Australia Semiconductor Market Size, Share, Trends and Forecast by Components, Material Used, End User, and Region, 2026-2034

Australia Semiconductor Market Overview:

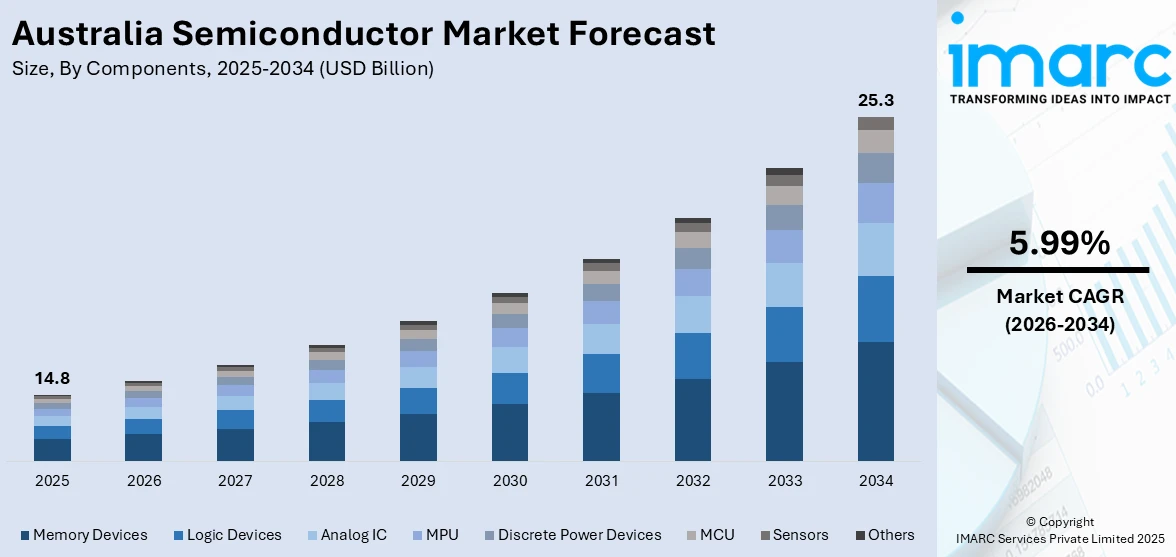

The Australia semiconductor market size reached USD 14.8 Billion in 2025. Looking forward, the market is expected to reach USD 25.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.99% during 2026-2034. The market is being driven by strong government incentives, increased research and development (R&D) investments, a skilled STEM workforce, rising demand for consumer electronics and the internet of things (IoT) devices, and strategic efforts to enhance local manufacturing and further integrate the country with global supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.8 Billion |

| Market Forecast in 2034 | USD 25.3 Billion |

| Market Growth Rate 2026-2034 | 5.99% |

Key Trends of Australia Semiconductor Market:

Government-Driven Expansion of Domestic Manufacturing Infrastructure

Over the past two years, Australia has made significant strides toward building a resilient, sovereign semiconductor ecosystem through strategic investments and partnerships. The Department of Industry, Science, and Resources has launched the National Semiconductor Manufacturing Hub, a public-private initiative to establish pilot fabrication facilities at top universities and industry sites, aiming to reduce import dependence and enhance supply-chain resilience. In October 2023, the Australian National Fabrication Facility received AUD 47.4 million under the National Collaborative Research Infrastructure Strategy to support semiconductor device R&D with advanced cleanrooms and precision equipment. Further backing came in February 2024, with over AUD 51 million allocated through the Cooperative Research Centers Projects (CRC-P) program for twenty-one R&D projects across compound semiconductors, advanced packaging, and quantum devices. These initiatives lay the foundation for Australia's transition from semiconductor importer to manufacturer. With pilot operations set for late 2025 and full-scale commercialization by 2027, Australia aims to double its onshore manufacturing capacity, reduce import reliance, and foster growth across defense, telecommunications, and industrial electronics sectors.

