Australia Smart Speaker Market Size, Share, Trends and Forecast by Component, Intelligent Virtual Assistant, Connectivity, Price Range, Distribution Channel, End User, and Region, 2025-2033

Australia Smart Speaker Market Overview:

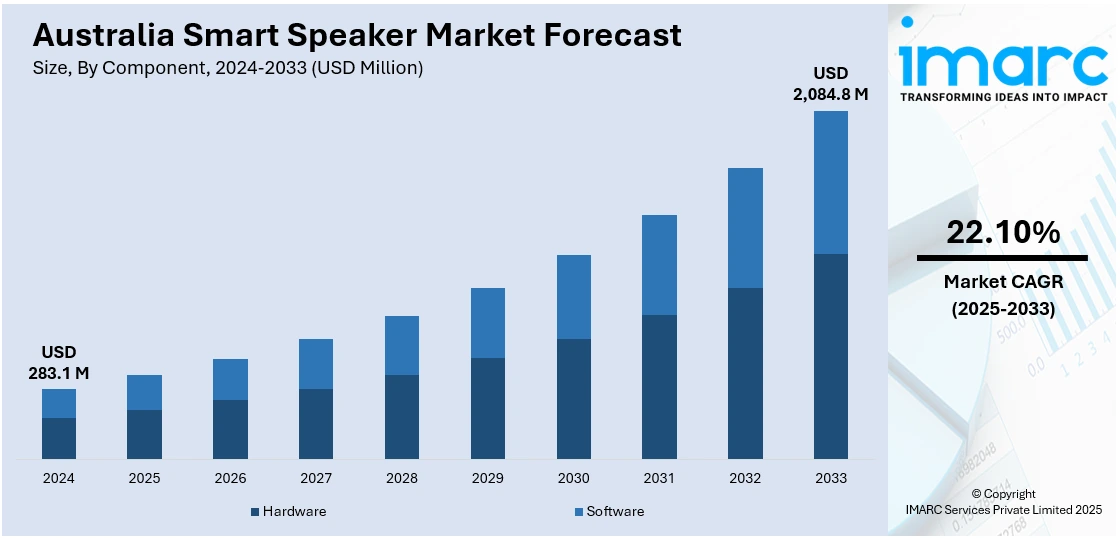

The Australia smart speaker market size reached USD 283.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,084.8 Million by 2033, exhibiting a growth rate (CAGR) of 22.10% during 2025-2033. The market is fueled by growing consumer uptake of voice-enabled technologies and interest in connected living, with increasing demand across a range of user demographics driving greater accessibility, improved functionality, and wider integration into personal and home digital ecosystems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 283.1 Million |

| Market Forecast in 2033 | USD 2,084.8 Million |

| Market Growth Rate 2025-2033 | 22.10% |

Australia Smart Speaker Market Trends:

Integration with Smart Home Ecosystems

The growing use of smart home appliances throughout Australian homes is playing an important role in the demand for smart speakers. The devices now act as hubs to control lights, thermostats, security systems, and entertainment systems using voice commands. For instance, in August 2024, Amazon released the Echo Show 8 (3rd Gen) in Australia. It has features such as spatial audio support, a 13MP camera with auto-framing, and adaptive content, providing a richer smart display experience. The product features an 8-inch HD display screen and better sound quality for streaming. Moreover, the smart speaker's seamless integration with larger Internet of Things (IoT) systems is drawing an expanding number of tech-friendly customers who appreciate automation and convenience. Since Australian consumers value convenience, the convergence of smart speakers with home management systems is gaining further traction. Furthermore, the growing infrastructure that supports connected living is opening up possibilities for richer user experiences. The continuous growth of smart homes is directly impacting market growth, as consumers invest in unified ecosystems that are based on intelligent voice control. This trend is aiding to cement Australia smart speaker market share within the consumer electronics market and upholds a robust market forecast fueled by usability and innovation.

To get more information on this market, Request Sample

Growth of Voice-Activated Services

Voice recognition technology has become ever more advanced, leading to growth in the application of smart speakers for multiple aspects of everyday usage in Australia. Customers are adopting these devices not just for simple functions like weather forecasts and music listening but also for advanced interactions like internet shopping, calendar organization, and language translation. This boost in functionality is causing amplified usage and long-term engagement across a broad range of ages. The option to customize services using voice interaction has increased customer satisfaction, further driving adoption. For example, in August 2023, Pantheone released Obsidian wireless speaker in Australia, combining Alexa integration, AirPlay 2 support, and high-quality audio performance in a handmade, sculptural form factor with 15-hour battery life. Additionally, the cultural transition to hands-free convenience is largely consistent with contemporary, high-paced living standards. With developers further optimizing voice-activated capabilities, consumer dependence on smart speakers for seamless digital assistance will rise. This shift in behavior is driving Australia smart speaker market growth and bolstering share, with a positive forecast drawn from intensifying demand for user-friendly technologies.

