Australia Real Estate Investment Market Size, Share, Trends and Forecast by Property Type, Distribution Channel, Purpose, and Region, 2025-2033

Australia Real Estate Investment Market Size and Share:

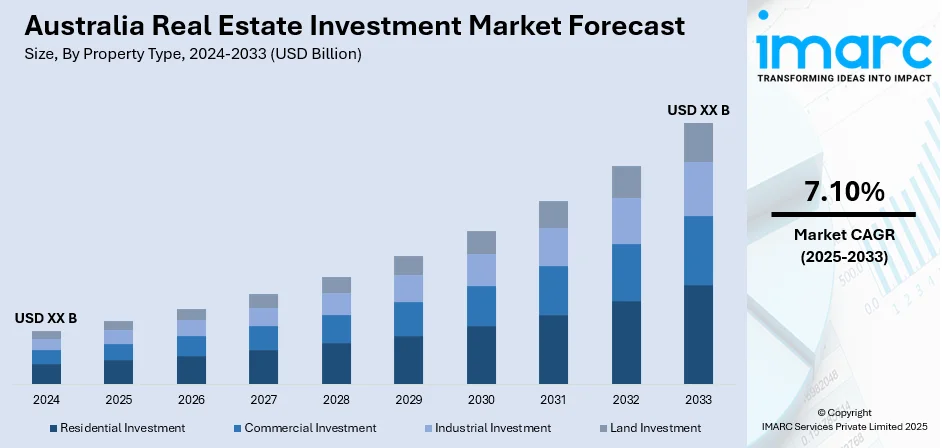

The Australia real estate investment market size reached USD 229.1 Billion in 2024. The market is projected to reach USD 424.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. Key factors driving the market include strong population growth, particularly due to migration, low interest rates, and increasing demand for commercial and residential properties. Additionally, continuous infrastructure development, government incentives, and the rise in tech-driven property sectors like data centers and logistics also play a significant role in enhancing real-estate investment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 229.1 Billion |

|

Market Forecast in 2033

|

USD 424.7 Billion |

| Market Growth Rate 2025-2033 | 7.10% |

Key Trends of Australia Real Estate Investment Market:

Rapid Population Growth

Australia has experienced a notable inflation in population, primarily driven by a high rate of net overseas migration. As of March 2024, the nation's population was around 27,122,411, marking an increase of 615,300 individuals from the prior year, which corresponds to a 2.3% growth rate. This inflating population is comparable to merging the populations of Canberra and Hobart in a single year. The rapid surge in population has driven demand in various real estate sectors. The real estate market, for example, has faced challenges, as increased competition for residences has led to elevated property values and rental costs. The rising demand has also spurred new home construction, as builders and investors aim to accommodate the expanding population. In addition, the population growth has positively impacted the commercial real estate industry. As more people move to Australia, there is escalated demand for retail outlets, office complexes, and industrial parks to accommodate the growing consumer market and labor force. This demand has drawn both local and foreign investors looking to capitalize on Australia's growing markets.

To get more information of this market, Request Sample

Favorable Government Policies

Public policy greatly influences the environment of real estate investments in Australia. Monetary policy by the Reserve Bank of Australia (RBA), especially the changes in the cash rate, has a direct influence on the cost of borrowing for both the investors and buyers of homes. In February 2025, the RBA lowered the cash rate by 0.25 percentage points to 4.1%, eased the burden of those who have mortgages, and improved buyer confidence. This step is also likely to stabilize housing prices and promote investment in the real estate sector. The demand for real estate is greatly influenced by the immigration policy of the government. The Albanese government recognized that its ambitious immigration goal of 1.2 million individuals over three years has helped fuel the housing unaffordability problem, especially for young Australians. Therefore, measures have been established to control foreign investment in homes in order to harmonize foreign capital inflows with the need for housing to remain affordable for the local residents. Tax policy, including negative gearing and exceptions of capital gains tax, also impacts the investment decision. These steps can become more favorable for investing in property by allowing losses to be offset against taxable income, thus making it more favorable for domestic and foreign investors to invest funds in the Australian real estate sector.

