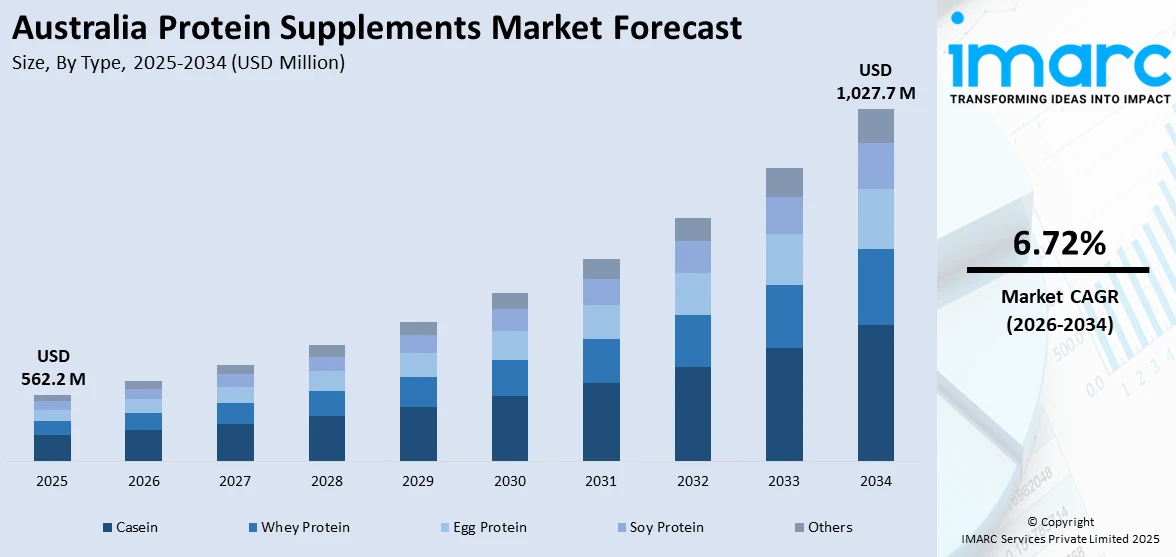

Australia Protein Supplements Market Report by Type (Casein, Whey Protein, Egg Protein, Soy Protein, and Others), Form (Protein Powder, Protein Bars, Ready to Drink, and Others), Source (Animal-Based, Plant-Based), Application (Sports Nutrition, Functional Food), Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Direct to Customers (DTC), and Others), and Region 2026-2034

Australia Protein Supplements Market Size and Share:

Australia protein supplements market size reached USD 562.2 Million in 2025. Looking forward, the market is expected to reach USD 1,027.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.72% during 2026-2034. The market is witnessing strong growth driven by rising health consciousness, expanding fitness culture, and increased demand for clean-label, plant-based products. Innovations in functional formulations and online distribution are further fueling consumer adoption across diverse age groups and lifestyles. These factors collectively contribute to the expanding Australia protein supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 562.2 Million |

| Market Forecast in 2034 | USD 1,027.7 Million |

| Market Growth Rate 2026-2034 | 6.72% |

Protein supplements represent concentrated protein sources derived from diverse origins, such as whey, casein, soy, pea, egg, etc. They are widely utilized by individuals with numerous objectives, including muscle development, weight management, fulfilling daily dietary requirements, etc. The manufacturing process involves extraction, purification, drying, and yielding of these supplements in the form of powders, bars, or shakes. Essential amino acids provided by protein supplements play a crucial role in various bodily functions, encompassing muscle repair, immune system reinforcement, enzyme production, etc. These supplements help in muscle recovery and meeting overall protein needs. This is particularly valuable for individuals with limited dietary options or specific fitness objectives.

