Australia Smart Manufacturing Market Size, Share, Trends and Forecast by Component, Technology, End Use, and Region, 2025-2033

Australia Smart Manufacturing Market Overview:

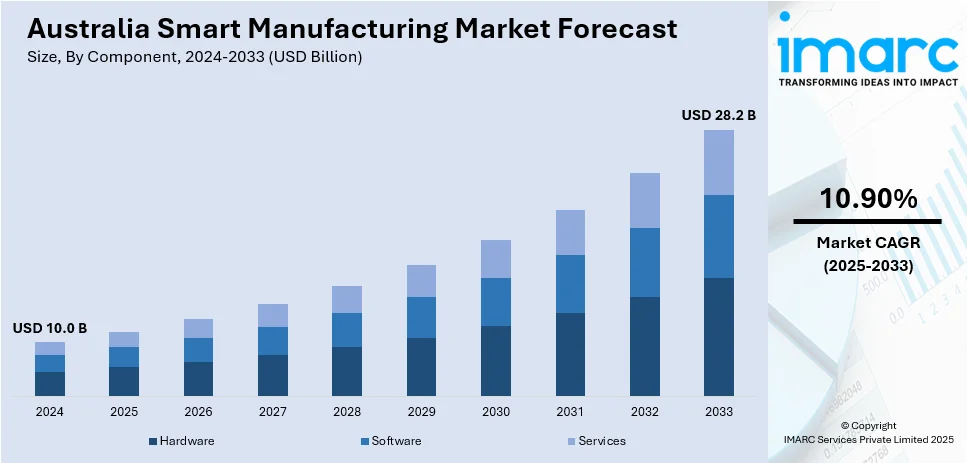

The Australia smart manufacturing market size reached USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.2 Billion by 2033, exhibiting a growth rate (CAGR) of 10.90% during 2025-2033. The market is driven by the growing adoption of Industry 4.0 technologies to improve production processes and operational effectiveness, persisting problems of skilled labor shortages in the manufacturing sector, and heightened usage of lifecycle analysis tools, waste minimization programs, and closed-loop systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.0 Billion |

| Market Forecast in 2033 | USD 28.2 Billion |

| Market Growth Rate 2025-2033 | 10.90% |

Australia Smart Manufacturing Market Trends:

Adopting Industry 4.0 Technologies Across Manufacturing Processes

Australian producers are increasingly embracing Industry 4.0 technologies, which is revolutionizing production processes and operational effectiveness. Cyber-physical systems, Industrial Internet of Things (IIoT), cloud computing, and advanced robotics are being integrated to enhance smart manufacturing systems. Businesses are investing in sensor networks, real-time data analytics, and machine learning algorithms that are facilitating predictive maintenance, minimizing downtime, and optimizing supply chains. This change is being facilitated by both private investments and government programs looking to increase the competitiveness of Australian industry. Digital twins and smart factories are becoming integrated parts, enabling manufacturers to run processes in simulation, test production strategies, and remotely monitor asset performance. These advancements in technology are redefining the manufacturing scene by creating a data-driven ecosystem. The IMARC Group predicts that the Australia digital transformation market size is expected to reach USD 84.7 Billion by 2033.

To get more information on this market, Request Sample

Addressing Labor Shortages Through Automation and Robotics

Australia is currently experiencing skilled labor shortages in the manufacturing sector, which is driving the implementation of automation and robotics to maintain productivity levels. The 2024 Occupation Shortage List (OSL) revealed that close to three out of ten professions in Australia (303 of 916) were in shortage. That was an increase of about 3% over the previous year. Still, a number of industries continue to experience difficulties attracting trained employees. Manufacturers are increasingly investing in smart automation solutions to replace or augment human labor, especially for repetitive, hazardous, or high-precision tasks. Robotic arms, collaborative robots (cobots), and automated guided vehicles (AGVs) are being deployed to streamline assembly lines and ensure consistent output. This trend is helping manufacturers address rising wage pressures and labor availability constraints. In addition, the use of intelligent systems is enabling real-time adjustments to production lines, reducing errors, and increasing throughput. As workforce demographics shift and younger generations show less interest in traditional manufacturing roles, the industry is focusing on smart solutions that require fewer human interventions but deliver higher efficiency.

