Australia Smart Grid Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2025-2033

Australia Smart Grid Market Size and Share:

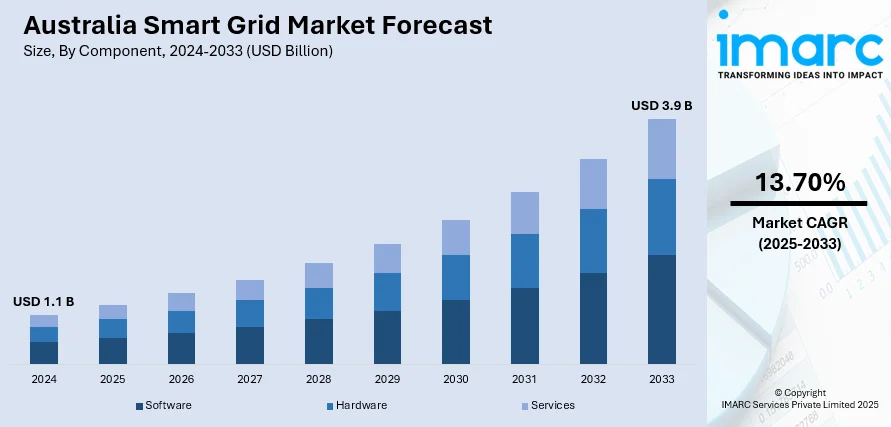

The Australia smart grid market size reached USD 1.1 Billion in 2024. Looking forward, the market is expected to reach USD 3.9 Billion by 2033, exhibiting a growth rate (CAGR) of 13.70% during 2025-2033. The market is fueled by increased demand for automobile manufacturing and consumer wants for comfort and safety features. The widespread adoption of sophisticated seating technologies, such as ergonomic compositions and light materials, is transforming the market. Automotive manufacturers are placing emphasis on seat functionality and design improvement to meet changing consumer needs. Consequently, major players are attempting to capture a majority of the Mexico automotive seat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Market Growth Rate 2025-2033 | 13.70% |

Key Trends of Australia Smart Grid Market:

Sustained Expansion of Advanced Metering Infrastructure (AMI)

Advanced Metering Infrastructure (AMI) rollouts across Australia are transforming the nation's smart grid market. AMI units allow utilities to collect real-time, granular energy usage information, providing valuable information to manage the grid better as well as optimize efficiency operation. AMI allows two-way communication between the utility and consumer, allowing dynamic pricing and allowing consumers to have better control of energy usage. This is particularly important as Australia transitions to a more sustainable energy future, where electricity demand becomes increasingly variable with the inclusion of renewable energy. As the deployment of AMI accelerates, it contributes to Australia's expansion in the smart grid market by allowing utilities to better manage demand, reduce energy losses, and improve service reliability. Its increase in AMI systems will also be felt in Australia's share in the smart grid market, making AMI a foundation of future energy infrastructure growth.

To get more information on this market, Request Sample

Integration of Renewable Energy Sources

Australia's intelligent grid system is taking center stage in the integration of renewable energy resources, including solar and wind energy, into the national grid. This integration is crucial as the nation strives to achieve its sustainability goals and cut back on dependence on conventional fossil fuels. Smart grids facilitate effective management of renewable energy through real-time monitoring and control, essential in managing the variability of renewable generation. With additional renewable energy developments going online, Australia's smart grid infrastructure is adapting to mitigate the variability of power supply and demand with a view to maximizing grid stability. The adoption of renewable energy has a direct influence on Australia smart grid market growth, with the demand for innovative technologies to enable the move towards a clean energy future. According to the reports, in April 2025, EnergyLab chose 10 clean energy startups globally to participate in its Scaleup Program, encouraging partnerships with Australian energy companies to speed up grid decarbonisation and smart energy innovation. Further, Australia's smart grid market share will keep growing as more advanced grid management solutions are deployed by utilities to adapt to renewable energy.

