Australia Sexual Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2026-2034

Australia Sexual Wellness Market Summary:

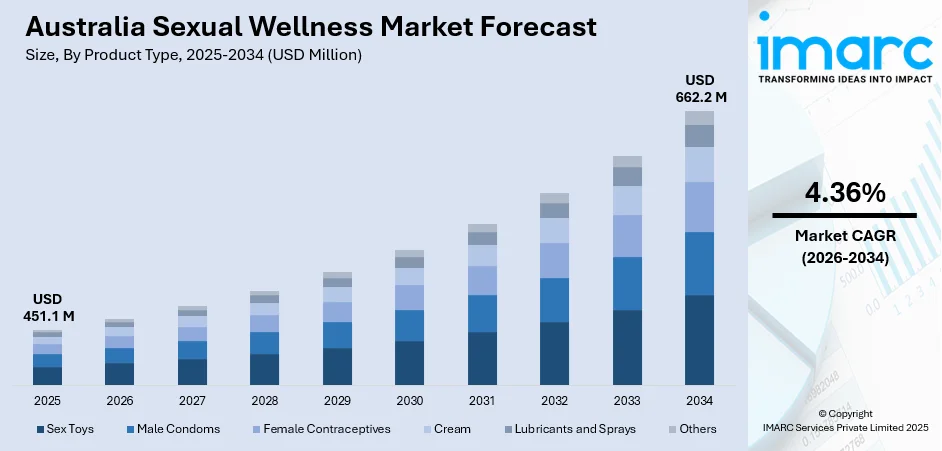

The Australia sexual wellness market size was valued at USD 451.1 Million in 2025 and is projected to reach USD 662.2 Million by 2034, growing at a compound annual growth rate of 4.36% from 2026-2034.

The Australian sexual wellness industry is growing steadily, supported by a progressive approach to sexual health and well-being. Improved availability and accessibility of sexual wellness products continue to drive market expansion, while consumers increasingly prefer high-quality and sustainable offerings. The rising emphasis on self-care and holistic wellness is integrating sexual well-being into the mainstream health and personal care sector. Additionally, greater awareness and the rapid growth of fast-moving consumer goods are further accelerating industry development.

Key Takeaways and Insights:

-

By Product Type: Male condoms dominate the market with a share of 46% in 2025, driven by widespread awareness of safe sex practices, extensive availability across retail channels, and their established role in preventing sexually transmitted infections and unintended pregnancies among sexually active Australians.

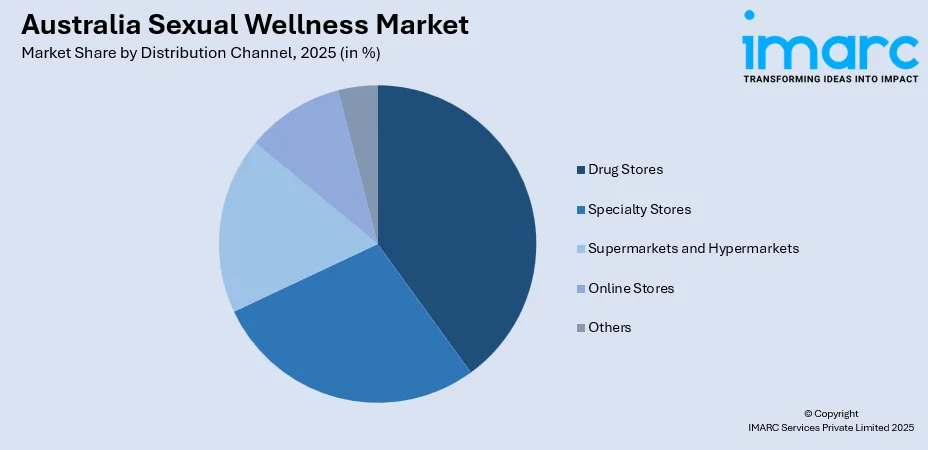

- By Distribution Channel: Drug stores lead the market with a share of 24% in 2025, attributed to consumer trust in pharmacy environments, professional guidance availability, convenient locations, and the perception of quality assurance associated with pharmaceutical retail channels.

- By Application: Men dominate the market with a share of 64% in 2025, owing to the traditional focus on male-oriented products including condoms and sexual enhancement solutions, along with growing male awareness about sexual health and willingness to invest in wellness products.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 32% in 2025, supported by the highest population concentration including Sydney and Canberra metropolitan areas, progressive urban attitudes, well-developed retail infrastructure, and strong healthcare awareness among residents.

