Australia Smart Welding Equipment Market Size, Share, Trends and Forecast by Component, Material Type, Welding Technology, Automation Level, End Use Industry, and Region, 2025-2033

Australia Smart Welding Equipment Market Overview:

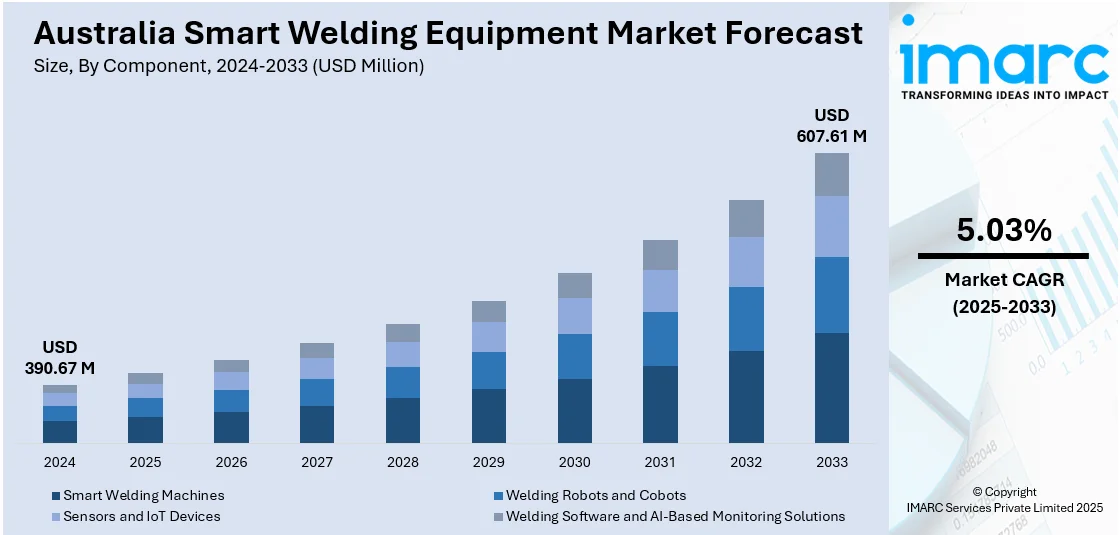

The Australia smart welding equipment market size reached USD 390.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 607.61 Million by 2033, exhibiting a growth rate (CAGR) of 5.03% during 2025-2033. The market is driven by the adoption of advanced technologies like AI, IoT, and robotics in welding processes. Industries such as construction, automotive, and mining are increasingly utilizing smart welding solutions to enhance precision, efficiency, and safety. Government initiatives supporting automation and infrastructure development further bolster this trend, fueling the Australia smart welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 390.67 Million |

| Market Forecast in 2033 | USD 607.61 Million |

| Market Growth Rate 2025-2033 | 5.03% |

Australia Smart Welding Equipment Market Trends:

Integration of Advanced Technologies

The adoption of technologies like IoT, AI, and robotics is transforming welding operations in Australia. Smart welding equipment has analytics, feedback control systems, and is a wireless device that will help improve the efficiency of the process, have fewer defects, and be able to make adjustments in real time. Such systems help to monitor weld quality from a distance, fine-tune settings as necessary, and achieve traceability. As most industries in Australia move to adopt Industry 4.0 applications, smart welding emerges as a critical application area for the implementation of the concept. This aids in keeping businesses competitive by reducing the incidence of manual interference and workflow. The growing interest in intelligent automation and connected production lines is driving demand for smart welding tools that align with the vision of data-driven, high-precision industrial operations.

To get more information on this market, Request Sample

Skilled Labor Shortages

Australia is currently experiencing a shortage of skilled welders, impacting industries such as shipbuilding, automotive, and mining. This labor gap has intensified the need for automation in welding processes. Smart welding equipment addresses this issue by automating complex tasks, reducing the skill barrier for operation, and enhancing output consistency. These systems often include intuitive user interfaces, preset weld programs, and self-calibrating functions, allowing even semi-skilled operators to perform effectively. As industries face challenges in recruiting and retaining trained personnel, investing in smart equipment becomes a strategic solution. The push to maintain productivity and meet tight project timelines is significantly contributing to the Australia smart welding equipment market growth and long-term relevance.

Government Initiatives and Infrastructure Projects

Australian government initiatives focused on infrastructure upgrades, such as roads, railways, renewable energy, and defense, are creating robust demand for high-performance welding technologies. Smart welding equipment enables faster, more precise work on large-scale projects while maintaining quality standards. Additionally, programs encouraging advanced manufacturing and technology adoption, including grants and incentives, have motivated companies to invest in intelligent welding systems. These policies align with national goals to improve industrial competitiveness and environmental sustainability. As public and private investment in infrastructure expands, businesses seek welding solutions that can enhance productivity and reduce rework. This shift toward smarter tools is accelerating the adoption of sensor-integrated welding equipment across Australia’s evolving industrial landscape.

Australia Smart Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, material type, welding technology, automation level, and end use industry.

