Australia Rooftop Solar Market Size, Share, Trends and Forecast by Grid Type, End User, and Region, 2025-2033

Australia Rooftop Solar Market Size & Share:

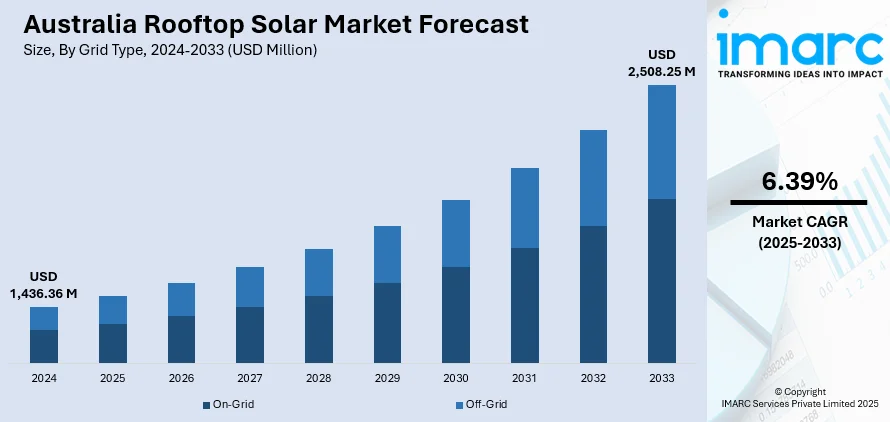

The Australia rooftop solar market size reached USD 1,436.36 Million in 2024. The market is projected to reach USD 2,508.25 Million by 2033, exhibiting a growth rate (CAGR) of 6.39% during 2025-2033. The market is propelled by strong policy support and the growing need for decentralized energy solutions. Government incentives and regulatory are making rooftop systems more affordable and attractive, encouraging long-term adoption. Additionally, grid limitations and rising energy demands are encouraging investment in advanced technologies that integrate rooftop solar into broader energy systems. Together, these factors are contributing to a steady rise in the Australia rooftop solar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,436.36 Million |

| Market Forecast in 2033 | USD 2,508.25 Million |

| Market Growth Rate 2025-2033 | 6.39% |

Key Trends in Australia Rooftop Solar Market:

Grid Constraints and Decentralized Energy Needs

With energy needs increasing in cities and grid reliability remains uneven in remote communities, rooftop solar provides a decentralized alternative to alleviate strain on the main network. Creating energy at the location of utilization minimizes transmission losses and alleviates peak load strain. To handle this transition successfully, utilities are putting money into cutting-edge grid technologies that enable real-time interaction between distributed energy sources and the primary grid. An important instance is the 2024 collaboration between Itron and Jemena, which launched a Low Voltage Distributed Energy Resource Management System (LV DERMS) in Australia. This system offered real-time information and remote-control features to align rooftop solar contributions with grid requirements, guaranteeing stability and efficiency. Such initiatives indicate a wider trend among energy suppliers to view rooftop solar not merely as a user product but as an essential part of grid infrastructure. These solutions are essential for managing power quality variations and preventing voltage spikes associated with increased solar integration. With the ongoing rise in decentralized solar use, systems such as LV DERMS are becoming crucial for incorporating distributed generation while maintaining reliability, emphasizing the role of rooftop solar in enhancing both household finances and national energy security.

To get more information on this market, Request Sample

Policy Backing and State-Level Incentives

The Australia rooftop solar market growth is tied to steady policy commitments at both federal and state levels, which is making solar systems financially viable and widely accessible. Programs like the small-scale renewable energy scheme (SRES), along with state-specific rebates, net metering rules, and favorable feed-in tariffs, have collectively shortened payback periods and enhanced return on investment for individuals. These measures not only incentivize system installation but also promote long-term engagement in distributed energy generation and trading. Importantly, government targets and clear renewable energy timelines provide a sense of stability that boosts user and installer confidence. For instance, in 2024, the state of Victoria launched a roadmap aiming to install 7.6 GW of solar by 2035, including 6.3 GW rooftop, 1.2 GW distributed, and 3 GW utility-scale solar. This program directly aided the state's wider objective of 95% renewable energy by 2035 and a net-zero aim for 2045, further aligning rooftop usage with climate responsibilities. By intentionally integrating rooftop capacity into its strategic planning, Victoria strengthened the importance of residential and small-scale commercial solar in reaching statewide decarbonization goals. These specific policies illustrate that rooftop solar is now considered not just an additional energy resource but a fundamental component of Australia's transition approach. These organized and future-oriented incentives maintain ongoing market momentum, particularly as other subsidies start to decline, and establish rooftop solar as a lasting solution integrated into national and subnational climate strategies.

High Residential Adoption

Australia has become a world leader in rooftop solar adoption at the domestic level. A large proportion of suburban and regional homes now boast solar panels, a testament to strong consumer demand to reduce electricity bills and be less dependent on the grid. The high take-up is driven by plenty of sunlight, increasing power prices, and favorable policies. Solar power systems are no longer a rare sight on rooftops, neither in large cities nor in small towns. From a trend of early adopters to mainstream homeowners, the installations have become a routine part of home upgrades or home renovations. The long-term energy savings, coupled with increasing environmental concern, continue to fuel installations. As installation procedures grow more efficient and solar systems more powerful, homeowner demand is far from abating. According to Australia rooftop solar market analysis, residential uptake is expected to remain strong, with continued growth supported by cost reductions, improved technology, and expanding consumer awareness of the financial and environmental benefits.

