Australia Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Australia Running Gear Market Overview:

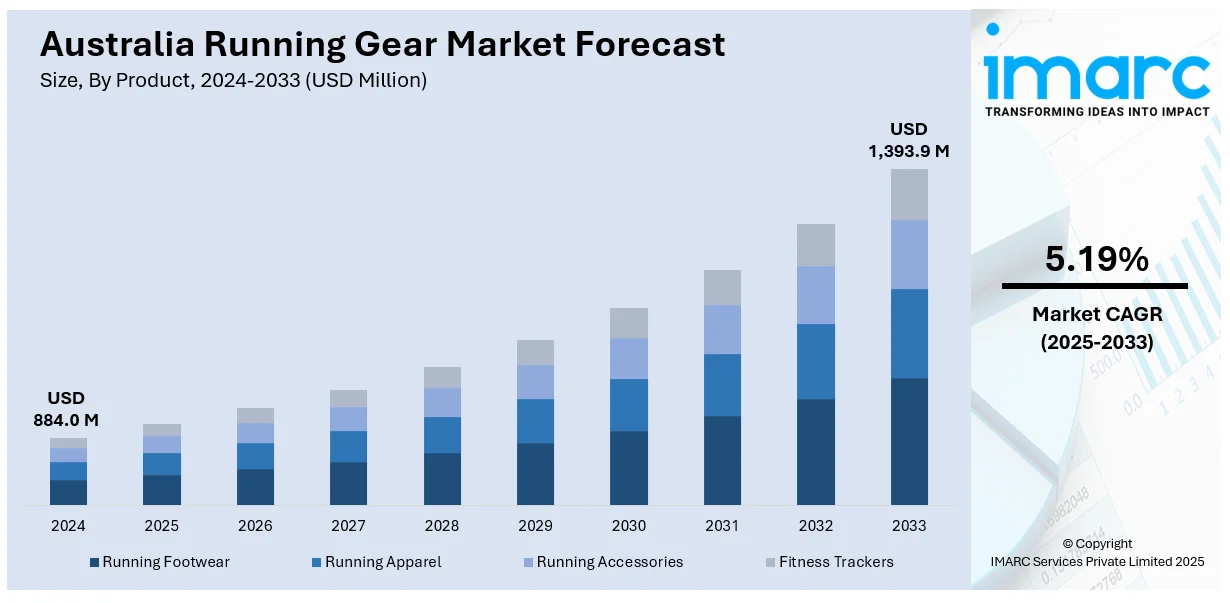

The Australia running gear market size reached USD 884.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,393.9 Million by 2033, exhibiting a growth rate (CAGR) of 5.19% during 2025-2033. The Australia running gear market share is expanding due to the growing health consciousness, rising participation in fitness activities, increased demand for stylish and performance-oriented gear, expanding e-commerce platforms, strong brand promotions, and technological advancements in smart wearables and athletic apparel.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 884.0 Million |

| Market Forecast in 2033 | USD 1,393.9 Million |

| Market Growth Rate 2025-2033 | 5.19% |

Australia Running Gear Market Trends:

Increase in Health Consciousness Driving Demand for Smart Running Gear

Australia's rising awareness around health, wellness, and fitness is significantly impacting the running gear market, especially in the post-pandemic era. As Australians increasingly prioritize physical activity and outdoor sports, there's a marked shift toward advanced and functional running equipment. Smart fitness trackers, moisture-wicking apparel, and performance-enhancing footwear are gaining traction. The millennial and Gen Z demographic is fueling this trend, with a growing preference for tech-integrated products like GPS-enabled watches and heart-rate monitors, which is fostering Australia running gears market growth. Major urban marathons and community running events are also driving demand for high-performance gear. Additionally, rising disposable incomes and influencer-driven marketing are encouraging more frequent purchases. This trend reflects not just a lifestyle shift, but also a new perception of running gear as a hybrid of fashion, utility, and technology.

