Australia Smart Agriculture Market Size, Share, Trends and Forecast by Agriculture Type, Offering, Farm Size, and Region, 2026-2034

Australia Smart Agriculture Market Summary:

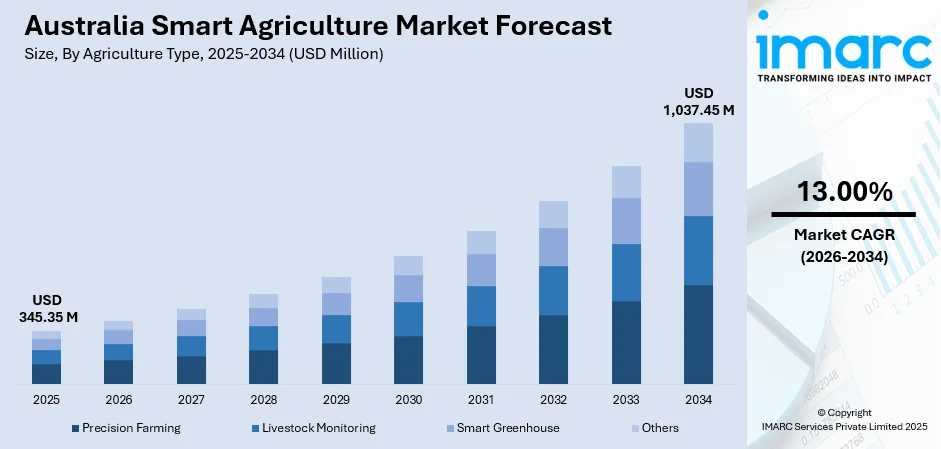

The Australia smart agriculture market size was valued at USD 345.35 Million in 2025 and is projected to reach USD 1,037.45 Million by 2034, growing at a compound annual growth rate of 13.00% from 2026-2034.

The Australian smart agriculture market is growing at a rapid pace due to its rising adoption associated with precision agriculture technology and IoT-based farm and data analytics solutions. In agriculture, farmers and other agricultural stakeholders have been adopting GPS technology and drones to manage farm resources and boost crop production. Additionally, there is increasing focus on sustainable and water conserving agriculture practices in Australia that further adds to its technological adoption.

Key Takeaways and Insights:

- By Agriculture Type: Precision farming dominates the market with a share of 48% in 2025, driven by widespread adoption of GPS guidance systems, variable rate application technologies, and real-time crop monitoring solutions that enable data-driven decision-making and optimize input utilization across large-scale farming operations.

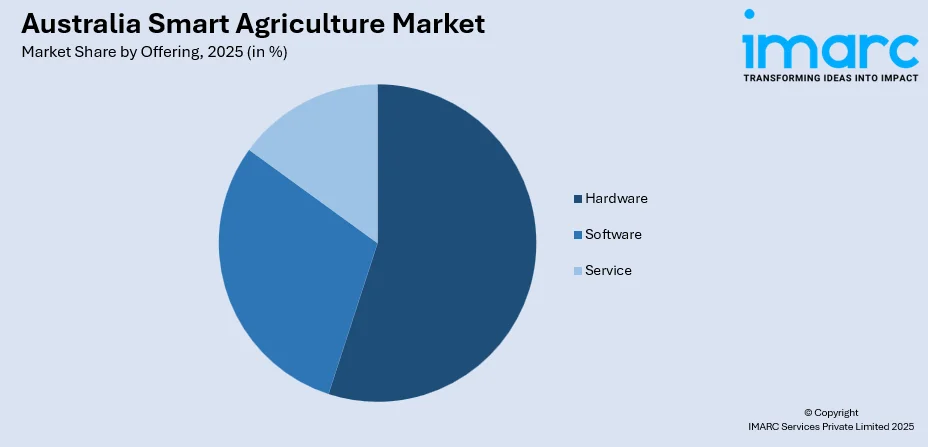

- By Offering: Hardware leads the market with a share of 63% in 2025, attributed to substantial investments in sensors, drones, GPS equipment, and automated machinery that form the foundational infrastructure for smart farming implementations and enable comprehensive field data collection capabilities.

- By Farm Size: Medium dominate the market with a share of 45% in 2025, reflecting the balanced approach of mid-sized agricultural operations that possess sufficient scale to justify technology investments while maintaining operational flexibility to implement integrated smart farming solutions.