Responding to Environmental Sustainability Goals and Energy Efficiency Standards

Australian industries are increasingly getting aligned with national environmental sustainability objectives, which is driving the implementation of smart manufacturing technologies. The Australian Government’s Future Made in Australia initiative was launched in 2024 to help industries use renewable energy. Organizations are proactively implementing energy-efficient equipment and sustainable production technologies that lower carbon footprints and maximize the use of resources. Smart energy management systems based on Internet of Things (IoT) sensors and AI-powered analytics are being implemented to monitor and reduce energy usage in real time. This transition is also driven by strict regulatory standards and customer demand for green products. Companies are leveraging lifecycle analysis tools, waste minimization programs, and closed-loop systems to design circular manufacturing processes. Because of this, sustainability is no longer a compliance activity but a competitiveness and innovation driver. These constant attempts are putting smart manufacturing as one of the prominent drivers for carbon neutrality targets and long-term sustainable environmental practices.

Australia Smart Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, and end use.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Technology Insights:

- Machine Execution Systems

- Programmable Logic Controller

- Enterprise Resource Planning

- SCADA

- Discrete Control Systems

- Human Machine Interface

- Machine Vision

- 3D Printing

- Product Lifecycle Management

- Plant Asset Management

The report has provided a detailed breakup and analysis of the market based on the technology. This includes machine execution systems, programmable logic controller, enterprise resource planning, SCADA, discrete control systems, human machine interface, machine vision, 3d printing, product lifecycle management, and plant asset management.

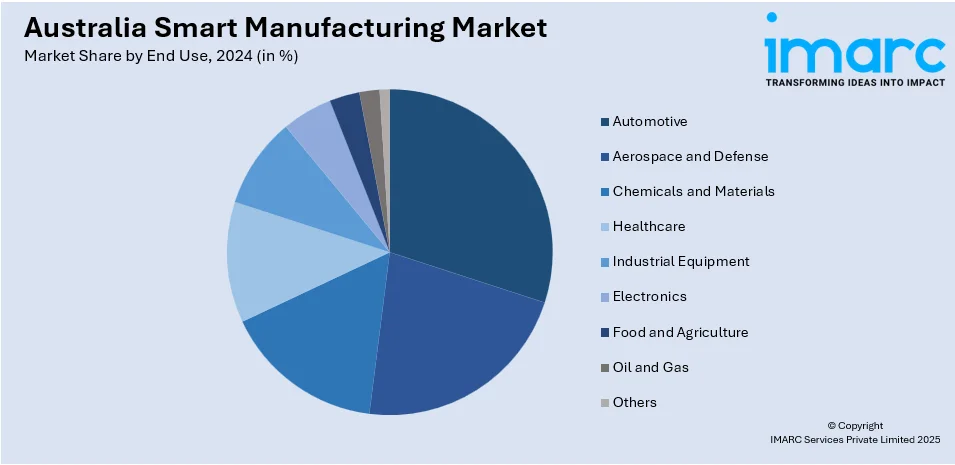

End Use Insights:

- Automotive

- Aerospace and Defense

- Chemicals and Materials

- Healthcare

- Industrial Equipment

- Electronics

- Food and Agriculture

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes automotive, aerospace and defense, chemicals and materials, healthcare, industrial equipment, electronics, food and agriculture, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technologies Covered | Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, Plant Asset Management |

| End Uses Covered | Automotive, Aerospace and Defense, Chemicals and Materials, Healthcare, Industrial Equipment, Electronics, Food and Agriculture, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart manufacturing market on the basis of component?

- What is the breakup of the Australia smart manufacturing market on the basis of technology?

- What is the breakup of the Australia smart manufacturing market on the basis of end use?

- What is the breakup of the Australia smart manufacturing market on the basis of region?

- What are the various stages in the value chain of the Australia smart manufacturing market?

- What are the key driving factors and challenges in the Australia smart manufacturing market?

- What is the structure of the Australia smart manufacturing market and who are the key players?

- What is the degree of competition in the Australia smart manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)