Growth Drivers in Australia Rooftop Solar Market:

Rising Electricity Prices

Electricity prices have steadily increased across Australia, placing a growing financial burden on households and small businesses. In response, many are choosing rooftop solar systems as a long-term cost-control measure. Solar power allows users to generate a portion of their energy needs on-site, reducing their dependence on the grid and lowering electricity bills. Time-of-use tariffs and rising peak charges have further incentivized self-generation. For many consumers, the savings from solar outweigh the upfront investment within a few years. This economic motivation continues to be one of the most powerful drivers of solar adoption, especially as inflation and global energy market volatility push power prices higher. The ability to cut ongoing expenses makes rooftop solar a practical choice for energy-conscious property owners.

Environmental Awareness

Public concern over climate change and environmental sustainability is pushing more Australians toward clean energy solutions. Rooftop solar is viewed as a simple, visible way to reduce household or business carbon emissions. As awareness grows about the environmental impact of fossil fuel-based electricity, many consumers are choosing solar to align their energy use with their values. The visibility of solar panels also promotes social proof within communities, further encouraging adoption. Schools, local councils, and community groups are also playing a role in promoting solar as part of broader climate goals. With increased media coverage and education around energy sustainability, solar adoption has become part of a wider cultural shift toward responsible consumption and environmental accountability. This growing environmental consciousness continues to drive consistent Australia rooftop solar market demand, as more households and institutions adopt solar as a practical step toward long-term sustainability.

Technological Advancements

Ongoing technology improvements have resulted in rooftop systems that are more efficient, longer-lasting, and easier to use. Solar panels today produce more energy per square meter, using less roof space to achieve the same output. Smart inverters allow for greater monitoring of energy, remote diagnostics, and connection with battery storage. Most systems today include mobile apps, enabling users to monitor generation and use in real time. Battery technology, although still in development, has improved to be more reliable and cost-effective, leading people to charge power generated during the day for use during the night or for grid outages. Such improvements enhance the solar selling proposition and enhance the overall return on investment. As technology advances, roof-top systems become more mainstream and scalable to more properties.

Australia Rooftop Solar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on grid type and end user.

Grid Type Insights:

- On-Grid

- Off-Grid

The report has provided a detailed breakup and analysis of the market based on the grid type. This includes on-grid and off-grid.

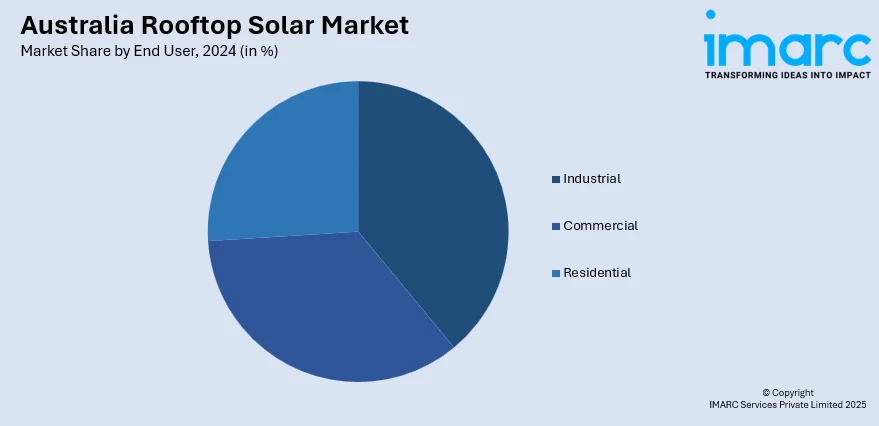

End User Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Rooftop Solar Market News:

- In February 2025, Aiko launched its new 480 W Neostar 2P rooftop solar panels in Australia, boasting a record 24.3% efficiency for residential PV modules. The boost is credited to Aiko’s n-type all-back-contact (ABC) cell technology without increasing panel size. Initial shipments are expected to arrive in Australia by March 2025.

- In February 2025, the Australian Government launched a $25 million “Solar for Apartment Residents” program to help apartment buildings in NSW install shared rooftop solar systems. The initiative covers up to 50% of installation costs, aiming to cut residents' energy bills by up to $600 annually.

Australia Rooftop Solar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grid Types Covered | On-Grid, Off-Grid |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia rooftop solar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia rooftop solar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia rooftop solar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rooftop solar market in the Australia was valued at USD 1,436.36 Million in 2024.

The Australia rooftop solar market is projected to exhibit a compound annual growth rate (CAGR) of 6.39% during 2025-2033.

The Australia rooftop solar market is expected to reach a value of USD 2,508.25 Million by 2033.

Widespread residential adoption, integration of battery storage, rise of virtual power plants, and growth in average system size are notable trends. Smart inverter requirements increased self-consumption focus, and growing participation from schools, businesses, and community groups are also shaping the market’s development.

Key drivers include rising electricity prices, falling solar technology costs, abundant sunlight, and strong government incentives. Increased environmental awareness, desire for energy independence, and advancements in battery storage and smart energy management systems continue to fuel steady adoption across households and businesses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)