Australia Smoothies Market Size, Share, Trends and Forecast by Product, Distribution Channel, Packaging Material, Consumption Pattern, and Region, 2026-2034

Australia Smoothies Market Overview:

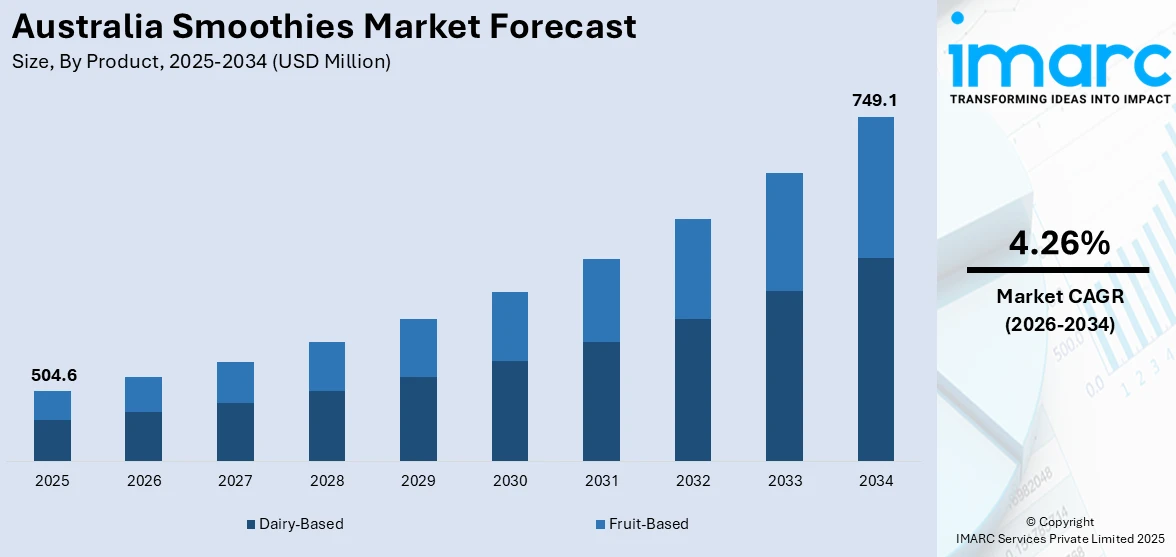

The Australia smoothies market size reached USD 504.6 Million in 2025. Looking forward, the market is projected to reach USD 749.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.26% during 2026-2034. The market is experiencing robust growth, propelled by the escalating health consciousness spurring a preference for nutritious and convenient smoothies, the elevating demand for natural and organic ingredients, and the expansion of smoothie bars and ready-to-drink (RTD) options in supermarkets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 504.6 Million |

| Market Forecast in 2034 | USD 749.1 Million |

| Market Growth Rate 2026-2034 | 4.26% |

Key Trends of Australia Smoothies Market:

Rising Demand for Functional and Plant-Based Smoothies

The growing demand for functional and plant-based beverages, driven by an increasingly health-conscious customer base, is a major factor driving the Australia smoothies market. Australians are increasingly choosing smoothies that provide concrete health advantages, such as improved immunity, digestion, and energy levels. This movement is driving a shift away from traditional dairy and toward plant-based alternatives, such as oat milk, almond milk, chia seeds, coconut water, and plant proteins, which appeal to vegan and lactose-intolerant customers. Functional smoothies loaded with superfoods, adaptogens, and probiotics are becoming increasingly popular, catering to specific wellness goals, such as stress reduction and gut health. Local startups are tapping into this trend by incorporating native Australian ingredients, such as Kakadu plum and finger lime, offering unique nutritional value and market differentiation.

