Australia Ship Repairing Market Size, Share, Trends and Forecast by Vessel Type, Application, End User, and Region, 2025-2033

Australia Ship Repairing Market Size and Share:

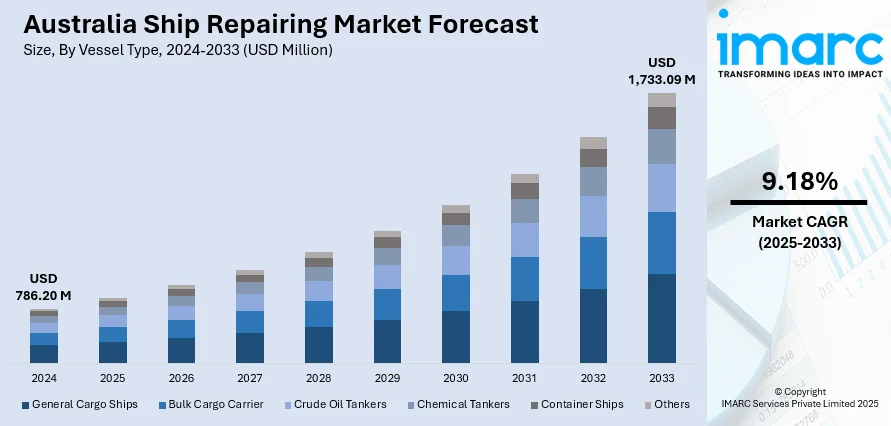

The Australia ship repairing market size reached USD 786.20 Million in 2024. Looking forward, the market is expected to reach USD 1,733.09 Million by 2033, exhibiting a growth rate (CAGR) of 9.18% during 2025-2033. The market is driven by increasing naval defense spending, growing commercial shipping activity, aging fleet modernization, and rising demand for offshore support vessels. Port infrastructure development and sustainability regulations also boost service requirements. These drivers collectively support a steady increase in the Australia ship repairing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 786.20 Million |

| Market Forecast in 2033 | USD 1,733.09 Million |

| Market Growth Rate 2025-2033 | 9.18% |

Key Trends of Australia Ship Repairing Market:

Emphasis on Green Ship Repair Solutions

Environmental sustainability is becoming a cornerstone of Australia ship repairing market growth, with increasing emphasis on eco-friendly repair techniques and materials. Regulatory bodies such as the Australian Maritime Safety Authority (AMSA) are enforcing stricter environmental standards, pushing ship repair companies to adopt low-emission processes and biodegradable materials. Shipyards are also integrating energy-efficient equipment and waste management systems to comply with carbon reduction goals. These developments are crucial for meeting international emission regulations and for appealing to global shipping companies that prioritize sustainability in their operations. This green transition is influencing procurement policies, encouraging shipowners to select service providers that demonstrate environmental stewardship, thereby expanding business opportunities within the Australia ship repairing market. For instance, in November 2024, Babcock Australasia completed its first Anzac Class maintenance under the Regional Maintenance Provider West (RMP West) program, servicing HMAS Stuart at HMAS Stirling Naval Base. The 17-week project involved 374 tasks, including a rare in-water replacement of the starboard Propulsion Diesel Engine. This initiative supports Australia’s Maritime Sustainment Model, aiming to strengthen sovereign capabilities and generate $300 million in economic benefits through long-term naval maintenance operations.

To get more information on this market, Request Sample

Expansion of Regional Repair Hubs and Infrastructure

Another significant trend contributing to Australia ship repairing market growth is the expansion of regional repair hubs and maritime infrastructure. State governments and private investors are collaborating to upgrade shipyards, dry docks, and logistics networks to accommodate larger vessels and increased traffic. Strategic locations such as Western Australia and Northern Territory are receiving infrastructure enhancements to support both defense and commercial repair activities. These developments reduce turnaround times and provide localized service options, minimizing the need for overseas maintenance. Additionally, such investments generate employment and foster skill development, creating a robust domestic supply chain. As Australia positions itself as a key player in the Indo-Pacific maritime corridor, its ship repair capacity is expected to grow substantially. For instance, in March 2025, Australia committed AUD 1.2 Million to support Fiji’s maritime sector through a new shipbuilding and repair facility in Lautoka. The initiative, launched by Fiji’s Prime Minister and Australia’s High Commissioner, aims to boost local jobs, vocational training, and economic growth, with up to 120 roles projected.