- By Region: Australia Capital Territory and New South Wales leads the market with a share of 32% in 2025, supported by concentration of agricultural research institutions, technology providers, and progressive farming communities that drive early adoption of innovative agricultural technologies across diverse crop cultivation.

- Key Players: The Australia smart agriculture market exhibits a moderately competitive landscape with established global technology providers competing alongside innovative domestic agritech startups. Market participants focus on developing integrated solutions combining hardware, software, and services to deliver comprehensive farm management capabilities.

To get more information on this market Request Sample

The Australian smart agriculture sector is driving a major transformation in farming by addressing challenges such as climate variability, water scarcity, and labor shortages. Farmers are adopting interconnected technologies that provide real-time monitoring of soil conditions, crop health, and environmental factors. In 2025 the Australian Government introduced Round 2 of the Climate-Smart Agriculture Program with millions in grants for projects that help farmers adopt climate-resilient and sustainable practices, including soil health improvement and water management. This support is boosting the use of smart farming technologies. Artificial intelligence and machine learning provide predictive analytics that improve yield outcomes and optimize resource use. Government initiatives that promote sustainable practices and technology adoption are enhancing market prospects. Ongoing investment in agricultural research and development strengthens innovation and encourages collaboration between technology providers and farming communities while supporting long-term market growth.

Australia Smart Agriculture Market Trends:

Integration of Artificial Intelligence and Machine Learning

Australian farms are increasingly adopting AI powered decision support systems that analyze large datasets from multiple sources to deliver practical insights. Microsoft Australia and its partners have deployed digital twin platforms that combine soil, satellite, sensor, and weather data using AI. These systems help farmers model fields, plan plantings, and manage environmental conditions in real time. The platforms optimize planting schedules, predict pest risks, and recommend precise input use. Machine learning improves accuracy over time, helping farmers anticipate challenges and boost productivity.

Expansion of Autonomous Agricultural Machinery

The use of autonomous tractors, robotic weeders, and self‑navigating sprayers is expanding across Australian farms. According to reports, in November 2025, SwarmFarm Robotics, a leading ag‑tech company, operated over 250 autonomous robots across millions of acres, assisting growers with spraying, weed control, and crop monitoring. These machines perform field operations with consistent precision, regardless of time or weather. By reducing reliance on manual labor, autonomous equipment helps address ongoing labor shortages in rural areas while enhancing operational efficiency and ensuring critical farming tasks are completed reliably.

Advancement of Drone Technology and Aerial Monitoring

Agricultural drones in Australia are increasingly used for precision spraying, seeding, and detailed crop health monitoring. In December 2025, Hort Innovation launched a major project to develop advanced drone solutions to protect crops from bird damage, conducting multi‑year trials of fixed‑wing and flapping‑wing drones across key horticulture regions. Equipped with multispectral and thermal imaging sensors, these drones generate detailed vegetation indices and detect crop stress before visible symptoms appear. Their aerial reach allows rapid coverage of large areas, enabling timely interventions and efficient resource management across diverse farms.

Market Outlook 2026-2034:

The Australia smart agriculture sector has immense growth potential due to increased technological availability, lowering sensor costs, and an increase in the awareness level of precision agriculture benefits. There is a high priority placed on making technological advancements in agriculture, which have benefits in improved productivity and sustainability. Favorable technological investment conditions exist due to government assistance initiatives and availability of favorable policy structures. Demand from export markets for sustainably produced goods also ensures the use of track and monitor solutions in agriculture. The market generated a revenue of USD 345.35 Million in 2025 and is projected to reach a revenue of USD 1,037.45 Million by 2034, growing at a compound annual growth rate of 13.00% from 2026-2034.

Australia Smart Agriculture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Agriculture Type | Precision Farming | 48% |

| Offering | Hardware | 63% |

| Farm Size | Medium | 45% |

| Region | Australia Capital Territory & New South Wales | 32% |

Agriculture Type Insights:

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

The precision farming dominates with a market share of 48% of the total Australia smart agriculture market in 2025.