To get more information on this market Request Sample

Convenience-Driven Growth in RTD Smoothies

Another significant trend transforming the Australian smoothies market is the rapid rise of RTD smoothies, driven by growing consumer demand for convenience and on-the-go nutrition. With increasingly fast-paced lifestyles, Australians are embracing RTD options as quick meal replacements and energy boosters. The segment is experiencing robust growth, fueled by advancements in shelf-stable formulations and innovative packaging that maintain nutritional value without the need for refrigeration. Major retailers and convenience stores nationwide have expanded their RTD smoothie offerings, while platforms like Uber Eats and DoorDash have made fresh smoothies highly accessible. Young urban consumers are at the forefront of this trend, drawn to wellness-focused and grab-and-go options. Additionally, brands adopting eco-friendly packaging, such as biodegradable or recyclable materials, are gaining traction, particularly among environmentally conscious millennials and Gen Z consumers. This trend reflects broader market shifts toward health, convenience, and sustainability.

Surge in Customization Options

One prominent trend influencing Australia’s smoothies market is the growing demand for personalized drinks. Today's consumers desire greater control over their nutritional choices, prompting smoothie bars to provide various options for base liquids such as almond milk, coconut water, or oat milk, in addition to an extensive selection of fruits, vegetables, and superfood enhancements. This degree of customization accommodates a range of dietary preferences, from high-protein blends aimed at fitness enthusiasts to low-sugar alternatives for those watching their health. Smoothie bars are increasingly aligning themselves with lifestyle brands, where flavor aligns with wellness objectives. The attraction of unique, customized beverages enhances customer loyalty and plays a substantial role in the overall expansion of the Australia smoothies market share.

Growth Drivers of Australia Smoothies Market:

Health and Wellness Focus

Australian consumers are increasingly discerning about their beverage choices, opting for drinks that are nutritious and free from excessive sugar or artificial ingredients. Smoothies, crafted from fresh fruits, vegetables, and superfoods, are gaining popularity as healthier substitutes for carbonated soft drinks and bottled juices. This shift is driven by a heightened awareness about lifestyle-related illnesses and the value of preventive healthcare. Smoothies packed with fiber, antioxidants, and vitamins resonate with health-conscious groups, particularly millennials and young families. Brands are also innovating with organic and clean-label products to cater to the growing demand for ingredient transparency. This strong focus on health is transforming beverage selections and steadily increasing Australia smoothies market demand throughout retail environments and smoothie bars across the country.

Busy Lifestyles

The rapid pace of urban life in Australia has spurred demand for food and beverage options that offer both convenience and nutrition. Smoothies are becoming popular as meal replacements, providing a quick and satisfying choice for breakfast, lunch, or snacks. Their portability and availability in ready-to-drink formats make them especially appealing to office workers, students, and commuters. Smoothie bars are tapping into this trend by providing grab-and-go options with customizable blends. The movement toward healthier eating on the run is a significant factor behind this popularity, as individuals seek alternatives to fast food that support their wellness aspirations. This combination of convenience, flavor, and health benefits is a major driver of Australia smoothies market growth, as the category attracts more busy consumers.

Rising Fitness Culture

The rise of fitness culture in Australia has fostered a robust market for functional beverages, including protein and energy smoothies. As more people engage with gyms, sports, and active lifestyles, there's a growing demand for smoothies enhanced with whey protein, plant-based proteins, electrolytes, and other performance-supporting ingredients. These products are increasingly recognized as effective pre- or post-workout choices that contribute to muscle recovery and sustained energy levels. Smoothie manufacturers are focusing on this demographic by providing blends designed for athletic and fitness needs. The focus on performance nutrition aligns with broader wellness trends and opens the door for premium offerings. According to Australia smoothies market analysis, this synergy between fitness goals and beverage innovation is considerably fortifying the sector.

Australia Smoothies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, distribution channel, packaging material, and consumption pattern.

Product Insights:

- Dairy-Based

- Fruit-Based

The report has provided a detailed breakup and analysis of the market based on the product. This includes dairy-based and fruit-based.