To get more information on this market Request Sample

Rapid Rise of Quantum Semiconductor Technologies and Private Sector Innovation

Australia is rapidly emerging as a global leader in quantum semiconductor research and commercialization, underscored by significant government and private sector investments. In July 2024, the federal government allocated AUD 180 million in the first round of the Economic Accelerator grants to boost quantum technologies, marking them as a national priority. Further strengthening this momentum, on April 30, 2024, the Commonwealth, supported by the Queensland Government, committed AUD 466.4 million to PsiQuantum for the construction of a world-first utility-scale fault-tolerant silicon quantum computer facility in Brisbane. This initiative is expected to create hundreds of jobs and attract billions in downstream investments. Private investment is also booming, with Q-CTRL securing USD 75 million and photonics startup Diraq raising USD 120 million in early 2024. These developments are fostering collaboration across universities, the National Fabrication Facility, and global tech firms, with over thirty companies now engaged in pilot projects. Australia's quantum advancements are not only transforming R&D into tangible devices yet are also creating synergies in cryogenic control electronics, secure communications, and photonic interconnects, enhancing both commercial and defense tech markets, while also contributing to the increasing Australia semiconductor market share.

Growth Drivers of Australia Semiconductor Market:

Strategic Government Support and Policy Initiatives

In Australia, among the most significant impetuses to semiconductor market growth has been proactive and visionary support from state and federal governments. Such strategic intervention involves the establishment of encouraging policy environments that attract both overseas investment and home country innovation. For example, incentives like research grants, technology infrastructure tax relief, and funded matches for semiconductor pilot projects have strengthened company confidence to create local design and test capacities. In addition to pure fiscal incentives, the Australian government has also placed emphasis on semiconductor-related skills through university-industry cooperation, scholarships, and training programs designed to foster design, fabrication, and packaging talent, respectively, and specifically for the semiconductor industry. These policies have resulted in a virtuous cycle, as local talent increases, so does the attractiveness for international semiconductor companies to invest, partner, and localize key parts of their supply chain in Australia's advanced innovation environment.

Asia-Pacific Tech Ecosystem Proximity and Supply Chain Resilience

According to the Australia semiconductor market analysis, the region’s geographical location and robust economic connections in the Asia-Pacific region offer a distinct advantage in developing markets for semiconductors. In contrast to areas burdened with lengthy lead times or single‑source risk, Australia has the luxury of proximity to prominent semiconductor production centers like Taiwan, South Korea, and Singapore, without being excessively vulnerable to the risks of any one region. This enables Australia to establish itself as a hardy backup node in design as well as assembly segments. Further, Australia uses its strong legal system, stable political climate, and high‑quality infrastructure, specifically in sections of New South Wales and Victoria—to entice semiconductor companies looking to diversify their supplier bases. This local connectivity, married with Australia's reliability reputation, creates an environment where smaller semiconductor design houses, domestic foundry partnerships, and international companies can co‑innovate. Access to local talent and logistics networks without significant exposure to geopolitical and logistics chokepoints enhances growth in the Australian semiconductor industry.

nnovation Culture Anchored by Cross‑Sector Applications

The unique focus on niche innovation facilitated by cross-industry collaboration that differentiates the Australia semiconductor market demand. Australia has developed a culture of bridging semiconductor technologies and its successful aerospace, defense, mining, healthcare, and even agricultural industries. Aboriginal requirements, like ruggedized electronics for far‑flung mining developments or high‑precision sensors for environmental monitoring in Australia's enormous outback and coastal zones, have driven custom semiconductor design and microfabrication strategies especially suited to local environments. Furthermore, the country's increasing emphasis on clean‑energy, clean‑tech, and quantum computing has continued to drive efforts into low‑power, highly efficient chip architectures well suited to Australia's energy‑savvy goals and scientific research centers. University spin‑offs often collaborate closely with industry‑focused users, generating differentiated semiconductor IP that, although specific to local requirements, also possesses global appeal. This convergence of industry use‑cases with local R&D results in a unique bottom‑up innovation driver, that fuels local market expansion while creating exportable knowledge and innovative technology blueprints.

Opportunities of Australia Semiconductor Market:

Growth of Local Design Hubs and Indigenous Innovation

Among the strongest potential opportunities in the Australian semiconductor ecosystem is developing and growing local design centers. Australia has world-class research universities and innovative technology institutes in which fundamental work in chip design, microelectronics, and high-end sensors is growing. By capitalizing on these existing centers of excellence and strengthening partnerships with industry, Australia has an opportunity to become a design leader. The nation's dynamic startup ecosystem, especially in Sydney and Melbourne, could be further tapped to incubate semiconductor spinouts focusing on application-specific integrated circuits for local requirements such as deep-space exploration, mineral exploration hardware, and high-performance computing specifically designed for climate modeling. This is highlighted by Australia's strengths in areas such as astrophysics, environmental science, and defense technology, where local chip pioneers can excavate niche market spaces in both the domestic and global markets, leveraging solutions based on distinctly Australian challenges and world views.

