Australia Refrigerated Trucks Market Size, Share, Trends and Forecast by Type, Tonnage Capacity, Application, and Region, 2025-2033

Australia Refrigerated Trucks Market Overview:

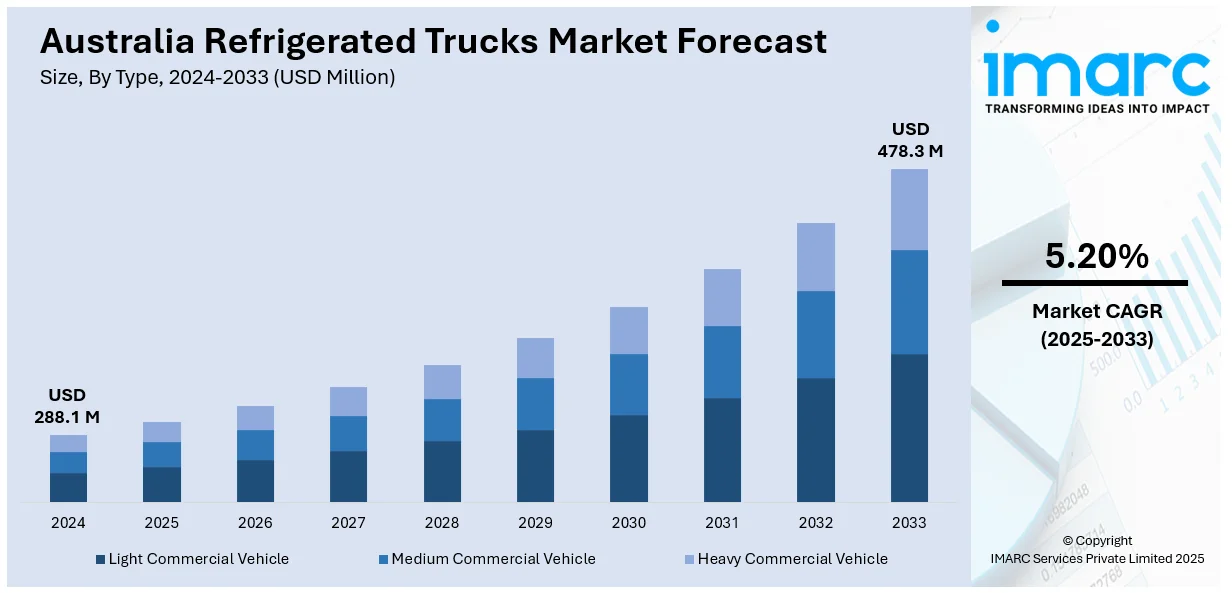

The Australia refrigerated trucks market size reached USD 288.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 478.3 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by factors such as the increasing demand for fresh and perishable goods, the growth of e-commerce, and stricter food safety regulations. Technological advancements in refrigeration and telematics, along with a focus on sustainability and energy-efficient solutions, further propel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 288.1 Million |

| Market Forecast in 2033 | USD 478.3 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Australia Refrigerated Trucks Market Trends:

Integration of Advanced Telematics and IoT

IoT and telematics technologies are transforming the Australia refrigerated trucks market outlook by furnishing fleet managers with real-time information regarding truck locations, goods conditions, as well as surrounding environmental conditions such as temperature. These technologies enable businesses to cost-effectively manage their refrigeration trucks in ways that ensure intactness of perishing commodities upon delivery. With telematics, operators are able to get immediate notification if there are deviations from specified temperature levels or other vital conditions, enabling rapid action. Historical data also assists in optimizing route planning and operational efficiency. This integration not only enhances fleet management but also safety, compliance, and transparency, making it a significant trend in ensuring high standards of service in the refrigerated transport industry.

To get more information on this market, Request Sample

Shift Towards Sustainable Refrigeration Technologies

Sustainability is becoming a key focus in the Australia refrigerated truck market, with a growing shift toward adopting environmentally friendly refrigeration systems. A significant move is the integration of electric, solar, and battery-powered refrigeration units that are not only energy-efficient but also drastically reduce emissions compared to traditional diesel systems. For instance, these systems can cut operating costs by up to 90% and reduce the carbon footprint by approximately 9 tonnes of CO₂ per vehicle annually. In addition to that, growing utilization of low-global-warming-potential (GWP) refrigerants is reducing the environmental footprint even further. With growing regulatory pressures and increased customer demand for more environmentally friendly practices, operators are moving ahead proactively to convert their fleets. Through investment in cleaner technology, operators are keeping themselves abreast of regulations, reducing long-term costs, and improving environmental credentials in a competitive logistics environment.

Expansion of Cold Chain Infrastructure and E-commerce Integration

The growth of e-commerce, especially in the online grocery and perishable items space, is fueling the Australia refrigerated trucks market growth. As demand for fresh products delivered to doorsteps increases among consumers, companies are investing significantly in cold chain infrastructure to facilitate these deliveries. This encompasses increasing refrigerated storage facilities and last-mile logistics optimization to ensure that products stay at the necessary temperature during the delivery process. Sophisticated logistics systems are being used to track and manage temperatures, enhance route optimization, and increase delivery precision. This market growth has led to tighter integration between refrigerated transport companies and the changing requirements of e-commerce companies, transforming the face of logistics.

