Australia Publishing Market Report by Type (Book Publishing, Magazine Publishing, Newspaper Publishing), Platform (Traditional, Digital), and Region 2025-2033

Australia Publishing Market Size and Share:

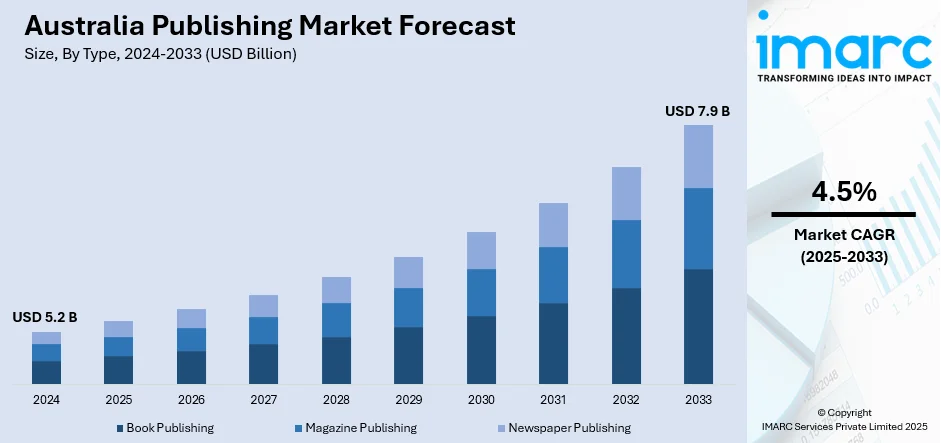

The Australia publishing market size reached USD 5.2 Billion in 2024. Looking forward, the market is projected to reach USD 7.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is propelled by the increasing demand for digital content, such as e-books and audiobooks, rise of self-publishing platforms and independent authors, expansion of educational programs, growth of subscription-based reading services, and social media influence on reading trends and book discovery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.2 Billion |

|

Market Forecast in 2033

|

USD 7.9 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

Key Trends of Australia Publishing Market:

Digital Transformation and E-Books

The publishers in Australia are rapidly digitizing the industry, particularly with the rapid uptake of e-books, audiobooks, and other forms of digital content. As the number of e-readers and mobile devices increase significantly, there demand for physical copies of books is witnessing a decline. Some of the publishing houses monetize on this trend by expanding their offerings digitally for a wider reach and eliminate the constraints of printing and distribution. In addition to this, digital platforms are offering opportunities for self-publishing, which allows independent authors to maintain control over their work and bypass traditional gatekeepers in the industry. This trend is further accelerated by the subscription-based models offered by services such as Kindle Unlimited and Audible, making digital books increasingly accessible to more readers. The increasing popularity of digital content is supplementing physical books while making new revenue sources for Australian publishers.

To get more information on this market, Request Sample

Rise of Independent and Self-Publishing

Among the major driving forces of the Australia publishing market are various emerging independent and self-publishing platforms. Authors no longer need to depend on conventional publishing houses to bring their works before a reading audience. The arrival of Amazon's KDP and Smashwords, amongst many others, has opened avenues for independent authors to publish and circulate their manuscripts to every corner of the world. According to Dettori Publishing, self-published books worth of $1.25 Billion are sold each year. This, in turn, democratizes the publishing process and allows more creative control to the author, while increasing the percentage of royalties. Self-publishing also allows targeting niche markets, which may have been overlooked by traditional publishers due to perceived lack of mass-market appeal. Moreover, numerous individuals are attaining success through this concept of self-publishing and are further encouraging others to explore this avenue, further creating a positive market outlook.

Increased Demand for Local and Diverse Voices

Another major driving force behind the publishing market of Australia is the increasing demand for local voices and diversity. The readers increasingly demand for relatable books through which they can identify themselves and come across the multicultural society of modern Australia. This has therefore contributed to the demand for stories from indigenous authors and other books addressing themes about the immigrant communities of Australia. Publishers are catering to this demand by vigorously acquiring and promoting works from authors coming from diverse backgrounds while ensuring an ideal depiction of the inclusive population of Australia. This encouragement is not performed as a mere moral duty, rather a lucrative market opportunity. This has encouraged publishers to invest in upcoming authors and stories that may have been left unnoticed. Furthermore, this expands the range of books available to readers, boosting the growth of the Australia publishing industry.