Deployment of Grid Automation and Monitoring Technologies

Australia is spending large amounts on grid automation and monitoring technologies, crucial to the optimal operation and stability of its smart grid infrastructure. As per the sources, in April 2025, Federation Asset Management established a long-duration energy storage investment platform in Australia to access sizeable battery storage potential and enhance national grid stability and energy security. Moreover, such technologies, such as real-time sensors, automated switching, and predictive analytics, allow utilities to identify faults rapidly, reduce downtime, and enhance overall grid performance. Automation enables improved coordination between conventional and renewable energy resources, enhancing grid stability and reducing costs. Moreover, the installation of high-end monitoring technology facilitates improving forecasting energy usage trends, with utilities better capable of streamlining energy delivery to curb wastage. As dependable and effective power solutions are becoming more sought-after, automation technology and monitoring as integral parts of Australia's intelligent grid network assumes ever-growing prominence. This transition should play a significant role in Australia's share of the smart grid market, with automation and monitoring technologies being central to driving market growth and enhanced grid management.

Growth Drivers of Australia Smart Grid Market:

Rising Electricity Demand and Urbanization

As Australia’s population grows and urban development accelerates, electricity demand continues to rise, particularly in densely populated cities. This boom is weighing down on the conventional grid systems, presenting the necessity of more intelligent, responsive energy infrastructure. The smart grids overcome this problem by introducing dynamic load management, blackouts are less likely, and energy distribution is more efficient. Such systems can track the trends of consumption in real time and adjust to fluctuations in demand to provide a stable supply even during high times when demand is the highest. Moreover, the smart grid promotes sustainable urbanization because renewable sources can be integrated into the city using the system, and their efficiency is increased. Their ability to meet the rising electricity needs of expanding urban environments is a major factor driving Australia smart grid market demand.

Shift Toward Decentralized Energy Systems

Australia’s energy landscape is rapidly shifting toward decentralized systems due to the widespread adoption of rooftop solar panels and residential battery storage. This move away from centralized generation demands a grid capable of managing complex, two-way power flows and localized energy production. Smart grid technologies are crucial to enabling this transformation, as they provide advanced control systems, real-time monitoring, and data analytics to balance and optimize energy use at the local level. By improving integration with distributed energy resources (DERs), smart grids increase energy resilience and reduce dependence on traditional power plants. This shift not only empowers consumers but also promotes a more flexible, efficient, and sustainable national energy infrastructure.

Consumer Demand for Energy Control

Australian consumers are increasingly seeking more control over their energy usage, driven by rising electricity prices and a growing interest in sustainable living. Smart grid technologies cater to this demand by providing real-time consumption data, user-friendly energy management platforms, and flexible billing systems such as time-of-use pricing. These tools help consumers make informed decisions about when and how they use electricity, leading to potential cost savings and reduced environmental impact. Additionally, smart appliances and home automation systems further enhance user control and convenience. This evolving consumer mindset is pushing utilities to modernize their services, making customer engagement and personalized energy solutions key drivers in the broader adoption of smart grids.

Opportunities of Australia Smart Grid Market:

Growth of Electric Vehicle (EV) Infrastructure

The rising adoption of electric vehicles across Australia is opening new avenues for smart grid integration. With an increase in EVs' electric supply, there is a need to handle charging needs, particularly during peak load. Otherwise, there may be a likelihood of overloading the grid. Smart grids provide smart charging capabilities with smooth load distribution and load reduction, and optimization by time of use. Also, vehicle-to-grid (V2G) systems allow bi-directional supply and demand of energy, with the power stored in EVs able to be redeployed back into the grid to support periods of high demand. This helps in grid stability and draws maximum utilization of energy. The development in EV infrastructure is well in line with the visions of decarbonization and energy decentralization, which sets the utilities with a great reason to invest in smart grid features adapted to electric mobility integration.

Development of Energy-as-a-Service Models

Smart grid advancement is driving the evolution of Energy-as-a-Service (EaaS) business models in Australia. Instead of merely supplying electricity, utilities are beginning to offer a suite of value-added services, such as real-time energy management, predictive maintenance, demand response, and consumption analytics. According to the Australia smart grid market analysis, these services are tailored to specific customer needs, providing both operational savings and enhanced energy efficiency. Through smart grid platforms, utilities can better engage with customers, offering subscription-based or performance-based packages that generate recurring revenue. EaaS models also promote proactive energy use behavior, supporting broader sustainability goals. As competition among utilities increases and consumer expectations rise, EaaS provides a dynamic pathway for market differentiation and long-term customer retention.

