Australia Software Development Market Size, Share, Trends and Forecast by Language, Demand, Deployment Type, Business Size, End-Use Industry, and Region, 2026-2034

Australia Software Development Market Summary:

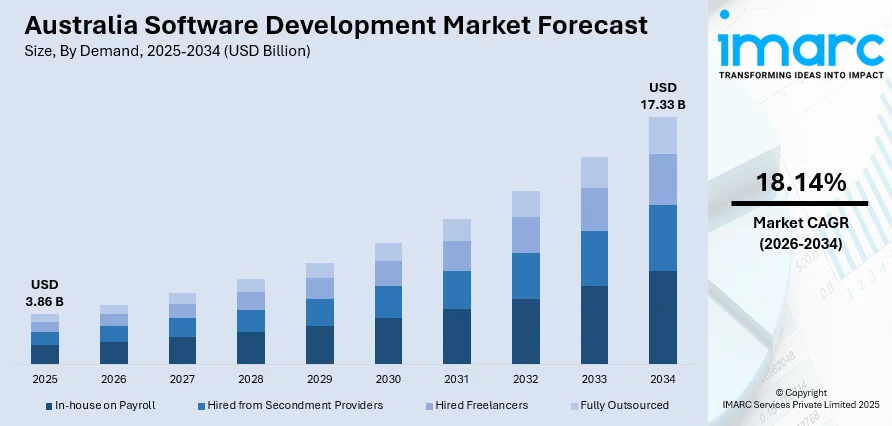

The Australia software development market size was valued at USD 3.86 Billion in 2025 and is projected to reach USD 17.33 Billion by 2034, growing at a compound annual growth rate of 18.14% from 2026-2034.

The market growth is primarily driven by Australia's accelerated digital transformation initiatives across enterprises, substantial government investments in technology infrastructure, and the nation's thriving startup ecosystem. The convergence of cloud computing adoption, artificial intelligence (AI) integration, and expanding remote work culture is fundamentally reshaping demand patterns for software development services. Rising requirements for sector-specific solutions across banking, healthcare, retail, and government sectors continue to create substantial opportunities for market participants.

Key Takeaways and Insights:

- By Language: JavaScript dominates the market with a share of 18% in 2025, driven by its universal browser compatibility, extensive framework ecosystem, and widespread adoption in both frontend and full-stack development across Australian enterprises.

- By Demand: In-house on payroll leads the market with a share of 46% in 2025, owing to enterprises' preference for maintaining direct control over proprietary codebases, ensuring intellectual property protection, and building long-term technical capabilities within their organizations.

- By Deployment Type: Cloud represents the largest segment with a market share of 61% in 2025. This dominance is driven by scalability advantages, cost-efficiency through pay-as-you-go models, and enhanced collaboration capabilities supporting distributed development teams.

- By Business Size: Small and medium business dominates the market with a share of 54% in 2025, reflecting the democratization of software development tools and cloud-based platforms enabling SMEs to compete effectively with larger enterprises.

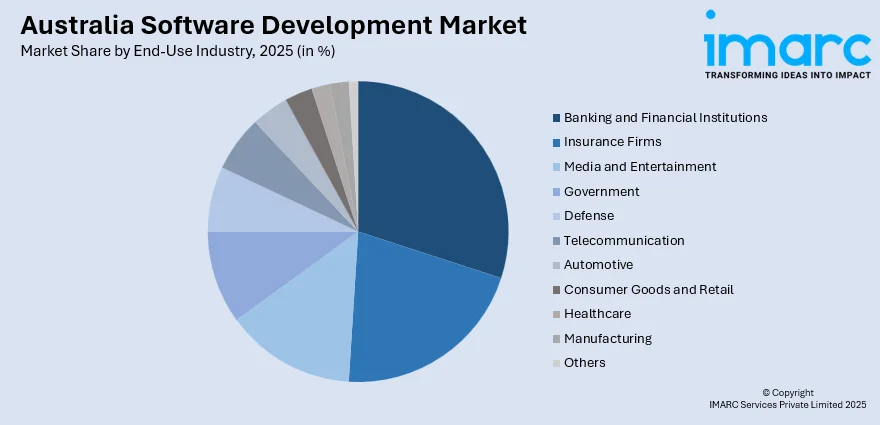

- By End-Use Industry: Banking and financial institutions lead the market with a share of 14% in 2025, due to digital banking transformation, regulatory compliance requirements, and increasing fintech integration demands.

