Australia Small-Scale Hydropower Market Size, Share, Trends and Forecast by Capacity, Component, and Region, 2025-2033

Australia Small-Scale Hydropower Market Overview:

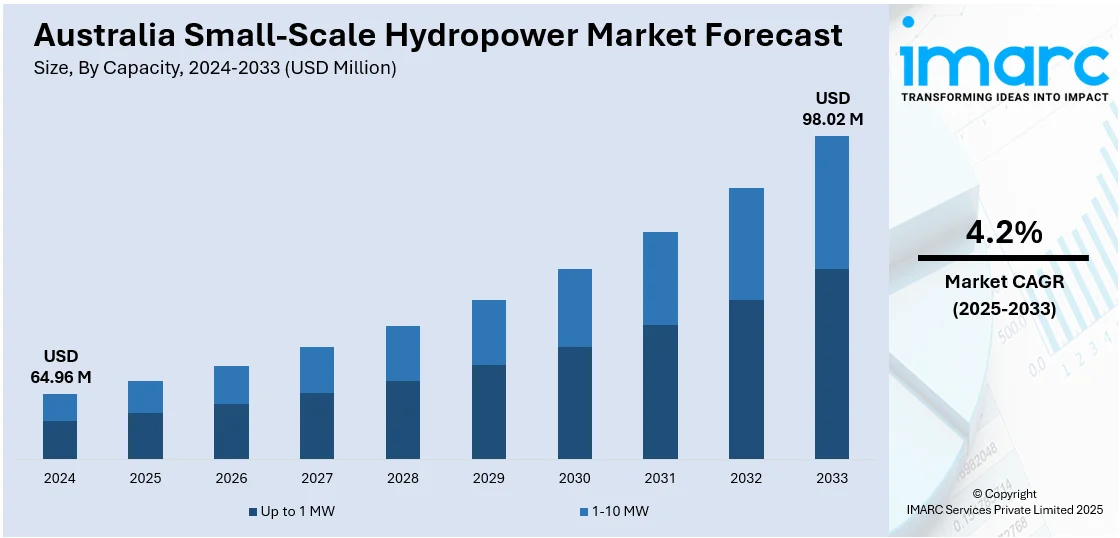

The Australia small-scale hydropower market size reached USD 64.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 98.02 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. Clean energy goals, aging grid infrastructure in remote areas, rising demand for off-grid renewable solutions, and support through government grants are some of the factors contributing to Australia small-scale hydropower market share. The repurposing of existing irrigation and water systems also boosts development, especially in rural and agricultural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.96 Million |

| Market Forecast in 2033 | USD 98.02 Million |

| Market Growth Rate 2025-2033 | 4.2% |

Australia Small-Scale Hydropower Market Trends:

Steady Growth in Renewable Energy Integration

Australia is experiencing a steady increase in the adoption of small-scale hydropower as part of its broader shift toward renewable energy. These systems are gaining recognition for their ability to provide consistent, low-emission electricity, particularly in areas where large infrastructure projects may not be viable. Small hydropower is increasingly being used to complement solar and wind, helping to balance supply and support energy reliability. With rising interest in clean energy solutions, decentralized and environmentally low-impact installations are becoming more common. This movement aligns with national goals to reduce carbon emissions and strengthen energy self-sufficiency. The integration of various renewable sources is shaping a more resilient and flexible power system, with small-scale hydropower playing a supportive role in both grid-connected and off-grid applications across the country. These factors are intensifying the Australia small-scale hydropower market growth. For example, according to an article published in January 2024, in 2021–22, hydropower contributed 6.3% to Australia's electricity generation, with renewables accounting for over 30% of the total supply.

To get more information on this market, Request Sample

Growing Alignment with Digital Energy Demands

Small-scale hydropower in Australia is increasingly being recognized for its role in supporting the power needs of energy-intensive sectors, particularly data centers. As digital infrastructure expands, the demand for reliable, zero-emission electricity has become more critical. Hydropower offers dispatchable generation, making it a strong complement to intermittent sources like solar and wind. Its ability to deliver consistent output supports grid stability and ensures continuity for operations that require unbroken power supply. The emphasis on integrating hydropower with other renewables reflects a broader effort to strengthen energy security while advancing decarbonization. Small-scale installations are especially well-suited to local applications, offering a low-footprint solution that aligns with both environmental and technological objectives. This positioning enhances their appeal in a future where data-driven operations and emissions reduction targets are converging. The ongoing interest in such systems points to their growing value in Australia’s clean energy mix. For instance, in January 2025, the former Australian prime minister emphasized the potential of hydropower, including small-scale projects, to support the energy demands of data centers. It was highlighted that hydropower offers zero-emission, dispatchable energy, making it suitable for integration with solar and wind to provide reliable power. This advocacy underscores the role of small-scale hydropower in Australia's renewable energy strategy.