Regional Resilience

Other cities away from the big capitals, such as Perth and Adelaide, are also seeing considerable increases in real estate activity. The affordability of these places relative to the higher-priced capital cities is drawing in investors and homebuyers. As these regions enjoy economic growth fueled by mining, agriculture, and domestic industries, housing and commercial property demand is increasing. Moreover, infrastructure upgrades and urban development initiatives are adding to their popularity. This regional growth is spreading out the Australian real estate investment, providing potential for rental yields and capital appreciation. Investors are increasingly looking beyond Sydney and Melbourne to capitalize on the potential in these regions, contributing to the growth of Australia real estate investment market share.

Growth Drivers of Australia Real Estate Investment Market:

Rapid Urbanization

Urbanization continues to be a key propellant of the Australian real estate investment market. As more individuals shift towards major cities and regional hubs for employment, education, and lifestyle, demand for residential, commercial, and mixed-use properties increases. This growth is most evident in cities such as Sydney, Melbourne, and Brisbane, where population densities are increasing, necessitating constant development of new housing and infrastructure. The movement towards urban dwellings has also generated interest in mixed-use properties, where residential, retail, and office properties are brought together. This movement boosts demand for housing units and drives commercial real estate expansion, fueling more development. As urban areas continue to expand, the Australia real estate investment market demand is expected to remain strong, attracting investors looking for growth opportunities.

Economic Stability

Australia's economy stability is pivotal in strengthening investor confidence within the real estate sector. Australia's diversified industries, including mining, agriculture, and technology, remain robust, serving as a solid foundation for long-term growth. Economic strength draws domestic and foreign investors, guaranteeing a consistent supply of properties in residential, commercial, and industrial sectors. With low unemployment and a healthy financial system, Australia is still a safe bet for real estate investment opportunities with possibilities of capital growth and stable rental returns. As the economy continues to be sound, the Australian real estate market continues to deliver secure long-term investment opportunities, particularly in principal urban and regional markets.

Infrastructure Development

Real estate development in Australia is driven by investment in infrastructure. Large-scale transport, utilities, and public amenity projects are adding to connectivity and enhancing the general livability of different regions. Road, rail, airport, and port upgrades open up previously underserved locations, which in their turn generate higher demand for residential, commercial, and mixed-use projects. Also, the building of new schools, hospitals, and recreational centers draws in businesses and families to these areas. As infrastructure construction grows, places with improved connectivity and amenities become more appealing to investors and buyers alike, further driving the development of the Australian real estate market.

Challenges of Australia Real Estate Investment Market:

High Property Prices in Australia

Skyrocketing property prices in major Australian cities like Sydney and Melbourne are one of the biggest challenges for both new investors and first-time buyers. As demand continues to outpace supply, particularly in urban areas, property values have reached record highs, making it increasingly difficult for individuals and smaller investors to enter the market. This has created a barrier for homeownership and investment, as many are priced out of desirable locations. High property prices also affect rental yields, limiting profitability for investors. While the demand for housing remains high, the affordability issue is leading to growing concerns about long-term market sustainability, with calls for policy interventions to address the housing affordability crisis.

Interest Rate Fluctuations Impacting Demand

Fluctuations in interest rates significantly affect mortgage affordability, which in turn impacts demand in the Australian real estate market. For investors and homebuyers, rising interest rates result in increased monthly mortgage payments since borrowing becomes more costly. This can dampen investor sentiment, particularly in a market already facing high property prices. Conversely, when rates are low, there is an increased demand for properties as borrowing costs decrease. However, unpredictable interest rate hikes from the Reserve Bank of Australia in response to inflation can create market volatility, reducing buyer confidence and slowing down property transactions. Investors need to carefully consider how interest rate trends will influence their investment strategies and returns.

