Australia Ready to Drink Coffee Market Size, Share, Trends and Forecast by Packaging and Distribution Channel, and Region, 2026-2034

Australia Ready to Drink Coffee Market Overview:

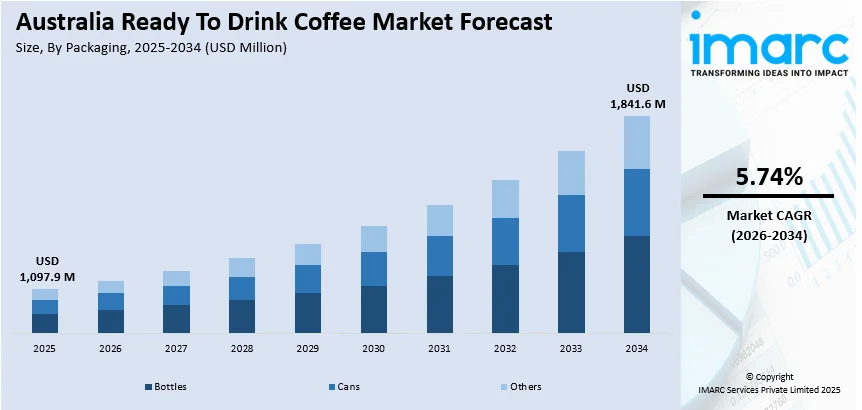

The Australia ready to drink coffee market size reached USD 1,097.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,841.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.74% during 2026-2034. The market is seeing strong growth fueled by a number of key trends. Consumers increasingly want functional beverages that provide added health benefits beyond caffeine, so manufacturers are responding with improved ingredients. The demand for plant-based and dairy-free products is part of a wider trend toward sustainability and veganism. In addition, premiumization and the mounting demand for cold brew coffee led to superior quality and distinctive taste experiences. These trends, in turn, collectively drive market diversification and growth, favorably impacting the Australia ready to drink coffee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,097.9 Million |

| Market Forecast in 2034 | USD 1,841.6 Million |

| Market Growth Rate 2026-2034 | 5.74% |

Australia Ready to Drink Coffee Market Trends:

Increased Demand for Functional Ingredients

One of the new trends within the Australian RTD coffee market is the accelerating consumer demand for functional beverages. Consumers in Australia are no longer content with merely getting a caffeine boost, they are looking for extra benefits, such as increased energy, enhanced concentration, immune support, or digestive wellness. This has given rise to the use of functional ingredients like protein, adaptogens, MCT oil, collagen, and probiotics in ready-to-drink coffee beverages. These are most favored among wellness-focused consumers who seek performance and health benefits in an easy, on-the-go package. This is an extension of a wider trend towards changing consumption behavior in which beverages should serve lifestyle needs, rather than just refreshing the consumer. Younger adults, gym users, and city professionals are leading the trend, forcing innovation in packaging and formulae. The trend is helping to drive overall expansion of Australia's ready-to-drink coffee market, creating new opportunities for product differentiation and market growth. For instance, in August 2024, First Press Coffee introduced a new ready-to-drink iced coffee in Australia, indicating growing consumer demand and ongoing growth within the Australia ready to drink coffee market.

To get more information on this market Request Sample

Move Toward Plant-Based and Dairy-Free Products

Growing popularity of plant-based diets and lactose intolerance in Australia has played a major role in shaping the evolution of ready-to-drink (RTD) coffee. As people's tastes shift towards sustainable, ethical food and beverage options, there is greater demand for alternatives that are non-dairy. For example, in April 2024, Dare Iced Coffee introduced dairy-free Double Espresso and Mocha in Australia, extending its legendary lineup to accommodate increasing demand for plant-based, lactose-free options within the ready-to-drink market. Furthermore, oat milk, almond milk, soy milk, and coconut milk are now commonplace in numerous RTD coffee products, taking the place of traditional dairy without affecting taste or texture. Alternatives appeal not just to vegans but to flexitarians and health seekers who want lighter, low-allergen options. The neutral flavor and smooth texture of some plant milks, particularly oat, have found them best suited for coffee, complementing the experience. It also resonates with environmental sentiments, as plant-based items generally have a lighter carbon footprint. Companies are now more inclined to innovate in this category to develop well-balanced, shelf-stable products. This trend favours Australia ready-to-drink coffee market growth, offering it a more inclusive and forward-looking market.

