Australia Pulmonary Arterial Hypertension Drugs Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, End User, and Region, 2025-2033

Australia Pulmonary Arterial Hypertension Drugs Market Overview:

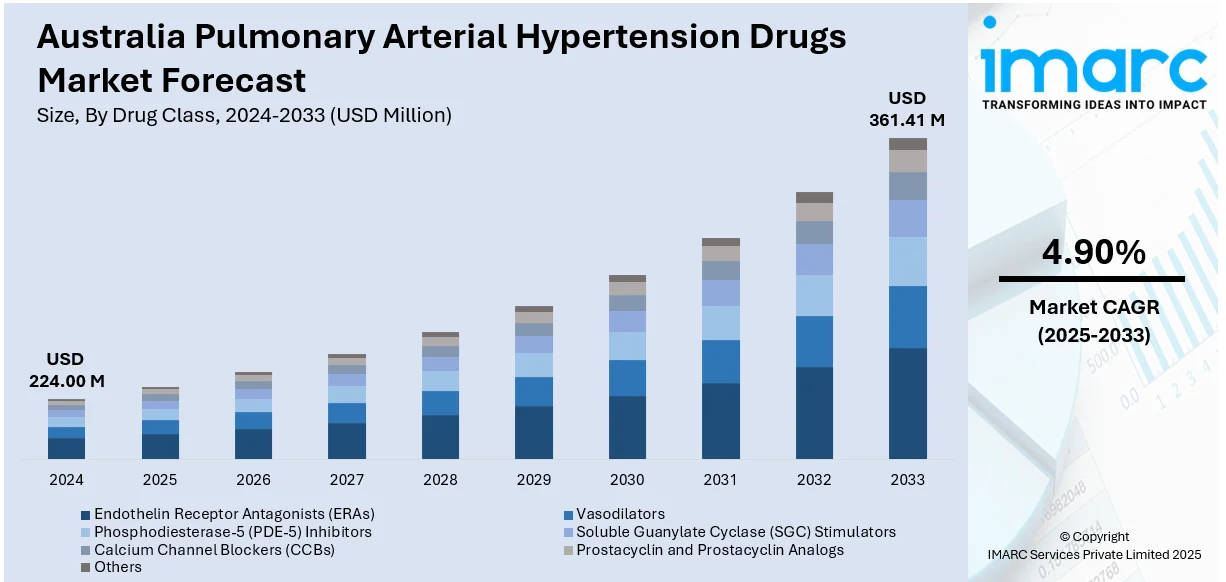

The Australia pulmonary arterial hypertension drugs market size reached USD 224.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 361.41 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is being driven by the rising prevalence of pulmonary arterial hypertension (PAH), an aging population, the adoption of advanced therapies like prostacyclin analogs and soluble guanylate cyclase (SGC)stimulators, favorable reimbursement policies, and ongoing research and development (R&D) initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 224.00 Million |

| Market Forecast in 2033 | USD 361.41 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Australia Pulmonary Arterial Hypertension Drugs Market Trends:

Shift Toward Combination Therapies for Enhanced Treatment Outcomes

The growing adoption of combination therapies is a significant trend driving the expansion of the PAH drugs market in Australia. These therapies, which often combine endothelin receptor antagonists (ERAs), phosphodiesterase-5 inhibitors (PDE-5Is), and prostacyclin analogs or SGC stimulators, are proving more effective than monotherapy in managing the complex and progressive nature of PAH. This shift has become especially important as physicians increasingly prescribe combination therapies for patients with advanced PAH, backed by evolving clinical evidence and global treatment guidelines. A growing share of newly diagnosed PAH patients are subjected to combination therapy. The growing clinical evidence is encouraging payers and policymakers to expand coverage, further accelerating the adoption of combination therapies.

To get more information on this market, Request Sample

Advancements in Targeted and Oral PAH Therapies

The development and approval of targeted oral therapies are significantly propelling the growth of the PAH drugs market in Australia by enhancing patient compliance and expanding treatment access. Oral medications, such as selexipag (a selective IP receptor agonist) and riociguat (an SGC stimulator), are increasingly prescribed for both early- and late-stage PAH due to their convenience and efficacy. This shift away from traditional injectable therapies is further supported by clinical results showing similar or superior outcomes. The majority of PAH patients in Australia are managed with at least one oral agent. These therapies are especially favored for their ease of use, better tolerability, and reduced hospital dependency. Promising pipeline drugs like rodatristat ethyl and seralutinib, currently in Phase II/III trials, underscore the growing potential of oral targeted therapies, particularly benefiting rural and remote patients facing challenges with hospital-based infusions.

Australia Pulmonary Arterial Hypertension Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug class, route of administration, and end user.

