Australia Shipping Container Market Size, Share, Trends and Forecast by Product, Container Size, Application, and Region, 2026-2034

Australia Shipping Container Market Overview:

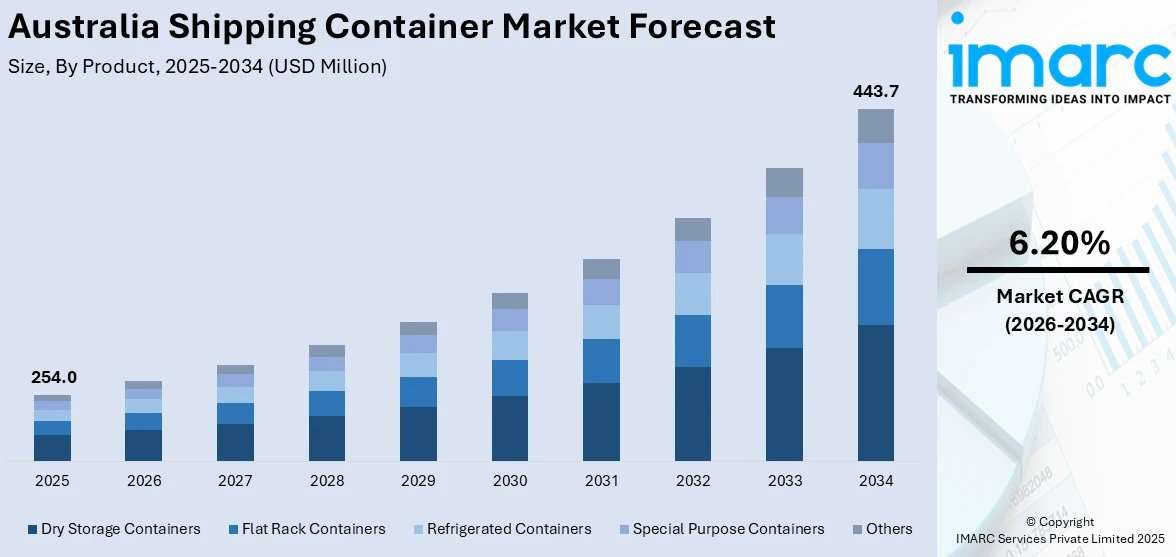

The Australia shipping container market size reached USD 254.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 443.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.20% during 2026-2034. The market is driven by increasing international trade, rising e-commerce demand, expanding infrastructure investments, surging port expansions, boosting sustainability initiatives, increasing supply chain digitization, and growing demand for modular construction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 254.0 Million |

| Market Forecast in 2034 | USD 443.7 Million |

| Market Growth Rate 2026-2034 | 6.20% |

Australia Shipping Container Market Trends:

Growth in Sustainable and Eco-Friendly Container Solutions

The Australia shipping container market is adopting sustainable practices because businesses need environmentally friendly solutions to decrease their carbon emissions. This is boosting the Australia shipping container market share. Various businesses now purchase reusable and naturally decomposing materials alongside climate-friendly surface finishes and energy-saving temperature management systems for shipping compartments. Moreover, the market trend particularly favors repurposed shipping containers due to recent sustainability regulations and consumer demand for sustainable options, driving their use in construction and retail, and hospitality businesses. For example, in December 2024, the Australian Department of Climate Change, Energy, Environment and Water (DCCEEW) unveiled the "Australia’s Circular Economy Framework," aiming to double the nation's circularity by 2035. This initiative encourages the adoption of reusable materials and supports the integration of repurposed shipping containers in various sectors. Through government efforts to lower emissions and support circular economy principles, Australia drives the industry toward new developments, including solar-powered box containers and fuel efficiency monitoring technologies. Besides this, container industry companies achieve competitive advantages through adopting carbon offset programs and sustainable shipping routes which demonstrates their commitment to environmental responsibility. Furthermore, major changes in environmental concerns and regulatory needs are sustainably transforming the Australia shipping container market outlook through increased adoption of green container solutions.

To get more information on this market Request Sample

Digitalization and Smart Container Technology

The widespread use of digital and smart container solutions in the Australia shipping container operations is enhancing the efficiency and better security levels, along with clearer supply chain transparency. In line with this, the implementation of the Internet of Things (IoT), artificial intelligence (AI)-driven analytics, and blockchain by shipping companies enables real-time tracking and predictive maintenance systems and automated temperature control. For instance, in September 2024, the Australian Government introduced the Voluntary AI Safety Standard to ensure the secure deployment of AI technologies, including those used in smart shipping containers, further enhancing operational security and efficiency. Concurrently, the addition of global positioning system (GPS), along with Radio Frequency Identification (RFID) and remote monitoring sensors to smart containers, helps businesses optimize inventory control and simultaneously cut down delays and boost shipping container security. In confluence with this, Australia’s expansive seafood, dairy, and pharmaceutical export business needs precise temperature and humidity control. The combination of digital documentation along with blockchain-based smart contracts allows companies to speed up trade operations by eliminating paperwork while reducing potential instances. Furthermore, the rising complexities in worldwide trade have driven Australian logistics businesses to invest in innovative container technologies that make shipping operations more transparent while enhancing reliability and lowering costs for business success. As a result, this trend is significantly driving the Australia shipping container market growth.