Increasing Demand of Low-Cost and Entry-Level Devices

Affordability has emerged as a major factor in the smart speaker market, particularly among new buyers in Australia. With the increasing availability of technology, a wider audience, including students, young professionals, and seniors, is entering the market. Smart speakers at the entry level now provide adequate functionality for everyday use, making them appealing to cost-conscious consumers. The launch of slim, affordable variants has actually brought down the cost barrier, aiding higher household penetration. This also is being supplemented by seasonal campaigns and bundling with other intelligent devices, again fueling uptake. Consequently, there is significant growth in volume sales, led by online distribution channels. Such price-sensitive consumption patterns are majorly driving the market development, enabling higher numbers of consumers to try voice-enabled living. As a result, the surge in affordable devices is propelling share upward and affirms a favorable Australia smart speaker market outlook distinguished by accessibility and high penetration.

Australia Smart Speaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, intelligent virtual assistant, connectivity, price range, distribution channel, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Intelligent Virtual Assistant Insights:

- Amazon Alexa

- Google Assistant

- Siri

- Cortana

- Others

A detailed breakup and analysis of the market based on the intelligent virtual assistant have also been provided in the report. This includes amazon Alexa, google assistant, Siri, Cortana, and others.

Connectivity Insights:

- Wi-Fi

- Bluetooth

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes Wi-Fi and Bluetooth.

Price Range Insights:

- Low range (Less than $100)

- Mid-range ($101 to $200)

- Premium (Above $200)

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range (less than $100), mid-range ($101 to $200), and premium (above $200).

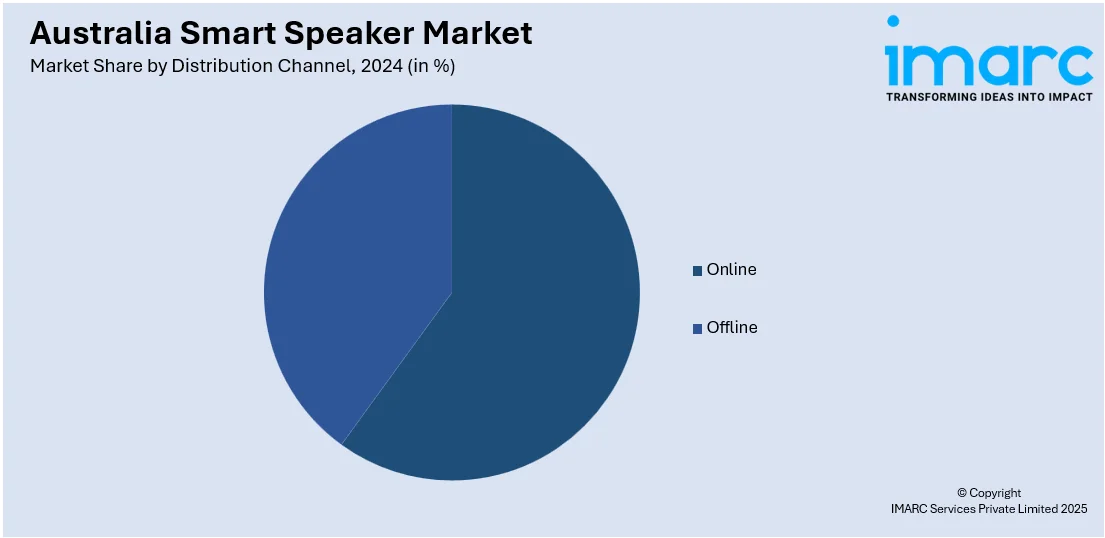

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

End User Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Speaker Market News:

- In July 2024, Yoto, the screen-free children's audio platform, launched in Australia. With this launch, products such as the Yoto Player and Yoto Mini became available, providing interactive, screen-free entertainment through physical cards. Since their release, these devices have become increasingly popular among Australian parents looking for alternatives to screen entertainment for kids.

- In January 2024, BlueAnt introduced at CES 2024 its long-awaited Soundblade, an Australian-engineered under-monitor soundbar. It is designed for 4K material and offers 120W output, an 80mm neodymium subwoofer, two neodymium drivers, and racetrack drivers to provide rich audio, powerful bass, and razor-sharp dialogue for an overall richer desktop sound experience.

Australia Smart Speaker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Intelligent Virtual Assistants Covered | Amazon Alexa, Google Assistant, Siri, Cortana, Others |

| Connectivities Covered | Wi-Fi, Bluetooth |

| Price Ranges Covered | Low-range (Less than $100), Mid-range ($101 to $200), Premium (Above $200) |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart speaker market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart speaker market on the basis of component?

- What is the breakup of the Australia smart speaker market on the basis of virtual assistant?

- What is the breakup of the Australia smart speaker market on the basis of connectivity?

- What is the breakup of the Australia smart speaker market on the basis of price range?

- What is the breakup of the Australia smart speaker market on the basis of distribution channel?

- What is the breakup of the Australia smart speaker market on the basis of end user?

- What is the breakup of the Australia smart speaker market on the basis of region?

- What are the various stages in the value chain of the Australia smart speaker market?

- What are the key driving factors and challenges in the Australia smart speaker?

- What is the structure of the Australia smart speaker market and who are the key players?

- What is the degree of competition in the Australia smart speaker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart speaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart speaker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart speaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)