Australia Soda Ash Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Australia Soda Ash Market Summary:

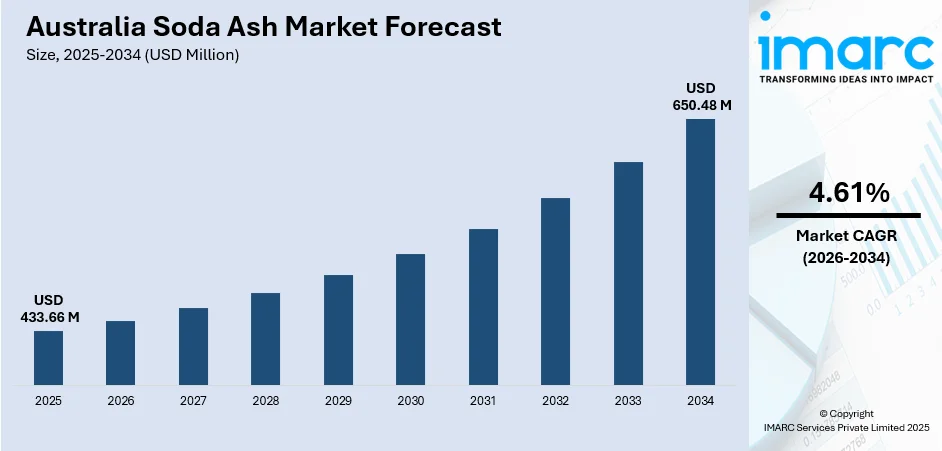

The Australia soda ash market size was valued at USD 433.66 Million in 2025 and is projected to reach USD 650.48 Million by 2034, growing at a compound annual growth rate of 4.61% from 2026-2034.

The Australia soda ash market is experiencing consistent growth driven by robust demand from the glass manufacturing sector, expanding construction activities, and rising consumption in detergent and chemical industries. Government sustainability initiatives, infrastructure development programs, and the increasing focus on domestic manufacturing capabilities are strengthening market fundamentals. Technological advancements in energy-efficient production processes and growing applications in water treatment are further supporting market expansion, positioning Australia as a key consumer of soda ash in the Asia-Pacific region and enhancing the Australia soda ash market share.

Key Takeaways and Insights:

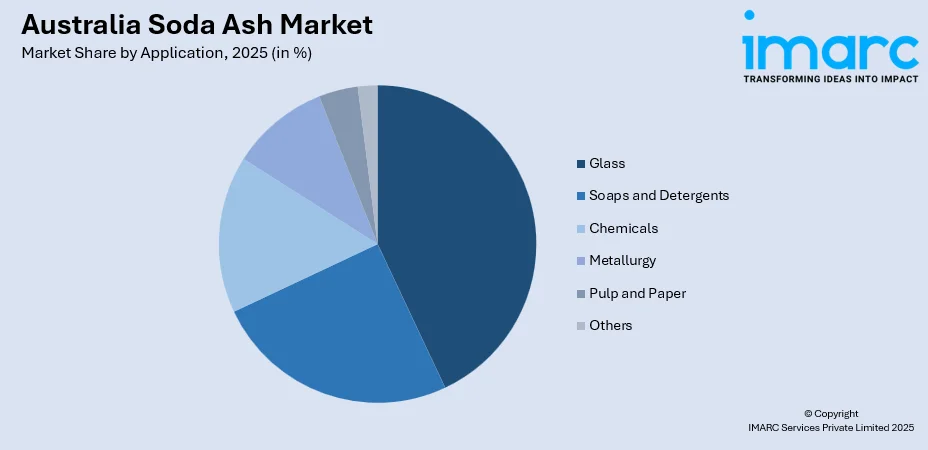

- By Application: Glass dominates the market with a share of 43% in 2025, driven by robust demand from construction, automotive, and packaging industries where soda ash serves as a critical raw material for flat glass, container glass, and specialty glass production across Australia.

- By Region: Australia Capital Territory & New South Wales lead the market with a share of 25% in 2025, reflecting the concentration of glass manufacturing facilities, chemical processing plants, and detergent production operations in this economically significant region.