Supply Chain Issues

Supply chain disruptions in Australia’s real estate market are causing significant delays and cost increases in construction projects. Material shortages, particularly in steel, timber, and other essential building supplies, have escalated prices and extended timelines for development projects. These challenges have been exacerbated by global supply chain issues and domestic logistical constraints. As a result, real estate developers face higher construction costs, which can erode profit margins and delay project completion. This also impacts the overall market, reducing the availability of new housing and commercial spaces. Investors in the Australian real estate market are increasingly concerned about these delays, as they affect both the short-term supply and long-term returns. Australia real estate investment market analysis shows that overcoming these challenges is crucial to maintaining growth and investor confidence.

Australia Real Estate Investment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on property type, distribution channel, and purpose.

Property Type Insights:

- Residential Investment

- Commercial Investment

- Office Space

- Retail Space

- Leisure Space

- Others

- Industrial Investment

- Manufacturing Plants

- Warehouse/Distribution

- Others

- Land Investment

The report has provided a detailed breakup and analysis of the market based on the property type. This includes residential investment, commercial investment (office space, retail space, leisure space, and others), industrial investment (manufacturing plants, warehouse/distribution, and others), and land investment.

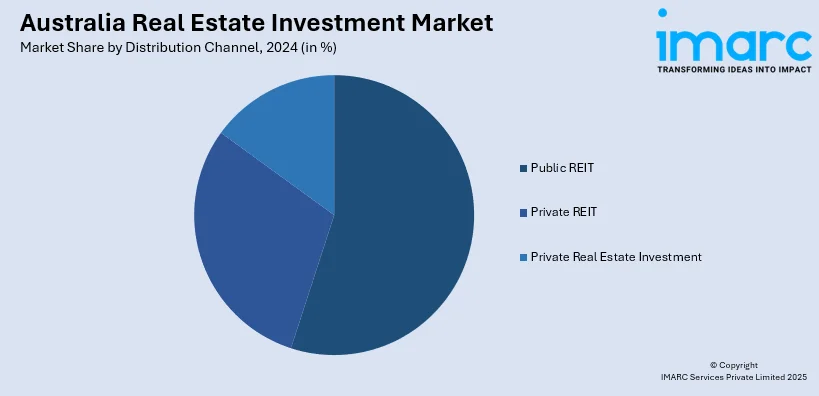

Distribution Channel Insights:

- Public REIT

- Private REIT

- Private Real Estate Investment

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes public REIT, private REIT, and private real estate investment.

Purpose Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the purpose have also been provided in the report. This includes sales and rental.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Real Estate Investment Market News:

- February 2025: Hong Kong’s Link REIT has appointed a new head of Australian investment, indicating its strategic expansion in the country’s real estate market. This move reflects increasing foreign investor interest in Australia’s commercial property sector, particularly in key cities like Sydney and Melbourne. The appointment aligns with Link REIT’s broader efforts to diversify its portfolio beyond Hong Kong.

- December 2024: Goodman Group is leading Australian property firms by capitalizing on the growing demand for data centers driven by AI advancements. Its focus on digital infrastructure has boosted investor confidence and positioned it strongly in the market. This highlights a shift in real estate investment trends towards tech-driven assets.

Australia Real Estate Investment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Property Types Covered |

|

| Distribution Channels Covered | Public REIT, Private REIT, Private Real Estate Investment |

| Purposes Covered | Sales, Rental |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia real estate investment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia real estate investment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia real estate investment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate investment market in the Australia was valued at USD 229.1 Billion in 2024.

The Australia real estate investment market is projected to exhibit a compound annual growth rate (CAGR) of 7.10% during 2025-2033.

The Australia real estate investment market is expected to reach a value of USD 424.7 Billion by 2033.

Australia’s real estate market is seeing strong demand driven by population growth, urbanization, and infrastructure development. Key trends include rising regional investment, increased foreign interest, a focus on sustainable properties, and the growth of mixed-use developments as urban spaces evolve to meet modern needs.

The key growth drivers include Australia’s stable economy, government support for housing and infrastructure, low-interest rates, and rising demand for sustainable and wellness-focused properties. Additionally, foreign investment continue to fuel real estate demand across residential and commercial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)