Australia Preschool Education Market Size, Share, Trends and Forecast by Type of Institution, Age Group, Program Type, Mode of Delivery, Funding Source, and Region, 2025-2033

Australia Preschool Education Market Overview:

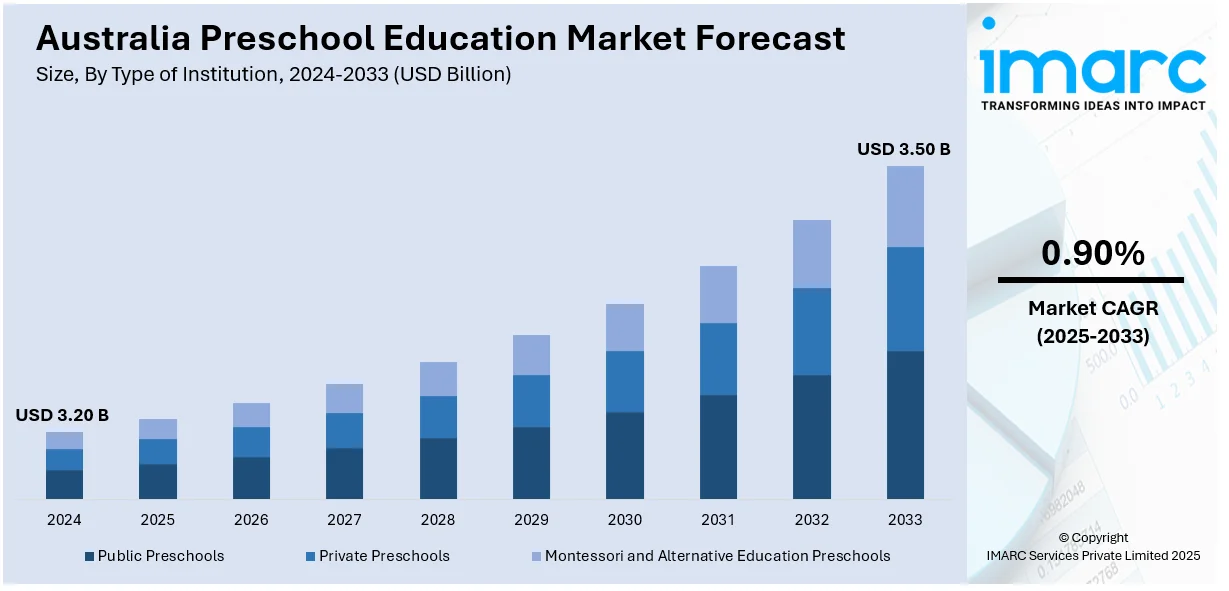

The Australia preschool education market size reached USD 3.20 Billion in 2024. Looking forward, the market is expected to reach USD 3.50 Billion by 2033, exhibiting a growth rate (CAGR) of 0.90% during 2025-2033. The increasing government funding, rising awareness about early childhood development, growing working parent population, evolving educational standards, and ongoing technological advancements enhancing curriculum delivery and accessibility are some key factors impelling the Australia preschool education market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.20 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Market Growth Rate 2025-2033 | 0.90% |

Key Trends of Australia Preschool Education Market:

Increased Government Support and Policy Initiatives

The increased funding and policy reforms of the Australian government are driving significant growth in the preschool education market. Initiatives such as the National Quality Framework (NQF) have enhanced the standards of early childhood education, ensuring uniform quality across services. Subsidies like the Child Care Subsidy (CCS) have improved affordability for families, leading to higher enrollment rates. State-level investments in universal preschool access for four-year-olds, are elevating the demand for early learning programs. These measures, aim at improving accessibility and quality, which is making preschool education more inclusive for families across socio-economic backgrounds. Moreover, by addressing affordability and standardization, government initiatives are fostering a robust preschool ecosystem, supporting the developmental needs of young children, aiding the market growth. Additionally, the growing focus on preschool education as an essential part of the educational system, with recognition of its long-term benefits, is encouraging investment and policy support, further aiding the Australia preschool education market share.