Growth Drivers of Australia Publishing Market:

Educational Sector Growth

The educational sector remains a core driving force in the Australian publishing industry marked by a continued demand for textbooks, study materials, and online resources. Institutions of learning such as schools, universities, and vocational training institutions rely on quality and contemporary publications to support curriculum planning and skill acquisition. The advent of digital learning platforms has further boosted the demand for e-books and interactive resources accompanying conventional print form. In addition, development of vocational training and lifelong learning initiatives is widening the arena of education publishing. With the constant requirement of curriculum updations and a growing student population the educational segment is a steady and recurring source of revenue for publishers. This strong dependence on academic resources plays a significant role in the overall Australia publishing market share.

Cultural and Creative Industry Support

Australia’s publishing industry is also propelled by the cultural and creative sectors with a growing interest in local authors, indigenous narratives, and literature that captures Australian identity. Readers are actively seeking genuine voices prompting publishers to focus more on regional and diverse stories. Literary festivals, book fairs, and community-oriented initiatives are enhancing the visibility of Australian writers both nationally and internationally. The rise of niche genres and independent publications is promoting creativity and innovation within the industry. This cultural movement enriches Australia’s literary landscape while creating new avenues for publishers to connect with diverse audiences. Consequently, this robust cultural dynamism continues to positively impact Australia publishing market demand.

Government and Institutional Backing

Government efforts and institutional support are essential in maintaining the momentum of the Australian publishing sector. Funding for literacy initiatives, grants aimed at local authors, and financial assistance for libraries and academic publications ensure ongoing opportunities for growth. Public policy initiatives also focus on promoting indigenous literature and increasing access to educational materials for rural and underserved populations. These actions foster a well-rounded publishing environment that meets both educational and cultural demands. In addition, collaborations with universities and research institutions promote the creation of high-quality academic journals and knowledge resources. By nurturing both print and digital publishing avenues, government-supported programs enhance innovation, accessibility, and inclusivity. Such ongoing support is crucial for propelling Australia publishing market growth.

Opportunities of Australia Publishing Market:

Global Audience Reach

The Australian publishing market presents significant opportunities for global growth through international partnerships, translations, and digital distribution. Authors and publishers in Australia can broaden their audience by collaborating with foreign publishers to adapt their works for various cultural and linguistic groups. The rise of digital platforms eliminates many geographical constraints, allowing e-books and audiobooks to be shared worldwide at a low cost. Engaging in international book fairs and literary festivals also boosts the visibility of Australian literature and academic publishing. This cross-border exposure boosts sales and enhances Australia’s cultural presence across the globe. By exploring diverse international markets, publishers can reach larger audiences, create additional revenue sources, and establish a solid foothold in the global publishing industry.

Self-Publishing Platforms

The emergence of self-publishing platforms offers significant opportunities for the Australian publishing market allowing aspiring writers to connect directly with audiences without the obstacles of traditional publishing. These platforms enable authors to publish in various formats both digital and print while providing affordable options and creative freedom. Publishers can profit from collaborating with self-published authors to discover promising talent and broaden their catalog with niche or experimental content. Furthermore, e-commerce and digital platforms facilitate the visibility of independent works through targeted marketing and reader feedback. This trend promotes inclusivity in publishing enabling a broader range of voices. According to Australia publishing market analysis, self-publishing is becoming a transformative force creating new revenue opportunities while reshaping traditional publishing models.

Corporate and Research Publishing

Increasing demand for corporate and research-focused publications is creating important opportunities within the Australian publishing market. Organizations and educational institutions are turning to professional reports, whitepapers, and industry-specific content to inform their decision-making and share knowledge. Likewise, universities and research institutions are driving the need for peer-reviewed journals, academic studies, and specialized books that contribute to the advancement of scientific and professional understanding. Publishers can capitalize on this trend by providing customized solutions such as subscription-based access to research databases and digital knowledge platforms. As industries like healthcare, technology, and finance continue to grow the potential for specialized publishing expands. This emphasis on corporate and academic publishing offers publishers consistent revenue streams and positions them as vital players in knowledge distribution and professional growth.

Challenges of Australia Publishing Market:

Digital Disruption

Digital disruption poses a significant challenge to the Australian publishing market as consumer preferences shift away from traditional print media toward online content and multimedia formats. The increasing popularity of e-books, audiobooks, blogs, and free digital resources has led to a decline in demand for physical books, newspapers, and magazines. Particularly among younger audiences, there is a strong inclination toward mobile-based reading and subscription services that offer convenience and affordability. While the adoption of digital formats presents opportunities for innovation, it also puts pressure on traditional publishers to adapt swiftly. Many find it difficult to balance the costs associated with print production while investing in digital platforms. This ongoing evolution underscores the necessity for publishers to broaden their offerings and embrace digital transformation in order to stay competitive within an increasingly technology-driven market.

