Australia Power Electronics Market Size, Share, Trends and Forecast by Device, Material, Application, Voltage, End Use Industry, and Region, 2025-2033

Australia Power Electronics Market Overview:

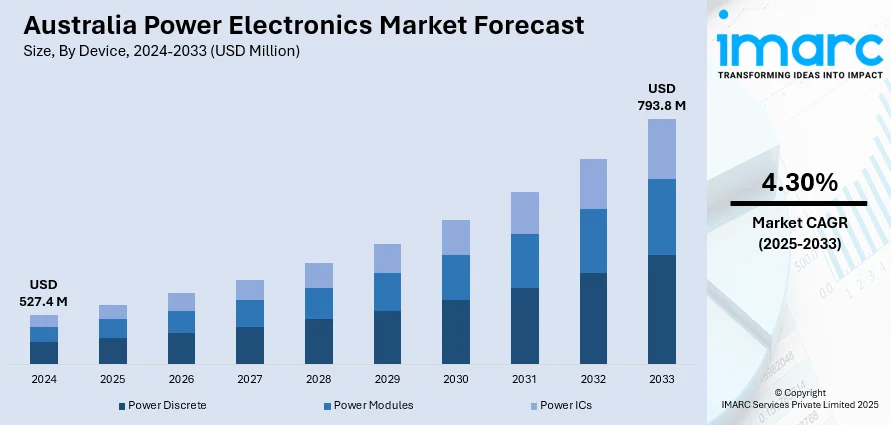

The Australia power electronics market size reached USD 527.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 793.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is fueled by increasing renewable energy use, electric vehicle adoption, and grid transformation. Moreover, government incentives, carbon reduction goals, and increasing demand for energy efficiency also accelerate investment. Apart from this, innovation through technological improvements in semiconductors and industrial automation growth plays a major role, driving innovation and increasing the Australia power electronics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 527.4 Million |

| Market Forecast in 2033 | USD 793.8 Million |

| Market Growth Rate 2025-2033 | 4.30% |

Australia Power Electronics Market Trends:

Renewable Energy Integration

Australia's power electronics industry is undergoing a tremendous revolution through the integration of renewable sources like solar and wind energy. The emphasis on lowering greenhouse gas emissions and increased energy security in the country has prompted enormous investments in renewable energy infrastructure. Power electronics make the transformation possible through efficient conversion and control of electricity from renewable energy sources. High-performance inverters and converters are necessary to integrate variable renewable energy into the grid while maintaining stability and reliability. The implementation of smart grid technologies also increases the flexibility and strength of the power distribution network in handling the intermittency of renewable energy output. Recently, in April 2025, Australia made a notable move toward a completely renewable energy future as the first phase of Project EnergyConnect became operational. This transmission line, the biggest of its type in the nation, stretches 135 km from Robertstown in South Australia to Buronga in New South Wales, along with a spur connection to Red Cliffs in Victoria. The direct effect is an extra 150 megawatts (MW) of power exchange capability between South Australia and its adjoining states. After finishing the second phase to Wagga Wagga, the transfer capacity will increase to 800 MW, allowing South Australia to import as much as 750 MW and export up to 700 MW, rising to over 1.3 GW in both directions by late 2027.

To get more information on this market, Request Sample

Growth of Electric Vehicles and Energy Storage Systems

The increasing use of electric vehicles (EVs) and the emergence of energy storage systems are significantly influencing the Australia power electronics market growth. EVs need advanced power electronics for effective battery management, motor control, and charging systems. As more EVs are on the road, the need for high-performance power electronic components is increasing. At the same time, large-scale energy storage systems like the Victorian Big Battery are being installed to store surplus renewable energy and offer grid stability. Advanced power electronics are used in these systems to control the charging and discharging process, providing maximum performance and durability. The convergence of EVs and energy storage systems offers new dimensions for power electronics innovation, specifically in the realm of vehicle-to-grid integration and demand response technology.

Semiconductor Materials and Smart Grid Technology Advancements

Semiconductor materials and smart grid technology advancements play a critical role in defining the Australia power electronics market outlook. The creation of wide-bandgap semiconductors like gallium nitride (GaN) and silicon carbide (SiC) provides important advances in efficiency, thermal characteristics, and power density over conventional silicon-based products. Hence, it is essential to ensure that large photovoltaic plants support grid stability, especially as renewable energy grows in importance within the energy mix of nations, notably in Australia, which provided 73% of its energy on September 9, 2024, marking the highest share ever recorded. These semiconductors are especially useful in high-power related applications like that of renewable energy systems, EVs, and industrial automation. Concurrently, the execution of smart grid technologies allows real-time monitoring and control of the power distribution network, enabling better distributed energy resources integration and enhancing grid resilience. The convergence of these technological advancements is driving innovation in power electronics, leading to more efficient, reliable, and sustainable energy systems in Australia.