To get more information on this market, Request Sample

Rising Demand for Holistic Early Learning Programs

Modern parents in Australia are increasingly recognizing the importance of holistic early childhood development, driving the demand for preschools that embrace comprehensive learning approaches. These schools are blending academics with cognitive, social, and emotional growth, emphasizing play-based and inquiry-driven curriculums aligned with developmental science. Programs focusing on creative arts, science, technology, engineering, and management (STEM) activities, and multicultural learning are gaining popularity, and reflecting the diverse needs of Australian families. Additionally, there is growing interest in bilingual and language immersion preschools as parents seek to prepare their children for global opportunities. This shift in parental preferences is prompting educational institutions to adapt and meet evolving expectations for well-rounded, future-ready early education, thereby supporting the market growth. Furthermore, as more working parents are looking for flexible learning options, preschools are offering extended hours or part-time programs are attracting higher enrollments, thus facilitating a considerable shift in the Australia preschool education market outlook.

Integration of Technology in Early Education

The incorporation of technology into preschool curriculums is transforming early childhood education. Interactive learning tools, such as tablets, educational apps, and smartboards are enhancing engagement and providing personalized learning experiences. Online platforms and digital content are offering valuable resources for the teachers and parents, extending learning beyond the classroom. Moreover, virtual preschool programs are creating new avenues for growth, allowing families in remote areas to access quality education and overcoming geographical barriers. The emphasis on digital literacy from an early age reflects broader societal trends and is positioning technology as a key enabler in the education sector. Additionally, schools are increasingly partnering with ed-tech companies to implement innovative solutions, further driving technological integration. As a result, the integration of technology in early learning is reshaping the landscape of preschool education and propelling the market forward.

Growth Drivers of Australia Preschool Education Market:

Expanding Workforce Participation and Changing Family Dynamics

The growing participation of women in the Australian workforce is fundamentally reshaping childcare needs and driving substantial growth in the preschool education sector. With increasing numbers of dual-income households and single-parent families requiring reliable childcare solutions, demand for comprehensive early education programs has surged significantly. Modern Australian families increasingly recognize the dual benefits of quality preschool services: professional childcare that enables parental workforce participation while providing foundational educational experiences for children. This demographic shift toward working parents seeking flexible, full-day educational programs is creating sustained market expansion. Additionally, changing societal attitudes toward early childhood education, where parents view preschool as an essential developmental foundation rather than mere childcare, is driving enrollment growth and willingness to invest in premium educational services.

Enhanced Government Investment and Policy Support

The Australian government’s dedication to universal early childhood education through extensive funding measures is unlocking significant market prospects, driving the Australia preschool education market demand. Substantial federal initiatives aimed at strengthening the early learning system highlight enduring support for sector expansion and workforce development. The introduction of the 3 Day Guarantee, offering families reliable access to subsidized care each week, is poised to broaden participation and stimulate enrollment growth. Complementary state-led programs, including initiatives like NSW’s Start Strong and the National Preschool Reform Agreement, reinforce funding stability while promoting quality upgrades and wider accessibility. Collectively, these coordinated governmental actions are lowering cost barriers for families and motivating service providers to invest in expanded capacity and enhanced standards, fostering a robust and inclusive early education landscape nationwide.

Rising Recognition of Early Childhood Development Benefits

Growing scientific evidence demonstrating the critical importance of early childhood education for long-term developmental outcomes is driving increased parental investment and societal support for quality preschool programs. Research consistently shows that children participating in quality early education programs demonstrate superior school readiness, social-emotional development, and academic achievement throughout their educational journey. Australian parents are increasingly aware that the first five years represent a crucial window for brain development, language acquisition, and social skill formation. This heightened awareness is translating into higher enrollment rates and demand for specialized programs addressing cognitive, emotional, and social development needs. Furthermore, the recognition of early childhood education as a foundation for reducing educational inequality and supporting disadvantaged children is generating broader community and government support for market expansion and quality improvement initiatives.