Australia Small-Scale Hydropower Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on capacity and component.

Capacity Insights:

- Up to 1 MW

- 1-10 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 1 MW and 1-10 MW.

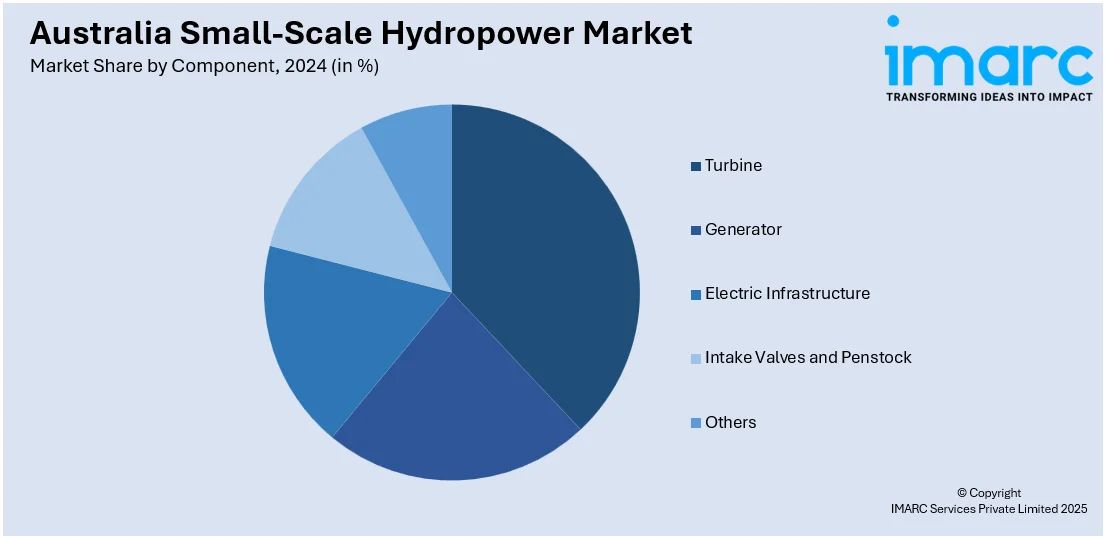

Component Insights:

- Turbine

- Generator

- Electric Infrastructure

- Intake Valves and Penstock

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes turbine, generator, electric infrastructure, intake valves and penstock, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Small-Scale Hydropower Market News:

- In February 2025, the Clean Energy Council launched the 'Clean Energy Works for Australia' campaign to address misinformation about renewables. A survey of 2,501 Australians revealed 73% support for hydropower, indicating strong public backing for small-scale hydro projects. The campaign aims to inform voters about clean energy's role in reducing energy bills and creating jobs, highlighting opportunities for small-scale hydropower in Australia's renewable energy landscape.

- In November 2024, at COP29 in Baku, the International Hydropower Association launched the Global Alliance for Pumped Storage (GAPS), with support from over 30 governments, including Australia. This initiative aims to accelerate the deployment of pumped storage hydropower, enhancing energy security and supporting renewable energy integration.

Australia Small-Scale Hydropower Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | Up to 1 MW, 1-10 MW |

| Components Covered | Turbine, Generator, Electric Infrastructure, Intake Valves and Penstock, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia small-scale hydropower market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia small-scale hydropower market on the basis of capacity?

- What is the breakup of the Australia small-scale hydropower market on the basis of component?

- What is the breakup of the Australia small-scale hydropower market on the basis of region?

- What are the various stages in the value chain of the Australia small-scale hydropower market?

- What are the key driving factors and challenges in the Australia small-scale hydropower market?

- What is the structure of the Australia small-scale hydropower market and who are the key players?

- What is the degree of competition in the Australia small-scale hydropower market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia small-scale hydropower market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia small-scale hydropower market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia small-scale hydropower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)