- Key Players: The Australian sexual wellness market is highly competitive, featuring a mix of established international brands and emerging local players. Competition is driven by product innovation, premiumization, sustainability, e‑commerce presence, and consumer demand for discreet, tech-enabled, and holistic sexual wellness solutions.

To get more information on this market Request Sample

The Australian sexual wellness market is growing as consumers increasingly prioritize safe, high-quality, and innovative products that enhance intimate experiences. In December 2024, Australian brand Moments launched an AI-powered chatbot, BlissBOT, alongside a new customer loyalty program, offering personalized sexual health guidance and product recommendations online, demonstrating how technology is improving access to education and support. Supported by progressive regulations, comprehensive sexual health education, and public health campaigns, the market benefits from cultural acceptance and informed purchasing behaviors. Locally founded brands offering premium, sustainable, and ethically produced products cater to rising demand for transparency and responsible manufacturing. Digital platforms continue to transform retail by providing discreet access, tailored recommendations, and educational content, strengthening brand–consumer engagement and driving market growth in line with evolving consumer expectations.

Australia Sexual Wellness Market Trends:

Growing Emphasis on Premium and Sustainable Products

Australian consumers are increasingly prioritizing premium quality and sustainability in sexual wellness products, driving demand for items made from natural, body-safe, and eco-friendly materials. In September 2024, Moments Condoms launched a new range of sustainable pleasure products made from high-quality, planet-friendly silicone, highlighting a shift toward eco-conscious design. Locally founded brands are also offering organic lubricants, ethically sourced natural rubber condoms, and chemical-free intimate care products. The trend toward sustainable packaging and clean formulations aligns with environmentally conscious consumers seeking products that reflect their broader lifestyle values.

Integration of Technology and Innovation in Intimate Products

Technological advancement is reshaping the Australian sexual wellness market as manufacturers introduce sophisticated products featuring app connectivity, smart functions, and innovative designs. App-connected devices, such as We‑Vibe couples vibrators available through major Australian retailers, exemplify this trend by offering Bluetooth control, custom vibration patterns, and remote operation via smartphone apps, appealing to consumers seeking interactive and personalized experiences. These connected products enable customizable settings and remote control, catering to tech-savvy users who value both convenience and enhanced functionality. Innovation also extends to ergonomic designs, advanced materials, and features that promote pleasure and health benefits.

Expansion of E-commerce and Direct-to-Consumer Channels

E‑commerce has transformed access to sexual wellness products in Australia, offering discreet purchasing, broad product variety, and convenient home delivery. According to reports, David Jones expanded into the category with a curated online and in‑store range of premium devices, accessories, and intimate skincare, highlighting growing mainstream retail acceptance. Online platforms provide product information, reviews, and educational content, while direct‑to‑consumer brands use subscriptions and personalized recommendations. The privacy and convenience of e‑commerce reduce barriers and enable smaller brands to expand beyond urban retail hubs.

Market Outlook 2026-2034:

The Australian sexual wellness industry is on the cusp of growth as a result of the change in attitudes, strong public health infrastructure, and the shift in behavior in the pursuit of overall well-being. The industry will continue to experience growth as these products become more routinized in overall health practices, integrating the need for these items into overall well-being practices. The growth is also fueled by the changes in the industry, such as the use of technology, which provides opportunities for the high-end market of the industry. The market generated a revenue of USD 451.1 Million in 2025 and is projected to reach a revenue of USD 662.2 Million by 2034, growing at a compound annual growth rate of 4.36% from 2026-2034.

Australia Sexual Wellness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Male Condoms |

46% |

|

Distribution Channel |

Drug Stores |

24% |

|

Application |

Men |

64% |

|

Region |

Australia Capital Territory & New South Wales |

32% |

Product Type Insights:

- Sex Toys

- Male Condoms

- Natural Latex Condoms

- Female Contraceptives

- Cream

- Waist/Hip Lightening Cream

- Hair Removal Foam/cream

- Lubricants and Sprays

- Gels

- Lubes

- Massage Oil

- Others

- Intimate Wash, Foam, Wipes

- Intimate Fragrances, Sprays, Pockets

The male condoms dominate with a market share of 46% of the total Australia sexual wellness market in 2025.