Government Support of Australia Preschool Education Market:

National Quality Framework and Regulatory Standards

The Australian government has established comprehensive regulatory frameworks through the National Quality Framework (NQF) to ensure consistent quality standards across all early childhood education services nationwide. This framework encompasses the Education and Care Services National Law, National Regulations, and approved learning frameworks that guide educational practice and service delivery. Government investment in regulatory oversight, including increased compliance monitoring and quality assessment processes, ensures that families receive high-quality educational services regardless of provider type or geographic location. The NQF's emphasis on qualified educators, developmentally appropriate programs, and safe environments creates market confidence while driving continuous improvement in service standards. This regulatory foundation supports sustainable market growth by establishing clear quality benchmarks that protect children while enabling providers to operate with certainty about compliance requirements and performance expectations.

Universal Access Initiatives and Funding Mechanisms

Federal and state governments are advancing broad universal access initiatives to guarantee every Australian child receives quality preschool education, regardless of family situation or location. The Preschool Reform Agreement secures continuous federal funding for states and territories, ensuring consistent preschool opportunities for children in the year before school. A newly introduced three-day access policy marks a significant shift, replacing activity-based eligibility with assured subsidized care for all families each week. This measure aims to expand childcare availability and ease financial constraints, improving pathways to early learning. Together, these universal access efforts reflect a strong governmental commitment to early childhood education as an essential public service deserving robust, sustained public investment and nationwide support for lifelong developmental benefits.

Infrastructure Development and Workforce Investment

Government support extends beyond subsidies to include significant infrastructure development and workforce strengthening initiatives essential for sustainable market expansion. The $1 billion Building Early Education Fund will support the construction and expansion of 160 new early childhood education services, particularly in underserved areas, including outer suburbs and regional communities. Priority placement on school sites, wherever possible, creates integrated education pathways while maximizing public infrastructure utilization. Concurrently, the $3.6 billion Worker Retention Payment program addresses critical workforce shortages by funding wage increases for up to 200,000 early childhood educators and teachers. This comprehensive approach to infrastructure and human capital development creates enabling conditions for sustained market growth while addressing key capacity constraints that have historically limited service availability and quality.

Opportunities of Australia Preschool Education Market:

Technology Integration and Digital Learning Innovation

The accelerating integration of educational technology presents significant opportunities for preschool providers to enhance learning outcomes while differentiating their service offerings. Digital platforms, interactive learning applications, and smart classroom technologies are creating new possibilities for personalized learning experiences that adapt to individual children's developmental needs and learning styles. Virtual and hybrid learning models, particularly valuable for families in remote areas or during service disruptions, are expanding market reach beyond traditional geographic constraints. Educational technology partnerships enable providers to offer innovative programs that appeal to tech-savvy parents while supporting educator professional development and administrative efficiency. The growing emphasis on digital literacy from an early age creates opportunities for providers to develop specialized STEM-focused programs and coding curricula that prepare children for future educational and career success.

Specialized Program Development and Market Differentiation

The evolving landscape of parental expectations and child development understanding creates substantial opportunities for providers to develop specialized program offerings that address specific family needs and educational philosophies. Bilingual and multicultural education programs appeal to Australia's diverse population while preparing children for global opportunities. Special needs inclusion programs, supported by government funding through the Inclusion Support Program, represent growing market segments requiring specialized expertise and resources. Montessori, Waldorf, and other alternative pedagogical approaches attract families seeking distinctive educational experiences aligned with their values and beliefs. Additionally, programs addressing specific developmental areas such as early literacy, environmental education, and social-emotional learning create differentiation opportunities while supporting comprehensive child development goals.

Regional Expansion and Underserved Market Development

Significant opportunities exist for market expansion into underserved geographic areas where demand for quality early childhood education exceeds current supply capacity. Regional and rural communities often face limited access to quality preschool services, creating opportunities for providers willing to establish services in these areas. Government support through the Building Early Education Fund specifically prioritizes underserved markets, providing financial incentives for expansion into priority areas. Co-location opportunities on school sites reduce infrastructure costs while creating integrated educational pathways from early childhood through primary education. Mobile and satellite service models offer innovative approaches to reaching dispersed populations while maintaining quality standards. These expansion opportunities are particularly attractive given growing government support for regional development and recognition that early childhood education access should not depend on geographic location.

