Australia Refrigerant Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Australia Refrigerant Market Overview:

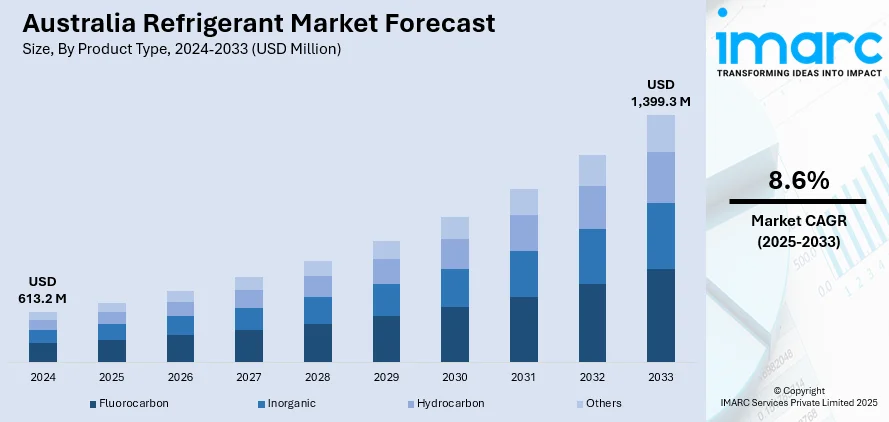

The Australia refrigerant market size reached USD 613.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,399.3 Million by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. The market is driven by the growing implementation of environmental policies to mitigate greenhouse gas emissions, fast expansion of cold chain logistics and innovations in the food and beverage (F&B) industry, and increasing use of air conditioning systems in residential, commercial, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 613.2 Million |

| Market Forecast in 2033 | USD 1,399.3 Million |

| Market Growth Rate (2025-2033) | 8.6% |

Australia Refrigerant Market Trends:

Regulatory Shifts Toward Low-Global Warming Potential (GWP) and Environment Friendly Refrigerants

Australia's refrigerant industry is largely influenced by environmental policy to mitigate greenhouse gas emissions. The Australian Government's adoption of the Ozone Protection and Synthetic Greenhouse Gas Management (OPSGGM) imposes tight controls on hydrofluorocarbon (HFC) imports, production, and usage as a powerful greenhouse gas. Apart from this, Australia plans to reduce HFC use to improve environmental conditions. This policy momentum is encouraging air conditioner manufacturers to use of low-GWP alternatives like hydrofluoroolefins (HFOs), natural refrigerants like ammonia, CO₂, and hydrocarbons that have significantly lower environmental footprints. From 1 July 2024, the Australian government planned to prohibit the import and production of small air conditioners with a GWP exceeding 750. These transitions are motivating manufacturers and individuals to invest in new systems compatible with eco-friendly refrigerants.

To get more information on this market, Request Sample

Expanding Cold Chain Infrastructure in the Food and Beverage (F&B) Industry

The fast expansion of cold chain logistics in Australia is impelling the growth of the market. Innovations in the food and beverages (F&B) industry, specifically in perishables such as dairy, meat, and seafood, is driving demand for efficient and effective refrigeration systems at all stages of storage, processing, and distribution. Australia's high-value agricultural exports to various destinations require significant cold storage facilities up to international standards. In addition, year-round availability of fresh and frozen products is encouraging retail chains and logistics firms to build refrigerated warehousing capacity and refrigerated transport fleets. Both of these have a direct impact on the refrigerant market as more cooling systems are put in place and existing systems are retrofitted with new-generation refrigerants. As the cold chain sector focuses on energy efficiency and compliance with regulations, demand for refrigerants that not only optimize performance but also lower environmental footprints and operating expenditures is increasing. The IMARC Group predicts that the Australia cold chain logistics market size will reach USD 7.1 Billion by 2033.

Increasing Adoption of Air Conditioning Systems in Residential and Commercial Sectors

The increasing use of air conditioning systems in residential, commercial, and industrial sectors in Australia is accounting for most of the refrigerant consumption. This is being influenced by increasing population and global warming leading to rising temperatures. As per the State of the Climate 2024 report by the government, Australia's average temperature increased on average by 1.44 ± 0.24 °C from when national records commenced in 1910. Every decade has been warmer than the previous since 1950. Day temperatures and night-time temperatures have also risen. This factor is responsible for the high demand for air conditioning in the country. The increase in urban developments is facilitating the installation of heating, ventilation, and air conditioning (HVAC) equipment in new homes, offices, shopping malls, and public facilities. As units are replaced by newer, energy-efficient models, the shift towards new refrigerants, including low-GWP blends, is becoming more widespread. Furthermore, government promotion of energy-saving appliances through measures like the government-initiated schemes at the state level further facilitate the transition to refrigerants that meet environment-friendly standards.

Australia Refrigerant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Fluorocarbon

- Inorganic

- Hydrocarbon

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fluorocarbon, inorganic, hydrocarbon, and others.

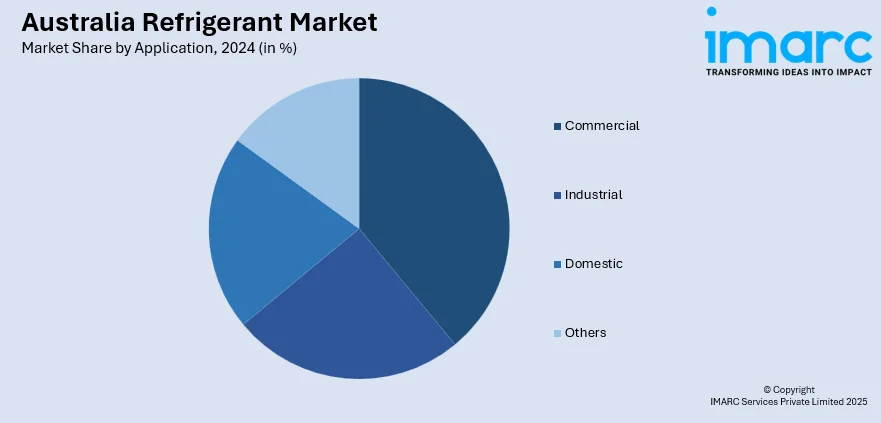

Application Insights:

- Commercial

- Industrial

- Domestic

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, domestic, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Refrigerant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fluorocarbon, Inorganic, Hydrocarbon, Others |

| Applications Covered | Commercial, Industrial, Domestic, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia refrigerant market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia refrigerant market on the basis of product type?

- What is the breakup of the Australia refrigerant market on the basis of application?

- What is the breakup of the Australia refrigerant market on the basis of region?

- What are the various stages in the value chain of the Australia refrigerant market?

- What are the key driving factors and challenges in the Australia refrigerant market?

- What is the structure of the Australia refrigerant market and who are the key players?

- What is the degree of competition in the Australia refrigerant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia refrigerant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia refrigerant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia refrigerant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)