Australia Pre-Engineered Buildings Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Australia Pre-Engineered Buildings Market Overview:

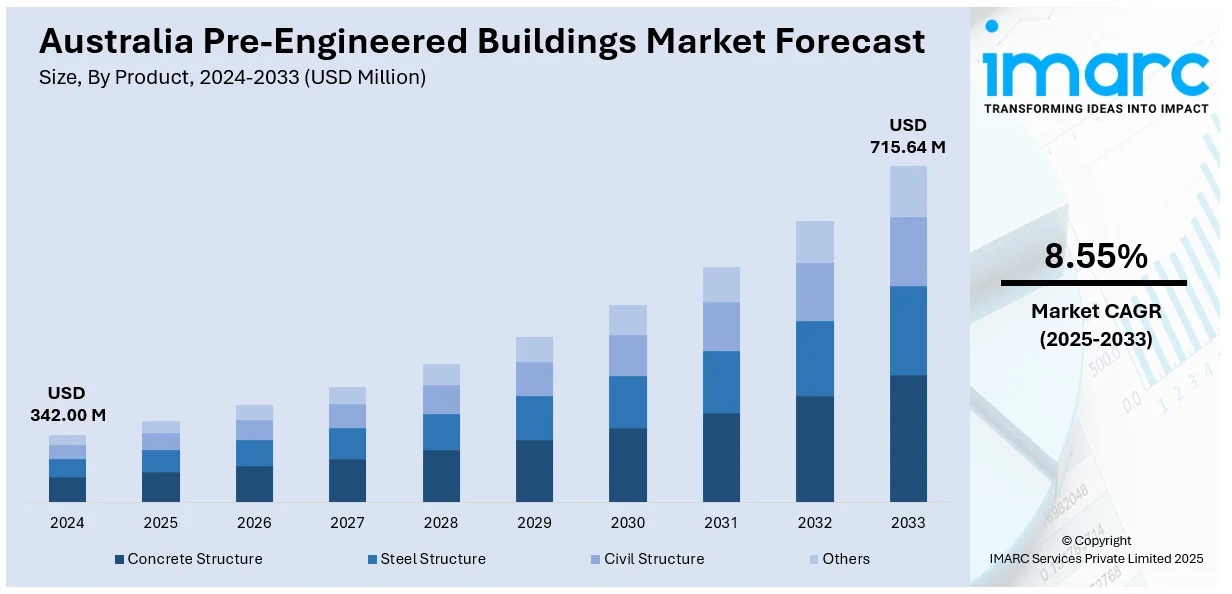

The Australia pre-engineered buildings market size reached USD 342.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 715.64 Million by 2033, exhibiting a growth rate (CAGR) of 8.55% during 2025-2033. The expansion of the market is primarily driven by the increasing number of infrastructure and industrial developments, favorable government policies supporting modular construction, and the rising demand for efficient logistics and warehousing solutions fueled by rapid e-commerce growth. These factors collectively underscore the importance of speed, adaptability, cost-effectiveness, and scalability in contemporary construction practices, thereby contributing to an increase in Australia pre-engineered buildings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 342.00 Million |

| Market Forecast in 2033 | USD 715.64 Million |

| Market Growth Rate 2025-2033 | 8.55% |

Australia Pre-Engineered Buildings Market Trends:

Expansion of Infrastructure and Industrial Sectors

The rising number of infrastructure and industrial projects is a major factor propelling the Australia pre-engineered buildings market growth. As the need for facilities that cater to transportation, logistics, warehousing, and manufacturing grows, pre-engineered buildings are becoming ideal because of their customizable features, especially for the expansive, open areas required in industrial activities. As governments keep funding infrastructure initiatives, such as transport hubs and logistics facilities, the need for pre-engineered buildings increases. A notable instance is DHL’s declaration in 2024 regarding the initiation of a pioneering sustainable Transport Hub in Derrimut, Victoria. The capacity of pre-engineered buildings to provide functional, high-quality buildings rapidly makes them appealing to developers in these high-demand industries. This trend in infrastructure development drives economic growth while also securing a continuous demand for affordable, adaptable building solutions in the future.

To get more information on this market, Request Sample

Government Policies and Incentives for Modular Construction

Government initiatives and incentives that support modular and pre-engineered buildings are contributing to the market growth. Amid rising demands to tackle housing shortages, urban growth, and disaster readiness, officials are promoting building techniques that provide rapidity, economic efficiency, and eco-friendliness. Incentives like tax advantages, funding opportunities, and simplified regulations are enhancing the financial accessibility of pre-engineered buildings for developers, while also encouraging sustained operational savings. A major enhancement occurred in 2025, as the Australian federal government dedicated $54 million to increase prefab and modular housing. This funding encompasses financial support for swift home building, simplified financing choices, and the implementation of a nationwide certification system to shorten approval durations. These actions aim to accelerate housing development and enhance affordability, underscoring the strategic significance of pre-engineered buildings. With increasing policy backing, the incorporation of pre-engineered buildings into extensive projects is growing significantly.