Growing Need for Naval Fleet Maintenance and Upgrades

Australia's emphasis on maritime defense and regional security is significantly increasing the demand for naval fleet maintenance. The government is making substantial investments to modernize its naval capabilities, ensuring both operational readiness and the long-term viability of the fleet. This modernization effort includes scheduled dry-docking, structural repairs, system enhancements, and upgrades to communication and combat systems. The rise in geopolitical tensions and greater involvement in joint maritime exercises are further driving the necessity for routine overhauls and urgent repairs. Moreover, the aging vessels of the Royal Australian Navy are frequently undergoing refits to prolong their service life. These elements, along with the growth of naval infrastructure, are leading to a steady increase in the Australia ship repairing market demand.

Growth Drivers of Australia Ship Repairing Market:

Strategic Location Enhancing Regional Ship Repair Activity

Australia’s advantageous location near essential Asia-Pacific shipping routes positions it as a crucial maritime center for repair and maintenance services. The nation acts as a stopping point for vessels involved in long-distance global trade, especially those navigating between East Asia, Oceania, and the Indian Ocean area. This geographical benefit enables Australian shipyards to draw in a variety of domestic and international clients seeking routine maintenance, urgent repairs, and system enhancements. Ports such as Sydney, Perth, and Darwin have developed into significant service hubs due to their strategic accessibility and robust infrastructure. As shipping traffic increases, a growing number of vessels are utilizing Australia’s repair services to reduce downtime. According to Australia ship repairing market analysis, this geographic advantage remains a key factor for further growth.

Rising Maintenance Needs of an Aging Commercial Fleet

Australia’s commercial fleet, encompassing cargo ships, ferries, and bulk carriers, is aging and increasingly dependent on both planned and unplanned maintenance. Many of these vessels are more than ten years old, necessitating regular mechanical overhauls, engine refurbishments, and compliance upgrades to ensure they remain operational and meet global standards. This aging profile heightens the need for routine servicing and motivates vessel owners to pursue system upgrades rather than full replacements. As a result, Australian shipyards are observing consistent demand from local shipping firms looking to extend the lifespan of their fleets in a cost-effective manner. This trend is anticipated to stimulate long-term growth prospects in the repair sector, especially for specialized and mid-sized repair facilities throughout the country.

Higher Trade Volumes Driving Vessel Servicing Demand

Australia's expanding international trade landscape is placing increased demand on commercial vessels, leading to more wear and tear and necessitating frequent maintenance. The rise in imports of consumer products and raw materials, coupled with robust exports in agriculture, mining, and energy, has resulted in heightened vessel usage. This increase in operational intensity accelerates component wear, system failures, and structural strain, all of which require expert repair services. As shipping activities grow, shipowners are emphasizing the importance of timely maintenance to prevent costly delays and to adhere to safety and environmental regulations. This escalating vessel activity is generating ongoing demand for shipyards in major ports, reinforcing a positive market outlook.

Opportunities of Australia Ship Repairing Market:

Development of Specialized Repair Facilities

Australia’s ship repair industry stands to gain substantially from the establishment of specialized facilities designed for complex and high-value vessels. With the global fleet adapting to include LNG-powered ships, autonomous vessels, and advanced naval platforms, the need for sophisticated technical repair services is increasing. Creating dedicated infrastructure with expertise in such vessels could position Australia as a prime hub for niche repairs in the Asia-Pacific area. These specialized shipyards would draw international contracts, lessen dependency on overseas services, and generate high-margin business prospects. With appropriate investment and skill enhancement, Australian shipyards can develop a strong competitive advantage in the global market for technically advanced ship repair solutions.

