Australia Snack Bar Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, and Region, 2025-2033

Australia Snack Bar Market Overview:

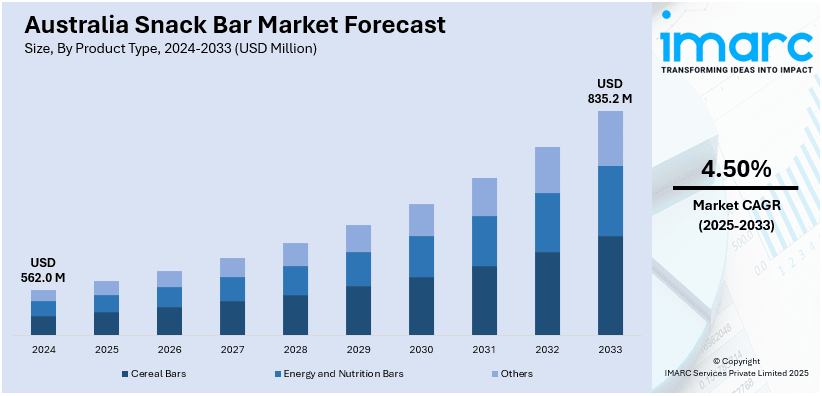

The Australia snack bar market size reached USD 562.0 Million in 2024. Looking forward, the market is expected to reach USD 835.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The burgeoning demand for convenient, nutritious product variants, rising health awareness, busy lifestyles, growing gym culture, shifting preference for clean-label products, adoption of plant-based diets, strong retail networks, online product availability, and targeted influencer marketing are factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 562.0 Million |

| Market Forecast in 2033 | USD 835.2 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Key Trends of Australia Snack Bar Market:

Rising Health Consciousness

The increasing focus on health and wellness among consumers is one of the key factors boosting the Australia snack bar market growth. The escalating awareness regarding balanced nutrition, weight management, and disease prevention is another growth inducing factor. Consumers are actively working to reduce added sugars, trans fats, and highly processed ingredients and are opting for products that align with the dietary goals. Snack bars are high in fiber, protein, vitamins, and minerals, which is why, they are witnessing a considerable demand in across Australia. In recent years, there has been a growing trend toward mindful eating and ingredient transparency, with consumers more carefully reading labels and evaluating nutritional content. In line with this, key brands are launching cleaner ingredient profiles with lowered sugar content and labeling such as ‘no artificial additives’ or ‘natural source of energy,’ which is supporting market growth.

To get more information on this market, Request Sample

Growing Demand for On-the-Go Nutrition

The consumer lifestyle, particularly in urban regions, is increasingly fast paced, driving a need for convenient and healthful food choices. Snack bars are becoming a top pick for people looking for a quick meal without compromising on the health benefits, which is propelling the Australia snack bar market share. Additionally, the portability, portion control, and nutritional profile of snack bars have surged their demand among office workers, students, and fitness enthusiasts as meal replacements or between-meal fillers. This is further supported by changing work habits, including hybrid and flexible schedules. Apart from this, key market players are working to develop creative and resealable packaging, portioned multipacks, and travel-ready designs, which is facilitating the market growth. For instance, in 2025, Arnott’s introduced Jatz Minis in Sea Salt and Cheese & Garlic flavors. These oven-baked, bite-sized crackers are made from 100% Australian wheat and contain no artificial colors or flavors. They aim to offer a convenient snack option for various occasions, which further contributes to the Australia snack bar market demand as well.

Increasing Gym Memberships

In Australia, fitness culture has experienced a substantial rise in its registered members, with growing levels of gym enrollees and organized physical activity. This transition has generated robust demand for performance-based nutrition products, such as high-protein snack bars, that aid in muscle recovery, energy restoration and weight management. The growth of boutique fitness studios, group training formats, and 24-hour gyms, have cemented the demand for functional snacks, which is creating a positive Australia snack bar market outlook. In line with this, snack bar manufacturers have developed demarcated product lines catering to pre-workout, intra-workout, or post-workout consumption, which are frequently promoted with relevant nutritional breakdowns on-pack. They are also introducing supplements with added whey protein, branched-chain amino acids (BCAAs), creatine or collagen to increase their consumer base. Additionally, the growing partnerships, sampling at gyms, and influencer-led endorsements in the health and fitness segment are further supporting the market expansion.

Growth Drivers of Australia Snack Bar Market:

Rising Demand for Functionality and Nutritional Benefits

One of the dominant drivers of the snack bar industry in Australia is increasing consumer demand for functional foods that deliver beyond mere nutritional value. Australians are finding that they are consuming snack bars for several health advantages, be it to give energy a boost, help digest what they have eaten, improve mental clarity, or support fitness aspirations. This has created the demand for protein bars, energy bars, and fortified bars with ingredients such as collagen, omega-3, prebiotics, and adaptogens. Companies are getting innovative to address these functional requirements without compromising on desirable taste and texture. The sports and fitness culture in Australia, especially in younger and urban demographics, is also stimulating the demand for high-performance nutrition on the move. This trend toward functional snacking is seen in gyms and health food stores, and also in supermarkets and convenience stores, where more health-focused snack bars are being offered, making functional nutrition mainstream.

