands recognize benefits including reduced transportation costs, improved product freshness, and enhanced consumer convenience. Innovation in barrier coatings and resealable closures continues expanding application possibilities, positioning pouches as versatile solutions meeting diverse packaging requirements across food, beverage, healthcare, and personal care sectors throughout Australia.

Australia Pouches Market Trends:

Accelerating Shift Toward Sustainable and Recyclable Pouch Materials

Australian manufacturers are increasingly transitioning from conventional multi-layer laminates to mono-material structures that enable kerbside recycling compatibility. This transformation reflects mounting consumer expectations for environmentally responsible packaging that aligns with circular economy objectives. Converters are developing innovative barrier technologies using single polymer systems that maintain product protection while simplifying end-of-life recovery. The integration of post-consumer recycled content into new pouch production represents another dimension of this sustainability-driven evolution, supporting closed-loop material flows and reducing dependence on virgin plastic feedstocks. Brand owners recognize that packaging recyclability credentials increasingly influence purchasing decisions, motivating investment in redesigned pouch formats that communicate environmental commitment through clear labeling and certified disposal pathways.

Growing Adoption of Smart and Interactive Pouch Technologies

The Australia pouches market is witnessing increasing integration of intelligent features that enhance consumer engagement and supply chain visibility. Active packaging technologies incorporating oxygen scavengers, moisture absorbers, and antimicrobial agents are extending shelf life while reducing food waste across temperature-sensitive product categories. QR codes and augmented reality elements printed on pouch surfaces enable interactive brand experiences, providing consumers with traceability information, usage instructions, and promotional content accessible through smartphone scanning. These digital connectivity features support authentication programs that combat counterfeiting while enabling manufacturers to gather valuable consumer insights. Time-temperature indicators embedded in packaging structures alert consumers to freshness status, building trust in product quality and supporting premium positioning strategies across food and pharmaceutical applications.

Expansion of Convenient Closure and Dispensing Systems

Pouch manufacturers are developing increasingly sophisticated closure mechanisms that enhance user convenience while supporting product preservation between uses. Resealable zipper profiles, precision spouts, and portion-control dispensing features address consumer demands for functionality that accommodates modern consumption patterns. The proliferation of on-the-go lifestyles drives innovation in single-hand opening systems and mess-free pouring configurations that enable convenient product access across diverse usage occasions. Child-resistant closures meeting regulatory requirements for pharmaceutical and household chemical applications expand addressable market opportunities. These advanced closure technologies also support sustainability objectives by enabling product portioning that minimizes waste while maintaining freshness throughout extended usage periods.

Market Outlook 2026-2034:

The Australia pouches market outlook remains positive as manufacturers continue investing in advanced production technologies and sustainable material innovations that address evolving consumer expectations. Expanding applications across food, beverage, healthcare, and personal care segments drive capacity expansion initiatives throughout the forecast period. The market generated a revenue of USD 1.62 Billion in 2025 and is projected to reach a revenue of USD 2.71 Billion by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034. Regulatory frameworks promoting recyclable packaging formats and phasing out problematic single-use plastics create favorable conditions for pouch adoption across retail categories. E-commerce expansion necessitates robust yet lightweight packaging solutions capable of withstanding distribution handling while minimizing shipping costs. Strategic partnerships between material suppliers, converters, and brand owners accelerate innovation cycles delivering performance improvements and sustainability enhancements. Domestic manufacturing investments strengthen supply chain resilience while supporting localized production capabilities responsive to regional market requirements.

Australia Pouches Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material |

Plastic |

58% |

|

Treatment Type |

Standard |

45% |

|

Product |

Stand-up |

61% |

|

Closure Type |

Tear Notch |

50% |

|

End Use |

Food and Beverages |

47% |

|

Region |

Australia Capital Territory & New South Wales |

25% |

Material Insights:

- Plastic

- Metal

- Paper

- Bioplastics

Plastic dominates with a market share of 58% of the total Australia pouches market in 2025.

Plastic pouches maintain dominant market positioning through exceptional versatility, barrier performance, and manufacturing efficiency that enables cost-effective high-volume production across diverse application categories. The material offers superior flexibility allowing pouches to conform to varied product shapes while providing reliable protection against moisture, oxygen, and contamination throughout supply chain handling. Plastic films accommodate multiple printing techniques including rotogravure and flexographic processes that deliver vibrant graphics enhancing brand visibility on retail shelves. The segment's adaptability supports integration of advanced features including resealable closures, spouts, and tear mechanisms that enhance consumer convenience.