To get more information on this market Request Sample

Key Trends of Australia Protein Supplements Market:

Hybrid and Functional Protein Product Innovation

The market is evolving with multifunctional protein supplements that offer benefits beyond muscle building. Companies are developing hybrid products incorporating other nutrients, including collagen to support skin, probiotics to support digestion, or adaptogens to relieve stress. These value-added formulations waste consumer requirements looking to attain comprehensive well-being in a single handy item. This innovation is not only attractive to its performance-based customer base, but it is also appealing to the ordinary health-sensitive consumer as part of the transition away from a single performance-based sports nutrition to a more combined health management system. These multiple benefits products are likely to monopolize shelves, particularly in the high-end market segments and lifestyle-focused ones, as personalization continues to rise.

Rise in Online Sales and Subscription-Based Models

Digitalization has transformed how Australians purchase supplements, which is driving the Australia protein supplements market demand. E-commerce platforms and brand websites now account for a large share of sales, fueled by influencer marketing, fitness apps, and health-based communities. Many companies offer personalized online consultations and subscription models that provide monthly protein deliveries tailored to user goals. This trend enhances convenience and customer loyalty while allowing brands to collect user data for product development and targeted marketing. The digital-first approach also enables niche and startup brands to enter the market with lower overhead and nationwide reach, intensifying competition and innovation.

Diversification of Target Consumers

While protein supplements were once primarily targeted at male athletes and bodybuilders, today’s market includes a much wider consumer base. Women, busy professionals, vegetarians, seniors, and even teenagers are incorporating protein into their diets for various health goals. Brands are responding with targeted marketing, gender-neutral packaging, and diverse product forms such as protein waters, coffee blends, and snack bars. This democratization of protein use is redefining product positioning and expanding distribution beyond supplement stores to supermarkets, pharmacies, and convenience outlets. The broadening audience is a key factor in sustaining long-term market growth.

Growth Drivers of Australia Protein Supplements Market:

Expanding Fitness and Active Lifestyle Demographics

The growing number of Australians engaging in fitness activities—such as gym training, running, yoga, and competitive sports—is significantly boosting the demand for protein supplements. These consumers seek quick and effective nutritional solutions to aid muscle recovery, endurance, and performance. The trend spans across age groups, from young adults to middle-aged fitness enthusiasts, supported by the rising popularity of wellness culture and social media influence. This active lifestyle shift is reshaping daily nutritional habits, increasing acceptance of supplements as part of mainstream diets, and driving consistent product demand across retail and digital channels.

Aging Population with Preventive Health Focus

Australia’s aging population is increasingly turning to protein supplementation to maintain muscle mass, bone health, and metabolic function. Protein-rich diets are being recommended by healthcare providers to counter age-related sarcopenia and support recovery from illness or surgery. Older adults are more willing to adopt dietary supplements as they seek convenient, medically endorsed options to maintain mobility and independence. According to the Australia protein supplements market analysis, this demographic shift is creating a sustained demand for easy-to-digest, high-quality protein products tailored to senior health needs, expanding the market beyond fitness-oriented consumers and into clinical and preventive healthcare segments.

Growth in Clean-Label and Transparent Product Preferences

Modern Australian consumers are increasingly conscious of what goes into their bodies, driving demand for clean-label protein supplements. Products free from artificial sweeteners, GMOs, synthetic additives, and allergens are gaining preference. This shift has encouraged brands to adopt transparent labeling and ethically sourced ingredients, enhancing consumer trust. Certifications such as organic, non-GMO, vegan, and gluten-free are becoming essential purchase drivers. The growing availability of these options in both plant-based and whey protein lines is broadening the appeal of supplements to health-focused individuals, especially those with dietary restrictions or lifestyle-specific preferences, thereby contributing to strong market momentum.

Australia Protein Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, form, source, application, and distribution channel.

Type Insights:

- Casein

- Whey Protein

- Egg Protein

- Soy Protein

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes casein, whey protein, egg protein, soy protein, and others.

Form Insights:

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes protein powder, protein bars, ready to drink, and others.

Source Insights:

- Animal-Based

- Plant-Based

The report has provided a detailed breakup and analysis of the market based on the source. This includes animal-based and plant-based.