Piracy and Copyright Issues

Piracy and copyright infringement continue to be significant obstacles in the Australian publishing landscape, especially with the rise of digital content. The unauthorized distribution of e-books, academic papers, and journals through online channels greatly compromises publishers’ revenues and deters investment in new works. A considerable number of consumers opt for pirated versions due to their availability at little to no cost, presenting a significant challenge for publishers aiming to protect intellectual property. Although legal measures are in place, enforcement can be challenging and expensive, particularly in a digital-first environment where unauthorized sharing can escalate quickly. This problem impacts not just publishers but also authors, who suffer a loss in recognition and financial returns for their creations. Addressing piracy necessitates enhanced copyright protections, technological safeguards, and increased consumer awareness to maintain a fair and profitable publishing ecosystem.

Market Saturation

Market saturation represents another challenge for the Australian publishing sector, where both domestic and international publishers vie for the same audience. With a multitude of players offering similar products, distinguishing oneself requires considerable investment in marketing, branding, and innovation. The surplus of books, magazines, and digital publications often results in consumer fatigue, making it more difficult for publishers to gain and maintain audience attention. Furthermore, the emergence of self-publishing platforms adds to the competitive landscape, allowing independent authors to connect directly with readers. This crowded market scenario reduces profit margins and creates challenges for smaller publishers to compete against established brands. To navigate this challenge, publishers must concentrate on niche markets, offer unique content, and implement diversification strategies to set themselves apart in an already oversaturated market.

Australia Publishing Market News:

- 22 January 2024: Penguin Random House Australia and BBC studios have announced that the Bluey publishing program will expand in 2024 to include three new illustrated chapter books for readers aged six and up.

Australia Publishing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and platform.

Type Insights:

- Book Publishing

- Magazine Publishing

- Newspaper Publishing

The report has provided a detailed breakup and analysis of the market based on the type. This includes book publishing, magazine publishing, and newspaper publishing.

Platform Insights:

- Traditional

- Digital

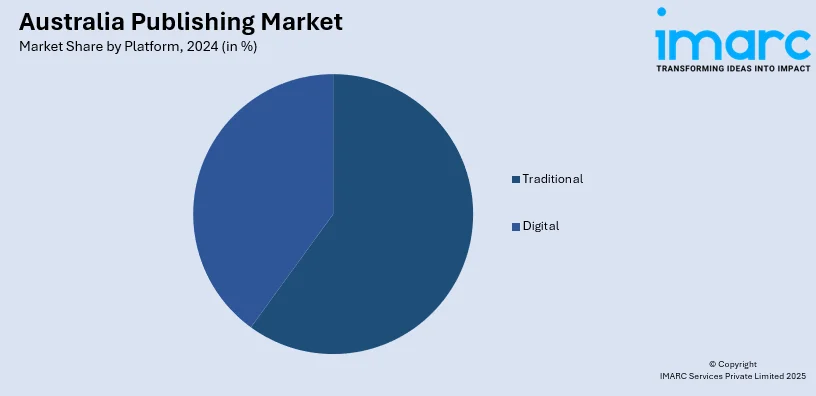

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes traditional and digital.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Publishing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Book Publishing, Magazine Publishing, Newspaper Publishing |

| Platforms Covered | Traditional, Digital |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia publishing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia publishing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia publishing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The publishing market in Australia was valued at USD 5.2 Billion in 2024.

The Australia publishing market is projected to exhibit a compound annual growth rate (CAGR) of 4.5% during 2025-2033.

The Australia publishing market is expected to reach a value of USD 7.9 Billion by 2033.

The Australia publishing market is witnessing trends such as the rising adoption of audiobooks and podcasts, growth of interactive and multimedia-based learning content, and increasing popularity of subscription-based reading platforms. Consumer preference for personalized content and sustainable printing practices is also reshaping the industry’s direction.

Market growth is driven by rising literacy initiatives, growing demand for professional and technical publications, and expanding use of digital platforms for education and entertainment. Supportive government policies, increasing global collaborations, and the growing visibility of Australian authors internationally further strengthen the opportunities for sustainable expansion in the publishing sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)