Australia Power Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device, material, application, voltage, and end use industry.

Device Insights:

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Module

- Power Integrated Module

- Power ICs

- Power Management Integrated Circuit (PMIC)

- Application-Specific Integrated Circuit (ASIC)

The report has provided a detailed breakup and analysis of the market based on the device. This includes power discrete (diode, transistors, and thyristor), power modules (intelligent power module and power integrated module), and power ICs (power management integrated circuit (PMIC) and application-specific integrated circuit (ASIC)).

Material Insights:

- Silicon

- Sapphire

- Silicon Carbide

- Gallium Nitride

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes silicon, sapphire, silicon carbide, gallium nitride, and others.

Application Insights:

- Power Management

- UPS

- Renewable

- Others

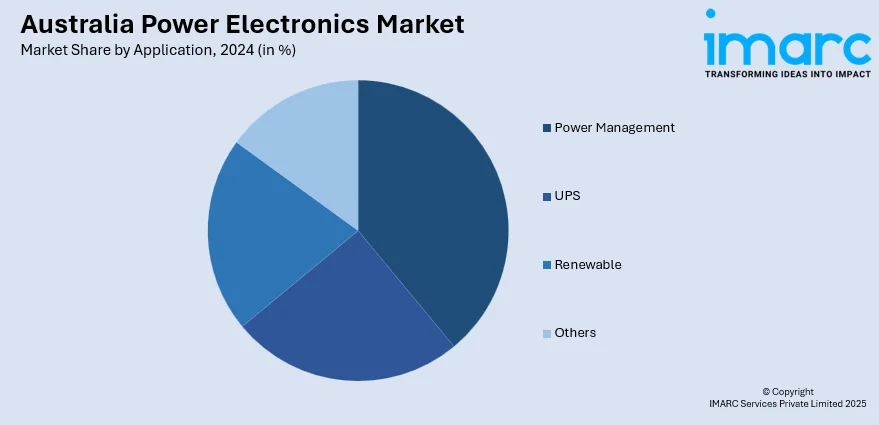

The report has provided a detailed breakup and analysis of the market based on the application. This includes power management, UPS, renewable, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

End Use Industry Insights:

- Automotive

- Military and Aerospace

- Energy and Power

- IT and Telecommunication

- Consumer Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, military and aerospace, energy and power, IT and telecommunication, consumer electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Electronics Market News:

- In February 2025, EnergyAustralia announced its full-year results for 2024, reporting A$115 million NPATF, supported by improved availability and performance of its generation assets. This outcome was an enhancement over the 2023 NPATF of -$35M1. The outcome was announced concurrently with EnergyAustralia advancing initiatives to introduce new adaptable capacity that supports a dependable and lower emissions future while minimizing costs for customers.

- In February 2025, Australia's leading energy producer AGL Energy (AGL.AX) revealed plans to pursue 1.4 gigawatts of grid-scale battery storage initiatives within the coming year, reinforcing its dedication to the green transition. The statement is made as AGL aims to honor its commitment to leaving coal-powered generation behind and reach net zero by 2035, even with a retreat of pro-climate initiatives following the election of U.S. President Donald Trump.

- In October 2024, Power Electronics revealed they will advance their decarbonization initiative for Oceania by attending All Energy Australia. This seeks to strengthen their leadership role in the area, with initiatives set to deploy solutions that surpass 36 GW of installed capacity in the upcoming years.

- In September 2024, EnergyAustralia announced its partnership with Ausgrid, the Network Services Provider for New South Wales, to enhance a dynamic pricing trial that seeks to utilize the benefits of Virtual Power Plants, enabling customers to maximize the advantages of their home solar systems. Project Edith, named to honor electrical power system pioneer Edith Clarke, is an 18-month experiment on dynamic network pricing led by Ausgrid. This initiative aims to promote the various benefits of Virtual Power Plants, influencing customers to increase the value of home energy assets such as rooftop solar and batteries, and support the community by granting more households access to renewable energy.

Australia Power Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Materials Covered | Silicon, Sapphire, Silicon Carbide, Gallium Nitride, Others |

| Applications Covered | Power Management, UPS, Renewable, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Use Industries Covered | Automotive, Military and Aerospace, Energy and Power, IT and Telecommunication, Consumer Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power electronics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power electronics market on the basis of device?

- What is the breakup of the Australia power electronics market on the basis of material?

- What is the breakup of the Australia power electronics market on the basis of application?

- What is the breakup of the Australia power electronics market on the basis of voltage?

- What is the breakup of the Australia power electronics market on the basis of end use industry?

- What is the breakup of the Australia power electronics market on the basis of region?

- What are the various stages in the value chain of the Australia power electronics market?

- What are the key driving factors and challenges in the Australia power electronics?

- What is the structure of the Australia power electronics market and who are the key players?

- What is the degree of competition in the Australia power electronics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)