Public-Private Partnerships

Cooperative efforts between the Australian government and private shipyard operators are emerging as a strategic approach to upgrade the nation’s marine repair infrastructure. Public-private partnerships (PPPs) can facilitate the financing of advanced dry docks, automation technologies, and environmentally friendly facilities. These joint initiatives are essential for addressing the increasing complexity of both naval and commercial vessel repair needs. PPPs also promote knowledge exchange, innovation, and expedited project delivery, contributing to a more competitive ecosystem. By harnessing combined resources and aligning national defense goals with private sector expertise, Australia can markedly enhance its repair capabilities. This cooperative model has significant potential to expand capacity and attract maritime clients from both domestic and international markets.

Lifecycle Support Contracts

One of the most promising avenues in the Australian ship repair market involves providing lifecycle support contracts to both commercial and defense fleet operators. These long-term agreements encompass scheduled maintenance, urgent repairs, and performance enhancements throughout the vessel's operational life. Lifecycle contracts secure steady cash flow, mitigate business volatility, and foster deeper client relationships. They are especially beneficial for naval fleets and large shipping companies seeking to outsource maintenance while ensuring operational reliability. By implementing this service model, Australian shipyards can transition from one-off repair jobs to value-added partnerships, establishing themselves as strategic maintenance providers rather than temporary service vendors. This shift supports continuous growth and sustained relevance in the market.

Challenges of Australia Ship Repairing Market:

High Operational and Labor Costs

The ship repairing sector in Australia encounters considerable financial pressures stemming from elevated labor costs, steep energy expenses, and stringent regulatory compliance demands. These elements escalate the total cost of repair services, rendering Australian shipyards less appealing in terms of pricing relative to competitors in Southeast Asia. Skilled labor commands high wages here, and the industry must also adhere to rigorous safety and environmental regulations, which further elevate overhead costs. Additionally, the volatility of utility prices, especially for electricity and fuel, imposes extra financial burdens on operations. Consequently, ship owners looking for cost-efficient options frequently opt for international facilities. Unless counterbalanced by enhanced services or productivity improvements, these cost challenges continue to hinder the acquisition of international contracts.

Shortage of Skilled Marine Workforce

A persistent issue in Australia’s ship repairing industry is the shortage of a skilled marine workforce. There is a limited availability of trained welders, marine engineers, electricians, and technicians, all vital for providing complex and timely repair services. This talent deficiency hampers shipyards' ability to expand operations or undertake technically challenging projects. A lack of vocational training pathways and diminished interest among youth in marine trades exacerbates this challenge. During peak demand periods, shipyards often struggle to adhere to project timelines, which negatively impacts service quality and client satisfaction. To enhance competitiveness, the industry must prioritize investments in education, apprenticeships, and upskilling programs to revive its technical workforce.

Aging Infrastructure at Smaller Yards

Numerous small and mid-sized ship repair facilities in Australia function with outdated infrastructure and equipment. These constraints limit their capacity to accommodate large vessels or execute the high-precision repairs demanded by modern fleets, including LNG carriers and digitalized ships. The presence of older dry docks, restricted lifting capabilities, and inefficient logistics hampers productivity and prolongs repair durations. Additionally, the absence of digital integration and automation puts these yards at a disadvantage against more technologically advanced facilities in Asia. Modernizing infrastructure necessitates substantial capital investments, which many smaller operators find challenging to acquire. This situation creates a disparity between market demand and service readiness, ultimately posing obstacles to the industry’s growth prospects.

Australia Ship Repairing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vessel type, application, and end user.

Vessel Type Insights:

- General Cargo Ships

- Bulk Cargo Carrier

- Crude Oil Tankers

- Chemical Tankers

- Container Ships

- Others

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes general cargo ships, bulk cargo carrier, crude oil tankers, chemical tankers, container ships, and others.

