Australia Precision Agriculture Market Size, Share, Trends and Forecast by Technology, Type, Component, Application, and Region, 2025-2033

Australia Precision Agriculture Market Overview:

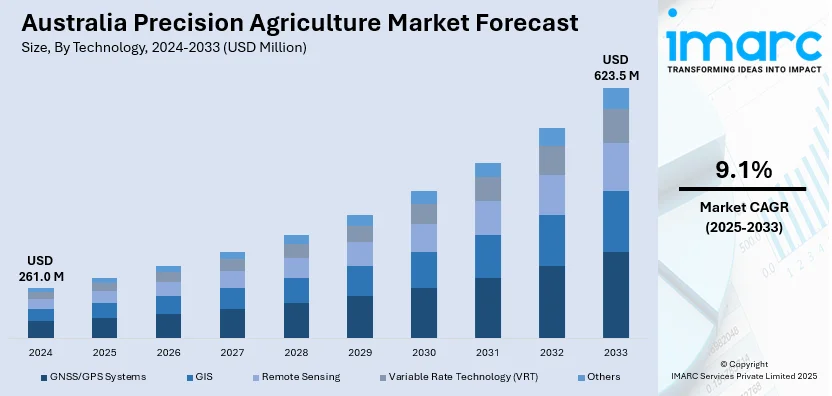

The Australia precision agriculture market size reached USD 261.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 623.5 Million by 2033, exhibiting a growth rate (CAGR) of 9.1% during 2025-2033. The growth of the market is driven by increasing demand for sustainable farming, water scarcity challenges, and government support for agritech adoption. Advancements in IoT, AI, and drone technologies enhance farm efficiency, while rising labor costs and climate variability push farmers toward data-driven solutions to optimize yields and reduce environmental impact.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 261.0 Million |

| Market Forecast in 2033 | USD 623.5 Million |

| Market Growth Rate 2025-2033 | 9.1% |

Australia Precision Agriculture Market Trends:

Increasing Adoption of IoT and Smart Farming Technologies

The rising adoption of IoT (Internet of Things) and smart farming technologies is expanding the Australia precision agriculture market share. Representing 55% of land use in Australia and an estimated $ 71.5 Billion in exports in the 2023–24 period, Australian agriculture is increasingly adopting smart farming technologies to improve sustainability and productivity. In 2025, 85% of cropping farms practice stubble retention, and 61% of livestock farms are using innovative grazing. In response to escalating climate and resource challenges, Australia’s agricultural sector is expanding its use of technology-driven practices to ensure a sustainable future. Connected technologies, such as soil moisture sensors, GPS-enabled equipment, and automated irrigation system, are being increasingly leveraged by farmers to improve their resource management and crop yields. Such innovations allow for real-time data collection and analysis for precision application of water, fertilizers, and pesticides. Increasing demand, especially in drought-prone regions where water is at a premium, is being driven by the growing trend toward sustainability and cost-effectiveness. Programs from governments, such as the financing of smart agriculture initiatives, are pushing for faster adoption as well. Additionally, new technologies in artificial intelligence and machine learning are enhancing predictive analytics to help farmers anticipate changes in the weather and pest outbreaks. As a result, agribusinesses are investing in scalable IoT solutions to enhance productivity while minimizing environmental impact, supporting the Australia precision agriculture market growth.

To get more information on this market, Request Sample

Growth of Drone and Satellite-Based Farming Solutions

Another key trend in the market is the expanding use of drones and satellite-based farming solutions. Drones equipped with multispectral and thermal imaging cameras provide high-resolution field data, enabling farmers to monitor crop health, detect diseases, and assess soil conditions with unmatched accuracy. Over the next 20 years, the agricultural industry in Australia is expected to save between $ 2.8 Billion to $ 10.4 Billion due to the increasing use of drones and advanced farming technologies, with an anticipated 23,900 units deployed by 2040. Drones are also enhancing precision agriculture by streamlining water management, crop spraying, yield prediction, and livestock monitoring. Presently utilized by 10% of farms, these advancements are transforming productivity and sustainability within the country's primary sectors. Satellite imagery complements this by offering large-scale insights into weather patterns, vegetation indices, and land use efficiency. These technologies reduce manual labor and operational costs while improving yield forecasting. The declining cost of drone technology and improved data analytics platforms are making these solutions more accessible to small and medium-sized farms. Furthermore, partnerships between agritech firms and space agencies are enhancing satellite-based precision farming capabilities. As climate variability increases, the demand for remote sensing and aerial mapping tools is accelerating, creating a positive Australia precision agriculture market outlook.

