Australia School Market Size, Share, Trends and Forecast by Education, Ownership, Affiliation, Fee Structure, and Region, 2025-2033

Australia School Market Overview:

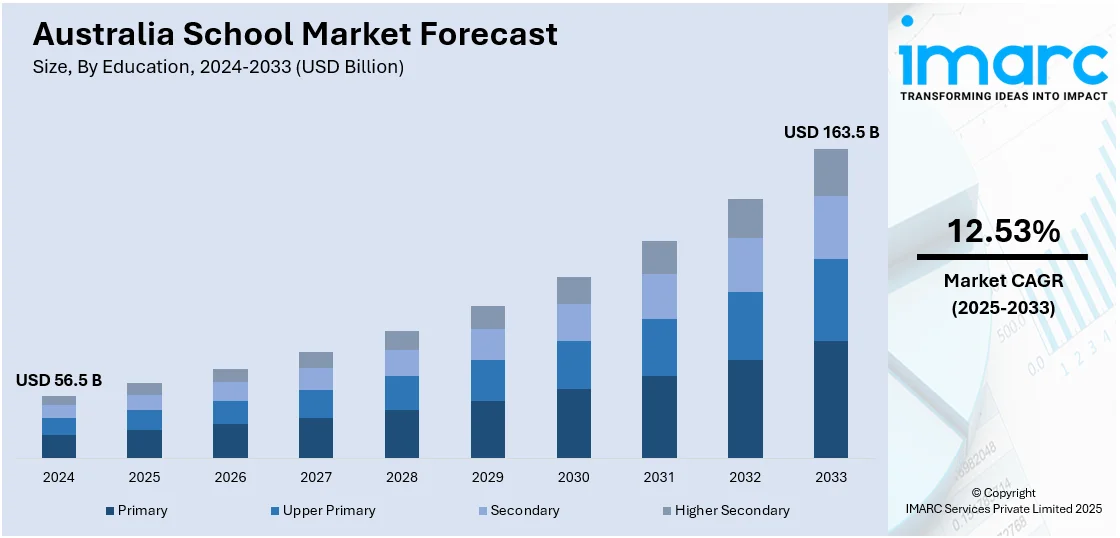

The Australia school market size reached USD 56.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 163.5 Billion by 2033, exhibiting a growth rate (CAGR) of 12.53% during 2025-2033. The market is fueled by the incorporation of digital learning, emphasis on the whole child in education, and growing inclusiveness, fueled by government actions such as AI inclusion and enhanced access to broadband connections, creating the potential for high growth into the future.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.5 Billion |

| Market Forecast in 2033 | USD 163.5 Billion |

| Market Growth Rate 2025-2033 | 12.53% |

Australia School Market Trends:

Focus on Integration of Digital Learning

Australia's education system is in the process of implementing a strategic change towards digital incorporation at all learning levels. With more emphasis placed on technology-enhanced and student-centered learning, schools are turning to digital devices to improve students' engagement levels and academic achievement. Interactive sites, artificial intelligence (AI) driven learning assistants, and virtual classrooms are increasingly becoming integral parts of teaching. According to the reports, in November 2023, the Australian Framework for Generative Artificial Intelligence in Schools was published by the Australian Department of Education to support ethical and responsible application of generative AI in education. Moreover, this trend also conforms to the national digital literacy framework, which gives top priority to coding competency, data interpretation, and safe internet usage from primary years onwards. Not only are institutions improving infrastructure, but they are also investing in teachers' upskilling to seamlessly integrate digital content into conventional curricula. Australia school market outlook is bright with the ongoing rapid adoption of digital resources facilitating blended and hybrid learning models to suit changing student requirements. This change is part of a wider initiative to ready students for careers in a digitally fueled global economy.

To get more information on this market, Request Sample

Growing Demand for Holistic Education

Australian schools are increasingly becoming focused on imparting holistic education that develops not only academic acumen but also emotional intelligence. Curriculums increasingly include life skills like critical thinking, teamwork, personal finance, and mindfulness. As per the reports, in August 2024, the Australian Government reinforced its commitment to STEM education by committing funds for school and early learning programs across Australia, including teaching aids in AI, lending libraries of digital devices, and national curriculum-based professional development courses. Furthermore, co-curricular and extracurricular activities like sports, music, and volunteer work are becoming more emphasized as a means to promote balanced growth. Education policies facilitate the inclusion of mental health education and resilience programs, with trained professionals on school campuses. Environmental education and sustainability awareness are also integrated across the curriculum, encouraging responsible citizenship from a young age. Parents and teachers are coming together to develop student-centered learning environments that promote social-emotional development and ethical values. Australia school market share of institutions offering such well-rounded educational experiences is progressively on the rise, indicating a cultural transformation in the definition of academic success. This holistic strategy is fortifying the pillar for young Australians to excel in academic as well as life aspects.