Premiumization and Popularity of Cold Brew

Australian consumers are increasingly shifting towards premium products within the ready-to-drink coffee segment, a change in attention away from mass market towards products that are understood to be superior in quality. Premiumization is witnessed through the popularity of cold brew coffee, prized for its round taste profile, reduced acidity, and artisanal value. Shoppers now equate cold brew with café-grade sophistication and are willing to pay a premium for products that meet expectations on flavor, bean provenance, and small-batch manufacturing processes. The desire for premium experience is also transforming packaging, with clean, minimalist design and transparent communication of sourcing and brewing methods. RTD coffee is no longer a convenience drink; it is now a lifestyle product that conveys quality and sophistication. This trend is particularly strong among young adults and urban consumers who are knowledgeable about specialty coffee culture. Therefore, premiumization is driving the expansion of Australia's ready-to-drink coffee market, elevating its prestige and popularity.

Australia Ready to Drink Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on packaging and distribution channel.

Packaging Insights:

- Bottles

- Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes bottles, cans, and others.

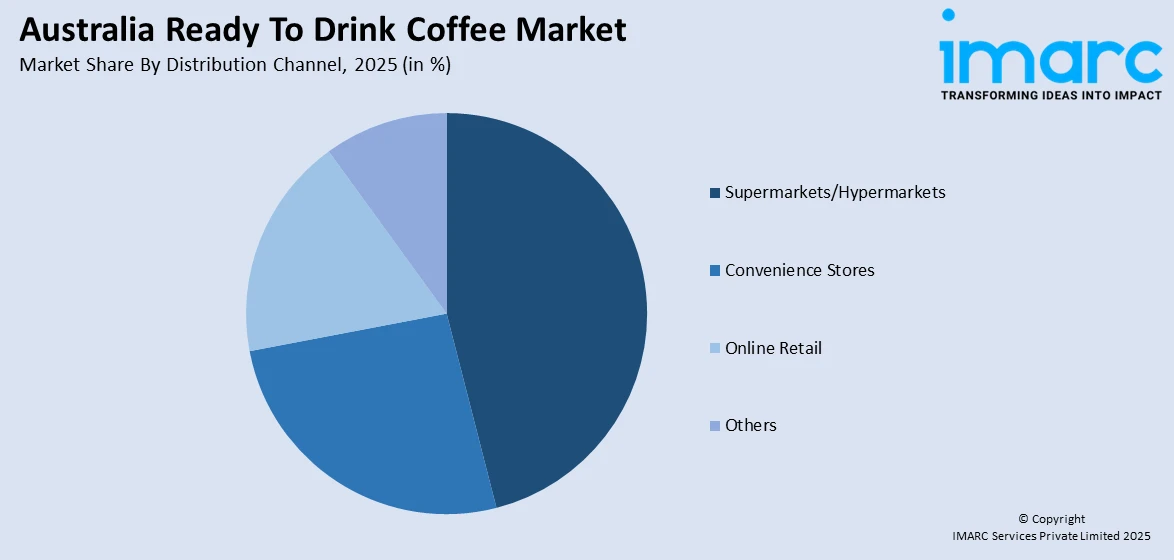

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, online retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ready to Drink Coffee Market News:

- In May 2024, Nestlé rolled out a premium espresso concentrate in Australia, as consumers increasingly demand cold, customizable coffee. The new product extends its successful soluble coffee portfolio and appeals to younger consumers who want convenience, marking the increasing market acceptance of coffee concentrates in addition to instant coffee in Australia's dynamic ready-to-drink coffee market.

- In October 2023, Sydney's Single O released its first ready-to-drink offering—the Iced Latte Pilot Can—using oat milk and one espresso shot. Limited to 8,000 cans, it's sold online and through wholesale partners. A QR code encourages feedback, following Single O's customer-driven approach to specialty coffee innovation and convenience.

Australia Ready to Drink Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia ready to drink coffee market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia ready to drink coffee market on the basis of packaging?

- What is the breakup of the Australia ready to drink coffee market on the basis of distribution channel?

- What is the breakup of the Australia ready to drink coffee market on the basis of region?

- What are the various stages in the value chain of the Australia ready to drink coffee market?

- What are the key driving factors and challenges in the Australia ready to drink coffee?

- What is the structure of the Australia ready to drink coffee market and who are the key players?

- What is the degree of competition in the Australia ready to drink coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ready to drink coffee market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ready to drink coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ready to drink coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)