Australia Rail Transportation Market Report by Types of Service (Freight Rail, Passenger Rail), Mode of Operation (Heavy Haul Rail, Intermodal Rail, Dedicated Freight Rail, Shared Passenger and Freight Rail), Ownership (Public Sector, Private Sector), and Region 2025-2033

Australia Rail Transportation Market Overview:

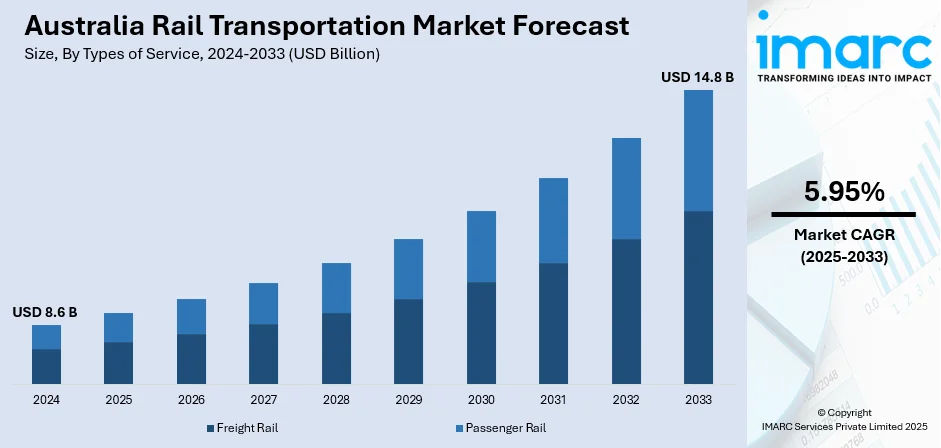

The Australia rail transportation market size reached USD 8.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The market is witnessing stable growth, primarily driven by elevated infrastructure investments, rapid urbanization, and escalating demand for effective passenger and freight services. Additionally, surge in sustainability projects and technological innovations are further enhancing operational efficacy and market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.6 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Market Growth Rate 2025-2033 | 5.95% |

Australia Rail Transportation Market Trends:

Increasing Investment in Rail Infrastructure

The Australia rail transportation market is witnessing substantial investments in infrastructure ventures that are aimed at enhancing connectivity as well as capacity. For instance, in May 2024, the Australian Government announced an investment of USD 670.4 million for ARTC rail network, which is a part of the government’s four-year Infrastructure Investment Program. Both state and federal governments are allotting significant funds for major railway projects, improving passenger as well as freight rail networks. Moreover, such ventures are developed to reduce emissions, foster economic development, and minimize road congestion by enhancing rail accessibility. In addition, with long-term advantages for regional and urban commute, this trend is anticipated to bolster as a part of Australia's comprehensive transportation strategy, catering to the escalating demand for more efficient and sustainable transport solutions.

To get more information on this market, Request Sample

Rapid Adoption of Advanced Rail Technologies

Technological innovations are playing a critical role in steering the Australia rail transportation market. The rapid adoption of digital technologies, such as smart signaling, real-time analysis of data, and automated systems, is improving safety as well as operational efficacy across the railway network. Moreover, the deployment of predictive maintenance techniques is helping in enhancing service credibility and reducing downtime, which, in turn, is favoring the market growth. In addition, the country is exploring the adoption of electric and autonomous trains to r enhance sustainability and functionality, which is expected to play a key role in driving market growth. For instance, in March 2024, Aurizon, the biggest rail freight operator in Australia, announced the development as well as trial of a battery-electric tender for general freight and heavy haulage trains, supported by a significant USD 4.9 million investment from the Australian Renewable Energy Agency. Furthermore, such technological advancements are reshaping the rail segment, offering more environmentally friendly and cost-efficient transport solutions. Consequently, with the increasing digitalization, the market is anticipated to witness continued modernization of rail sector.

Rising Emphasis on Green Transport and Sustainability

Sustainability has recently become a major objective in the Australian rail transportation market, principally driven by stringent government regulations aimed at significantly lowering the carbon emissionsy. Rail is rapidly being adopted as a greener alternative to road transportation system, especially for long-route and freight commute. According to industry reports, in 2023, cars sold by five companies in Australia generated carbon emissions equivalent to those of 156 standard coal mines. Moreover, a new car bought in the country consumes around 6.9 liters of fuel per 100km, significantly more than the fuel consumption rates in Europe and the United States. Moreover, continuous efforts for the electrification rail networks, combined with the incorporation of renewable sources of energy, are substantially catering to the Australian market’s environmental objectives. In addition, the notable inclination towards energy-saving rail infrastructure and electric trains is increasingly gaining traction, as operators are currently striving to adhere to the emissions targets and minimize their energy consumption.

