Australia Smart Buildings Market Report by Component (Solution, Services), End Use (Residential, Commercial, Industrial) and Region 2025-2033

Australia Smart Buildings Market Overview:

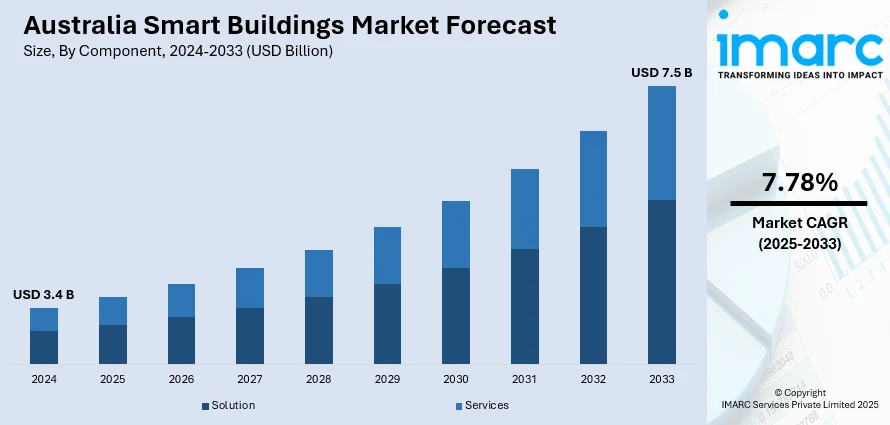

The Australia smart buildings market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.78% during 2025-2033. Increasing energy efficiency regulations, government incentives, rising demand for sustainable infrastructure, the Internet of Things (IoT) integration in building systems, the growing urbanization, advancements in automation technologies, the push for carbon emission reduction, and rising consumer interest in smart home technologies are fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Market Growth Rate 2025-2033 | 7.78% |

Australia Smart Buildings Market Trends:

Energy Efficiency Regulations and Green Building Practices

Stringent energy efficiency standards in Australia plays a key role in driving the market growth. The policy mandates that a building meet certain criteria to lower the energy use and carbon footprint, which has further surged the demand for smart technologies, such as automated lighting systems and heating, ventilation, and air conditioning (HVAC) systems. Moreover, the Green Star certification by the Green Building Council of Australia has compelled the developers to move toward more sustainable designs, which is further propelling the market growth. Apart from this, the integration of advanced energy management systems with smart buildings to monitor and control real-time energy use, which is creating a positive market outlook.

To get more information of this market, Request Sample

Government Initiatives and Incentives

Sustainability is a core initiative undertaken by the Australian government, and umpteen local initiatives are in place providing incentives to promote smart building technologies. For instance, the National Australian Built Environment Rating System (NABERS) provides environmental performance ratings and encourage developers to develop energy efficient buildings. Moreover, green building tax incentives and rebates have spurred the use of smart products for both commercial and residential buildings, which is further boosting the market growth. In addition to this, the government is also working to raise awareness regarding energy efficient and smart infrastructure, which is propelling the market growth.

IoT Integration for Building Automation

The integration of IoT in building management systems is revolutionizing the way smart buildings operate in Australia. IoT enables real-time monitoring and control of critical systems like lighting, HVAC, and security through connected devices. These systems use data-driven insights to optimize performance, reduce energy waste, and enhance occupant comfort. Automated lighting can adjust based on natural light levels or occupancy, while HVAC systems can be fine-tuned to maintain optimal temperature settings depending on building use patterns. IoT also facilitates predictive maintenance by alerting operators about potential equipment failures before they occur.

Australia Smart Buildings Market News:

- In 2023, ABB made a significant move in Australia's smart building sector by launching its Cylon Building Management System (BMS). This system is designed to enhance energy efficiency and sustainability in commercial buildings by offering advanced control and automation capabilities. The Cylon BMS allows for real-time monitoring of building operations, helping property managers reduce energy consumption and optimize building performance.

Australia Smart Buildings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, and end use.

Component Insights:

- Solution

- Safety and Security Management

- Access Control System

- Video Surveillance System

- Fire And Life Safety System

- Energy Management

- HVAC Control System

- Lighting Management System

- Others

- Building Infrastructure Management

- Parking Management System

- Water Management System

- Others

- Integrated Workplace Management System (IWMS)

- Real Estate Management

- Capital Project Management

- Facility Management

- Operations and Services Management

- Environment and Energy Management

- Network Management

- Wired Technology

- Wireless Technology

- Safety and Security Management

- Services

- Consulting

- Implementation

- Support and Maintenance

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution [safety and security management (access control system, video surveillance system, fire and life safety system), energy management (HVAC control system, lighting management system, others), building infrastructure management (parking management system, water management system, others), integrated workplace management system (IWMS) (real estate management, capital project management, facility management, operations and services management, environment and energy management), network management (wired technology, wireless technology)], and services [consulting, implementation, support and maintenance].

End Use Insights:

- Residential

- Commercial

- Healthcare

- Retail

- Academic

- Others

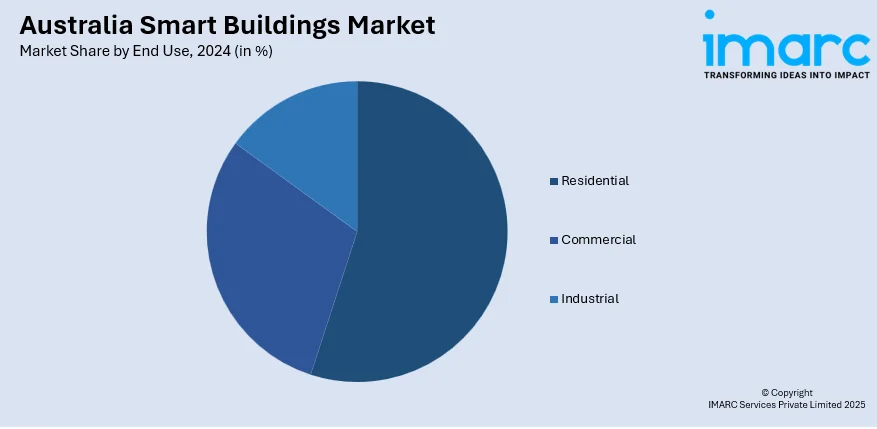

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial (healthcare, retail, academic, others) and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Buildings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End Uses Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart buildings market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia smart buildings market?

- What is the breakup of the Australia smart buildings market on the basis of component?

- What is the breakup of the Australia smart buildings market on the basis of end use?

- What are the various stages in the value chain of the Australia smart buildings market?

- What are the key driving factors and challenges in the Australia smart buildings?

- What is the structure of the Australia smart buildings market and who are the key players?

- What is the degree of competition in the Australia smart buildings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart buildings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart buildings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart buildings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)