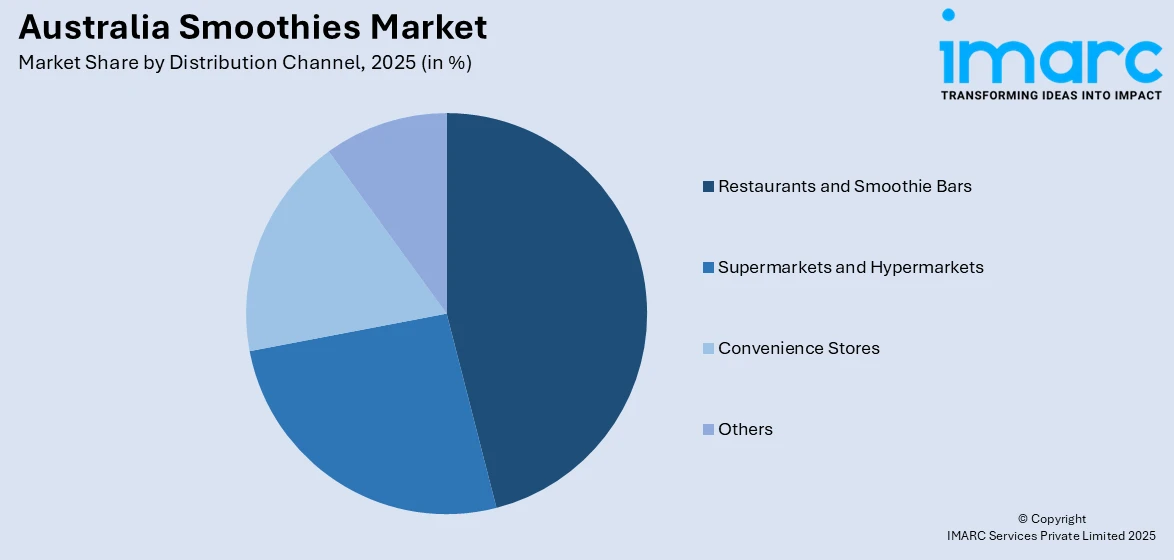

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Restaurants and Smoothie Bars

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes restaurants and smoothie bars, supermarkets and hypermarkets, convenience stores, and others.

Packaging Material Insights:

- Plastic

- Paper

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging material. This includes plastic, paper, glass, and others.

Consumption Pattern Insights:

- Out of Home

- At Home

A detailed breakup and analysis of the market based on the consumption pattern have also been provided in the report. This includes out of home and at home.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smoothies Market News:

- November 2024: Oakberry Açaí launched a new beverage menu across Australia, featuring six layered smoothies that blend their signature açaí with passionfruit, mango, banana, and matcha. Highlights included the Tropical Boost, Brekkie Pump, and Açaí Matcha, catering to health-conscious consumers seeking nutritious and flavorful options.

- February 2024: Melbourne-based Boost Juice introduced smoothie variants named Pash & Splash and Sea & Tea. These beverages combined roasted seaweed with tropical fruits and creamy ingredients, offering a blend of sweet, tangy, and umami flavors.

Australia Smoothies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dairy-Based, Fruit-Based |

| Distribution Channels Covered | Restaurants and Smoothie Bars, Supermarkets and Hypermarkets, Convenience Stores, Others |

| Packaging Materials Covered | Plastic, Paper, Glass, Others |

| Consumption Patterns Covered | Out of Home, At Home |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smoothies market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smoothies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smoothies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smoothies market in Australia was valued at USD 504.6 Million in 2025.

The Australia smoothies market is projected to exhibit a compound annual growth rate (CAGR) of 4.26% during 2026-2034.

The Australia smoothies market is expected to reach a value of USD 749.1 Million by 2034.

The Australia smoothies market is witnessing trends such as rising demand for plant-based and dairy-free options, increased incorporation of superfoods and functional ingredients, growth in ready-to-drink packaged smoothies, and greater focus on health-conscious and convenient on-the-go beverages among urban consumers.

Growth in the Australia smoothies market is driven by increasing health and wellness awareness, rising consumption of nutritious and natural ingredients, busy lifestyles encouraging convenient meal and snack options, and innovation in flavors and functional blends that offer added benefits such as immunity support, energy boost, and digestive health.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)