Diversification of the Supply Chain and Potential for Domestic Manufacturing

Another significant opportunity for Australia semiconductor market growth, lies in building resilience by diversifying supply chains through localized manufacturing and assembly capacity. Across the world, supply chain disruptions have underscored the vulnerability of highly concentrated manufacturing nodes. Australia, with its secure energy foundation, stable regulatory framework, and highly developed logistics infrastructure, particularly around Western Australia and New South Wales ports, is well‑placed to create pilot lines for packaging, testing, and even wafer fabrication of niche chips. These might be directed to local markets such as mining, who need ruggedized electronics suited to remote, high-vibration conditions; healthcare, where accurate diagnostic equipment is enhanced by proximity in design and test cycles; and renewable energy systems depending on custom power-management chips. By taking these steps locally, Australia can provide global customers with faster response times, reduced risk of interruption, and security of supply. This also presents a chance to develop competencies, preserve IP, and anchor more of the semiconductor value chain locally.

Strategic Partnerships in Emerging Sectors and Sustainability

Australia's semiconductor industry is well placed to take advantage of growth across new high-impact industries connected to the country's technological and sustainability aspirations. As Australia moves at a faster pace toward renewable energy, there's an opportunity to create low-power, high-efficiency specialized semiconductors for solar, battery storage, and smart grid technologies. Spliced with Australia's prominence in earth observation and remote sensing technologies, semiconductor companies have a lucrative opportunity to make chips that enable environmental surveillance in the outback, coastal areas or bushfire‑susceptible areas, which are regions where regular chips might not survive hostile temperature or humidity levels. Furthermore, collaboration with national defense programs opens the door for hardened, rugged semiconductors for drones, communications and surveillance systems specific to vast remote regions. Notably, the Australian research landscape—led by institutions venturing into quantum information science, presents opportunities for coalescing efforts on next-generation quantum-ready chip platforms. By bringing semiconductor innovation in step with the country's strategic interests in sustainability, resource management, defense, and emerging technologies, Australia has significant potential to influence future markets that converge the international demand for resilient, efficient and specialized chips.

Government Support and Investment in Australia Semiconductor Market:

Strategic Innovation Funds and Collaborative Research Ecosystems

The Australian government has adopted a carefully coordinated strategy to support the semiconductor industry through strategic funding for innovation and by promoting cooperative research environments. Federal and state authorities have given high priority to developing semiconductor-related expertise by investing in dual-use research centers and collaborative laboratories, which integrate academia with industry. For example, some research districts across several universities and innovation precincts have been specifically designed to enable microfabrication, device prototyping, and testing. These efforts provide rich soil for deep collaboration: university research teams and early-stage start-ups are invited to collaborate on developing innovative chip architectures and microelectronics specific to Australia's distinctive industrial applications like mining, remote sensing, and the environment, while industry captains introduce practical, design-to-manufacturing insights. By these concerted actions, Australia successfully sows the seeds for a more developed semiconductor design and supply ecosystem, one that has public investment generating sustained private sector drive and maintaining crucial know-how in-country, specially tailored to the country's landscape and technological strengths.

Industrial Strategy Linkages with National Priorities

The government of Australia has been skillful at linking semiconductor support to wider national objectives, from defense resilience to sustainability and critical minerals, thereby establishing an influential policy synergy. Governmental agencies have prioritized semiconductors as a strategic sector, incorporating support into defense environments that require highly reliable and secure chip technologies tailored for rugged and decentralized use. Layering these priorities, however, means that semiconductor policy is not in a siloed state but is instead integrated into national plans for resource sovereignty, advanced manufacturing, and environmental security. An example is government-supported innovation pathways directing design advancements toward practical problems, such as ruggedized sensors to explore minerals in remote areas or resilient control chips for smart grid infrastructure, so that semiconductor support aligns with challenges that are uniquely Australian. By intertwining semiconductor efforts with these larger industrial and geopolitical threads, Australia is positioning itself as a downstream recipient of international chip technologies and as a contributor to solutions appropriate for its unique industrial and geographic environment.