Component Insights:

- Smart Welding Machines

- Welding Robots and Cobots

- Sensors and IoT Devices

- Welding Software and AI-Based Monitoring Solutions

The report has provided a detailed breakup and analysis of the market based on the component. This includes smart welding machines, welding robots and cobots, sensors and IoT devices, welding software and AI-based monitoring solutions.

Material Type Insights:

- Steel and Stainless Steel Welding

- Aluminum and Non-Ferrous Metal Welding

- Composite and Advanced Material Welding

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel and stainless steel welding, aluminum and non-ferrous metal welding, composite and advanced material welding.

Welding Technology Insights:

- Arc Welding

- Resistance Welding

- Laser Welding

- Electron Beam Welding

- Ultrasonic Welding

- Friction Stir Welding

- Plasma Welding

A detailed breakup and analysis of the market based on the welding technology have also been provided in the report. This includes arc welding, resistance welding, laser welding, electron beam welding, ultrasonic welding, friction stir welding, and plasma welding.

Automation Level Insights:

- Manual Welding Equipment

- Semi-Automated Welding Systems

- Fully Automated and AI-Integrated Welding Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding equipment, semi-automated welding systems, and fully automated and AI-integrated welding systems.

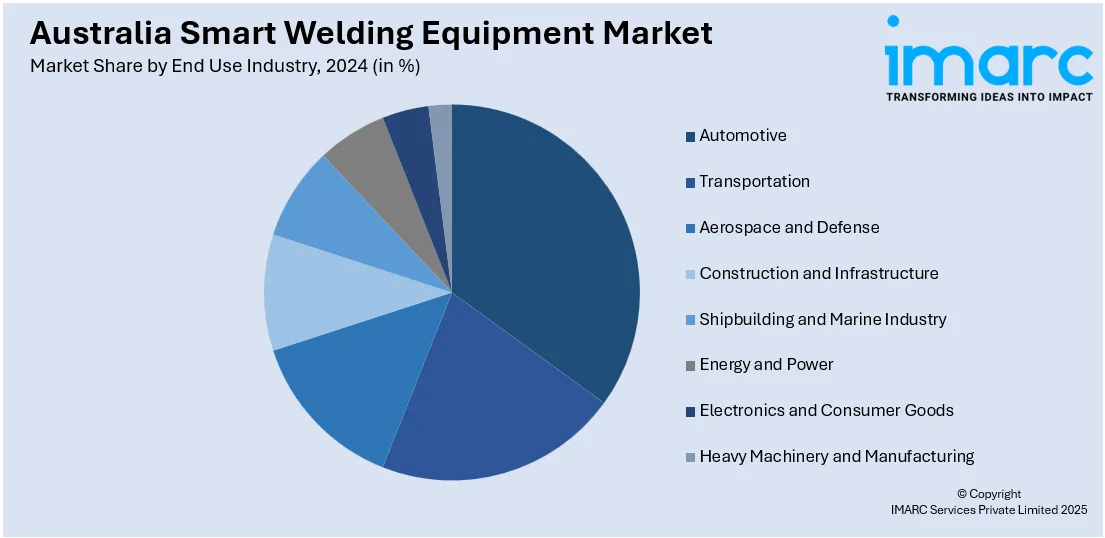

End Use Industry Insights:

- Automotive

- Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Shipbuilding and Marine Industry

- Energy and Power

- Electronics and Consumer Goods

- Heavy Machinery and Manufacturing

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, transportation, aerospace and defense, construction and infrastructure, shipbuilding and marine industry, energy and power, electronics and consumer goods, and heavy machinery and manufacturing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Smart Welding Machines, Welding Robots and Cobots, Sensors and IoT Devices, Welding Software and AI-Based Monitoring Solutions |

| Material Types Covered | Steel and Stainless Steel Welding, Aluminum and Non-Ferrous Metal Welding, Composite and Advanced Material Welding |

| Welding Technologies Covered | Arc Welding, Resistance Welding, Laser Welding, Electron Beam Welding, Ultrasonic Welding, Friction Stir Welding, Plasma Welding |

| Automation Levels Covered | Manual Welding Equipment, Semi-Automated Welding Systems, Fully Automated and AI-Integrated Welding Systems |

| End Use Industries Covered | Automotive, Transportation, Aerospace and Defense, Construction and Infrastructure, Shipbuilding and Marine Industry, Energy and Power, Electronics and Consumer Goods, Heavy Machinery and Manufacturing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart welding equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart welding equipment market on the basis of component?

- What is the breakup of the Australia smart welding equipment market on the basis of material type?

- What is the breakup of the Australia smart welding equipment market on the basis of welding technology?

- What is the breakup of the Australia smart welding equipment market on the basis of automation level?

- What is the breakup of the Australia smart welding equipment market on the basis of end use industry?

- What is the breakup of the Australia smart welding equipment market on the basis of region?

- What are the various stages in the value chain of the Australia smart welding equipment market?

- What are the key driving factors and challenges in the Australia smart welding equipment market?

- What is the structure of the Australia smart welding equipment market and who are the key players?

- What is the degree of competition in the Australia smart welding equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart welding equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)