Challenges of Australia Preschool Education Market:

Workforce Shortages and Quality Maintenance

Australia’s early childhood education sector continues to grapple with ongoing workforce pressures that jeopardize service capacity and the ability to uphold quality standards. Staffing levels remain strained as growing demand, especially under new government access guarantees, intensifies the need for more qualified professionals. High employee turnover, fueled by traditionally low wages and challenging working conditions, disrupts operations and drives up recruitment expenses for providers. Mandatory educator qualifications under the National Quality Framework, while crucial for maintaining strong outcomes, further narrow the talent pipeline and elevate labor costs. Sustaining consistent service quality amid these shortages requires substantial investment in training, retention efforts, and competitive pay structures—commitments that many providers find difficult to meet without risking long-term financial stability.

Rising Operational Costs and Financial Sustainability

Preschool education providers face mounting pressure from escalating operational costs while navigating complex funding mechanisms and fee regulation constraints. Increased regulatory requirements, while beneficial for quality assurance, generate additional compliance costs including staff training, documentation, facility improvements, and administrative overhead. The recently implemented fee growth cap, limiting annual fee increases to 4.4%, constrains providers' ability to offset rising costs for wages, utilities, insurance, and educational materials. Government funding mechanisms, while supportive, often involve complex reporting requirements and delayed payment schedules that challenge cash flow management. Smaller providers particularly struggle to achieve economies of scale necessary for financial sustainability while maintaining quality standards. According to the Australia preschool education market analysis, these financial pressures force difficult decisions between service quality, staff compensation, and business viability, potentially affecting long-term market stability.

Regulatory Compliance and Quality Standard Management

The comprehensive regulatory environment, while protecting children and ensuring quality, creates significant operational challenges for providers managing multiple compliance requirements across various jurisdictions. The National Quality Framework demands continuous documentation, assessment, and improvement processes that require substantial administrative resources and specialized knowledge. Maintaining compliance across areas, including staff qualifications, educator-to-child ratios, physical environment standards, and educational program delivery, requires ongoing investment in training, systems, and monitoring processes. Regulatory changes and updates necessitate frequent policy adjustments, staff retraining, and potential facility modifications that disrupt operations and increase costs. Additionally, the consequences of non-compliance, including potential service closure or funding loss, create significant operational risks that require careful management and professional expertise that smaller providers may find difficult to maintain consistently.

Australia Preschool Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type of institution, age group, program type, mode of delivery, and funding source.

Type of Institution Insights:

- Public Preschools

- Private Preschools

- Montessori and Alternative Education Preschools

The report has provided a detailed breakup and analysis of the market based on the type of institution. This includes public preschools, private preschools, and Montessori and alternative education preschools.