Male condoms remain the leading contraceptive in Australia, widely used and easily accessible. In November 2025, the government launched the national “Beforeplay” STI awareness campaign to promote safe sex, emphasizing consistent condom use and regular sexual health testing among Australians under 35. Public health initiatives and comprehensive sexual education have reinforced condoms’ role in preventing STIs and unintended pregnancies. Broad distribution across pharmacies, supermarkets, convenience stores, and online platforms ensures accessibility, while consumer awareness supports responsible sexual health practices.

The segment for male condoms keeps changing as innovations within materials, sizes, and textures are developed, each of which adds some more comfort while still upholding their safety parameters. Choices range from ultra-thin varieties to latex-free products and specialty designs. Tourism supports this demand due to the disposition of guests for safe sex basics, while various government and public health initiatives distribute free condoms through community projects and healthcare centers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Drug Stores

- Online Stores

- Others

The drug stores lead with a share of 24% of the total Australia sexual wellness market in 2025.

Drug stores represent the main retailing medium for sexual well-being products in Australia. This retailing medium has the advantages of customer trust and quality assurance. Moreover, it ensures convenient customer access to condoms, sex lubes, and other forms of contraception with flexible operating hours. It also includes the expertise of pharmacists, who are readily available to provide customer assistance regarding merchandise choices, especially for products of the health-related category.

The pharmacy-based channel is supported by regular patronage of health and well-being items as part of established customer shopping behavior. Major pharmacy retailers provide a well-supported offering of sexual wellness items. These items are normally incorporated into overarching health and personal care categories, allowing for greater convenience and normalizing the purchase of such items. This assists further in reducing associated stigma. This channel is also utilizing technology through online shopping and pick-up options at pharmacy locations.

Application Insights:

- Men

- Women

- LGBT Community

The men dominate with a market share of 64% of the total Australia sexual wellness market in 2025.

Men represent the largest segment in Australia’s sexual wellness market, traditionally focused on condoms, lubricants, and enhancement products. Recent data from Australia’s Adult Toy Mega Store shows men increasingly purchasing a wider range of products, including adult toys, often outspending women, reflecting a cultural shift toward embracing broader sexual wellness. Growing awareness and acceptance, combined with marketing targeting male consumers, support strong brand recognition. The segment benefits from diverse offerings, including performance enhancers, pleasure devices, and protective products catering to evolving male preferences.

With the evolution of the notion of masculinity and the role of self-care in the relationship between males and intimacy and sexuality, the category of male sexual well-being products has expanded. There is an increase in the demand for products that help with intimacy, performance anxiety, and overall issues of male sexual health. E-commerce accessibility and the normalization of conversations about male sexuality in the area of health providers and campaigns are factors that encourage the adoption of male sexual well-being products.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 32% share of the total Australia sexual wellness market in 2025.

The Australia Capital Territory and New South Wales region maintains its position as the leading market for sexual wellness products, driven by the highest population concentration in the country including the Sydney metropolitan area and the national capital Canberra. The region benefits from progressive urban attitudes toward sexual health, well-developed retail infrastructure, and strong healthcare awareness among residents. High population density in urban centers creates concentrated demand that supports diverse retail formats including specialty stores, pharmacies, and extensive e-commerce delivery networks. The cosmopolitan nature of Sydney particularly contributes to early adoption of innovative products and premium brands.

The region demonstrates strong e-commerce adoption and digital purchasing behaviors that complement traditional retail channels. Major pharmacy chains and retail networks maintain comprehensive presence across the region, ensuring product accessibility for diverse consumer segments. Additionally, the concentration of healthcare providers, sexual health clinics, and educational institutions supports ongoing awareness and engagement with sexual wellness products through outreach programs, counseling services, and evidence-based public health initiatives.

Market Dynamics:

Growth Drivers:

Why is the Australia Sexual Wellness Market Growing?

Progressive Societal Attitudes and Comprehensive Sexual Education

Australia has fostered progressive attitudes toward sexual health through comprehensive education programs in schools and universities. According to reports, WA Health launched the Healthysexual campaign to promote regular STI testing and condom use among people aged 16–49, reducing stigma around sexual health and encouraging safer practices. Such initiatives cultivate early understanding, responsibility, and healthy attitudes toward sexuality, creating an informed consumer base. Open cultural conversations and ongoing public health campaigns normalize sexual wellness discussions, reinforce safe sex practices, and support sustained market growth by encouraging the adoption of sexual wellness products.