Australia Precision Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, type, component, and application.

Technology Insights:

- GNSS/GPS Systems

- GIS

- Remote Sensing

- Variable Rate Technology (VRT)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes GNSS/GPS systems, GIS, remote sensing, variable rate technology (VRT), and others.

Type Insights:

- Automation and Control Systems

- Sensing and Monitoring Devices

- Farm Management System

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes automation and control systems, sensing and monitoring devices, and farm management system.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

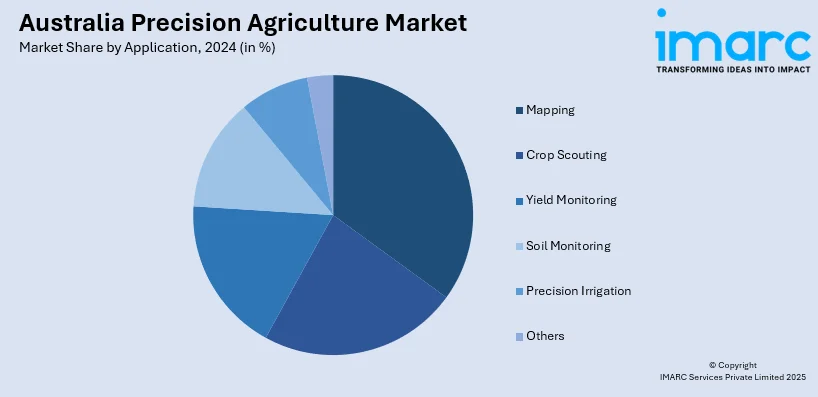

Application Insights:

- Mapping

- Crop Scouting

- Yield Monitoring

- Soil Monitoring

- Precision Irrigation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mapping, crop scouting, yield monitoring, soil monitoring, precision irrigation, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Precision Agriculture Market News:

- February 24, 2025: Yamaha Motor established Yamaha Agriculture, Inc., the company's entry into precision agriculture utilizing AI and autonomous technologies following its acquisitions of Robotics Plus (New Zealand) and The Yield (Australia). This initiative supports Australian farmers who grow specialty crops such as wine grapes and apples with innovative solutions to mitigate labor shortages and climate-related challenges. With 2,200 autonomous units already operating across 800,000 hectares in Japan, Yamaha leverages its extensive experience in automation to enhance the agricultural technology landscape in Australia.

- May 14, 2024: Precision Agriculture Australia launched its new national campaign, "Soil is Life," following its national rebrand to Precision Ag, a campaign that underlines the need for a focus on soil health as the bedrock of agriculture productivity. Experienced with over 3,500 clients through its proprietary VRT platform, it is on a mission to catalyze the industry for sustainable growth and carbon reduction in the farming space. Aiming to broaden its reach and appeal, this name change mirrors Precision Ag's commitment to diversify its holdings and strengthen its footprint in Australia's precision agriculture sector.

Australia Precision Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management System |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia precision agriculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia precision agriculture market on the basis of technology?

- What is the breakup of the Australia precision agriculture market on the basis of type?

- What is the breakup of the Australia precision agriculture market on the basis of component?

- What is the breakup of the Australia precision agriculture market on the basis of application?

- What is the breakup of the Australia precision agriculture market on the basis of region?

- What are the various stages in the value chain of the Australia precision agriculture market?

- What are the key driving factors and challenges in the Australia precision agriculture?

- What is the structure of the Australia precision agriculture market and who are the key players?

- What is the degree of competition in the Australia precision agriculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia precision agriculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia precision agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia precision agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)