To get more information on this market, Request Sample

E-commerce and Athleisure Boom Fueling Market Expansion

The rapid digitization of retail and the growing popularity of athleisure wear are transforming the dynamics of the Australian running gear market. For instance, Lorna Jane's profit for the fiscal year that ended on June 30 nearly doubled to USD 21.3 Million from USD 11.6 Million the year before. Revenue increased slightly from USD 198.3 Million to USD 199.6 Million over the previous year. After leaving the US market, the company now only has 98 stores in Australia, down from a peak of 144 domestic sites and 35 in the US. Online platforms now account for a sizable portion of gear sales, offering consumers greater convenience, variety, and competitive pricing. Brands are leveraging digital channels to launch exclusive collections, run targeted ads, and offer AI-based size guides to improve customer experience. Simultaneously, the blurred lines between athletic and casual wear have given rise to fashion-forward running apparel, embraced widely by both fitness enthusiasts and everyday consumers, which in turn is positively impacting Australia running gears market outlook. As work-from-home culture persists, versatile running wear that can double as casual outfits has become particularly desirable. The synergy of e-commerce and fashion-driven athletic wear is not only expanding market reach but also encouraging more frequent consumer purchases, contributing to sustained market growth across both metropolitan and regional parts of Australia.

Australia Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness tracker.

Gender Insights:

- Male

- Female

- Unisex

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male, female, and unisex.

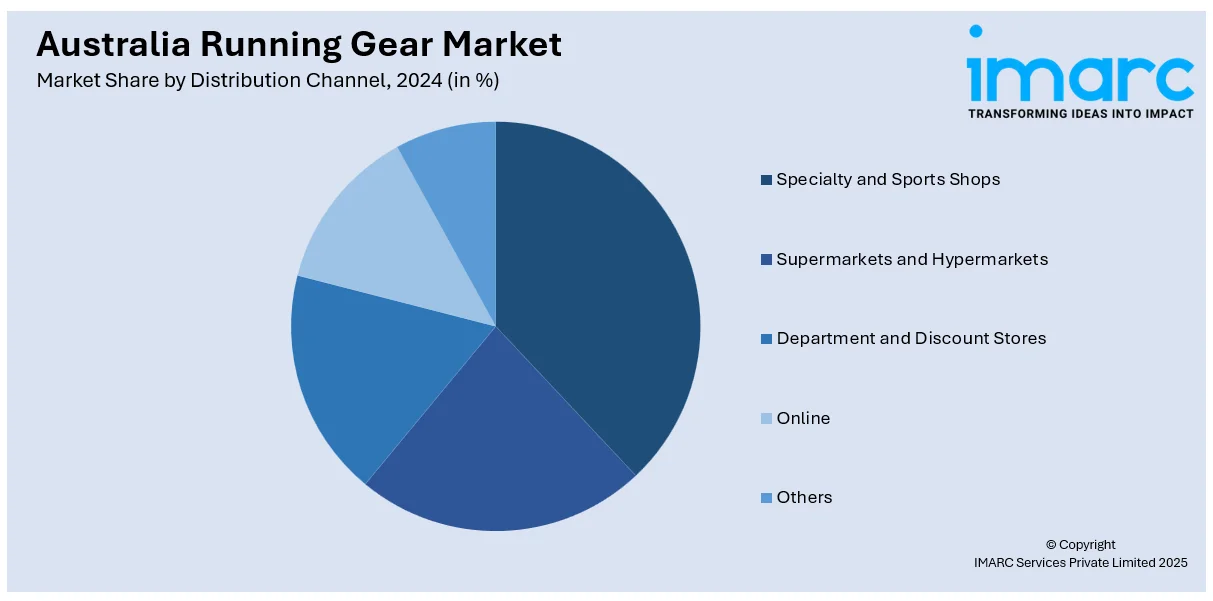

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Tracker |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia running gear market on the basis of product?

- What is the breakup of the Australia running gear market on the basis of gender?

- What is the breakup of the Australia running gear market on the basis of distribution channel?

- What is the breakup of the Australia running gear market on the basis of region?

- What are the various stages in the value chain of the Australia running gear market?

- What are the key driving factors and challenges in the Australia running gear?

- What is the structure of the Australia running gear market and who are the key players?

- What is the degree of competition in the Australia running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)