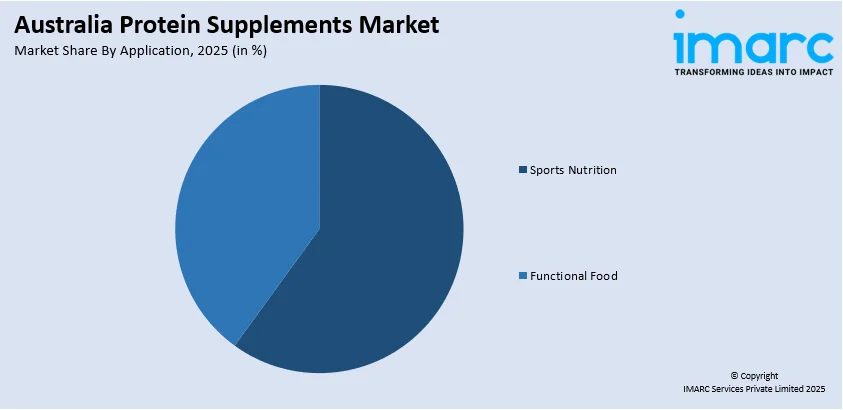

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sports Nutrition

- Functional Food

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sports nutrition and functional food.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, online stores, direct to customers (DTC), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Amway Australia

- BScSupplements

- Bulk Nutrients

- EHPlabs Australia

- Happy Way

- Max's Protein

- Myprotein (THG Nutrition Limited)

- Optimum Nutrition

- Protein Supplies Australia

- True Protein

- Uprotein

- VPA Australia

Australia Protein Supplements Market News:

- In July 2025, Elite Supplements, a retailer specializing in health and fitness products, named Access Communications as its official public relations partner in Singapore. This collaboration coincides with the brand’s launch of its first international flagship store at Funan Mall, set to open in July this year.

- In March 2024, Bulk Nutrients officially joined forces with North Melbourne as the club’s designated Protein and Supplement Partner. Under this newly established two-year agreement, Bulk Nutrients will supply its premium range of protein powders and nutritional supplements to aid in the performance, recovery, and overall development of athletes across both the AFL and AFLW teams at North Melbourne.

- In May 2023, Ingredient Optimized revealed that three leading Australian brands have introduced new products featuring its cutting-edge protein innovation, ioPea. According to the company, ioPea has been clinically shown to deliver 2 to 5 times greater bioavailability and absorption than standard, unmodified pea protein, offering enhanced nutritional effectiveness.

Australia Protein Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Casein, Whey Protein, Egg Protein, Soy Protein, Others |

| Forms Covered | Protein Powder, Protein Bars, Ready to Drink, Others |

| Sources Covered | Animal-Based, Plant-Based |

| Applications Covered | Sports Nutrition, Functional Food |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Direct to Customers (DTC), Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Amway Australia, BScSupplements, Bulk Nutrients, EHPlabs Australia, Happy Way, Max's Protein, Myprotein (THG Nutrition Limited), Optimum Nutrition, Protein Supplies Australia, True Protein, Uprotein, VPA Australia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia protein supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia protein supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia protein supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The protein supplements market in Australia was valued at USD 562.2 Million in 2025.

The Australia protein supplements market is projected to exhibit a CAGR of 6.72% during 2026-2034.

The Australia protein supplements market is projected to reach a value of USD 1027.7 Million by 2034.

The rising health awareness, fitness culture, and preventive wellness are driving demand for protein supplements in Australia. Broader acceptance across all age groups, coupled with innovation in plant-based and easily digestible formulations, is expanding the market. Increased online accessibility and lifestyle-focused branding further support sustained consumer adoption and market growth.

The key trends of the Australia protein supplements market include a shoft toward plant-based and clean-label protein supplements, with growing demand for functional blends offering added health benefits. Personalized nutrition, supported by digital tools, is reshaping consumer preferences. Convenient formats like ready-to-drink shakes and bars are further gaining popularity, especially through online and direct-to-consumer platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)