Expansion into Remote and Off-Grid Areas

Deploying smart grid technology in Australia’s remote and off-grid regions presents significant opportunities for market expansion. Traditional grid infrastructure is often costly and impractical in these areas, but smart solutions—such as microgrids, renewable energy integration, and autonomous control systems—offer cost-effective alternatives. These localized smart grids provide reliable electricity access, reduce dependency on diesel generators, and enhance energy resilience for isolated communities. Additionally, they support critical services like healthcare, education, and communications, where a consistent power supply is essential. Government-backed rural electrification programs and funding initiatives further support such deployments. By closing the energy access gap, smart grids contribute to equitable development while opening new commercial opportunities in previously underserved markets.

Challenges of Australia Smart Grid Market:

High Initial Investment and Upgrade Costs

Establishing smart grid infrastructure demands substantial upfront investment in areas such as advanced sensors, communication systems, control software, and cybersecurity frameworks. These costs can be a major barrier, particularly for smaller utilities and those operating in rural or low-revenue areas. Beyond initial deployment, ongoing maintenance, workforce training, and system upgrades add to the financial burden. While long-term savings and efficiencies are often promised, the delayed return on investment can deter stakeholders from committing resources early. Limited access to financing or incentives also restricts the pace of adoption. For smart grid expansion to be more inclusive, targeted government support and innovative funding models will be essential to help bridge the affordability gap in less-resourced regions.

Interoperability and Legacy System Integration

A major challenge in Australia’s transition to smart grids lies in integrating new technologies with existing, often outdated, grid infrastructure. Many legacy systems lack compatibility with modern digital components, making seamless data exchange and coordinated operations difficult. Achieving interoperability across multiple platforms—ranging from energy management systems to IoT devices—requires complex system redesigns, software upgrades, and standardization efforts. These processes not only demand technical expertise but also involve considerable time and investment. Furthermore, inconsistent protocols between different vendors and utilities complicate collaboration and data sharing. Without resolving these integration challenges, the potential benefits of smart grids—such as real-time control and network responsiveness—may remain partially unrealized, slowing progress across the national grid network.

Data Privacy and Cybersecurity Risks

Smart grids rely on vast amounts of data transmitted through interconnected communication networks, making them vulnerable to cyber threats and data breaches. From smart meters to control systems, every connected device represents a potential entry point for malicious attacks. Ensuring the confidentiality and integrity of customer data, energy usage patterns, and operational commands is critical for both utility providers and consumers. Cybersecurity strategies must evolve to address increasingly sophisticated threats while maintaining system availability and resilience. Regulatory frameworks around data protection are also becoming more stringent, requiring utilities to implement advanced compliance protocols. Balancing technological innovation with robust cybersecurity measures is a persistent challenge, especially as digital transformation accelerates across Australia’s energy sector.

Government Support of Australia Smart Grid Market:

Federal and State-Level Funding Initiatives

To drive the advancement of smart grid technologies, both federal and state governments in Australia have introduced a range of funding mechanisms, including grants, subsidies, and financial incentives. These programs are designed to support early-stage research, technology pilot trials, and the broader rollout of smart grid systems, especially in the context of integrating renewable energy sources and modernizing outdated grid infrastructure. Funding is often directed at projects that demonstrate measurable improvements in energy efficiency, grid resilience, and carbon emissions reduction. These initiatives not only reduce the financial burden on utilities and technology providers but also encourage innovation, collaboration, and faster market adoption of intelligent energy solutions across urban, suburban, and rural communities.

National Energy Policies and Regulatory Frameworks

Australia’s smart grid development is strongly supported by national energy strategies and regulatory frameworks that emphasize grid modernization, sustainability, and energy market competitiveness. Central to this is the National Electricity Objective, which aims to ensure reliable, secure, and affordable electricity supply through technological innovation. Additionally, national and state-level energy transition roadmaps outline long-term goals for decarbonization and digital transformation. These policies establish clear guidelines for grid upgrades, promote the integration of renewables, and encourage the use of advanced technologies such as automation, demand-side management, and data analytics. By creating a stable and forward-looking regulatory environment, these frameworks provide confidence to investors and stakeholders, accelerating the deployment of smart grid solutions across the energy sector.

