Australia Smart Power Transmission Market Size, Share, Trends and Forecast by Component, Technology, Voltage Level, End User, and Region, 2025-2033

Australia Smart Power Transmission Market Overview:

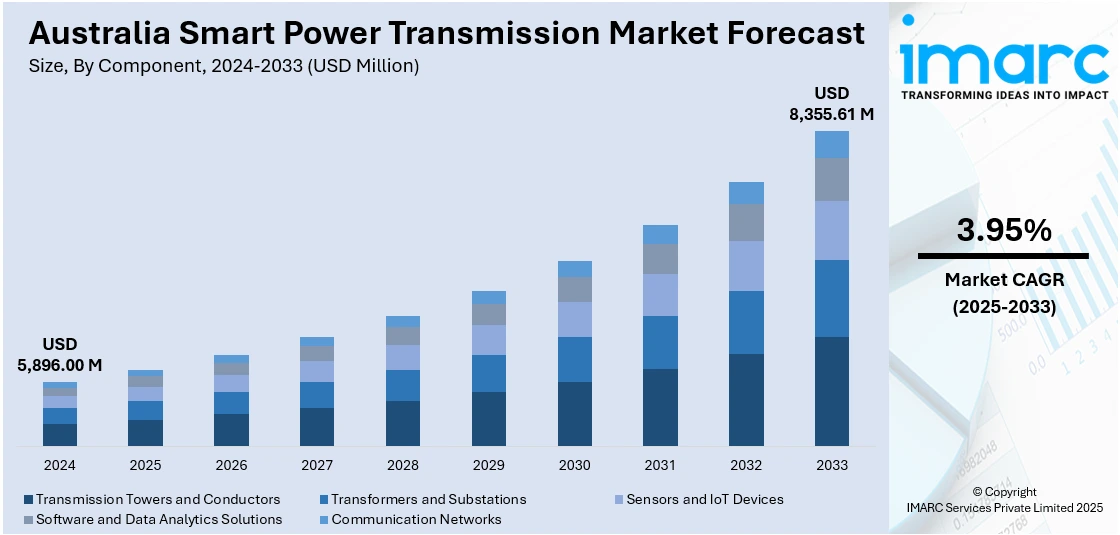

The Australia smart power transmission market size reached USD 5,896.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,355.61 Million by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033. The market is being driven by the need to modernize the grid and meet decarbonization targets. Renewable energy integration demands real-time monitoring, predictive diagnostics, and automated control systems to manage variability and ensure reliability. National strategies and evolving regulations are reinforcing the shift from conventional to intelligent infrastructure. These systems are also critical for tracking emissions, minimizing losses, and enhancing coordination between distributed and central generation to meet climate goals and improve grid performance. This growing shift is significantly shaping the Australia smart power transmission market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,896.00 Million |

| Market Forecast in 2033 | USD 8,355.61 Million |

| Market Growth Rate 2025-2033 | 3.95% |

Australia Smart Power Transmission Market Trends:

Grid Modernization Mandates and Renewable Integration

Australia's energy shift is speeding up due to its decarbonization commitments, with renewable energy integration becoming a key foundation. Solar and wind, though plentiful, bring fluctuations to the grid that traditional systems struggle to handle. This is leading to a shift towards intelligent power transmission technologies that provide real-time monitoring, dynamic load management, and predictive diagnostics, which is an essential feature for aligning fluctuating supply with consistent demand. National strategies, changing grid regulations, and policy reforms are bolstering this transition, encouraging utilities to implement digital substations, extensive monitoring systems, and automated controls. The focus is not solely on cutting emissions but also on improving operational efficiency and system resilience. A significant advancement in this area occurred in 2024 when the AUD 2.3 billion EnergyConnect initiative achieved key milestones. This involved powering up the initial section of the Buronga substation in New South Wales and setting up the first of 334 transmission towers. Stretching 900 km, this interconnector connects South Australia, New South Wales, and Victoria, establishing an essential route for more than 2 GW of renewable energy initiatives. It aimed to stabilize long-range power transfers and enhance grid reliability, particularly with increasing renewable integration. The initiative illustrates the necessity of substantial infrastructure, supported by intelligent transmission features, for achieving climate objectives while ensuring energy security.

To get more information on this market, Request Sample

Decarbonization Targets and Climate Commitments

Australia's climate pledges at both national and state levels are urging energy sector stakeholders to revamp current infrastructure and speed up decarbonization efforts. Conventional grid systems do not possess the adaptability and intelligence required for quick renewable integration, leading to a significant move toward smart power transmission technologies. These systems are essential for minimizing transmission losses, improving coordination between centralized and distributed generation, and offering real-time visibility needed to monitor and manage carbon intensity throughout the network. Advanced grid analytics and automated systems facilitate emissions tracking at critical points, rendering adherence to climate objectives both quantifiable and controllable. As deadlines for net-zero emissions approach, transmission operators are enhancing infrastructure that can adapt to renewable production while maintaining stability and resilience. A recent illustration of this shift is the Hunter Transmission Project, propelled by a commitment deed signed in 2025 by Transgrid and the Government of New South Wales. The 100 km, 500kV transmission line will link essential renewable energy areas to the state’s primary grid, enhancing its ability to incorporate cleaner energy sources. In addition to its environmental importance, the project is anticipated to create approximately 700 construction jobs and boost regional industry in the Hunter region. Such initiatives demonstrate how climate policies are encouraging the installation of intelligent transmission systems that fulfill decarbonization goals while also providing socio-economic and operational advantages throughout Australia's changing energy landscape.

Australia Smart Power Transmission Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, voltage level, and end user.