Talent Development, Workforce Readiness, and Regional Outreach

One of the essential spaces for government assistance in the Australian semiconductor industry is the creation of an educated talent pipeline and taking capacity-building further than the capital cities. Conscious that semiconductor design and applied microelectronics requirements could span various regions, from metropolitan innovation clusters to outback mining and coastal observatories, where government initiatives have been implemented to aid in scholarships, niche training programs, and technology-to-industry fellowships to semiconductor-relevant fields. These programs are deliberately designed not just to cultivate electronics design graduates, materials science graduates, and photonics graduates but also to link them to authentic regional industry demand—be that frontier telecommunications in back-block towns or robust sensor systems for oceanic conditions along Australia's vast coasts. This regional engagement ensures that semiconductor skills are not focused in and around big cities yet embedded in geographically varied ecosystems. Along with funding of startup accelerators and industrial clusters in diverse states and regions, this strategy optimizes the possibilities for semiconductor innovation and adoption over the extent of Australia's geography and local industries.

Challenges of Australia Semiconductor Market:

Restricted Domestic Production and Dependence on Foreign Facilities

A core difficulty facing the Australian semiconductor industry lies in its extremely limited native manufacturing capability. Although Australia is developing a large base of chip design and research teams involved in innovative microelectronics and sensor technology, there are hardly any physical facilities for fabrication, particularly at leading process nodes. The consequence is that even for locally designed chips, the path to high-volume production is dependent on using offshore foundries and package services. The result is two-fold: lead times are increased, supply chain exposures remain, and local iteration or customization opportunities diminish. Adding to the challenge is the fact that implementing foundry or advanced packaging infrastructure in Australia would mean not only capital expenditure but ongoing coordination among governments, universities, and private companies—a complicated ecosystem not yet in full bloom. The lack of strong manufacturing also constrains spillover advantages, including high-skilled employment in cleanrooms or formation of ancillary chemical, materials, and testing sectors. More broadly, this manufacturing deficiency is a critical hindrance to Australia pursuing a more self-reliant or resilient semiconductor path.

Talent Shortages and Competition from Global Tech Markets

Australia's semiconductor ambitions are also influenced by the fact of its limited talent pool. While it possesses universities that churn out superb electrical engineering, materials science, and photonics graduates, local semiconductor companies have to deal with the pull of foreign tech centers. High-level semiconductor positions—design, layout, or packaging engineering—tend to be occupied by skills attracted to large foreign hubs where ecosystem concentration, pay scales, and career tracks are now more attractive. This phenomenon is more than just losing individuals; it prevents Australian-oriented chip initiatives from growing and keeping multidisciplinary groups of required talent from the idea stage to commercialization. The challenge is particularly stark in finding professionals with hands-on exposure in semiconductor fabrication processes, industrial testing, or production line testing. Filling this talent gap involves not just increasing educational provision but also strengthening industry‑university transfer programs, internships, and local placement opportunities linked to distinctly Australian uses—chips hardened for the outback or far‑to‑medium range environmental sensing—so that local semiconductor careers become equally compelling and firmly linked to addressing local problems.

Geographic Scale and Fragmented Regional Innovation Ecosystems

The enormous geography of Australia, though culturally and ecologically diverse, poses a structural challenge to constructing collaborative semiconductor innovation ecosystems. In contrast to more compact tech corridors in smaller nations, Australian innovation is spread out over cities such as Sydney, Melbourne, Brisbane, and Canberra, as well as key regional strengths in cities such as Adelaide or Perth. This dispersal makes it difficult to create unbroken supply chains, multi‑site prototyping centers, and high‑density clusters where design houses, fabrication labs, and manufacturing services can come together. With key assets—like university micro‑fab labs, high‑end packaging facilities, and specialized testing labs—dispersed throughout various states, collaboration entails overcoming inter‑jurisdictional regulatory environments, different funding cycles, and logistical hurdles spanning long distances. For small businesses and start-ups, the implication is that it can take time and money to build a coherent chain of development—ranging from the design of chips and development of IP to physical proofing and pilot production. To counter the geographic fragmentation, there will need to be orchestrated national planning, linkage between state innovation precincts, and maybe virtual integration tools to sew together Australia's scattered semiconductor expertise into a more cohesive, scalable national capability.

