Australia Smart Factory Market Size, Share, Trends and Forecast by Field Devices, Technology, End Use Industry, and Region, 2025-2033

Australia Smart Factory Market Overview:

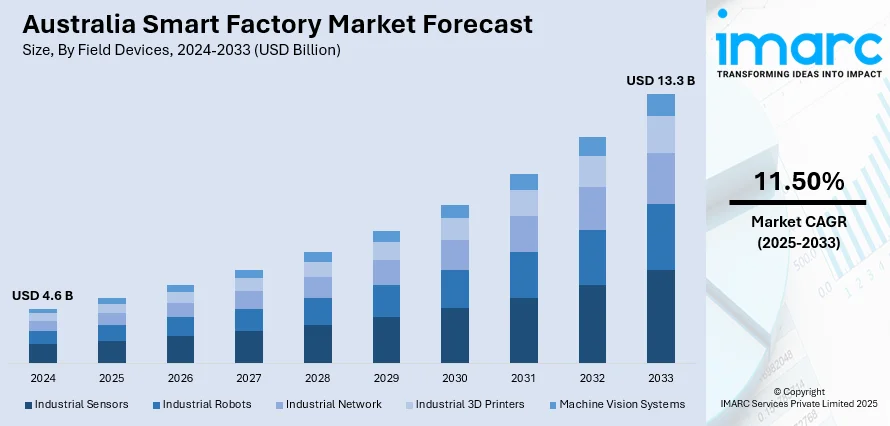

The Australia smart factory market size reached USD 4.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.3 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market for smart factory is growing heavily, with IoT, AI, ML, and collaborative robots driving the expansion. These help to increase the efficiency of operation, minimize downtime, and make production more effective. The industry is projected to grow exponentially with more investments made in automation as well as data-driven manufacturing practices defining the way forward for the sector, including the rising Australia smart factory market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.6 Billion |

| Market Forecast in 2033 | USD 13.3 Billion |

| Market Growth Rate 2025-2033 | 11.50% |

Australia Smart Factory Market Trends:

Integration of IoT in Smart Factories

Internet of Things (IoT) integration is among the primary factors driving Australia's smart factory evolution. IoT makes it possible to link a diverse array of devices, sensors, and machines in factories, generating an interrelated network that supports operational efficiency. Through the implantation of sensors on production lines and equipment, manufacturers can gain real-time insights into different elements, including performance, temperature, and maintenance requirements. This ongoing monitoring results in early problem detection, predictive maintenance, and reduced downtime. In Australia, the enhanced use of IoT in smart factories enables automation and optimization, enabling improved decision-making and enhanced workflow. IoT also facilitates better supply chain management through complete visibility and improved tracking. Australia smart factory market outlook is favorable, with IoT contributing strongly towards market growth. For instance, Bystronic, in collaboration with Lowa Lighting, opened Australia's first Smart Factory in Sydney. The plant will manufacture 400,000 LED lamps for NSW public schools, a major milestone in Australia's smart factory development with expansion plans over the next five years. Moreover, as more industries realize the value of IoT, its share within the Australian manufacturing sector is expected to increase rapidly.

To get more information on this market, Request Sample

Artificial Intelligence and Machine Learning in Manufacturing

Artificial Intelligence (AI) and Machine Learning (ML) are becoming the foundational pillars of smart factories in Australia, leading to efficiencies in manufacturing operations. AI systems can analyze and process massive amounts of data in real-time, allowing manufacturers to streamline production processes, anticipate demand, and minimize wastage. Machine learning, a type of AI, allows systems to learn and develop on their own by adapting from patterns and past data. This flexibility is key to optimizing processes such as quality control, inventory management, and scheduling. AI and ML also enable predictive maintenance by detecting likely machine failures before they happen, minimizing unplanned downtime. In Australia, the market for smart factories mirrors increasing investments in these technologies, which are reconfiguring conventional factories into sophisticated, data-driven settings. As the manufacturing industry continues to adopt AI and ML, these technologies are set to take a considerable Australia smart factory market growth, improving productivity, reducing costs, and overall manufacturing capability.