Component Insights:

- Transmission Towers and Conductors

- Transformers and Substations

- Sensors and IoT Devices

- Software and Data Analytics Solutions

- Communication Networks

The report has provided a detailed breakup and analysis of the market based on the component. This includes transmission towers and conductors, transformers and substations, sensors and IoT devices, software and data analytics solutions, and communication networks.

Technology Insights:

- Supervisory Control and Data Acquisition (SCADA) Systems

- Phasor Measurement Units (PMUs)

- Flexible AC Transmission Systems (FACTS)

- Advanced Metering Infrastructure (AMI)

- Smart Transformers

- High Voltage Direct Current (HVDC) Transmission

- Wide-Area Monitoring Systems (WAMS)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes supervisory control and data acquisition (SCADA) systems, phasor measurement units (PMUS), flexible AC transmission systems (FACTS), advanced metering infrastructure (AMI), smart transformers, high voltage direct current (HVDC) transmission, and wide-area monitoring systems (WAMS).

Voltage Level Insights:

- Extra High Voltage (EHV) Transmission (≥ 220 kV)

- High Voltage (HV) Transmission (66 kV - 220 kV)

- Medium Voltage (MV) Transmission (11 kV - 66 kV)

The report has provided a detailed breakup and analysis of the market based on the voltage level. This includes extra high voltage (EHV) transmission (≥ 220 kV), high voltage (HV) transmission (66 kV - 220 kV), and medium voltage (MV) transmission (11 kV - 66 kV).

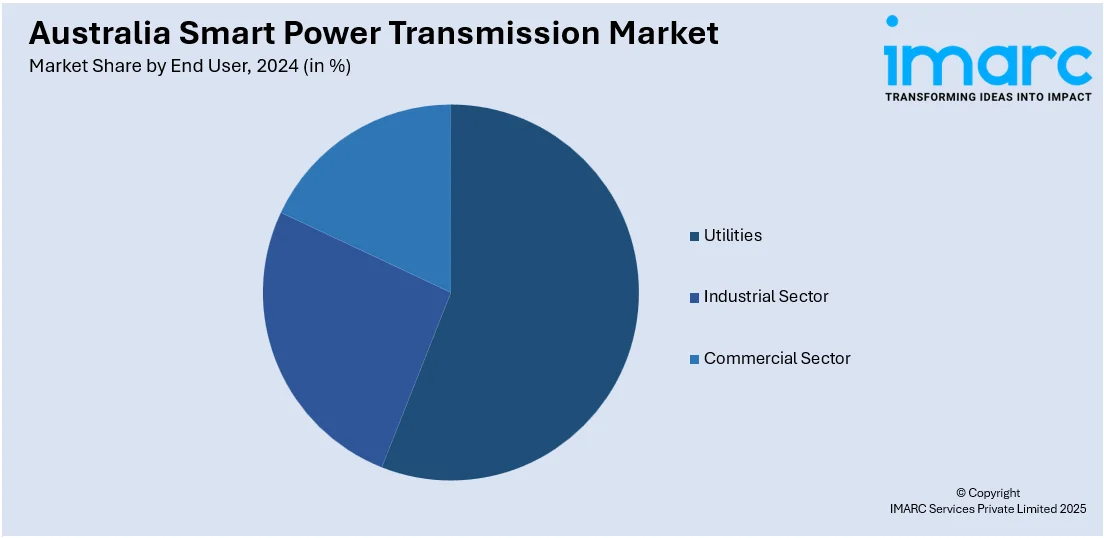

End User Insights:

- Utilities

- Industrial Sector

- Commercial Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities, industrial sector, and commercial sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Power Transmission Market News:

- In March 2025, RTE International announced the launch of its new subsidiary, RTEi Australia Pacific, to expand its engineering and HVDC consulting services in Australia. This move supports the modernization of Australia's energy infrastructure and renewable integration. The company has partnered with Powerlink and EDF Australia to assist in major transmission projects.

- In May 2024, Hitachi Energy supplied HVDC Light® technology for the Marinus Link, a 345 km interconnector between Tasmania and mainland Australia. This two-way HVDC system supported renewable energy integration and provided power for up to 1.5 million homes. The project was key to Australia’s Net Zero goals and aimed for completion by the end of the decade.

Australia Smart Power Transmission Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Transmission Towers and Conductors, Transformers and Substations, Sensors and IoT Devices, Software and Data Analytics Solutions, Communication Networks |

| Technologies Covered | Supervisory Control and Data Acquisition (SCADA) Systems, Phasor Measurement Units (PMUs), Flexible AC Transmission Systems (FACTS), Advanced Metering Infrastructure (AMI), Smart Transformers, High Voltage Direct Current (HVDC) Transmission, Wide-Area Monitoring Systems (WAMS) |

| Voltage Levels Covered | Extra High Voltage (EHV) Transmission (≥ 220 kV), High Voltage (HV) Transmission (66 kV - 220 kV), Medium Voltage (MV) Transmission (11 kV - 66 kV) |

| End Users Covered | Utilities, Industrial Sector, Commercial Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart power transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart power transmission market on the basis of component?

- What is the breakup of the Australia smart power transmission market on the basis of technology?

- What is the breakup of the Australia smart power transmission market on the basis of voltage level?

- What is the breakup of the Australia smart power transmission market on the basis of end user?

- What is the breakup of the Australia smart power transmission market on the basis of region?

- What are the various stages in the value chain of the Australia smart power transmission market?

- What are the key driving factors and challenges in the Australia smart power transmission market?

- What is the structure of the Australia smart power transmission market and who are the key players?

- What is the degree of competition in the Australia smart power transmission market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart power transmission market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart power transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart power transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)