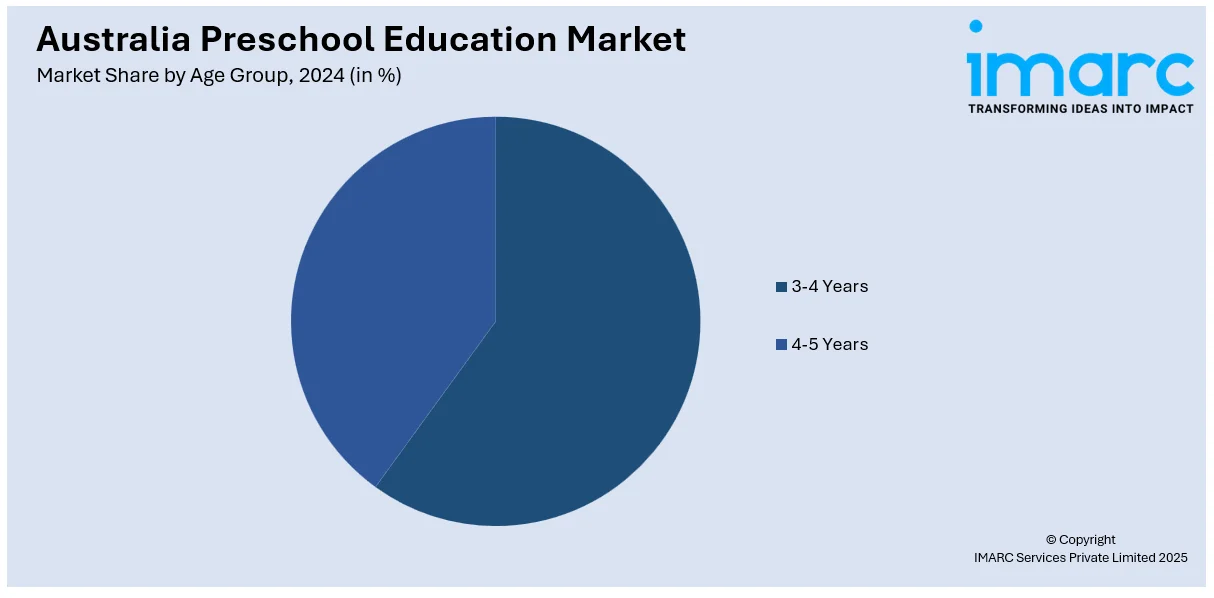

Age Group Insights:

- 3-4 Years

- 4-5 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 3-4 years, and 4-5 years.

Program Type Insights:

- Full-Day Programs

- Half-Day Programs

- Play-Based Learning Programs

- STEM-Focused Programs

The report has provided a detailed breakup and analysis of the market based on the program type. This includes full-day programs, half-day programs, play-based learning programs, and STEM-focused programs.

Mode of Delivery Insights:

- In-Person Learning

- Online and Hybrid Learning

A detailed breakup and analysis of the market based on the mode of delivery has also been provided in the report. This includes in-person learning and online and hybrid learning.

Funding Source Insights:

- Government-Funded Preschools

- Private and Fee-Based Institutions

The report has provided a detailed breakup and analysis of the market based on the funding source. This includes government-funded preschools and private and fee-based institutions.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Preschool Education Market News:

- In July 2024, Mayfield Childcare expanded its presence in South Australia by acquiring seven Precious Cargo centers. This strategic move enhanced access to quality early childhood education and created new employment opportunities.

- In November 2024, Storypark, a digital platform designed to support early childhood education, announced an exciting investment partnership with Potentia. It marked a significant step in enhancing its digital learning platform, aiming to improve early childhood education access and innovation across Australia.

Australia Preschool Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Institutions Covered | Public Preschools, Private Preschools, Montessori and Alternative Education Preschools |

| Age Groups Covered | 3-4 Years, 4-5 Years |

| Program Types Covered | Full-Day Programs, Half-Day Programs, Play-Based Learning Programs, STEM-Focused Programs |

| Modes of Deliveries Covered | In-Person Learning, Online and Hybrid Learning |

| Funding Sources Covered | Government-Funded Preschools, Private and Fee-Based Institutions |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia preschool education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia preschool education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia preschool education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia preschool education market was valued at USD 3.20 Billion in 2024.

The Australia preschool education market is projected to exhibit a CAGR of 0.90% during 2025-2033.

The Australia preschool education market is projected to reach a value of USD 3.50 Billion by 2033.

The market is experiencing growth driven by increased government support through policy initiatives and funding programs. Technology integration in early education transforming learning delivery through digital platforms and interactive tools, along with rising demand for holistic early learning programs reflecting parental preferences for comprehensive child development approaches, is also contributing to market growth.

The Australia preschool education market is driven by expanding workforce participation requiring reliable childcare solutions, enhanced government investment through universal access initiatives, and rising recognition of early childhood development benefits. The growing awareness about educational foundations and demographic shifts toward dual-income households further accelerates market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)