Adoption of Collaborative Robots (Cobots)

The use of collaborative robots (cobots) is a revolutionary trend in Australia's intelligent factories, enabling manufacturers to increase productivity without sacrificing flexibility in the workforce. Cobots are programmed to coexist with human workers safely, helping with repetitive, heavy-duty, or precision work. In contrast to conventional industrial robots, cobots are light, simple to program, and versatile in handling different tasks, making them a perfect fit for small and medium-sized businesses (SMEs) that wish to adopt automation without the necessity of large-scale infrastructure adjustments. Cobots enhance the speed and precision of tasks as well as worker safety by performing hazardous tasks. In Australia, the use of cobots is projected to increase as companies see value in using them to increase efficiency and cut labor expenses. Australia smart factory market outlook points to cobots as an important growth sector within the overall trend of automation. As robotics gets better, cobots will be central to the future of Australian manufacturing and again spur the adoption of smart factories.

Australia Smart Factory Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on field devices, technology, and end use industry.

Field Devices Insights:

- Industrial Sensors

- Industrial Robots

- Industrial Network

- Industrial 3D Printers

- Machine Vision Systems

The report has provided a detailed breakup and analysis of the market based on the field devices. This includes industrial sensors, industrial robots, industrial network, industrial 3D printers, and machine vision systems.

Technology Insights:

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)

- Enterprise Resource Planning (ERP)

- Manufacturing Execution Systems (MES)

- Distributed Control Systems (DCS)

- Industrial Control System

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes product lifecycle management (PLM), human machine interface (HMI), enterprise resource planning (ERP), manufacturing execution systems (MES), distributed control systems (DCS), industrial control system, and others.

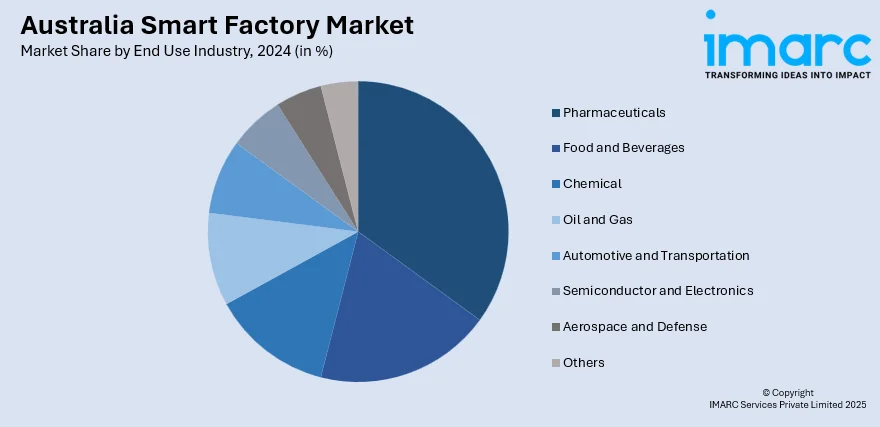

End Use Industry Insights:

- Pharmaceuticals

- Food and Beverages

- Chemical

- Oil and Gas

- Automotive and Transportation

- Semiconductor and Electronics

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes pharmaceuticals, food and beverages, chemical, oil and gas, automotive and transportation, semiconductor and electronics, aerospace and defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Factory Market News:

- In March 2024, Deloitte's Australia practice has purchased Efficientia Solutions, a firm that specializes in automated software solutions and productivity enhancement for the manufacturing and industrial industries. The acquisition further enhances Deloitte's capabilities in smart manufacturing through the addition of automation, manufacturing execution systems, and integrating operations technology with enterprise IT systems to enhance clients' productivity.

Australia Smart Factory Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Field Devices Covered | Industrial Sensors, Industrial Robots, Industrial Network, Industrial 3D Printers, Machine Vision Systems |

| Technologies Covered | Product Lifecycle Management (PLM), Human Machine Interface (HMI), Enterprise Resource Planning (ERP), Manufacturing Execution Systems (MES), Distributed Control Systems (DCS), Industrial Control System, Others |

| End Use Industries Covered | Pharmaceuticals, Food and Beverages, Chemical, Oil and Gas, Automotive and Transportation, Semiconductor and Electronics, Aerospace and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart factory market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart factory market on the basis of field devices?

- What is the breakup of the Australia smart factory market on the basis of technology?

- What is the breakup of the Australia smart factory market on the basis of end use industry?

- What is the breakup of the Australia smart factory market on the basis of region?

- What are the various stages in the value chain of the Australia smart factory market?

- What are the key driving factors and challenges in the Australia smart factory?

- What is the structure of the Australia smart factory market and who are the key players?

- What is the degree of competition in the Australia smart factory market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart factory market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart factory market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart factory industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)