- Key Players: The Australia soda ash market features a competitive landscape characterized by established chemical distributors, industrial suppliers, and regional manufacturers serving diverse downstream industries, including glass production, detergent manufacturing, water treatment, and chemical processing sectors.

To get more information on this market Request Sample

The Australian soda ash market is experiencing growth as industries such as glass manufacturing, detergents, chemicals, and water treatment expand to meet rising domestic demand. Continuous construction activity is boosting the consumption of flat and container glass, which drives soda ash use. The Australia construction market size was valued at USD 420.5 Billion in 2025. Looking forward, the market is expected to reach USD 603.0 Billion by 2034, exhibiting a CAGR of 4.09% from 2026-2034. Sustainability initiatives are prompting manufacturers to adopt energy-efficient production methods and circular economy practices. Eco-friendly detergent formulations and expanding water treatment infrastructure further support demand, highlighting the sector’s ongoing adaptation to environmental priorities while maintaining steady consumption of soda ash across multiple industrial applications.

Australia Soda Ash Market Trends:

Sustainable Glass Manufacturing and Recycling Initiatives

The Australian glass industry is steadily moving toward greater sustainability by adopting advanced recycling techniques and energy-efficient production processes. Companies are implementing innovative furnace technologies and enhanced cullet processing to lower carbon emissions while maintaining operational efficiency. This shift supports ongoing demand for soda ash as manufacturers align with environmental objectives and circular economy principles. Investments in modern recycling and manufacturing facilities are enabling higher production of glass products with substantial recycled content, reinforcing the role of sustainable practices in sustaining soda ash consumption across the domestic glass sector. For instance, in June 2024, The Orora glass bottle facility in Gawler undertook two new initiatives in collaboration with Origin Energy as part of the South Australian Government’s Retailer Energy Productivity Scheme (REPS). The plant, which employs close to 400 staff, produces a variety of wine, spirit, and beer bottles using both raw materials and recycled glass. Its beneficiation facility, opened in 2022, is the largest of its type in Australia and ranks among the top ten globally, reflecting the company’s commitment to advanced manufacturing and sustainable production practices.

Growing Demand for Eco-Friendly Cleaning Products

Australian consumers are increasingly prioritizing environmentally conscious cleaning products, driving manufacturers to develop sustainable detergent formulations. Soda ash remains a key ingredient due to its effectiveness as a water softener and cleaning agent combined with its biodegradable properties. The shift toward plant-based and phosphate-free detergents is supporting steady soda ash consumption. In May 2023, Unilever Australia invested AUD 9.5 million to upgrade its North Rocks facility in Western Sydney, enhancing production capabilities for brands including Omo and Surf to meet growing demand for sustainable cleaning products.

Expansion of Solar Glass Applications

Australia's renewable energy transition is creating new opportunities for soda ash consumption through solar panel glass manufacturing. In the first quarter of 2025, the country had over 4.1 million solar installations, generating demand for high-quality photovoltaic glass that requires soda ash in production. Government initiatives supporting domestic solar manufacturing are expected to strengthen this emerging application segment. In December 2025, the federal government announced USD 151 million under the Solar Sunshot program for the Hunter Valley Solar Foundry, a 500 MW facility producing lightweight and glass solar modules using local materials.

Market Outlook 2026-2034:

The outlook for the Australian soda ash market remains strong as industrial growth, infrastructure development, and sustainability initiatives collectively support ongoing demand. Glass manufacturing continues to drive consumption through construction and packaging applications, while chemical and detergent industries sustain consistent usage. Expanding government investment in water treatment facilities and renewable energy projects is opening new opportunities, further bolstering market growth. Overall, the convergence of traditional industrial demand and emerging sustainable applications underpins a positive trajectory for soda ash consumption in Australia. The market generated a revenue of USD 433.66 Million in 2025 and is projected to reach a revenue of USD 650.48 Million by 2034, growing at a compound annual growth rate of 4.61% from 2026-2034.

Australia Soda Ash Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Glass |

43% |

|

Region |

Australia Capital Territory & New South Wales |

25% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Glass

- Soaps and Detergents

- Chemicals

- Metallurgy

- Pulp and Paper

- Others

Glass dominates with a market share of 43% of the total Australia soda ash market in 2025.