Precision farming covers a wide range of technologies to better manage the use of inputs for maximum crop output. Major components of precision farming adopted by farmers in Australia include GPS-guided machinery, soil sensors, and variable rate application systems that distribute precise amounts of irrigation water, fertilizers, and crop protection products to the right places. This reduces great waste and significantly enhances overall farm efficiency and environmental sustainability across diverse farming systems.

The use of precision agriculture technology gathers pace as farmers understand its benefits in relation to low operating costs and stabilized crop production. The feature of real-time field mapping and management allows farmers to provide targeted treatment to various regions within a field depending on their needs. The compatibility of this technology with farm management software offers farmers a holistic management approach that is aligned with sustainable agriculture practices.

Offering Insights:

Access the comprehensive market breakdown Request Sample

- Hardware

- Software

- Service

The hardware leads with a share of 63% of the total Australia smart agriculture market in 2025.

Hardware components are the backbone of smart agriculture on Australian farms, including sensors for soil moisture, temperature, and nutrients, as well as GPS devices, drones, automated irrigation controllers, and connected machinery. In February 2025, John Deere Australia launched its “Precision Essentials” program, enabling farmers to upgrade or retrofit equipment with GPS‑guided and sensor‑enabled technology. Such investments highlight the critical role of physical hardware in supporting comprehensive farm monitoring, automation, and effective precision agriculture practices.

The reduction in sensor and IoT technology costs has made it more accessible for smaller agricultural ventures to adopt smart agriculture hardware. Durability and resistance to harsh environmental factors have ensured that agricultural equipment functions effectively in challenging agricultural seasons. The ability to integrate hardware and software is a benefit that allows farmers to create agricultural technology ecosystems.

Farm Size Insights:

- Small

- Medium

- Large

The medium dominates with a market share of 45% of the total Australia smart agriculture market in 2025.

Medium-scale farming operations reveal the most ideal characteristics for the adoption of smart agriculture technologies, since the balance between scale that justifies investment and operational agility for implementation stands in balance. Farms in this category have ample resources to undertake the deployment of extensive monitoring systems, while flexibility remains on high levels to adjust respective technologies to particular farming practices. Growing solution availability designed for mid-tier scalable operations seeking productivity improvements bolsters the segment.

Medium-scale farms are likely to be adopters of new farm technologies and are encouraged and supported through subsidies and financing options made available by the government. These farms may include diversified crop or mixed farming businesses that largely benefit from farm management solutions that monitor and control their operations. The dominance in the market shows that technologies have been successful in generating returns on investment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales exhibits a clear dominance with a 32% share of the total Australia smart agriculture market in 2025.

The Australia Capital Territory and New South Wales show dominance in the Australia smart agriculture industry with well-developed agricultural systems and early adoption of smart agriculture technology. The use of IoT-enabled sensors, GPS-enabled farming equipment, and data analytics is increasing in a big way in commercial farming operations in this region. The government is supporting such initiatives in agriculture, and this is acting as a booster for smart agriculture technology adoption.

In particular, New South Wales has much to benefit from the large agricultural production in the country, as well as the presence of agritechs, while the Australian Capital Territory focuses on government-led innovation initiatives, in addition to being near research institutions. High awareness among farmers about the efficiency, sustainability, and adaptability of solutions due to climatic change is contributing to investments in intelligent farming solutions.

Market Dynamics:

Growth Drivers:

Why is the Australia Smart Agriculture Market Growing?

Increasing Pressure from Climate Variability and Water Scarcity

Australia’s agriculture faces major challenges from climate variability, including prolonged droughts, extreme weather, and unpredictable rainfall. Smart agriculture technologies help farmers manage these risks through precise water management, real‑time monitoring, and adaptive strategies. Soil moisture sensors and automated irrigation systems optimize water use in drought‑affected areas, ensuring efficient allocation during critical periods. In July 2025, the Australian Government announced over $76 million in climate‑smart agriculture funding to support adoption of resilient practices and technologies. Predictive analytics further enable farmers to anticipate weather risks and adjust operations, strengthening farm resilience and sustaining productivity amid environmental uncertainties.

