Australia Power Rental Market Size, Share, Trends and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Region, 2026-2034

Australia Power Rental Market Growth Overview:

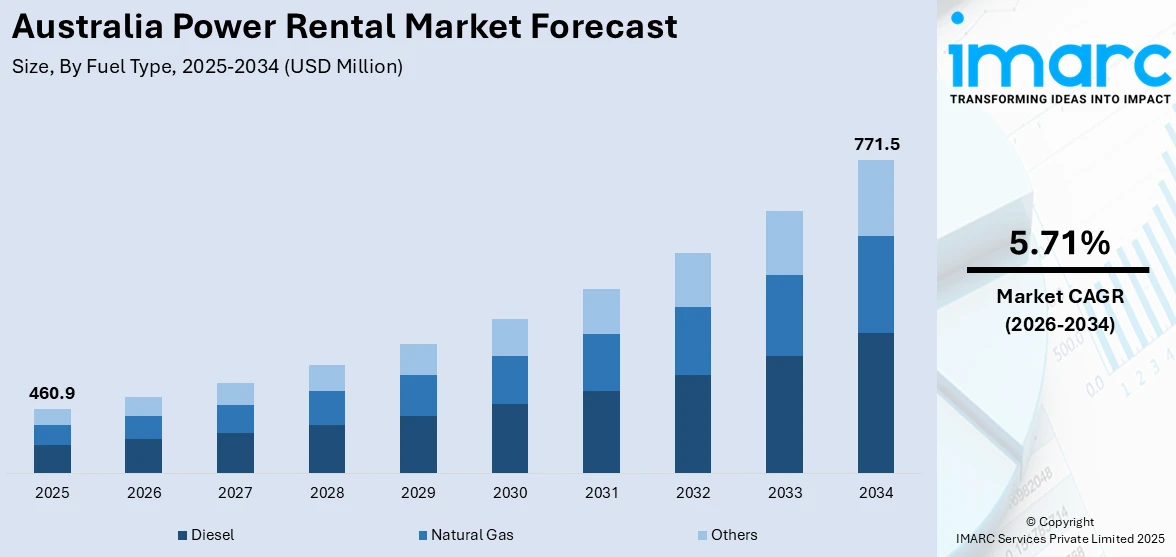

The Australia power rental market size reached USD 460.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 771.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.71% during 2026-2034. The ageing grid infrastructure and unreliable network supply, growing power needs from the expanding mining, construction, and events sectors, rising electrification of remote sites, and elevating adoption of hybrid and renewable rental solutions amid tightening emissions regulations are among the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 460.9 Million |

| Market Forecast in 2034 | USD 771.5 Million |

| Market Growth Rate 2026-2034 | 5.71% |

Australia Power Rental Market Trends:

Surging Demand from Mining and Construction Industries Amidst Grid Constraints

Australia’s mining and construction industries, often situated in remote regions lacking reliable grid access, constitute significant demand drivers for rental power solutions. In mining, where scalability and mobility are paramount, diesel generator rentals exceeding 1,000 kVA are routinely deployed to support large-scale site operations. Parallel growth in Australia’s metropolitan and regional events, entertainment, and festival sectors has elevated demand for temporary power to facilitate lighting, audio systems, and logistical infrastructure. Furthermore, the country’s vulnerability to natural disasters underscores the necessity for rapid-response standby power services. These rental solutions not only reduce capital expenditure for operators but also facilitate seamless power continuity for exploration camps, processing plants, and company-owned facilities. With infrastructure upgrades unable to match the pace of ongoing construction activity, rental power offers a flexible, cost-effective alternative that maximizes equipment utilization and underpins market expansion.

To get more information on this market Request Sample

Shift Toward Sustainable Hybrid Systems & Smart Telematics

Environmental regulations and corporate sustainability objectives are driving a transformative shift in Australia’s rental power market. Residential buildings account for approximately 24% of national electricity consumption and contribute over 10% of total carbon emissions, making the federal Trajectory for Low Energy Buildings, a cornerstone of the National Energy Productivity Plan, critical to achieving a 40% energy-productivity improvement by 2030. Although diesel generators remain prevalent, operators are increasingly adopting hybrid gensets, natural-gas units, and battery-storage systems to satisfy tightening emissions benchmarks. The deployment of telemetry-enabled remote monitoring and predictive-maintenance platforms further enhances uptime and performance in long-term or mission-critical applications. Simultaneously, integrating intermittent renewables, such as solar-augmented rentals provides a lower-carbon, versatile solution for data centers, hydrogen production sites, and regional infrastructure projects. As electrification expands and compliance requirements intensify, hybrid and smart power rentals are achieving double-digit growth, underscoring the rising appeal of flexible, decarbonized energy services.