Australia Refrigerated Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, tonnage capacity, and application.

Type Insights:

- Light Commercial Vehicle

- Medium Commercial Vehicle

- Heavy Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes light commercial vehicle, medium commercial vehicle, and heavy commercial vehicle.

Tonnage Capacity Insights:

- Less Than 10 Tons

- 10-20 Tons

- More Than 20 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes less than 10 tons, 10-20 tons, and more than 20 tons.

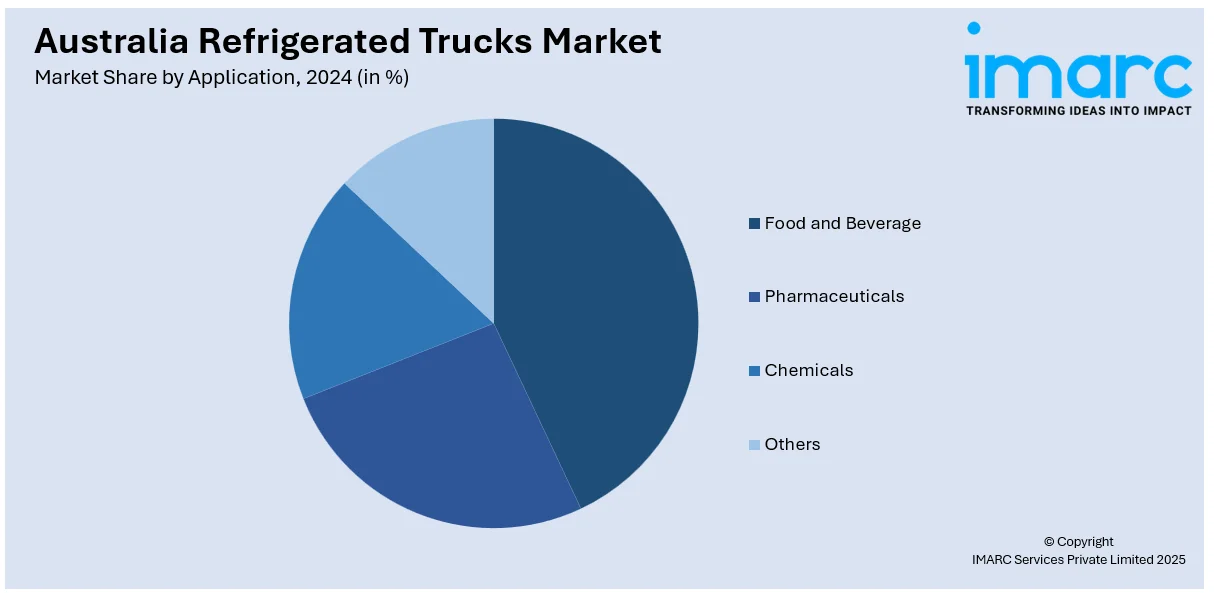

Application Insights:

- Food and Beverage

- Pharmaceuticals

- Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, pharmaceuticals, chemicals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Refrigerated Trucks Market News:

- In September 2024, Eurocold, a leader in refrigerated transport, is the sole Australian supplier of ISOKIT, the world’s most advanced isothermal system, offering unmatched thermal efficiency and fuel optimization. With over 60 years of experience, Eurocold provides tailored refrigerated truck solutions, including electric models like the Eurocold Revora EV. Their commitment to customer satisfaction and sustainability, through a six-step electrification process, ensures optimal temperature control and reliability for clients.

- In June 2024, Martin Brower Australia introduced its first electric delivery truck, an 8-pallet Volvo FL electric refrigerated truck, to its fleet. The truck will serve McDonald's restaurants in greater Sydney, delivering seven days a week. With zero tailpipe emissions, it reduces pollutants and noise, contributing to better air quality. This move is part of Martin Brower's broader sustainability efforts, targeting a 50% carbon emissions reduction by 2030 and net-zero emissions by 2050.

- In June 2024, Eurocold launched its Eurocold Revora EV range, marking a major step towards electrifying the Australian refrigerated transport industry. The range includes 2, 3, and 8-pallet electric trucks, along with a van model, featuring advanced electric refrigeration units from Carrier. Eurocold offers a turn-key solution with tracking software, charging stations, and ongoing support to help customers transition to zero-emission vehicles. The Revora EV range showcases Eurocold’s commitment to sustainability in the refrigerated transport sector.

Australia Refrigerated Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Commercial Vehicle, Medium Commercial Vehicle, Heavy Commercial Vehicle |

| Tonnage Capacities Covered | Less Than 10 Tons, 10-20 Tons, More Than 20 Tons |

| Applications Covered | Food and Beverage, Pharmaceuticals, Chemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia refrigerated trucks market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia refrigerated trucks market on the basis of type?

- What is the breakup of the Australia refrigerated trucks market on the basis of tonnage capacity?

- What is the breakup of the Australia refrigerated trucks market on the basis of application?

- What is the breakup of the Australia refrigerated trucks market on the basis of region?

- What are the various stages in the value chain of the Australia refrigerated trucks market?

- What are the key driving factors and challenges in the Australia refrigerated trucks?

- What is the structure of the Australia refrigerated trucks market and who are the key players?

- What is the degree of competition in the Australia refrigerated trucks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia refrigerated trucks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia refrigerated trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia refrigerated trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)