Government Support and Funding Initiatives for Agricultural Technology

Federal and state governments actively encourage smart agriculture adoption through funding, grants, and supportive policies. In November, the New South Wales Government launched the $25 million Agriculture Industries Innovation and Growth Program to help farmers invest in technologies and equipment that boost productivity, access export markets, and reduce emissions. Climate‑smart initiatives fund sensors, irrigation upgrades, and precision farming tools, while R&D support fosters collaboration between technology providers and farmers. Tax incentives and low‑interest loans further lower financial barriers, accelerating digital transformation and strengthening Australia’s agricultural competitiveness globally.

Persistent Labor Shortages in Rural Agricultural Regions

Australian agriculture faces persistent workforce challenges, with skilled labor scarce in regional and remote areas. Smart agriculture technologies help address these shortages through automation and remote monitoring, reducing reliance on manual labor. According to recent survey, it is found that 77% of employers across the Asia‑Pacific, including Australia’s agricultural sector, struggle to find skilled workers, highlighting the push toward tech solutions. Autonomous machinery performs repetitive tasks with consistent precision, while connected systems allow fewer personnel to manage larger areas. Robotic solutions handle time‑critical activities like harvesting and crop care, making labor‑saving technologies a key driver of investment in smart farming.

Market Restraints:

What Challenges the Australia Smart Agriculture Market is Facing?

High Initial Investment Costs and Implementation Complexity

Technologically advanced agricultural systems require high capital investment for equipment purchases, system implementation, and infrastructure establishment. Small-scale agricultural systems are especially faced with difficulties in rationalizing capital investments in technologies where the return on investment is uncertain and unpredictable. Technologically complex applications demand specialized knowledge, which is not readily available in remote geographical locations or settings.

Limited Connectivity Infrastructure in Remote Agricultural Areas

The farm in Australia might not be connected to the internet, which is a vital component of the precision farm system, which requires the fast transfer of data via the cloud. The regions where the use of the internet is not accessible imply that the use of the internet of things and other devices will not be applicable in that situation.

Technical Skill Gaps and Training Requirements

The optimal use of smart agriculture tools and techniques requires certain levels of technical expertise that many farmers today do not have in their skill sets. The use of complex equipment, understanding data results, and managing interfaces requires some degree of special training and learning and skill upgradation on a regular basis in areas where many farmers lack basic smart agriculture capability and skill sets in today’s fast-evolving tech-driven agriculture industry.

Competitive Landscape:

The Australia smart agriculture market features a dynamic competitive environment comprising established global agricultural technology providers, innovative domestic startups, and specialized equipment manufacturers. Market participants pursue diverse strategies including product innovation, strategic partnerships, and geographic expansion to strengthen their market positions. Technology providers focus on developing integrated solutions that combine hardware, software, and services to deliver comprehensive farm management capabilities. Collaboration between agricultural machinery manufacturers and technology companies accelerates the introduction of connected and autonomous equipment. The competitive landscape rewards companies demonstrating strong local market understanding and ability to deliver solutions adapted to Australian agricultural conditions and farming practices.

Recent Developments:

- In September 2025, Western Sydney University launched the ARC Training Centre for Smart & Sustainable Horticulture, a national collaboration to advance horticulture with smart technology, sustainability, and industry partnerships. It will train researchers and industry leaders to transform protected cropping and bolster Australia’s horticulture innovation.

Australia Smart Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agriculture Types Covered | Precision Farming, Livestock Monitoring, Smart Greenhouse, Other |

| Offerings Covered | Hardware, Software, Service |

| Farm Sizes Covered | Small, Medium, Large |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia smart agriculture market size was valued at USD 345.35 Million in 2025.

The Australia smart agriculture market is expected to grow at a compound annual growth rate of 13.00% from 2026-2034 to reach USD 1,037.45 Million by 2034.

Precision farming dominated the market with approximately 48% share, driven by widespread adoption of GPS-guided systems, variable rate technologies, and integrated crop monitoring solutions that optimize agricultural inputs and enhance yield productivity across Australian farming operations.

Key factors driving the Australia smart agriculture market include increasing climate variability necessitating precision water management, government funding programs supporting agricultural technology adoption, persistent labor shortages in rural regions accelerating automation demand, and growing export market requirements for sustainable and traceable production practices.

Major challenges include high initial technology investment costs particularly for smaller operations, limited connectivity infrastructure in remote farming regions, technical skill gaps requiring ongoing training programs, data management complexity, and fragmented state-level regulations affecting technology deployment across different jurisdictions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)