Rise of E-commerce and Warehousing Demands

The swift growth of e-commerce in Australia is driving the need for distribution centers, warehouses, and logistics facilities. E-commerce is thriving, increasing the demand for spacious, efficient facilities that can accommodate storage, inventory control, and order processing. Pre-engineered buildings are especially ideal for this sector because of their fast construction timelines, large column-free areas, and flexibility to accommodate specific needs like high-clearance shelving or climate-controlled settings. Their agility and quickness allow logistics firms to expand operations in accordance with market growth. In 2024, the e-commerce market in Australia was assessed at USD 536.0 billion as per IMARC Group and it is expected to attain USD 1,568.60 billion by 2033, demonstrating a CAGR of 12.70% from 2025 to 2033. This rapid expansion highlights the increasing significance of pre-engineered buildings in fulfilling infrastructure needs in the changing logistics and e-commerce environment.

Australia Pre-Engineered Buildings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Concrete Structure

- Steel Structure

- Civil Structure

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes concrete structure, steel structure, civil structure, and others.

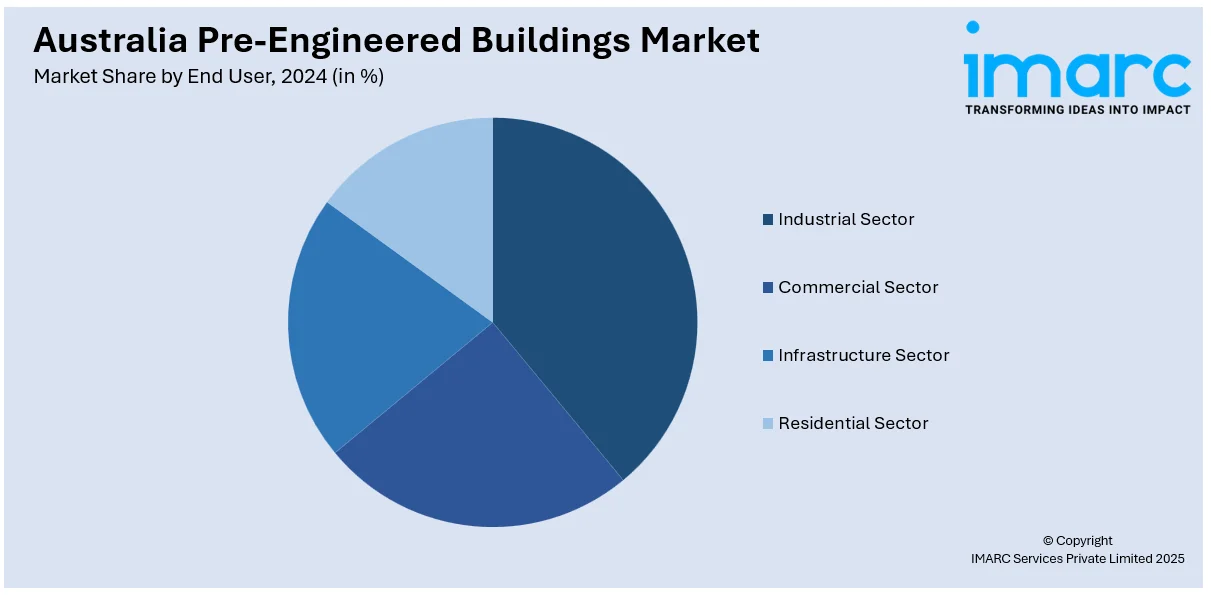

End User Insights:

- Industrial Sector

- Commercial Sector

- Infrastructure Sector

- Residential Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial sector, commercial sector, infrastructure sector, and residential sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pre-Engineered Buildings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Concrete Structure, Steel Structure, Civil Structure, Others |

| End Users Covered | Industrial Sector, Commercial Sector, Infrastructure Sector, Residential Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pre-engineered buildings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pre-engineered buildings market on the basis of product?

- What is the breakup of the Australia pre-engineered buildings market on the basis of end user?

- What is the breakup of the Australia pre-engineered buildings market on the basis of region?

- What are the various stages in the value chain of the Australia pre-engineered buildings market?

- What are the key driving factors and challenges in the Australia pre-engineered buildings market?

- What is the structure of the Australia pre-engineered buildings market and who are the key players?

- What is the degree of competition in the Australia pre-engineered buildings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pre-engineered buildings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pre-engineered buildings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pre-engineered buildings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)