Australia Retort Pouches Market Size, Share, Trends and Forecast by Product Type, Capacity, Closure Type, Material Type, Application, and Region, 2026-2034

Australia Retort Pouches Market Summary:

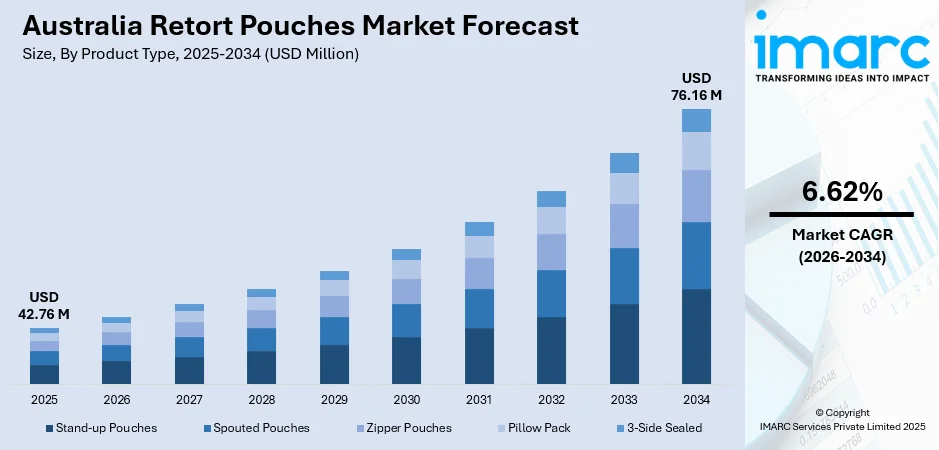

The Australia retort pouches market size was valued at USD 42.76 Million in 2025 and is projected to reach USD 76.16 Million by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

The Australia retort pouches market is expanding steadily, supported by rising demand for lightweight, shelf-stable, and convenient food packaging. Growth is driven by the shift toward ready-to-eat meals, improved packaging materials, and wider adoption across pet food, beverages, and processed foods. Manufacturers are focusing on product innovation, sustainability, and extended shelf life to meet evolving consumer expectations, strengthening the market’s outlook across retail and food service channels.

Key Takeaways and Insights:

- By Product Type: Stand-up pouches dominate the market with a share of 35% in 2025, driven by their superior shelf visibility, consumer-friendly design, and versatility across food and beverage applications in Australia.

- By Capacity: Medium leads the market with a share of 50% in 2025, reflecting consumer preference for portion-controlled packaging suitable for individual and family-sized ready meals.

- By Closure Type: Without cap represents the largest segment with a market share of 55% in 2025, owing to cost-effectiveness and widespread adoption in single-serve food packaging applications.

- By Material Type: Polypropylene exhibits a clear dominance with a market share of 30% in 2025, providing excellent heat resistance, flexibility, and recyclability aligned with Australia's sustainability targets.

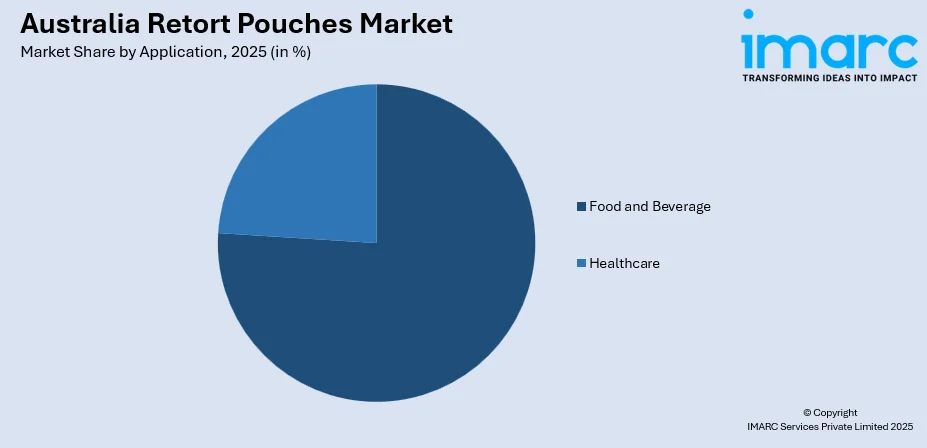

- By Application: Food and beverage holds the largest market share at 76% in 2025, driven by strong demand for convenient, shelf-stable packaging solutions across ready meals, soups, sauces, and pet food categories.

- Key Players: The Australia retort pouches market exhibits moderate competitive intensity, with multinational packaging corporations competing alongside regional manufacturers. Leading players are focusing on sustainable packaging innovations, mono-material solutions, and strategic partnerships to expand market presence and meet evolving consumer preferences for eco-friendly packaging formats.

