Australia Smart Conveyor Systems Market Size, Share, Trends and Forecast by Component, Product Type, Technology, Automation Level, Industry Vertical, and Region, 2025-2033

Australia Smart Conveyor Systems Market Overview:

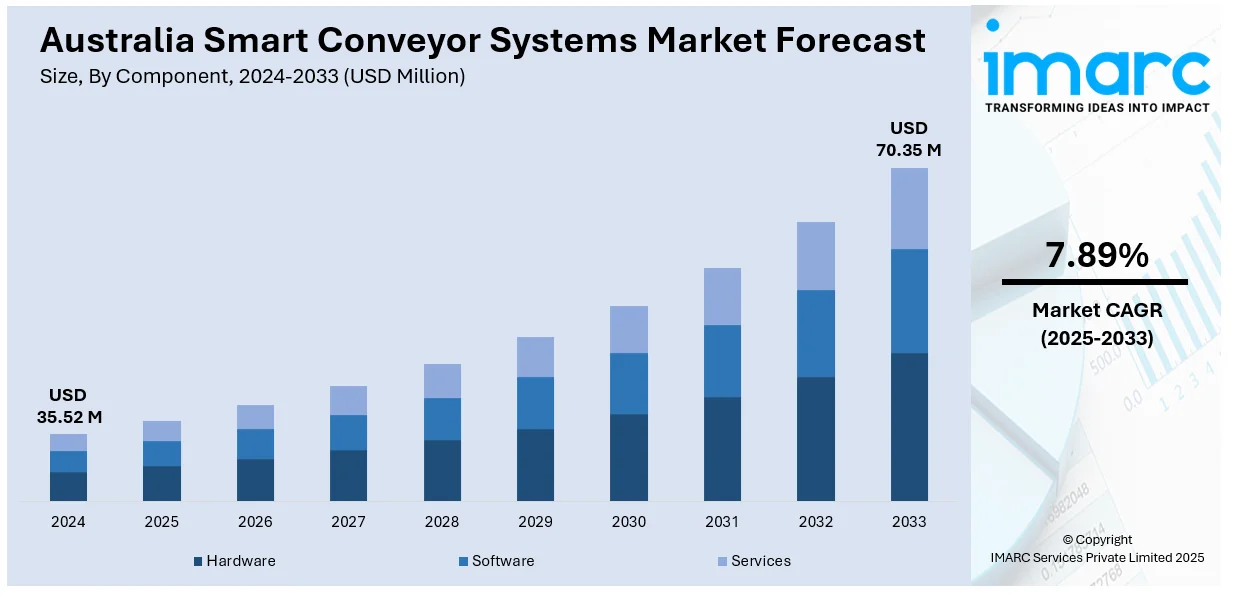

The Australia smart conveyor systems market size reached USD 35.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.35 Million by 2033, exhibiting a growth rate (CAGR) of 7.89% during 2025-2033. The market is expanding due to rising automation, the push for operational efficiency, and the adoption of Industry 4.0 technologies. Businesses are integrating intelligent systems like Internet of Things (IoT)and artificial intelligence (AI) to streamline operations and minimize unplanned downtime. Simultaneously, growing environmental concerns and sustainability goals are encouraging companies to adopt energy-efficient solutions. These smart systems boost productivity and support eco-friendly practices, aligning with both regulatory expectations and evolving corporate responsibility standards is impelling the Australia smart conveyor systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.52 Million |

| Market Forecast in 2033 | USD 70.35 Million |

| Market Growth Rate 2025-2033 | 7.89% |

Australia Smart Conveyor Systems Market Trends:

Integration of AI, IoT, and Predictive Maintenance

Australian industries are increasingly modernizing their conveyor systems with smart technologies such as artificial intelligence (AI), the Internet of Things (IoT), and predictive maintenance tools. These upgrades allow real-time monitoring of machinery, helping operators identify performance issues early and plan maintenance before problems escalate. This proactive approach reduces unplanned downtime and keeps operations running smoothly. The combination of machine learning and connected sensors also enhances decision-making, making conveyor systems more responsive and adaptive to workload changes. Industries like mining and manufacturing particularly benefit from these systems, as they improve reliability and worker safety. In a notable development from 2024, BHP partnered with Microsoft to implement AI-driven optimization at its Escondida copper mine in Chile, aiming to enhance ore processing and grade recovery through real-time data analysis and AI-based recommendations. Overall, this integration is helping businesses streamline operations while reducing disruptions and maintenance expenses.

To get more information on this market, Request Sample

Emphasis on Energy Efficiency and Sustainability

Both environmental sustainability and energy efficiency are now at the forefront of priorities for Australian industries, ranging from logistics to manufacturing. Conveyor systems are now designed to be smart with an eye on sustainability, employing energy-efficient motors, shutdown automation, and optimized paths to reduce waste. These conveyor systems are also increasingly made from recyclable components and are even designed to be easily dismantled for more sustainable end-of-life disposal. By incorporating green components and operation processes, businesses are trying to minimize their footprint on the environment as well as lower energy expenses. This phenomenon is a part of a greater trend toward greener industrial processes, where technology is harmonized with sustainability. By doing so, businesses are complying with regulatory requirements and public pressure for more sustainable solutions.