The glass manufacturing sector is the largest consumer of soda ash in Australia, supplying products for construction, automotive, packaging, and renewable energy applications. The Australia glass market size reached USD 8.29 Billion in 2024. Looking forward, the market is projected to reach USD 17.25 Billion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. Soda ash acts as a key flux, lowering the melting temperature of silica and enabling cost-efficient production of flat, container, and specialty glass. Growing construction activity drives demand for architectural glass in windows, facades, and building envelopes, with energy-efficient glazing solutions increasingly incorporated in commercial and residential projects to enhance sustainability and meet building performance standards.

Automotive demand for glass components such as windshields, windows, and mirrors remains steady, while the packaging sector relies on glass containers for beverages, food, and pharmaceutical products. The solar glass segment is expanding as renewable energy adoption accelerates, creating new opportunities for soda ash use. Investments in glass recycling and cullet processing support circular economy goals, reducing raw material consumption and environmental impact while sustaining production requirements across traditional and emerging glass applications.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales lead the market with a 25% share of the total Australia soda ash market in 2025.

In the Australian Capital Territory and New South Wales, soda ash demand is primarily driven by industrial expansion and sustained construction activity. The glass manufacturing sector, supplying architectural, container, and specialty glass, consumes significant volumes of soda ash. Ongoing infrastructure projects and urban development increase the need for flat and container glass, while energy-efficient glazing solutions are becoming standard in commercial and residential buildings. This consistent consumption supports stable demand for soda ash, reinforcing its role as a critical raw material in regional industrial and construction applications.

The growth of renewable energy initiatives and sustainability-focused manufacturing in these regions is creating new avenues for soda ash consumption. Solar panel production, particularly photovoltaic glass, requires soda ash as a key input, aligning with government-backed renewable energy expansion. Additionally, investments in glass recycling and cullet processing facilities support circular economy objectives, reducing raw material use while maintaining production efficiency. Combined, these developments in renewable energy and recycling are driving incremental demand for soda ash, diversifying its applications beyond traditional glass and industrial uses.

Market Dynamics:

Growth Drivers:

Why is the Australia Soda Ash Market Growing?

Robust Construction and Infrastructure Development

Australia’s construction sector continues to be a key driver of soda ash demand, fueled by extensive glass requirements for residential, commercial, and infrastructure projects. Rapid urban development, population growth, and government-backed infrastructure initiatives are generating sustained consumption of flat glass, architectural glazing, and specialty glass products. Increasing emphasis on energy efficiency in building codes is boosting the adoption of high-performance glazing solutions, such as double-glazed and low-emissivity coated glass. Ongoing construction across major metropolitan areas and infrastructure developments is reinforcing long-term soda ash demand, reflecting the sector’s critical role in supporting glass manufacturing for a wide range of building applications.

Expanding Water Treatment Infrastructure

The water treatment chemicals market in Australia is experiencing significant growth as governments and industries invest in water quality improvement and wastewater management infrastructure. Soda ash serves essential functions in water treatment applications, including pH adjustment, water softening, and corrosion control. The municipal water treatment sector, commanding a huge share of the water treatment chemicals market, maintains robust demand through an extensive network of over 700 community sewage treatment plants serving approximately 85% of Australia's population. The Australian government's annual investment of around USD 6 billion in water and wastewater treatment services is supporting infrastructure expansion and chemical procurement. Industrial water treatment requirements across power generation, mining, and manufacturing sectors further strengthen demand. Recent facility upgrades including the AUD 238.5 million enhancement at Woodman Point Water Resource Recovery Facility in Western Australia demonstrate ongoing infrastructure investment supporting soda ash consumption.