To get more information on this market, Request Sample

The Australia retort pouches market is witnessing steady expansion as consumers increasingly prefer convenient, lightweight, and shelf-stable packaging solutions. Growing demand for ready-to-eat meals, processed foods, and single-serve formats continues to strengthen market adoption across retail and food service channels. In January 2025, HyFun Foods partnered with Woolworths to expand its premium frozen food offerings in Australia. This collaboration aims to elevate HyFun's products, including Indian snacks and hashbrowns, into mainstream retail. The move aligns with rising consumer demand for convenient, high-quality frozen meals. The shift toward flexible packaging, coupled with advancements in high-barrier films and heat-resistant materials, supports broader use in food, beverages, and pet food applications. Sustainability is increasingly important, prompting manufacturers to invest in recyclable and lower-plastic laminated materials to meet national packaging goals. Rising urbanization, busier lifestyles, and the need for efficient, space-saving packaging in logistics further accelerate uptake. Additionally, the rising focus on extended shelf life and product safety is encouraging companies to adopt retort pouches as a cost-effective alternative to rigid formats, reinforcing their long-term market potential.

Australia Retort Pouches Market Trends:

Preference for Ready-to-Eat Meals

Increasing consumer reliance on ready-to-eat meals is significantly driving the adoption of retort pouches. Busy lifestyles and rising demand for convenient, time-saving food formats make these pouches highly attractive due to their long shelf life, easy storage, and quick heating options. According to a report published by the Australian Bureau of Statistics (ABS), employment in October 2025 rose to 14,678,400, resulting in an employment-to-population ratio of 64.0%. Underemployment decreased to 5.8%, and the total monthly hours worked reached 1,993 million. Seasonally adjusted figures indicated an increase of 55,300 full-time jobs. As Australia's workforce continues to grow, so does the demand for quick and ready-to-eat (RTE) meals. The ability of retort pouches to maintain food quality without refrigeration further enhances market acceptance across various product categories.

Shift Toward Flexible Packaging

The transition from rigid containers to flexible, lightweight retort pouches is accelerating as brands seek to cut transportation costs and enhance portability. These pouches require less storage space, reduce material usage, and offer improved handling for both retailers and consumers. Their versatility also supports innovative product designs, helping manufacturers optimize shelf presence and streamline supply chain efficiency.

Focus on Sustainable Packaging

Sustainability is becoming a central trend, encouraging manufacturers to introduce recyclable, mono-material, and reduced-plastic retort pouch solutions. This shift aligns with national packaging targets and rising consumer expectations for environmentally responsible products. In December 2025, the Australian Packaging Covenant Organisation (APCO) launched its FY26-27 Business Plan, focusing on enhancing Australia’s packaging system amid regulatory changes. CEO Chris Foley emphasized the need for stronger Extended Producer Responsibility (EPR). The plan outlines a 36-month strategy across five areas to support industry-led initiatives and improve packaging stewardship.

Market Outlook 2026-2034:

The Australia retort pouches market outlook remains positive, supported by rising consumer demand for convenient, shelf-stable, and portable food packaging. Growth is expected as ready-to-eat meals, pet food, and processed food categories increasingly adopt flexible formats over rigid alternatives. Sustainability efforts, including recyclable and reduced-plastic pouches, will shape future innovations. Continued advancements in high-barrier materials and heat-resistant structures will further strengthen product safety and shelf life, positioning retort pouches for sustained expansion across retail and food service sectors. The market generated a revenue of USD 42.76 Million in 2025 and is projected to reach a revenue of USD 76.16 Million by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

Australia Retort Pouches Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Stand-up Pouches | 35% |

| Capacity | Medium | 50% |

| Closure Type | Without Cap | 55% |

| Material Type | Polypropylene | 30% |

| Application | Food and Beverage | 76% |

Product Type Insights:

- Stand-up Pouches

- Spouted Pouches

- Zipper Pouches

- Pillow Pack

- 3-Side Sealed

The stand-up pouches dominated the Australia retort pouches market with a 35% share in 2025.

Stand-up pouches hold the leading position in the Australia retort pouches market due to their superior shelf visibility, stability, and versatility across food, beverage, and pet food categories. Brands prefer this format because it enhances product presentation while providing strong barrier protection and extended shelf life. Their lightweight structure also supports efficient storage, transportation, and handling across retail channels.

Stand-up pouches continue to gain traction as manufacturers seek packaging that balances convenience and performance. Their compatibility with advanced printing technologies enables strong branding and premium appeal. The format also supports portion-controlled and family-size packaging, making it suitable for a wide range of ready-to-eat meals, sauces, and processed foods. This adaptability strengthens its position as a preferred choice for both manufacturers and consumers.