The plastic segment benefits from continuous innovation in polymer formulations delivering enhanced sustainability credentials without compromising functional requirements. Converters are developing recyclable mono-material structures using polyethylene and polypropylene that maintain barrier performance while enabling kerbside recycling compatibility. Lightweight characteristics reduce transportation costs and carbon footprint compared to rigid alternatives, supporting brand owner sustainability commitments. Advanced printing technologies enable high-quality graphics that maximize shelf appeal and brand differentiation across competitive retail environments.

Treatment Type Insights:

- Standard

- Aseptic

- Retort

- Hot-fill

Standard leads with a share of 45% of the total Australia pouches market in 2025.

Standard treatment pouches capture the largest market share through versatile applications spanning ambient temperature products including snacks, confectionery, dry goods, and non-perishable food items. These pouches require minimal processing infrastructure compared to specialized treatment alternatives, enabling manufacturers to achieve competitive pricing while maintaining adequate product protection. The format's simplicity allows rapid production changeovers and efficient line operations that support diverse product portfolios without substantial capital investment in thermal processing equipment. Standard pouches deliver reliable barrier properties through multi-layer film constructions that prevent moisture ingress and oxygen transmission under normal storage conditions prevalent across retail distribution networks.

The segment's dominance reflects widespread adoption across grocery retail where ambient storage conditions prevail and extended shelf life requirements can be met through passive barrier protection rather than active preservation technologies. Standard pouches accommodate diverse product viscosities and textures while offering flexibility in size configurations from single-serve sachets to family-sized formats. Cost efficiency in both packaging material and filing operations makes standard treatment the preferred choice for price-sensitive consumer categories where packaging functionality requirements remain straightforward.

Product Insights:

- Flat

- Stand-up

The stand-up exhibits a clear dominance with a 61% share of the total Australia pouches market in 2025.

Stand-up pouches command substantial market share through superior shelf presence and consumer convenience advantages that differentiate products in competitive retail environments. The self-standing capability enables prominent display positioning that maximizes brand visibility while accommodating diverse merchandising configurations across supermarket aisles, convenience stores, and specialty retail outlets. The gusseted bottom construction provides structural stability that allows pouches to remain upright throughout handling and display, creating billboard-effect presentation opportunities that capture consumer attention. Retailers favor stand-up formats for efficient shelf space utilization and streamlined restocking processes that reduce labor requirements during inventory replenishment cycles.

The format's versatility supports integration of diverse closure systems including zippers, spouts, and resealable mechanisms that enhance consumer utility and product preservation between uses. Stand-up pouches offer significant material reduction compared to rigid containers while delivering equivalent or superior product protection, supporting sustainability objectives alongside cost efficiency goals. Brand owners increasingly transition from traditional packaging formats to stand-up pouches recognizing marketing advantages including large printable surface area, modern aesthetic appeal, and differentiation potential in crowded retail categories.

Closure Type Insights:

- Tear Notch

- Zipper

- Spout

Tear notch represents the leading segment with a 50% share of the total Australia pouches market in 2025.

Tear notch closures maintain market leadership through manufacturing simplicity, cost efficiency, and intuitive user operation that addresses single-use consumption occasions prevalent across snack, confectionery, and portion-controlled product categories. The laser-scored perforation technology enables clean opening without requiring scissors or additional tools, enhancing consumer convenience while maintaining package integrity prior to opening. Precise notch placement ensures consistent tear propagation along intended paths, preventing irregular openings that could compromise product dispensing or cause spillage during consumer use. The closure mechanism integrates seamlessly into existing converting processes without requiring specialized equipment investments or significant production line modifications.

The segment benefits from minimal incremental manufacturing costs compared to more complex closure mechanisms while delivering reliable functionality across diverse pouch formats and material constructions. Tear notch configurations accommodate various opening patterns including corner tear, top tear, and side tear options that manufacturers customize based on product characteristics and intended usage occasions. Food safety considerations favor tamper-evident tear notch designs that clearly indicate first opening, building consumer confidence in product integrity throughout retail distribution channels.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Healthcare

- Personal Care and Cosmetics

- Homecare

- Others

Food and beverages dominate with a market share of 47% of the total Australia pouches market in 2025.