Sustainability-Driven Manufacturing Transformation

Australia's manufacturing sector is undergoing significant transformation as companies invest in sustainable production technologies and circular economy initiatives. Glass manufacturers are implementing energy-efficient furnace technologies and expanding recycled content utilization, requiring consistent soda ash inputs while reducing environmental impact. The detergent industry is developing eco-friendly formulations that leverage soda ash's biodegradable properties and water softening capabilities. National sustainability targets and corporate environmental commitments are driving adoption of cleaner production processes across downstream industries. The Australian Packaging Covenant Organisation's target for 100% recyclable, compostable, or reusable packaging by 2025 is accelerating glass recycling investments. Advanced oxygen-only glass furnace technology is driving sustainable manufacturing by cutting energy use and increasing recycled glass production. These improvements support circular economy practices and maintain strong soda ash demand, ensuring efficient, environmentally aligned glass production.

Market Restraints:

What Challenges the Australia Soda Ash Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Australia's reliance on imported soda ash creates exposure to global supply chain disruptions, shipping delays, and international pricing fluctuations. Port congestion, elevated freight rates, and geopolitical tensions affecting major producing regions can impact supply reliability and procurement costs. The absence of significant domestic soda ash production capacity means Australian industries remain vulnerable to international market dynamics and currency fluctuations.

Energy Cost Volatility Affecting Downstream Industries

Rising energy costs across Australian manufacturing sectors are increasing operational expenses for glass producers, chemical manufacturers, and other soda ash consumers. Higher electricity and natural gas prices affect production economics and may constrain output expansion. Energy-intensive industries face cost pressures that could impact soda ash procurement volumes, particularly during periods of elevated energy prices or supply constraints.

Competition from Alternative Materials

Glass packaging continues to face strong competition from alternative materials such as plastics, aluminum, and fiber-based composites across various applications. Lightweight polymers provide benefits in certain uses, including enhanced flexibility, greater impact resistance, and cost-effectiveness. Ongoing pressure from these substitutes challenges domestic glass production and manufacturing competitiveness. As a result, demand for raw materials like soda ash may grow more slowly in specific sectors, reflecting shifting preferences toward alternative packaging solutions and the evolving dynamics of the broader materials market.

Competitive Landscape:

The Australia soda ash market features a competitive landscape characterized by established chemical distributors, industrial suppliers, and international trading companies serving diverse downstream industries. Market participants focus on supply chain reliability, logistics optimization, and technical support services to differentiate their offerings. Strategic partnerships with glass manufacturers, detergent producers, and chemical processors enable suppliers to secure long-term procurement agreements. Companies are investing in distribution network expansion, warehousing capabilities, and regional coverage to improve supply accessibility across industrial centers. The emphasis on sustainability is driving suppliers to offer products aligned with environmental standards while supporting customers' circular economy initiatives.

Recent Developments:

- February 2025: Visy's AUD 500 million glass recycling and manufacturing plant at Yatala, Queensland, entered its next construction stage. The precinct will manufacture one billion bottles annually with an average of 70% recycled content, representing a major investment in sustainable glass production infrastructure.

- December 2024: VINCI Construction won an AUD 385 million contract from Icon Water to upgrade Canberra's Lower Molonglo Water Quality Control Centre, including construction of a new membrane bioreactor to treat 97 mega-litres of wastewater daily, supporting water treatment chemical demand.

- July 2024: Visy ordered a USD 150 million oxygen-only glass furnace at its Penrith facility in New South Wales, reducing energy consumption by 50% while enabling production of 800 million recycled glass containers annually across the region.

Australia Soda Ash Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Glass, Soaps and Detergents, Chemicals, Metallurgy, Pulp and Paper, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia soda ash market size was valued at USD 433.66 Million in 2025.

The Australia soda ash market is expected to grow at a compound annual growth rate of 4.61% from 2026-2034 to reach USD 650.48 Million by 2034.

Glass represents the largest market share at 43% in 2025, driven by robust demand from construction, automotive, packaging, and renewable energy sectors, where soda ash serves as a critical raw material for glass manufacturing across Australia.

Key factors driving the Australia soda ash market include robust construction and infrastructure development, expanding water treatment infrastructure investments, sustainability-driven manufacturing transformation, and growing demand from glass, detergent, and chemical industries.

Major challenges include import dependency and supply chain vulnerabilities, energy cost volatility affecting downstream industries, competition from alternative materials in packaging applications, and limited domestic production capacity creating exposure to international market dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)