Influence of Dietary Trends and Customization

According to the Australia snack bar market analysis, modern dietary trends and the ability to customize also influences the growing market for snack bars. Several Australians are following certain eating habits like keto, paleo, vegan, or low-carb diets and searching for the kind of snacks that suit their lifestyle. Manufacturers of snack bars are reacting with products designed specifically to meet these needs, sometimes prominently labeled and marketed to appeal to specialized markets. In addition, allergen sensitivity, particularly with gluten, dairy, and nuts, is encouraging consumers to look for bars that align with their dietary needs without sacrificing taste or quality. Personalization has emerged as a market feature, with brands providing different formulations, ingredient profiles, and sizes. Direct-to-consumer models have also enabled smaller players to provide curated or build-your-own versions of snack bars. This need for personalization and dietary values alignment is transforming the competitive dynamics of the Australian snack bar market.

Innovation, Local Ingredients, and Sustainable Packaging

Product innovation in flavor, ingredients, and packaging is another major growth driver for the Australian snack bar market. Local brands are differentiating themselves through the utilization of locally native Australian ingredients like macadamia nuts, wattle seed, and finger lime to develop distinctive, place-inspiring products. This resonates with local consumers and makes Australian snack bars premium exports. Moreover, there is growing demand for sustainability and ethical sourcing among Australian consumers that is pressurizing brands to use green packaging and traceable supply chains. Most companies are also making investment in biodegradable or recyclable packs and emphasizing local sourcing to attract environmentally aware consumers. Usage of functional ingredients, e.g., adaptogens, superfoods, and plant-based proteins, is also on the rise, fueled by consumer desire for snacks to do something more than merely fill a void. Paired with strong flavors and innovative branding, these trends keep the category fresh and competitive, with consumers often consuming the product frequently and repeatedly in the Australian market for snack bars.

Australia Snack Bar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredient, and distribution channel.

Product Type Insights:

- Cereal Bars

- Granola/Muesli Bars

- Others

- Energy and Nutrition Bars

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal bars (granola/muesli bars and others), energy and nutrition bars, and others.

Ingredient Insights:

- Nuts

- Whole Grains

- Dried Fruits

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes nuts, whole grains, dried fruits, and others.

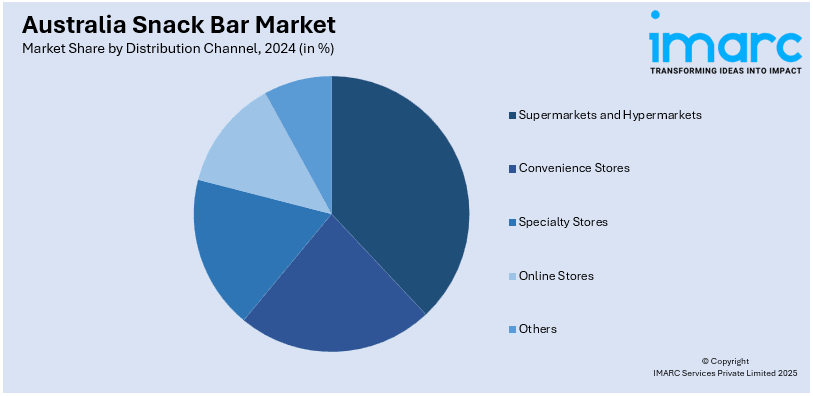

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Snack Bar Market News:

- In 2025, YouTuber MrBeast's snack brand, Feastables, expanded into the Australian market. The brand offers a variety of chocolate bars, emphasizing ethical sourcing and clean ingredients, aligning with the growing demand for transparent and responsible snacking options.

- In 2024, Violet Crumble partnered with BSC to introduce a range of chocolate protein bars. Available in Chocolate Honeycomb and Caramel Honeycomb flavors, each 55g bar contains 16g of protein, less than 3g of sugar, and boasts a 4.5 health-star rating, catering to health-conscious consumers seeking indulgent yet nutritious options.

Australia Snack Bar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Nuts, Whole Grains, Dried Fruits, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia snack bar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia snack bar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia snack bar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia snack bar market was valued at USD 562.0 Million in 2024.

The Australia snack bar market is projected to exhibit a CAGR of 4.50% during 2025-2033.

The Australia snack bar market is expected to reach a value of USD 835.2 Million by 2033.

The Australia snack bar market trends include increased demand for plant-based, high-protein, and low-sugar options. Personalized nutrition and on-the-go convenience continue to shape product innovation and brand differentiation that is further fueling market growth.

The Australia snack bar market is driven by rising demand for functional nutrition, alignment with dietary trends like vegan and keto, and innovation in ingredients and packaging. Consumers seek convenient, healthy snacks made with local produce and sustainable materials, while personalized options and clean-label products further boost market growth and appeal.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)