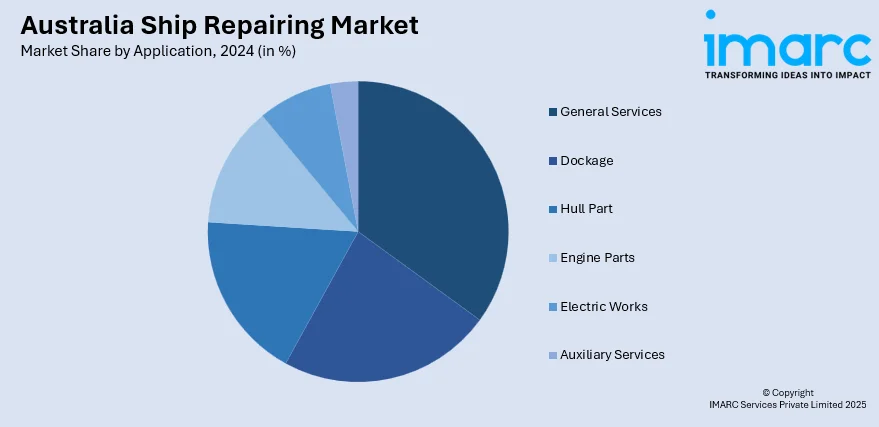

Application Insights:

- General Services

- Dockage

- Hull Part

- Engine Parts

- Electric Works

- Auxiliary Services

The report has provided a detailed breakup and analysis of the market based on the application. This includes general services, dockage, hull part, engine parts, electric works, and auxiliary services.

End User Insights:

- Transport Companies

- Military

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes transport companies, military, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- AIS Marine Pty Ltd

- ARA Group Limited

- Austal

- Harwood Slipway Pty Ltd

- OSS Maritime Group Pty Ltd

- Silverstar Marine

Australia Ship Repairing Market News:

- In August 2024, STS Leeuwin II begun repairs at the Australian Marine Complex in Henderson, nearly a year after being struck by the container ship Maersk Shekou at Fremantle Port. The vessel will receive new sails, a full rigging system, and sewage upgrades.

- In July 2024, Seatrium secured a long-term repair and upgrade contract from Teekay Shipping (Australia) under the Defence Maritime Support Services Program (DMSSP). This marks Seatrium’s first strategic partnership with a major ship management firm. The agreement involves refitting a fleet of vessels over two years, aiming to improve service efficiency and uphold high safety and environmental standards. The collaboration leverages both companies' expertise to meet specialized maintenance needs in Australia's maritime defense sector.

- In February 2024, Pearlson Shiplift Corporation signed a multi-million-dollar contract with Australian Naval Infrastructure (ANI) to upgrade and extend the shiplift system at Osborne Shipyard, South Australia. This project strengthens Pearlson’s global leadership in drydock systems. Completion is expected later in 2024, enhancing Australia’s naval and ship repair infrastructure.

Australia Ship Repairing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vessel Types Covered | General Cargo Ships, Bulk Cargo Carrier, Crude Oil Tankers, Chemical Tankers, Container Ships, Others |

| Applications Covered | General Services, Dockage, Hull Part, Engine Parts, Electric Works, Auxiliary Services |

| End Users Covered | Transport Companies, Military, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | AIS Marine Pty Ltd, ARA Group Limited, Austal, Harwood Slipway Pty Ltd, OSS Maritime Group Pty Ltd, Silverstar Marine, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ship repairing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ship repairing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ship repairing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ship repairing market in Australia was valued at USD 786.20 Million in 2024.

The Australia ship repairing market is projected to exhibit a compound annual growth rate (CAGR) of 9.18% during 2025-2033.

The Australia ship repairing market is expected to reach a value of USD 1,733.09 Million by 2033.

The key trend of the market is increased adoption of digital diagnostics, green retrofitting solutions, and modular repair techniques. Growth in offshore support vessel servicing, rising naval refit activity, and efforts to establish Australia as a regional service hub are also shaping emerging trends.

Key drivers include rising maritime trade, expansion of naval and offshore energy fleets, and government investment in port infrastructure. Demand from aging commercial vessels, environmental compliance requirements, and Australia's strategic geographic location are further contributing to sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)