Capacity Insights:

- Low

- Medium

- High

The medium capacity retort pouches lead the Australia retort pouches market with a 50% share in 2025.

Medium-capacity retort pouches lead the market as they meet the needs of households seeking balanced portion sizes without excessive packaging. They are widely used for soups, curries, sauces, and pet food, offering a practical volume that supports meal preparation and storage convenience. Their size ensures efficient sterilization, maintaining safety and product integrity.

Manufacturers favor medium-capacity pouches because they optimize material usage, production efficiency, and logistics. They offer the right balance between consumer convenience and cost-effectiveness, making them suitable for both everyday retail products and premium packaged meals. Their popularity is further supported by the growing demand for ready-to-eat and family-oriented food categories.

Closure Type Insights:

- With Cap

- Without Cap

The without cap prevails the market with a share of 55% of the total Australia retort pouches market in 2025.

Pouches without caps dominate the market because they offer a simpler, cost-effective structure suitable for heat-sealed and single-use applications. Their design ensures strong sealing integrity, making them ideal for shelf-stable products that undergo high-temperature processing. The format reduces packaging complexity while maintaining durability and product freshness.

This closure type is widely preferred for processed foods, ready-to-eat meals, and products that do not require resealing. The absence of additional components enhances sustainability by minimizing material usage. Manufacturers also benefit from faster production speeds and lower packaging costs, strengthening adoption across high-volume product lines.

Material Type Insights:

- Polypropylene

- Aluminum Foil

- Polyester

- Nylon

- Paper and Paperboard

- Others

The polypropylene exhibits a clear dominance with a share of 30% of the total Australia retort pouches market in 2025.

Polypropylene is the leading material due to its excellent heat resistance, durability, and compatibility with high-temperature sterilization. It supports strong barrier properties, helping preserve flavors, textures, and nutritional value. Its clarity and printability also make it suitable for attractive, high-quality packaging designs.

The material’s lightweight nature improves transportation efficiency and reduces overall packaging waste. Polypropylene is highly effective in multilayer laminates, providing added strength without sacrificing flexibility. Its affordability, adaptability in processing, and consistent performance make it a preferred option for manufacturers looking for versatile solutions in retort pouches.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Food and Beverage

- Healthcare

The food and beverage segment represents the largest segment with a share of 76% of the total Australia retort pouches market in 2025.

The food and beverage sector remains the dominant application area, driven by rising demand for ready-to-eat meals, processed foods, and convenient packaging formats. The Australia food and beverage market size reached USD 154.2 Billion in 2025 and is projected to reach USD 223.3 Billion by 2034, supporting stronger adoption of efficient packaging. Retort pouches offer extended shelf life without refrigeration, making them ideal for curries, soups, sauces, snacks, and pet food, while enhancing convenience for at-home and on-the-go consumption.

Manufacturers in the food and beverage sector prefer retort pouches for their cost efficiency, material flexibility, and suitability for a wide range of products. The format accommodates multiple portion sizes, from single serve to family packs, aligning with evolving lifestyle and consumption trends. Strong graphic capabilities also enhance brand visibility and differentiation, helping products stand out in competitive retail environments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales see strong demand for retort pouches due to rising urban consumption, growing dependence on ready-to-eat meals, and increased retail activity. Consumers in this region prefer lightweight, convenient packaging options that support busy lifestyles.

Victoria and Tasmania show steady adoption of retort pouches as processed food production grows and sustainability awareness rises. Manufacturers in these states increasingly favor flexible packaging for better shelf appeal, reduced material usage, and greater logistics efficiency.

Queensland’s expanding food processing industry and active population contribute to higher use of retort pouches. Consumers prefer shelf-stable, portable meal options, encouraging brands to offer more flexible formats in snacks, sauces, and ready-to-eat categories.

Northern Territory and South Australia experience strong demand for retort pouches due to remote-area consumption needs. Long shelf life, durability, and efficient transport make these pouches suitable for regional distribution and everyday meal convenience.

Western Australia shows increasing adoption of retort pouches driven by mining workforce demand, growing urban consumption, and preference for travel-friendly packaging. Expanding retail networks and rising meal delivery usage further support market growth in the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Retort Pouches Market Growing?

Impact of Urbanization and Busier Lifestyles

Rising urbanization and increasingly hectic daily routines are significantly boosting demand for quick-meal solutions, making retort pouches a preferred packaging choice. As of December2025, Australia's population is 27,081,566, with an estimated mid-year figure of 26,974,026. Urban residents make up 86.51% of the population, totaling 23,335,357 individuals. Their long shelf life, lightweight structure, and easy storage cater well to consumers seeking convenient, ready-to-eat or heat-and-serve options. As more individuals shift toward smaller households and time-pressed lifestyles, the appeal of compact, portable, and low-maintenance packaged food continues to grow, strengthening the role of retort pouches in modern food consumption patterns across Australia.