Australia Power Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on fuel type, equipment type, power rating, application, and end use industry.

Fuel Type Insights:

- Diesel

- Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, natural gas, and others.

Equipment Type Insights:

- Generator

- Transformer

- Load Bank

- Others

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes generator, transformer, load bank, and others.

Power Rating Insights:

- Up to 50 kW

- 51–500 kW

- 501–2,500 kW

- Above 2,500 kW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes up to 50 kW, 51–500 kW, 501–2,500 kW, and above 2,500 kW.

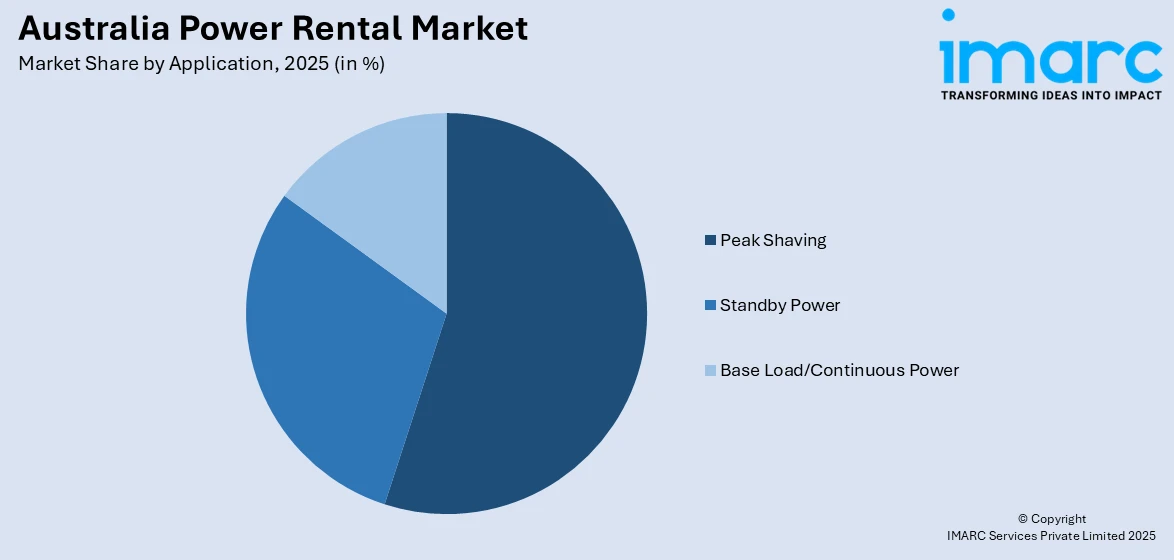

Application Insights:

Access the comprehensive market breakdown Request Sample

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes peak shaving, standby power, and base load/continuous power.

End Use Industry Insights:

- Utilities

- Oil and Gas

- Events

- Construction

- Mining

- Data Centers

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes utilities, oil and gas, events, construction, mining, data centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Rental Market News:

- September 2024: Blue Diamond Machinery and Ampd Energy partnered to distribute diesel-free battery energy storage systems across Australia. These systems, offering up to 85% carbon emission reduction and quieter operation, aim to electrify construction and heavy industries. The collaboration supports cleaner and more efficient power solutions suited for Australia’s remote and rugged conditions.

- September 2023: Blue Diamond Machinery partnered with Kennards Hire to supply POWR2’s POWRBANK battery energy storage systems, marking the first such integration into a rental fleet in Australia. This clean energy solution reduces diesel usage by up to 70%, cutting costs and emissions.

- August 2022: Kennards Hire introduced EODev's GEH₂ hydrogen generators, supplied by Blue Diamond Machinery. This move positions Kennards as a clean energy leader in the equipment hire sector, promoting zero-emission solutions for large-scale projects and accelerating the transition to sustainable, hydrogen-powered construction equipment.

Australia Power Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51–500 kW, 501–2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil and Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power rental market on the basis of fuel type?

- What is the breakup of the Australia power rental market on the basis of equipment type?

- What is the breakup of the Australia power rental market on the basis of power rating?

- What is the breakup of the Australia power rental market on the basis of application?

- What is the breakup of the Australia power rental market on the basis of end use industry?

- What is the breakup of the Australia power rental market on the basis of the region?

- What are the various stages in the value chain of the Australia power rental market?

- What are the key driving factors and challenges in the Australia power rental market?

- What is the structure of the Australia power rental market and who are the key players?

- What is the degree of competition in the Australia power rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power rental market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)