Australia Robotics in Manufacturing Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

Australia Robotics in Manufacturing Market Overview:

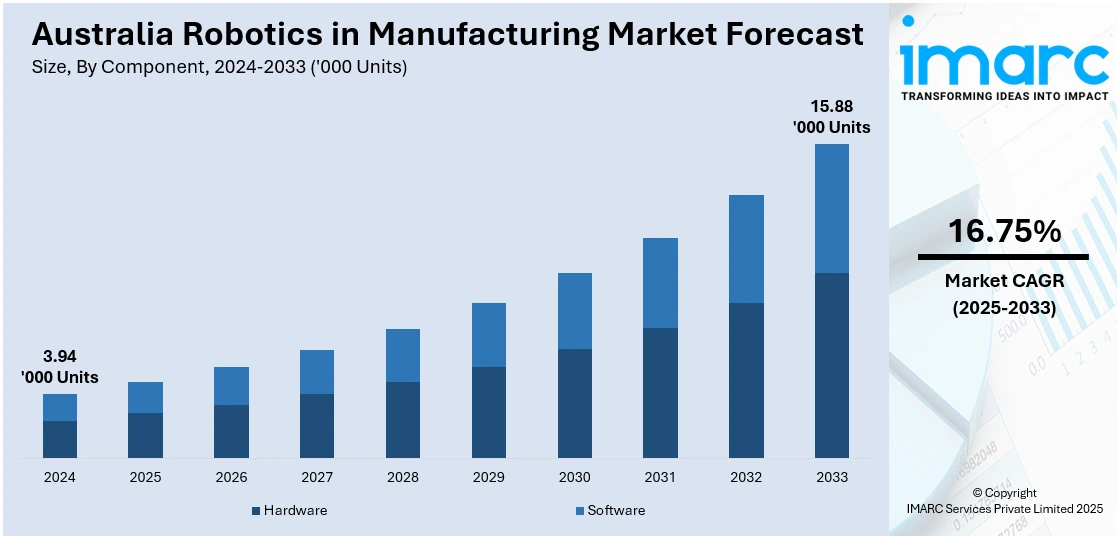

The Australia robotics in manufacturing market size reached 3.94 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 15.88 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 16.75% during 2025-2033. The market is driven by rising labor costs, demand for operational efficiency, and the need to enhance precision in production processes. Government support for advanced manufacturing technologies, increasing adoption of Industry 4.0 practices, and strong growth in automotive, food, and metal sectors are accelerating robot deployment. Additionally, advancements in AI and sensor technologies and the growing investments in automation are important factors augmenting Australia robotics in manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.94 Thousand Units |

| Market Forecast in 2033 | 15.88 Thousand Units |

| Market Growth Rate 2025-2033 | 16.75% |

Australia Robotics in Manufacturing Market Trends:

Surge in Collaborative Robots (Cobots) for SME-Driven Automation

Australia's manufacturing sector, particularly small and medium enterprises (SMEs), is increasingly adopting collaborative robots (cobots) to enable cost-effective automation without the complexity and capital burden of traditional industrial robots. Cobots are deployed in tasks such as material handling, packaging, assembly, and quality inspection, where human-robot interaction is essential. Their smaller footprint, lower upfront costs, and user-friendly programming interfaces are making them especially appealing in industries with constrained floor space and a limited technical workforce. According to industry reports, collaborative robots can enhance operational efficiency by up to 50% in the food and beverage industry. As a result, Australian SMEs, particularly in the food processing and packaging sectors, are increasingly adopting cobots to streamline production lines, reduce manual errors, and address labor shortages while maintaining consistent product quality. In addition to this, the implementation of government-backed initiatives like the Advanced Manufacturing Growth Centre (AMGC), which offers funding and advisory support to SMEs integrating automation. This is providing a boost to Australia robotics in manufacturing market growth. Additionally, with plug-and-play configurations and easier integration with legacy systems, cobots are accelerating automation diffusion across Australia's mid-tier manufacturers. The growing availability of domestic and Asia-Pacific vendors for cobots is also improving accessibility and serviceability, fostering broader market participation.