Food and beverages applications drive market demand through expanding consumption of processed foods, ready-to-eat meals, and convenience-oriented products packaged in flexible pouch formats. The segment benefits from pouches' exceptional barrier properties that extend shelf life while maintaining product freshness, flavor, and nutritional integrity throughout distribution and storage. In November 2024, MasterFoods announced testing of new paper-based packaging for their Squeeze-On Tomato Sauce packs at the Mars Food & Nutrition Wyong facility, containing substantially less plastic than original formulations while maintaining recyclability through traditional curbside collection.

Rising demand for single-serve portions, snack products, and on-the-go meal solutions accelerates pouch adoption as manufacturers recognize format advantages including reduced packaging weight, improved transportation efficiency, and enhanced retail display capabilities. The food industry represents the largest application segment for flexible packaging in Australia, with pouches increasingly displacing rigid containers across categories ranging from sauces and condiments to frozen foods and dairy products. Evolving consumer preferences, favoring portion control and waste reduction further support market expansion.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales leads with a share of 25% of the total Australia pouches market in 2025.

Australia Capital Territory and New South Wales command the largest regional market share through concentration of food processing facilities, established retail networks, and highest population density supporting robust packaging consumption volumes. The region hosts major manufacturing complexes and converting operations that anchor regional flexible packaging supply chains, benefiting from proximity to raw material suppliers and transportation infrastructure connecting domestic and export markets. Sydney serves as a hub for quick-service restaurant operations and food distribution networks that generate substantial demand for pouches across diverse product categories. Strong e-commerce penetration across the metropolitan area drives packaging requirements for direct-to-consumer fulfillment operations prioritizing lightweight and protective solutions.

The region's economic diversity encompasses pharmaceutical manufacturing, personal care product development, and premium food production sectors that collectively sustain diverse pouch application requirements. Established logistics corridors facilitate efficient distribution throughout the eastern seaboard, reducing lead times for packaging supply to brand owners operating production facilities across the region. Workforce availability and technical expertise support sophisticated converting operations delivering customized packaging solutions meeting specific customer specifications.

Market Dynamics:

Growth Drivers:

Why is the Australia Pouches Market Growing?

Regulatory Push Toward Sustainable Packaging Solutions

Australian federal and state governments are implementing increasingly stringent regulations targeting single-use plastics and promoting circular economy principles that create favorable conditions for recyclable and compostable pouch adoption. The National Packaging Targets established through collaborative industry and government efforts mandate that all packaging be reusable, recyclable, or compostable, compelling manufacturers to redesign packaging portfolios toward compliant formats. State-level legislation in Western Australia, South Australia, and other jurisdictions progressively bans problematic plastic items including plates, bowls, and containers, redirecting demand toward flexible pouch alternatives that meet environmental compliance requirements. These regulatory frameworks provide market certainty that encourages capital investment in sustainable packaging production capabilities.

Evolving Consumer Preferences for Convenience and Sustainability

Australian consumers increasingly prioritize packaging formats that combine functional convenience with environmental responsibility, driving brand owners to adopt pouch solutions that address both requirements simultaneously. Research indicates that substantial majorities of Australian consumers consider packaging composition when making purchasing decisions, creating competitive advantages for brands demonstrating sustainability leadership through recyclable or compostable packaging choices. The proliferation of on-the-go lifestyles across urban populations generates demand for lightweight, portable packaging formats that accommodate modern consumption patterns spanning commuting, workplace dining, and outdoor activities. Pouches deliver superior convenience through features including resealable closures, easy-open mechanisms, and portion-controlled sizing that align with consumer expectations for practicality alongside environmental considerations. Younger demographic cohorts demonstrate particularly strong preferences for sustainable packaging, influencing brand strategies across categories targeting millennial and Generation Z consumers who actively seek products reflecting their environmental values.

Expansion of E-commerce and Direct-to-Consumer Distribution

The accelerating growth of online retail and direct-to-consumer fulfillment channels creates substantial demand for packaging solutions optimized for distribution handling and shipping efficiency that pouches deliver effectively. E-commerce operations prioritize lightweight packaging that minimizes dimensional weight charges while providing adequate product protection throughout parcel delivery networks spanning urban and regional destinations. Flexible pouches occupy significantly less warehouse space than rigid alternatives, enabling efficient inventory management across fulfillment operations handling diverse product assortments. The format's durability withstands automated sorting equipment, conveyance systems, and last-mile delivery handling without compromising product integrity. Subscription services and meal kit delivery operations particularly favor pouch formats for individual ingredient packaging that combines portion control with freshness preservation across refrigerated and ambient product categories. Brand owners expanding online sales channels recognize pouches' advantages in reducing shipping costs while enhancing unboxing experiences through premium presentation possibilities.