Growing Focus on Holistic Health and Self-Care Practices

The integration of sexual wellness into broader health and self-care reflects evolving consumer views on holistic well-being. Australia’s Body+Soul 2025 Sex Census found that 40% of respondents engage in sexual activity to relax or relieve stress, while 28% say it boosts mood and confidence, showing sexual health is increasingly tied to mental and emotional wellness. Consumers now see sexual health as essential to overall well-being, driving demand for products that enhance intimacy and relationships. Normalized conversations around personal pleasure, especially among younger demographics, support sustainable market growth.

E-commerce Expansion and Enhanced Product Accessibility

The rapid growth of e‑commerce has transformed accessibility and convenience in Australia’s sexual wellness market. The country’s e‑commerce market reached USD 604.1 billion in 2025, reflecting widespread online adoption, and is projected to grow further, highlighting the potential of digital retail channels. Online platforms offer broad product variety, detailed information, customer reviews, and discreet delivery, appealing to privacy-conscious consumers. Direct-to-consumer brands use these channels to reach urban, regional, and rural shoppers. Convenience, educational content, and personalized recommendations have lowered barriers and expanded the consumer base for sexual wellness products nationwide.

Market Restraints:

What Challenges the Australia Sexual Wellness Market is Facing?

Regulatory Compliance and Product Safety Requirements

The sexual wellness industry in the Australian market is conducted in a very regulated environment concerning product safety and marketing. The requirements of compliance may constitute a challenge to new entrants in the industry and could increase development time for a company that wishes to offer innovative products. The regulatory requirements for the classification of therapeutic products constitute a challenge to entry and increased development costs due to regulatory requirements for industry entry. The above requirements are vital to the regulation of the industry.

Residual Social Stigma and Conservative Demographics

Although there is a progressive mindset in general attitudes toward the market for sexual wellness products, some social stigma still exists for these items in particular demographics and regions. A conservative mindset could be a hindrance to the extent a company wants to penetrate the market in a specific geographical area and age demographic. Some individuals may be very shy about inquiring for sexual wellness advice from medical staff or even salespeople from the company.

Market Competition and Price Sensitivity

The intense level of competition within the existing brand players and new direct-to-consumer brands creates pressures on product prices. The sensitivity of consumers to prices, especially for a commoditized product like condoms, further obstructs opportunities for high-end product pricing. The development of store-brand and value brands via the prominent retail chains accentuates the challenges of competition. At the same time, the small population size of the country relative to other larger markets restricts the size of the market.

Competitive Landscape:

The Australia sexual wellness market features a competitive landscape comprising established multinational corporations, regional players, and emerging direct-to-consumer brands. Global manufacturers maintain strong market positions through extensive product portfolios, established distribution networks, and significant marketing investments. Australian consumers benefit from diverse product availability spanning international brands with global recognition and locally founded companies offering products tailored to regional preferences. The competitive environment is characterized by ongoing innovation in product formulations, materials, and technologies. Emerging local brands differentiate through premium positioning, sustainable practices, and authentic brand stories that resonate with values-conscious consumers. E-commerce has enabled smaller players to compete effectively by building direct consumer relationships and leveraging targeted digital marketing strategies.

Recent Developments:

- In June 2025, Lovehoney, the global sexual wellness brand, launched a new creative platform in Australia through agency Leith. The campaign aims to enhance sexual wellness awareness and engagement across the country, reflecting growing market acceptance and interest in intimate health products.

Australia Sexual Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Drug Stores, Online Stores, Others |

| Applications Covered | Men, Women, LGBT Community |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia sexual wellness market size was valued at USD 451.1 Million in 2025.

The Australia sexual wellness market is expected to grow at a compound annual growth rate of 4.36% from 2026-2034 to reach USD 662.2 Million by 2034.

Male condoms dominated the Australia sexual wellness market with a share of 46%, driven by widespread awareness of safe sex practices, extensive retail availability, and their established role in preventing sexually transmitted infections and unintended pregnancies.

Key factors driving the Australia sexual wellness market include progressive societal attitudes toward sexual health, comprehensive sexual education programs, growing focus on holistic well-being and self-care practices, e-commerce expansion enhancing product accessibility, and government public health initiatives promoting safe sex practices and STI prevention.

Major challenges include stringent regulatory compliance requirements affecting product approvals and market entry, residual social stigma among certain demographic segments, intense market competition creating pricing pressures, and the relatively limited population base constraining overall market scale compared to larger global markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)