Australia Security as a Service Market Size, Share, Trends and Forecast by Component, Organization Size, Application, Vertical, and Region, 2025-2033

Australia Security as a Service Market Overview:

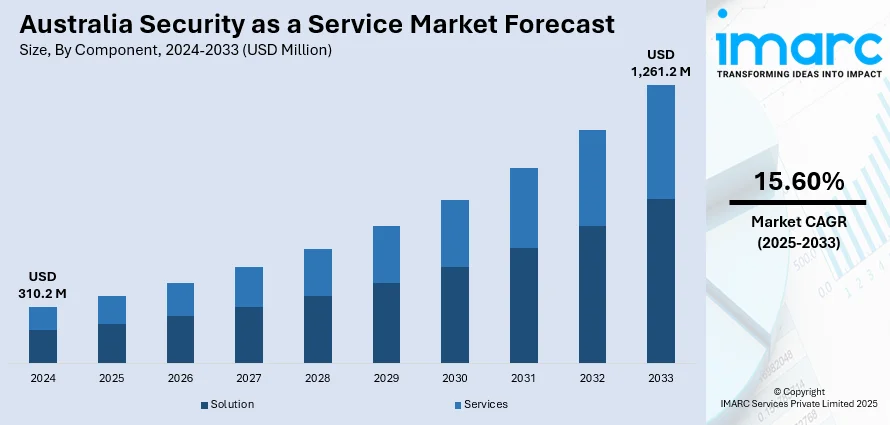

The Australia security as a service market size reached USD 310.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,261.2 Million by 2033, exhibiting a growth rate (CAGR) of 15.60% during 2025-2033. The increasing frequency of cyberattacks, growing regulatory pressures for data protection, and the rising adoption of cloud-based services across industries are leading to high market demand. Additionally, the need for cost-effective security solutions, the expansion of remote work environments, and continual advancements in threat detection technologies are some of the major factors augmenting Australia security as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 310.2 Million |

| Market Forecast in 2033 | USD 1,261.2 Million |

| Market Growth Rate 2025-2033 | 15.60% |

Australia Security as a Service Market Trends:

Rising Demand for Managed Detection and Response (MDR) Services

The market is experiencing significant growth, particularly in the demand for managed detection and response (MDR) services. This surge is largely driven by the increasing frequency and sophistication of cyber threats targeting mid-sized and large enterprises across the region. Organizations are now confronted with more advanced attacks, such as ransomware, credential theft, and advanced persistent threats, requiring robust and proactive security measures, which is supporting Australia as a service market growth. MDR services offer quick response times and continual monitoring to lessen the effects of these hazards. Industry reports highlight that in 2023-2024, the major three self-reported cybercrime types affecting businesses in Australia included online banking fraud (13%), email compromise (20%), and business email compromise fraud (13%). These figures underscore the growing need for effective cybersecurity strategies, as businesses are increasingly vulnerable to a range of cybercrimes. As a result, Australian enterprises are increasingly turning to MDR solutions to ensure real-time threat detection and rapid incident response, aligning with global trends in cyber threat mitigation. Additionally, regulatory requirements under frameworks such as the Australian Privacy Act and the Essential Eight maturity model are pushing businesses to demonstrate proactive threat management, strengthening the case for MDR adoption. The combination of evolving threat landscapes, compliance obligations, and operational cost pressures is making MDR a critical element in the market portfolio.

To get more information on this market, Request Sample

Increasing Adoption of Identity and Access Management (IAM)

Identity and access management (IAM) is emerging as a significant trend in the market, driven by the widespread adoption of hybrid and remote work models. According to industry reports, approximately 14% of workers in Australia work from home full-time, while 53% of workers work remotely at least occasionally. Furthermore, 69% of firms provide hybrid work arrangements, reflecting a significant shift in workplace dynamics. With employees accessing critical enterprise systems from various locations and devices, organizations are increasingly prioritizing secure, flexible, and scalable IAM solutions to safeguard sensitive information. IAM enables organizations to implement robust authentication, role-based access control, and user lifecycle management without the complexity of managing on-premises infrastructure. The growing integration of IAM with Zero Trust security frameworks is reinforcing its adoption, as Australian businesses aim to ensure that every user and device is authenticated and authorized before granting access. Apart from this, cloud-native IAM offerings are also gaining traction, especially among small and medium-sized enterprises, due to ease of deployment, automatic updates, and lower upfront costs. Furthermore, the increasing use of multi-cloud environments in Australia is creating a need for centralized identity management across platforms, further strengthening demand for IAM in the security as a service market in Australia.

Australia Security as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, organization size, application, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises, and large enterprises.

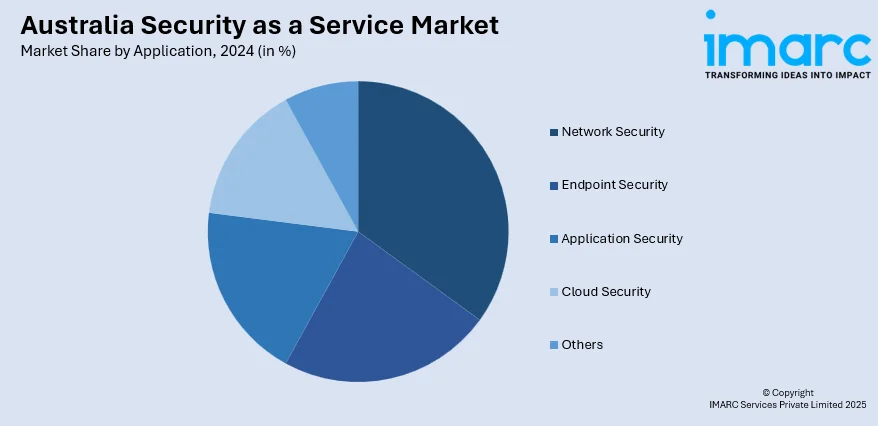

Application Insights:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes network security, endpoint security, application security, cloud security, and others.

Vertical Insights:

- BFSI

- Government and Defense

- Retail and E-Commerce

- Healthcare and Life Sciences

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, retail and e-commerce, healthcare and life sciences, IT and telecom, energy and utilities, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Security as a Service Market News:

- On November 25, 2024, Thales Australia announced the launch of new cyber security services aimed at strengthening the digital resilience of Australian businesses and government agencies. The services include advanced threat detection, incident response, and risk management solutions tailored to local needs. This expansion aligns with Thales’ commitment to enhancing Australia’s sovereign cyber capabilities and supporting national security objectives.

Australia Security as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | BFSI, Government and Defense, Retail and E-Commerce, Healthcare and Life Sciences, IT and Telecom, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia security as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia security as a service market on the basis of component?

- What is the breakup of the Australia security as a service market on the basis of organization size?

- What is the breakup of the Australia security as a service market on the basis of application?

- What is the breakup of the Australia security as a service market on the basis of vertical?

- What is the breakup of the Australia security as a service market on the basis of region?

- What are the various stages in the value chain of the Australia security as a service market?

- What are the key driving factors and challenges in the Australia security as a service market?

- What is the structure of the Australia security as a service market and who are the key players?

- What is the degree of competition in the Australia security as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia security as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia security as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia security as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)