Australia Semiconductor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on components, material used, and end user.

Components Insights:

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the components. This includes memory devices, logic devices, analog IC, MPU, discrete power devices, MCU, sensors, and others.

Material Used Insights:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

A detailed breakup and analysis of the market based on the material used have also been provided in the report. This includes silicon carbide, gallium manganese arsenide, copper indium gallium selenide, molybdenum disulfide, and others.

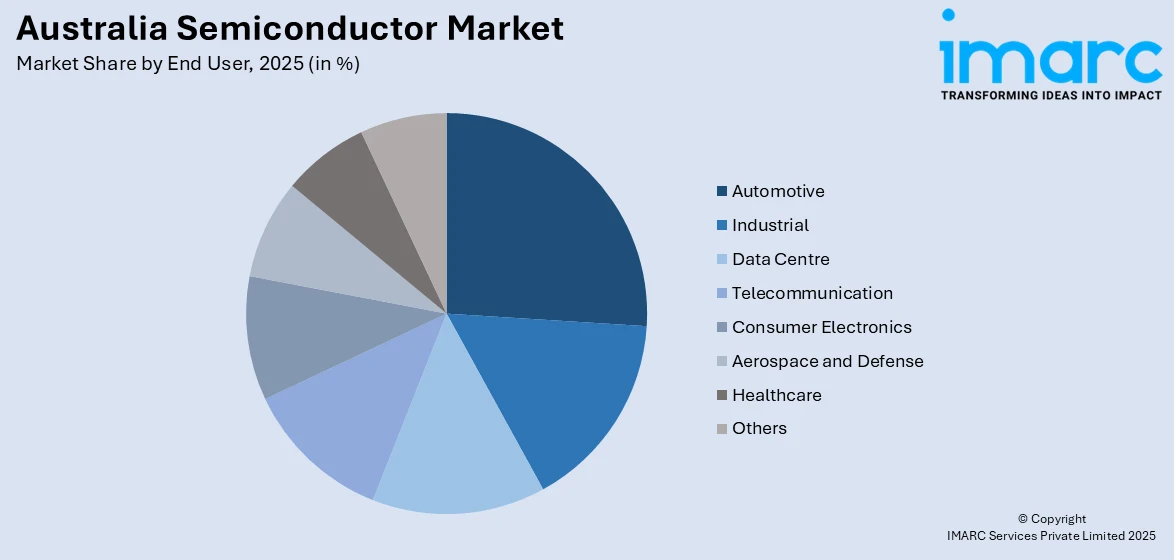

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Industrial

- Data Centre

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, industrial, data centre, telecommunication, consumer electronics, aerospace and defense, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Semiconductor Market News:

- February 2025: Nanoveu, an Australian nanotechnology company, executed a binding share sale agreement to acquire Embedded AI Systems, a system-on-chip semiconductor designing firm. This move aims to enhance Nanoveu's capabilities in semiconductor design.

- January 2025: Adisyn Ltd. completed the acquisition of Israeli semiconductor company 2D Generation. The acquisition focuses on developing capital-light semiconductor IP solutions for data centers, cybersecurity, and managed IT business segments.

Australia Semiconductor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, Others |

| Materials Used Covered | Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Others |

| End Users Covered | Automotive, Industrial, Data Centre, Telecommunication, Consumer Electronics, Aerospace and Defense, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia semiconductor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia semiconductor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia semiconductor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia semiconductor market was valued at USD 14.8 Billion in 2025.

The Australia semiconductor market is projected to exhibit a CAGR of 5.99% during 2026-2034.

The Australia semiconductor market is expected to reach a value of USD 25.3 Billion by 2034.

The Australia semiconductor market trends include increased investment in local design capabilities, rising collaboration between academia and industry, and a focus on niche applications like quantum computing, renewable energy, and ruggedized electronics. Efforts to enhance supply chain resilience and workforce development are also shaping the market's long-term trajectory and competitiveness.

The Australia semiconductor market is driven by strong government support, growing innovation ecosystem, and strategic positioning near Asia-Pacific supply chains. Local demand from sectors like defense, mining, and clean energy fosters specialized chip development, while collaboration between universities and industry accelerates design innovation tailored to the country's unique environmental and industrial needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)