Support for Innovation and Public-Private Partnerships

The Australian government actively promotes innovation in the smart grid sector through strong support for public-private partnerships. Collaborations between utilities, technology companies, universities, and research bodies are encouraged through dedicated funding, policy incentives, and co-development programs. These partnerships focus on areas such as AI-driven grid optimization, demand response platforms, peer-to-peer energy trading, and community-based energy solutions. Such initiatives foster experimentation and speed up the commercialization of emerging technologies, while also addressing practical implementation challenges. By combining private sector agility with public sector support and oversight, these collaborations play a vital role in scaling up smart grid applications, ensuring that innovation translates into real-world benefits for consumers, businesses, and the broader energy ecosystem.

Australia Smart Grid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component and end-user.

Component Insights:

- Software

- Advanced Metering Infrastructure

- Smart Grid Distribution Management

- Smart Grid Network Management

- Substation Automation

- Others

- Hardware

- Sensor

- Programmable Logic Controller

- AMI Meter

- Networking Hardware

- Others

- Services

- Consulting

- Support and Maintenance

- Deployment and Integration

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (advanced metering infrastructure, smart grid distribution management, smart grid network management, substation automation, and others), hardware (sensor, programmable logic controller, AMI meter, networking hardware, and others), and services (consulting, support and maintenance, and deployment and integration).

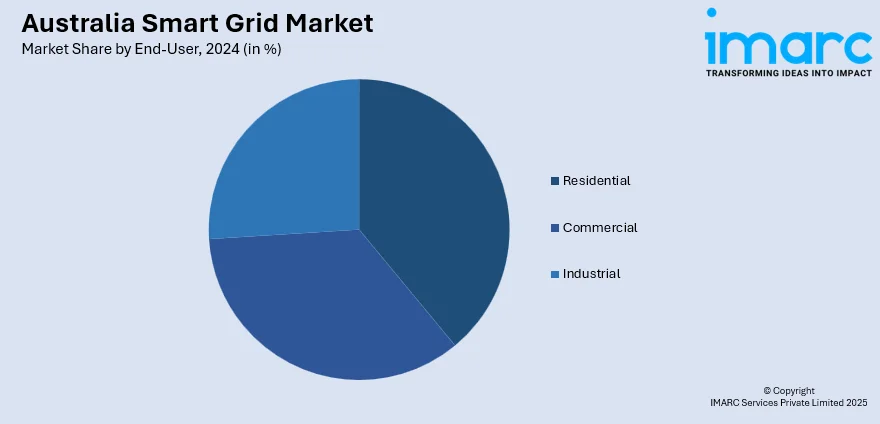

End-User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Grid Market News:

- In November 2024, Landis+Gyr and Sense collaborated to speed up the energy transition in Australia and New Zealand. The partnership combines Sense's machine learning software with Landis+Gyr's intelligent meters, offering real-time insights and predictive analytics for utilities to better manage energy resources and enable grid flexibility.

- In March 2024, the Australian Energy Market Commission (AEMC) expedited a rule amendment to speed up smart meter rollouts. Backed by SA Power Networks, Alinta Energy, and Intellihub, the project targets ubiquitous smart meter installation by 2030, with steps to enhance consumer protections as well as incorporate power quality information.

Australia Smart Grid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart grid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart grid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart grid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart grid market in Australia was valued at USD 1.1 Billion in 2024.

The Australia smart grid market is projected to exhibit a CAGR of 13.70% during 2025-2033.

The Australia smart grid market is projected to reach a value of USD 3.9 Billion by 2033.

Rising electricity consumption, increasing electric vehicle adoption, and the shift toward decentralized renewable energy systems are key growth drivers. Consumer demand for energy efficiency, coupled with strong government support, funding incentives, and policy frameworks, is accelerating the deployment of smart grid technologies across Australia’s urban and rural regions.

The key trend of the Australia smart grid market is evolving with AI-driven energy management, real-time analytics, and integration of EV infrastructure. Growth in peer-to-peer energy trading, microgrids for remote areas, and blockchain-based solutions reflects rising demand for flexibility, transparency, and resilience in grid operations and consumer-centric energy ecosystems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)