Drug Class Insights:

- Endothelin Receptor Antagonists (ERAs)

- Vasodilators

- Phosphodiesterase-5 (PDE-5) Inhibitors

- Soluble Guanylate Cyclase (SGC) Stimulators

- Calcium Channel Blockers (CCBs)

- Prostacyclin and Prostacyclin Analogs

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes endothelin receptor antagonists (ERAs), vasodilators, phosphodiesterase-5 (PDE-5) inhibitors, soluble guanylate cyclase (SGC) stimulators, calcium channel blockers (CCBs), prostacyclin and prostacyclin analogs, and others.

Route of Administration Insights:

- Inhalation

- Injectable

- Oral Administration

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes inhalation, injectable, and oral administration.

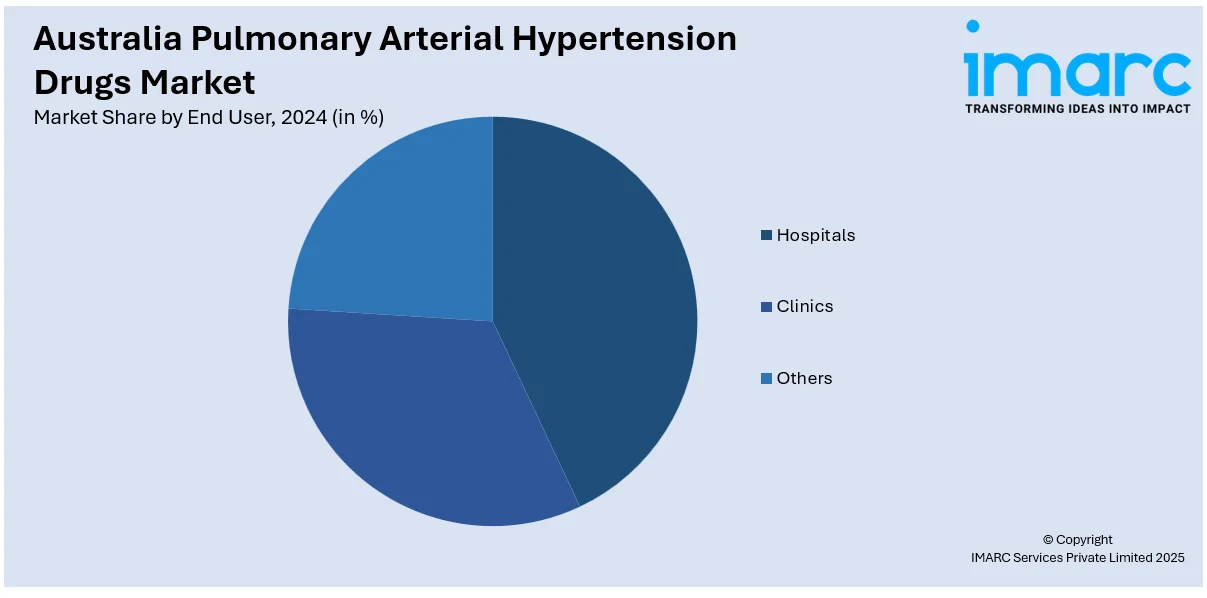

End User Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, clinics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pulmonary Arterial Hypertension Drugs Market News:

- October 2024: Monash University researchers, supported by BioCurate’s Proof of Concept Fund and the NHMRC, announced that they are developing a novel, disease-modifying therapy for pulmonary arterial hypertension (PAH). Targeting a specific G-protein coupled receptor involved in lung vessel inflammation and remodeling, the team aims to halt disease progression and reduce mortality. This collaborative effort includes clinicians and scientists, striving to address the limitations of current symptomatic treatments for PAH.

- February 2021: The Australian government added Uptravi® (selexipag) to the Pharmaceutical Benefits Scheme (PBS) for treating pulmonary arterial hypertension (PAH). This oral therapy, used alongside existing treatments, can delay disease progression and reduce reliance on intravenous therapies.

Australia Pulmonary Arterial Hypertension Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Endothelin Receptor Antagonists (ERAs), Vasodilators, Phosphodiesterase-5 (PDE-5) Inhibitors, Soluble Guanylate Cyclase (SGC) Stimulators, Calcium Channel Blockers (CCBs), Prostacyclin and Prostacyclin Analogs, Others |

| Routes of Administration Covered | Inhalation, Injectable, Oral Administration |

| End Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pulmonary arterial hypertension drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pulmonary arterial hypertension drugs market on the basis of drug class?

- What is the breakup of the Australia pulmonary arterial hypertension drugs market on the basis of route of administration?

- What is the breakup of the Australia pulmonary arterial hypertension drugs market on the basis of end user?

- What is the breakup of the Australia pulmonary arterial hypertension drugs market on the basis of region?

- What are the various stages in the value chain of the Australia pulmonary arterial hypertension drugs market?

- What are the key driving factors and challenges in the Australia pulmonary arterial hypertension drugs market?

- What is the structure of the Australia pulmonary arterial hypertension drugs market and who are the key players?

- What is the degree of competition in the Australia pulmonary arterial hypertension drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pulmonary arterial hypertension drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pulmonary arterial hypertension drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pulmonary arterial hypertension drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)