Market Restraints:

What Challenges the Australia Pouches Market is Facing?

Complex Recycling Infrastructure and Material Recovery Challenges

Multi-layer laminate constructions prevalent in high-barrier pouches present significant recycling challenges that complicate end-of-life material recovery and circular economy integration. The separation of different polymer layers requires specialized processing equipment unavailable in conventional recycling facilities, limiting diversion from landfill streams. Soft plastics collection programs face operational constraints following disruptions to recovery pathways, reducing consumer access to appropriate disposal options for flexible packaging. Contamination from food residues further complicates recycling viability, requiring consumer education initiatives to ensure proper preparation before disposal.

Raw Material Price Volatility and Supply Chain Vulnerabilities

Fluctuating costs for petroleum-based polymers, aluminum foils, and specialty films create pricing uncertainty that challenges manufacturer margin management and customer budgeting processes. Global supply chain disruptions stemming from geopolitical tensions, shipping delays, and container availability constraints introduce procurement complexities for converters dependent on imported materials. Energy costs affecting polymer production and converting operations contribute additional cost pressures throughout the packaging value chain. Currency exchange rate movements compound pricing challenges for Australian manufacturers sourcing materials from international suppliers, requiring sophisticated hedging strategies to maintain competitive positioning.

Competition from Alternative Packaging Formats

Rigid packaging formats including glass jars, metal cans, and plastic containers maintain established positions across product categories where perceived quality associations and traditional consumer preferences favor conventional packaging presentations. Paper-based packaging advances position fiber materials as sustainable alternatives competing for applications traditionally served by plastic pouches. Brand owners balancing sustainability messaging with functional requirements may select rigid recyclable formats offering clearer environmental credentials despite higher material and transportation costs. Consumer perceptions associating flexible packaging with lower quality in premium product categories constrain pouch adoption despite functional equivalence.

Competitive Landscape:

The Australia pouches market features a competitive landscape characterized by diverse participants ranging from multinational packaging corporations to specialized domestic converters serving regional customer bases. Market competition centers on innovation capabilities, particularly development of sustainable materials and advanced barrier technologies that address evolving regulatory requirements and brand owner sustainability commitments. Leading participants invest substantially in research and development programs targeting recyclable mono-material structures, compostable films, and post-consumer recycled content integration. Strategic partnerships between material suppliers and converters accelerate commercialization of innovative solutions meeting specific application requirements. Manufacturing efficiency improvements through automation and process optimization enable competitive pricing while maintaining quality standards. Customer service capabilities including technical support for packaging design optimization and rapid prototyping strengthen supplier relationships with brand owners seeking collaborative development partnerships. Geographic coverage and supply chain responsiveness differentiate competitors serving time-sensitive production requirements across dispersed customer locations.

Australia Pouches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Metal, Paper, Bioplastics |

| Treatment Types Covered | Standard, Aseptic, Retort, Hot-fill |

| Products Covered | Flat, Stand-up |

| Closure Types Covered | Tear Notch, Zipper, Spout |

| End Uses Covered | Food and Beverages, Healthcare, Personal Care and Cosmetics, Homecare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia pouches market size was valued at USD 1.62 Billion in 2025.

The Australia pouches market is expected to grow at a compound annual growth rate of 5.86% from 2026-2034 to reach USD 2.71 Billion by 2034.

Plastic dominated the market with a share of 58%, driven by superior flexibility, cost-effectiveness for high-volume manufacturing, and exceptional barrier performance protecting products against moisture and contamination.

Key factors driving the Australia pouches market include regulatory frameworks promoting sustainable packaging, evolving consumer preferences for convenience and recyclability, e-commerce expansion, and technological innovations in barrier films and closure mechanisms.

Major challenges include complex recycling infrastructure for multi-layer laminates, raw material price volatility affecting manufacturing costs, supply chain vulnerabilities from global disruptions, and competition from alternative packaging formats including rigid recyclable containers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)