Shift Toward Inclusive and Diverse Schooling

Over the past few years, diversity and inclusivity have been at the forefront of the transformation of Australia's education system. Educational policy now requires the adoption of inclusive practices to cater to students with diverse linguistic, cultural, and socio-economic backgrounds. Schools are modifying classrooms and instructional strategies to include students with special educational needs and disabilities through differentiated instruction and assistive technologies. In addition, greater representation of Indigenous views and multicultural education has made the curriculum more relevant and equitable. Teacher education now puts a priority on cultural competence, and school settings are consciously made safe, respectful, and discrimination-free. All these aim toward Australia's wider social inclusion, promoting equal access and opportunities for everyone. The consequent improvement in enrolment and retention rates across different student groups reflects positive progress. Australia school market growth mirrors this impartial trend, with policy initiative and societal norms collectively propelling fair learning experience across public and private schools.

Australia School Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on education, ownership, affiliation, and fee structure.

Education Insights:

- Primary

- Upper Primary

- Secondary

- Higher Secondary

The report has provided a detailed breakup and analysis of the market based on the education. This includes primary, upper primary, secondary, and higher secondary.

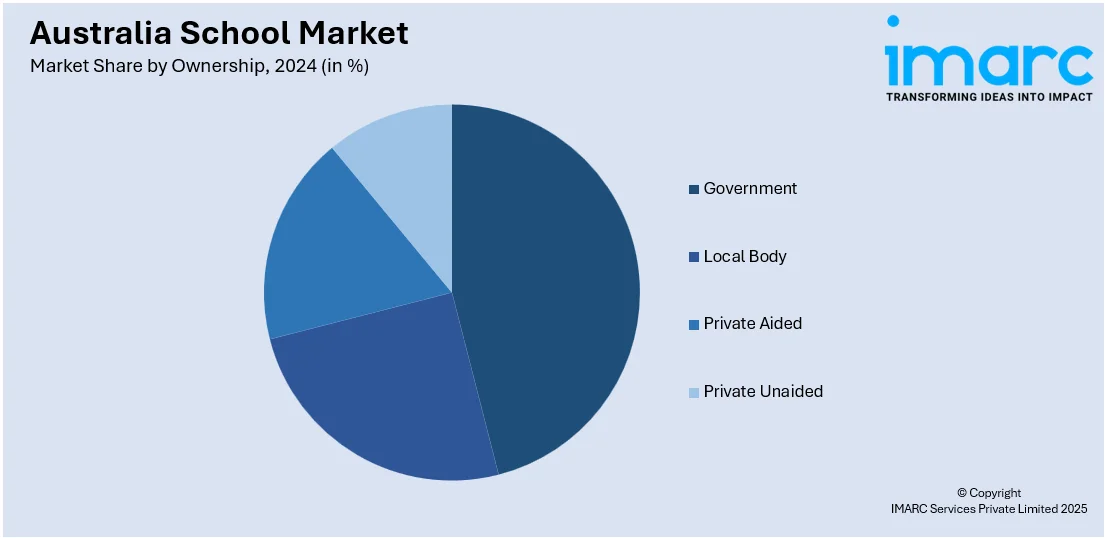

Ownership Insights:

- Government

- Local Body

- Private Aided

- Private Unaided

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes government, local body, private aided, and private unaided.

Affiliation Insights:

- Central Board of Secondary Education (CBSE)

- Council for the Indian School Certificate Examinations (CISCE)

- State Government Boards

- Others

The report has provided a detailed breakup and analysis of the market based on the affiliation. This includes central board of secondary education (CBSE), council for the Indian school certificate examinations (CISCE), state government boards, and others.

Fee Structure Insights:

- Low-Income

- Medium-Income

- High-Income

A detailed breakup and analysis of the market based on the fee structure have also been provided in the report. This includes low-income, medium-income, and high-income.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia School Market News:

- In April 2024, Spark Education opened its first offline school in Melbourne, Australia, extending its international reach in STEM education. The school provides Spark Math and Spark Chinese programs, with further programs to be introduced. This achievement complements Spark's licensing partnerships and increases face-to-face learning opportunities in the region.

- In February 2024, the Department of Education in New South Wales launched a pilot of NSWEduChat, a specially designed AI tool aligned with state curriculum. Intended to promote critical thinking, the system supports students through learning exercises without offering direct responses and provides teaching assistance to educators in the form of customized content creation.

Australia School Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Educations Covered | Primary, Upper Primary, Secondary, Higher Secondary |

| Ownerships Covered | Government, Local Body, Private Aided, Private Unaided |

| Affiliations Covered | Central Board of Secondary Education (CBSE), Council for the Indian School Certificate Examinations (CISCE), State Government Boards, Others |

| Fee Structures Covered | Low-Income, Medium-Income, High-Income |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia school market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia school market on the basis of education?

- What is the breakup of the Australia school market on the basis of ownership?

- What is the breakup of the Australia school market on the basis of affiliation?

- What is the breakup of the Australia school market on the basis of fee structure?

- What is the breakup of the Australia school market on the basis of region?

- What are the various stages in the value chain of the Australia school market?

- What are the key driving factors and challenges in the Australia school?

- What is the structure of the Australia school market and who are the key players?

- What is the degree of competition in the Australia school market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia school market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia school market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia school industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)