Adoption of High-Barrier Materials

The growing use of high-barrier and heat-resistant materials is boosting the performance and reliability of retort pouches. These advanced laminates protect products from oxygen, moisture, and contaminants, helping maintain flavor, texture, and nutritional value over extended periods. Improved heat resistance supports high-temperature sterilization, enabling safe packaging of soups, curries, sauces, and pet food. This capability expands application potential and encourages manufacturers to transition from rigid packaging to flexible pouch-based formats.

Growth of E-commerce and Meal Delivery

The rapid expansion of e-commerce and meal delivery services is significantly boosting demand for durable, tamper-proof packaging such as retort pouches. The Australia e-commerce market was valued at USD 536.0 Billion in 2024 and is expected to reach USD 1,568.60 Billion by 2033, highlighting the scale of this shift. As online retail accelerates, lightweight pouches help reduce shipping costs while strong sealing integrity ensures product safety. Their ability to withstand pressure, temperature changes, and handling makes them ideal for long delivery cycles, supporting freshness and minimizing product damage.

Market Restraints:

What Challenges the Australia Retort Pouches Market is Facing?

High Production and Material Costs

High production and material costs remain a significant restraint, particularly for advanced multilayer laminates used in retort pouches. These structures require specialized films, heat-resistant materials, and sophisticated manufacturing processes, increasing overall cost. Smaller or cost-sensitive manufacturers often find these expenses difficult to absorb, limiting broader market adoption. The need for consistent quality and stringent performance standards further raises investment requirements in equipment and technology.

Recycling and Environmental Challenges

Recycling challenges associated with multi-material retort pouches act as a major barrier to market growth. Their layered composition, combining plastics, aluminum, and barrier films, makes separation and recycling difficult using conventional facilities. This reduces environmental compatibility and slows progress toward circular economy targets. As regulations tighten and sustainable expectations rise, manufacturers face pressure to redesign pouches while balancing performance, cost, and functional integrity.

Low Consumer Awareness of Disposal Practices

Limited consumer awareness regarding the correct disposal of retort pouches contributes to negative sustainability perceptions. Many users are unsure whether these pouches are recyclable or how they should be discarded, often resulting in contamination of recycling streams. This undermines environmental initiatives and creates hesitation among eco-conscious buyers. Lack of clear labeling and inconsistent regional recycling guidelines further complicate consumer understanding and slows the shift toward responsible pouch usage.

Competitive Landscape:

The competitive landscape of the Australia retort pouches market is characterized by steady innovation, sustainability-driven differentiation, and strong focus on functional performance. Market participants compete by enhancing material quality, improving barrier properties, and offering customizable designs tailored to diverse food, beverage, and pet food applications. Companies are investing in recyclable and mono-material solutions to align with national packaging targets, reinforcing their competitive positioning. Additionally, manufacturers prioritize cost efficiency, advanced printing technologies, and faster production capabilities to meet evolving client requirements. Collaboration with food processors and retailers further strengthens market presence and fosters long-term growth opportunities.

Recent Developments:

- In May 2025, Cheerpack Asia Pacific and Flavour Makers won the Gold Award in Sustainable Packaging Design and Silver in Food Packaging Design at the Australasian Packaging Innovation & Design Awards 2025 for their eco-friendly “Australian Organic Food Co. Vanilla Custard.”

Australia Retort Pouches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Stand-Up Pouches, Spouted Pouches, Zipper Pouches, Pillow Pack, 3-Side Sealed |

| Capacities Covered | Low, Medium, High |

| Closure Types Covered | With Cap, Without Cap |

| Material Types Covered | Polypropylene, Aluminum Foil, Polyester, Nylon, Paper and Paperboard, Others |

| Applications Covered | Food and Beverage, Healthcare |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia retort pouches market size was valued at USD 42.76 Million in 2025.

The Australia retort pouches market is expected to grow at a compound annual growth rate of 6.62% from 2026-2034 to reach USD 76.16 Million by 2034.

Stand-up pouches, holding the largest revenue share of 35%, lead the Australia retort pouches market due to their superior shelf visibility, consumer-friendly design, and versatility across food and beverage applications requiring extended shelf life.

Key factors driving the Australia retort pouches market include increasing demand for convenient ready-to-eat food packaging, sustainability regulations promoting recyclable materials, expanding applications in pet food and healthcare sectors, and growing consumer preference for lightweight packaging alternatives.

Major challenges include high costs of sustainable material alternatives, limited soft plastic recycling infrastructure, technical barriers in achieving barrier performance with recyclable mono-materials, and balancing environmental objectives with essential product protection requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)