Australia Power Tool Accessories Market Size, Share, Trends and Forecast by Type, Application, End-Use Sector, and Region, 2025-2033

Australia Power Tool Accessories Market Overview:

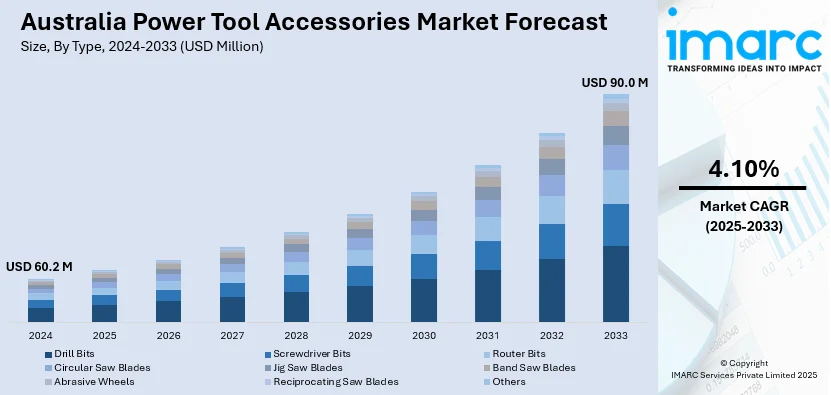

The Australia power tool accessories market size reached USD 60.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 90.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by rising DIY culture, demand for cordless tools with advanced lithium-ion batteries, and growth in construction and renovation activities. Innovations in energy-efficient accessories and competitive online retail offerings also contribute to market growth. E-commerce expansion, trade professional needs, and sustainability trends are further expanding the Australia power tool accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 60.2 Million |

| Market Forecast in 2033 | USD 90.0 Million |

| Market Growth Rate 2025-2033 | 4.10% |

Australia Power Tool Accessories Market Trends:

Rising Demand for Safety-Enhanced and Ergonomic Accessories

Workplace safety regulations and increasing awareness of ergonomic design are driving the Australia power tool accessories market growth. Australia reported 200 worker deaths from traumatic injury in 2023, mainly from vehicle accidents and falls from height. These incidents were most pronounced in industries, such as construction and manufacturing, that are both high-risk and dose-dependent due to the widespread use of power tools. Moreover, serious injury claims climbed to 139,000, with an increasing proportion linked to mental health problems (10.5%) and physical stress (32.7%). These changes highlight the urgent demand for safety regulations within the power tool accessories industry, a rapidly growing sector as industrial demand mounts. There is a growing preference for accessories that minimize vibration, reduce kickback, and feature anti-slip grips to prevent workplace injuries. For example, saw blades with low-vibration technology and drill bits with enhanced stability are gaining traction among construction and industrial users. Additionally, ergonomic designs such as lightweight yet durable materials and angled attachments are becoming key selling points, particularly for professionals who use power tools for extended periods. The trend is further supported by stricter occupational health and safety (OHS) standards, prompting manufacturers to invest in R&D for safer, user-friendly accessories. As businesses prioritize worker well-being, demand for safety-focused power tool accessories is growing, influencing future product development.

To get more information on this market, Request Sample

Growth in E-Commerce Sales of Power Tool Accessories

Online retail is transforming the market, with more consumers and businesses purchasing through e-commerce platforms. The convenience of comparing prices, reading reviews, and accessing a wider product range has accelerated this shift. A research report from the IMARC Group indicates that the e-commerce market in Australia was valued at USD 536.0 Billion in 2024. It is projected to grow to USD 1,568.60 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 12.70% from 2025 to 2033. Thus, this is creating a positive Australia power tool accessories market outlook.

Major retailers including Bunnings and specialized online stores are enhancing their digital presence, offering fast shipping and exclusive online discounts. Additionally, the rise of marketplace platforms has increased competition, prompting brands to improve product visibility through targeted ads and detailed listings. The trend is further supported by the post-pandemic preference for contactless shopping, particularly among trade professionals seeking time-efficient solutions. As digital payment systems and return policies become more user-friendly, online sales of power tool accessories—such as saw blades, sanding pads, and drill bits are projected to grow, reshaping traditional distribution channels.

Australia Power Tool Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, and end-use sector.

Type Insights:

- Drill Bits

- Screwdriver Bits

- Router Bits

- Circular Saw Blades

- Jig Saw Blades

- Band Saw Blades

- Abrasive Wheels

- Reciprocating Saw Blades

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes drill bits, screwdriver bits, router bits, circular saw blades, jig saw blades, band saw blades, abrasive wheels, reciprocating saw blades, and others.

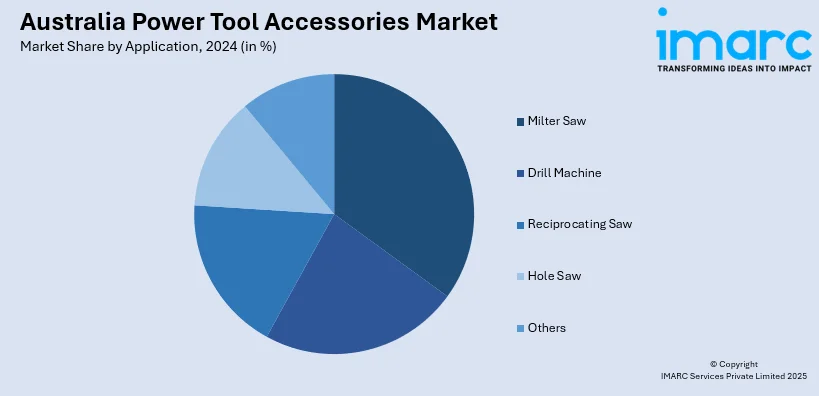

Application Insights:

- Milter Saw

- Drill Machine

- Reciprocating Saw

- Hole Saw

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes milter saw, drill machine, reciprocating saw, hole saw, and others.

End-Use Sector Insights:

- Industrial

- Automotive

- Construction

- Aerospace and Defense

- Energy

- Marine

- Others

- Residential

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes industrial (automotive, construction, aerospace and defense, energy, marine, and others), and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Tool Accessories Market News:

- June 12, 2024: Ventia launched RegTech GenAI, an AI-driven compliance solution powered by Microsoft Azure, to deliver internal standards to more than 10,000 employees across Australia and New Zealand. It targets high-danger areas, including infrastructure segments. Thus, it is expected to enhance efficacy in areas such as construction, significantly aiding the power tool accessories market. Venetia’s extensive document repositories feed the chatbot, which offers immediate and accurate responses.

Australia Power Tool Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drill Bits, Screwdriver Bits, Router Bits, Circular Saw Blades, Jig Saw Blades, Band Saw Blades, Abrasive Wheels, Reciprocating Saw Blades, Others |

| Applications Covered | Milter Saw, Drill Machine, Reciprocating Saw, Hole Saw, Others |

| End-Use Sectors Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power tool accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power tool accessories market on the basis of type?

- What is the breakup of the Australia power tool accessories market on the basis of application?

- What is the breakup of the Australia power tool accessories market on the basis of end-use sector?

- What is the breakup of the Australia power tool accessories market on the basis of region?

- What are the various stages in the value chain of the Australia power tool accessories market?

- What are the key driving factors and challenges in the Australia power tool accessories?

- What is the structure of the Australia power tool accessories market and who are the key players?

- What is the degree of competition in the Australia power tool accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power tool accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power tool accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power tool accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)