Australia Shipping Container Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product, container size, and application.

Product Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

- Special Purpose Containers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dry storage containers, flat rack containers, refrigerated containers, special purpose containers, and others.

Container Size Insights:

- Small Containers (20 feet)

- Large Containers (40 feet)

- High Cube Containers

- Others

A detailed breakup and analysis of the market based on the container size have also been provided in the report. This includes small containers (20 feet), large containers (40 feet), high cube containers, and others.

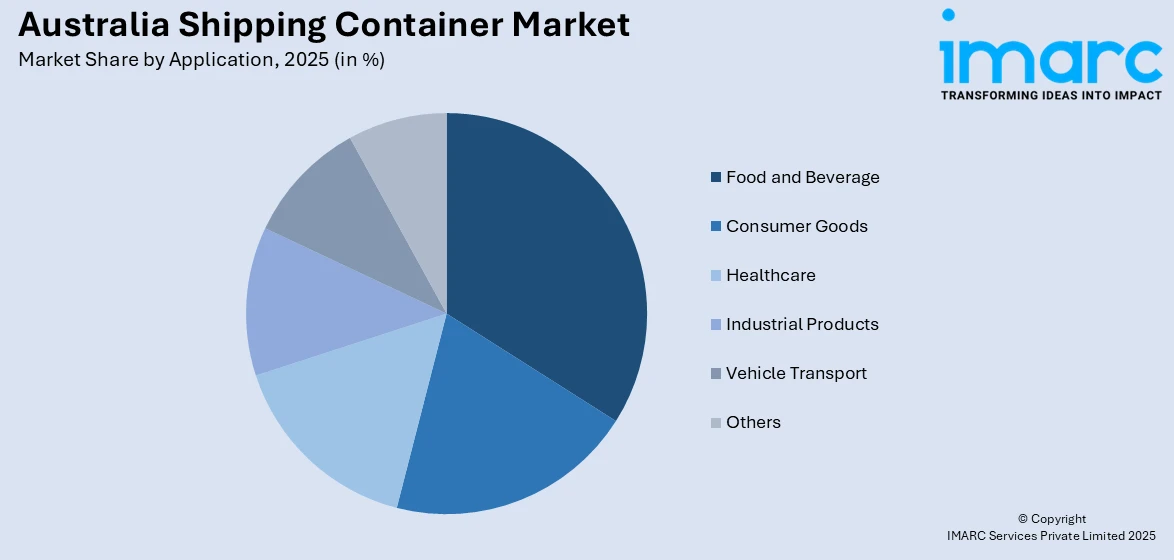

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Consumer Goods

- Healthcare

- Industrial Products

- Vehicle Transport

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, consumer goods, healthcare, industrial products, vehicle transport, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Shipping Container Market News:

- In November 2024, DP World Australia entered into a binding agreement to acquire 100% of Silk Logistics Holdings Limited for approximately A$174.5 million. This acquisition aims to enhance DP World's end-to-end logistics capabilities in Australia.

- In November 2024, OneStop and ACFS Port Logistics extended their partnership to include Brisbane-based facilities, e-Depot, and e-Link. This collaboration focuses on transforming container operations and improving efficiency in Brisbane, Australia.

Australia Shipping Container Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers, Special Purpose Containers, Others |

| Container Sizes Covered | Small Containers (20 feet), Large Containers (40 feet), High Cube Containers, Others |

| Applications Covered | Food and Beverage, Consumer Goods, Healthcare, Industrial Products, Vehicle Transport, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia shipping container market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia shipping container market on the basis of product?

- What is the breakup of the Australia shipping container market on the basis of container size?

- What is the breakup of the Australia shipping container market on the basis of application?

- What is the breakup of the Australia shipping container market on the basis of region?

- What are the various stages in the value chain of the Australia shipping container market?

- What are the key driving factors and challenges in the Australia shipping container?

- What is the structure of the Australia shipping container market and who are the key players?

- What is the degree of competition in the Australia shipping container market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia shipping container market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia shipping container market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia shipping container industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)