Adoption of Modular and Flexible Conveyor Designs

Flexibility is emerging as a key design criterion for the design of smart conveyor systems in Australia. Modular conveyor configurations are increasingly popular because they can be easily adapted to various production requirements and factory configurations. The systems are simple to add, re-design, or move, which benefits companies with changing production levels or product types. This modularity also makes it easy to integrate new technology such as scanners, sorters, and robotic arms. It facilitates a more dynamic and responsive production setup, enabling companies to respond rapidly to market needs or process shifts. Companies are therefore opting for modular systems to remain competitive, control costs, and future-proof their operations against changing industrial requirements further contributing to the Australia smart conveyor systems market growth.

Australia Smart Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, product type, technology, automation level, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Product Type Insights:

- Belt Conveyors

- Roller Conveyors

- Overhead Conveyors

- Pallet Conveyors

- Sortation Systems

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes belt conveyors, roller conveyors, overhead conveyors, pallet conveyors, and sortation systems.

Technology Insights:

- IoT-Enabled Conveyors

- AI-Driven Systems

- Robotic Integration

- RFID and Barcode Scanning

The report has provided a detailed breakup and analysis of the market based on the technology. This includes IoT-enabled conveyors, AI-driven systems, robotic integration, and RFID and barcode scanning.

Automation Level Insights:

- Semi-Automated Conveyor Systems

- Fully Automated Conveyor Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes semi-automated conveyor systems and fully automated conveyor systems.

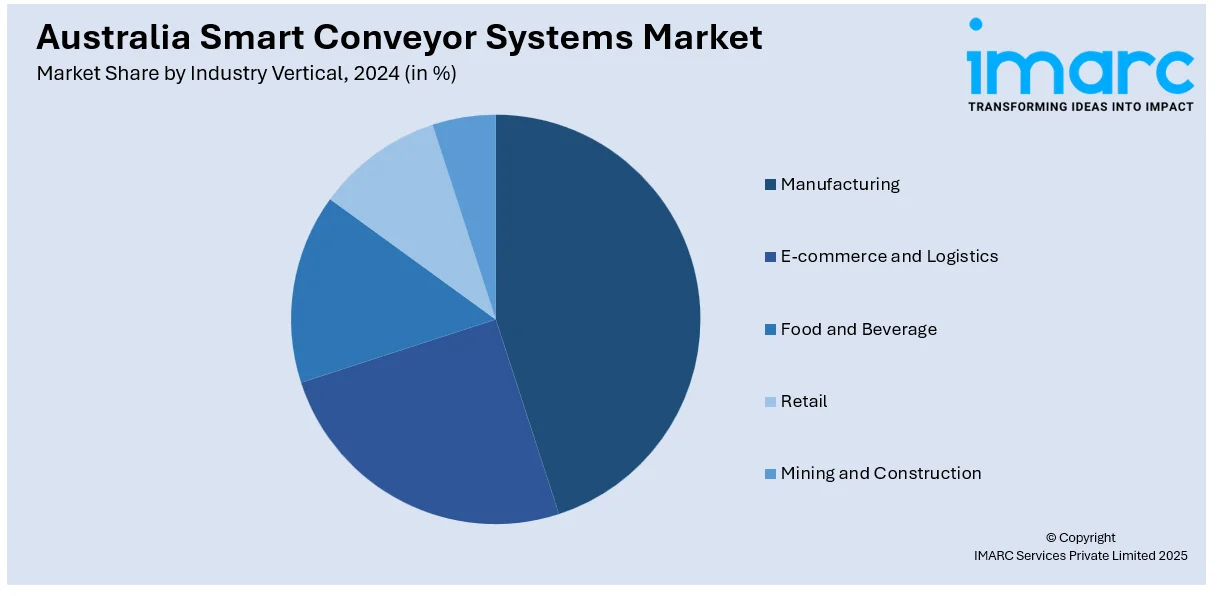

Industry Vertical Insights:

- Manufacturing

- E-commerce and Logistics

- Food and Beverage

- Retail

- Mining and Construction

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes manufacturing, e-commerce and logistics, food and beverage, retail, and mining and construction.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Conveyor Systems Market News:

- In April 2025, Fenner Conveyors and Rio Tinto renewed their partnership with a five-year contract, securing the supply of Australian-made conveyor belts and splice kits for Rio Tinto’s iron ore operations. The agreement supports local manufacturing, sustainability goals, and supply chain resilience. Both companies also continue to collaborate on social initiatives, including gender diversity and community engagement, through partnerships with NAWO and events in Western Australia’s Pilbara region.

Australia Smart Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Product Types Covered | Belt Conveyors, Roller Conveyors, Overhead Conveyors, Pallet Conveyors, Sortation Systems |

| Technologies Covered | IoT-Enabled Conveyors, AI-Driven Systems, Robotic Integration, RFID and Barcode Scanning |

| Automation Levels Covered | Semi-Automated Conveyor Systems, Fully Automated Conveyor Systems |

| Industry Verticals Covered | Manufacturing, E-commerce and Logistics, Food and Beverage, Retail, Mining and Construction |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart conveyor systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart conveyor systems market on the basis of component?

- What is the breakup of the Australia smart conveyor systems market on the basis of product type?

- What is the breakup of the Australia smart conveyor systems market on the basis of technology?

- What is the breakup of the Australia smart conveyor systems market on the basis of automation level?

- What is the breakup of the Australia smart conveyor systems market on the basis of industry vertical?

- What is the breakup of the Australia smart conveyor systems market on the basis of region?

- What are the various stages in the value chain of the Australia smart conveyor systems market?

- What are the key driving factors and challenges in the Australia smart conveyor systems?

- What is the structure of the Australia smart conveyor systems market and who are the key players?

- What is the degree of competition in the Australia smart conveyor systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart conveyor systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)