Australia Rail Transportation Market News:

- In April 2024, Alstom, a rail transport manufacturer, delivered its first locally developed C-series electric train, with a manufacturing cost of USD 845 million, under a contract with the Public Transport Authority of Western Australia. This energy-efficient train has a passenger capacity of 1,200 and can reach a speed of 130 km per hour.

- In March 2024, ABB, a well-known engineering and automation company, secured a $150 million contract with Hyundai Rotem, prominent manufacturer of rail components, to supply traction packages for 65 trains as part of Queensland’s $3 billion Train Manufacturing Programme (QTMP). ABB also announced an investment of $6 million to establish a local Traction Centre of Excellence in Maryborough, enhancing regional production capabilities.

Australia Rail Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on types of service, mode of operation, and ownership.

Types of Service Insights:

- Freight Rail

- Breakup by Cargo Type

- Bulk Freight

- Intermodal Freight

- Agricultural Products

- Consumer Goods

- Automotive

- Industrial Goods

- Others

- Breakup by End-Use Industry

- Mining

- Agriculture

- Manufacturing

- Energy

- Construction

- Retail and E-Commerce

- Others

- Breakup by Cargo Type

- Passenger Rail

- Breakup by Type

- Urban Rail (Metro/Subway, Light Rail/Tram)

- Intercity Rail

- Regional Rail

- Others

- Breakup by Type

The report has provided a detailed breakup and analysis of the market based on the types of service. This includes freight rail [breakup by cargo type (bulk freight, intermodal freight, agricultural products, consumer goods, automotive, industrial goods, others), breakup by end-use industry (mining, agriculture, manufacturing, energy, construction, retail and e-commerce, others)] and passenger rail [breakup by type (urban rail {metro/subway, light rail/tram}, intercity rail, regional rail, others)]

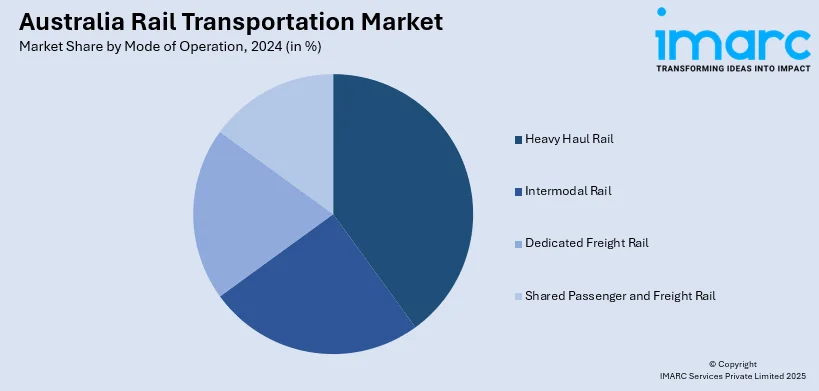

Mode of Operation Insights:

- Heavy Haul Rail

- Intermodal Rail

- Dedicated Freight Rail

- Shared Passenger and Freight Rail

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes heavy haul rail, intermodal rail, dedicated freight rail, and shared passenger and freight rail.

Ownership Insights:

- Public Sector

- Private Sector

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes public sector and private sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Rail Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Service Covered |

|

| Modes of Operation Covered | Heavy Haul Rail, Intermodal Rail, Dedicated Freight Rail, Shared Passenger and Freight Rail |

| Ownerships Covered | Public Sector, Private Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia rail transportation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia rail transportation market?

- What is the breakup of the Australia rail transportation market on the basis of types of service?

- What is the breakup of the Australia rail transportation market on the basis of mode of operation?

- What is the breakup of the Australia rail transportation market on the basis of ownership?

- What are the various stages in the value chain of the Australia rail transportation market?

- What are the key driving factors and challenges in the Australia rail transportation?

- What is the structure of the Australia rail transportation market and who are the key players?

- What is the degree of competition in the Australia rail transportation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia rail transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia rail transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia rail transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)