To get more information on this market, Request Sample

Integration of Artificial Intelligence and Machine Vision in Robotic Systems

The integration of robotics with artificial intelligence (AI) and machine vision is transforming the landscape of manufacturing in Australia. As manufacturers face growing demands for flexibility, precision, and speed, AI-powered robotics is emerging as a strategic enabler. According to the Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia's AI sector is projected to reach a valuation of USD 315 Billion by 2028, underscoring its growing importance across industries. Notably, 68% of Australian enterprises have already adopted AI-driven solutions within their operations. In the manufacturing sector, this trend is translating into the deployment of robotic systems equipped with machine learning algorithms, real-time data processing capabilities, and advanced sensor integration. These AI-enhanced robots can autonomously adapt to variable inputs, detect production anomalies, and optimize workflows with minimal human intervention. The application is especially pronounced in high-precision verticals such as electronics assembly, pharmaceuticals, and advanced metallurgy, where error tolerance is minimal, and output consistency is critical. For Australian manufacturers, such technology convergence not only increases productivity but also compensates for skill shortages and enhances global competitiveness. The expanding adoption of AI-infused robotics is poised to play a pivotal role in reshaping Australia's advanced manufacturing capabilities over the next decade.

Australia Robotics in Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Type Insights:

- Industrial Robots

- Collaborative Robots (Cobots)

- SCARA Robots

- Cartesian Robots

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes industrial robots, collaborative robots (Cobots), SCARA robots, and cartesian robots.

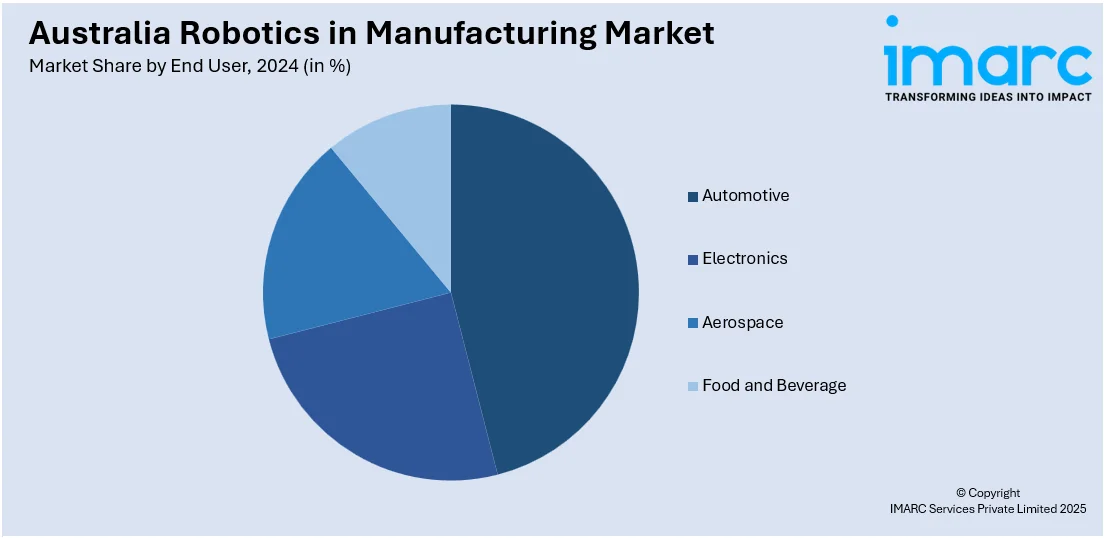

End User Insights:

- Automotive

- Electronics

- Aerospace

- Food and Beverage

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, electronics, aerospace, and food and beverage.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Robotics in Manufacturing Market News:

- On March 13, 2025, Vision AI, an Australian company specializing in robotics and machine vision, was appointed as ABB Robotics Australia's newest Authorized Value Provider (AVP). This partnership enables Vision AI to access ABB’s advanced tools, including RobotStudio®, and receive expert support to enhance their automation solutions. Notably, Vision AI has developed a precision-driven fruit grading and packing system utilizing ABB’s IRB 1200 and IRB 1300 industrial robots, addressing labor shortages and optimizing operations for clients.

Australia Robotics in Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Industrial Robots, Collaborative Robots (Cobots), SCARA Robots, Cartesian Robots |

| End Users Covered | Automotive, Electronics, Aerospace, Food and Beverage |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia robotics in manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia robotics in manufacturing market on the basis of component?

- What is the breakup of the Australia robotics in manufacturing market on the basis of type?

- What is the breakup of the Australia robotics in manufacturing market on the basis of end user?

- What is the breakup of the Australia robotics in manufacturing market on the basis of region?

- What are the various stages in the value chain of the Australia robotics in manufacturing market?

- What are the key driving factors and challenges in the Australia robotics in manufacturing market?

- What is the structure of the Australia robotics in manufacturing market and who are the key players?

- What is the degree of competition in the Australia robotics in manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia robotics in manufacturing market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia robotics in manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia robotics in manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)