- Key Players: The Australia software development market exhibits strong competitive dynamics, with internationally recognized unicorns such as Atlassian and Canva alongside emerging players competing across enterprise solutions, cloud platforms, and specialized vertical applications.

To get more information on this market Request Sample

The Australia software development market is experiencing growth, driven by the rapid adoption of advanced technologies, including cloud computing, AI, and machine learning (ML). As businesses across various sectors commit to digital transformation to enhance efficiency and competitiveness, there is a rise in the demand for innovative and customized software solutions. The growing need for software that facilitates automation, robust data analytics, and secure online platforms, alongside a heightened focus on cybersecurity and regulatory compliance, is influencing the market. This market growth is structurally supported by government action. For instance, in 2025, the Australian Government launched the National AI Plan to strategically grow the AI industry and build an AI-enabled economy that is productive and resilient. The plan focuses on three key goals like capturing opportunities by developing infrastructure and attracting investment, spreading benefits through workforce training and public service improvements, and ensuring public safety with robust legislative frameworks. This national strategy aims to ensure all Australians and industries benefit from AI while promoting responsible and ethical practices, thereby contributing to the market evolution and demand for advanced software capabilities.

Australia Software Development Market Trends:

Technological Advancements and Digital Transformation

The Australian software development market is being driven by rapid technological advancements and widespread digital transformation efforts across various sectors. As companies increasingly adopt cloud computing, AI, and ML, the demand for customized software solutions to support these technologies rises. A prime example of this growth is the 2025 joint venture between Infosys and Telstra to advance AI-powered digital transformation in Australia through their acquisition of a majority stake in Versent Group. This collaboration enhances cloud adoption and AI innovation, driving software developers to create solutions that improve efficiency, productivity, and the client experience, positively influencing the market.

Rising Trend of Software as a Service (SaaS)

Software as a service (SaaS) solutions provide businesses with flexible, scalable, and cost-effective alternatives to traditional on-premise software. This accessibility allows companies of all sizes to adopt advanced software applications without heavy upfront costs. The rise of SaaS is fostering innovation among local developers, who are increasingly creating user-focused, cloud-based solutions. A key example is Aqua Security’s launch of its Enterprise Cloud Native Security SaaS in Australia in 2024, addressing local data sovereignty and regulatory requirements like APRA CPS234. The SaaS offering, including supply chain security and vulnerability management, reflects the growing demand for subscription-based solutions in client management, impelling the sector growth.

Growing Demand for Enterprise Resource Planning (ERP) Systems

The growing complexity of business operations and the increasing need for efficient resource management are driving the demand for enterprise resource planning (ERP) systems in Australia. Companies across various industries are embracing ERP software to streamline their operations, integrate processes, and improve decision-making. With businesses demanding real-time data and centralized management of finances, supply chains, and human resources, the need for customizable ERP solutions is incrasing. As an example, in 2025, Akkodis acquired Barhead Solutions, a prominent Microsoft Business Applications partner, to enhance its CRM, ERP, low-code solutions, and digital transformation offerings, further bolstering the market growth.

Market Outlook 2026-2034:

The Australia software development market is poised for substantial growth, supported by ongoing digital transformation initiatives and the evolving technological needs of enterprises. The market generated a revenue of USD 3.86 Billion in 2025 and is projected to reach a revenue of USD 17.33 Billion by 2034, growing at a compound annual growth rate of 18.14% from 2026-2034. This growth reflects the increasing demand for innovative software solutions across various sectors in Australia.

Australia Software Development Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Language | JavaScript | 18% |

| Demand | In-house on Payroll | 46% |

| Deployment Type | Cloud | 61% |

| Business Size | Small and Medium Business | 54% |

| End-Use Industry | Banking and Financial Institutions | 14% |

Language Insights:

- JavaScript

- Java

- Python

- SQL

- Go

- PHP

- C/C++

- PERL

- Android

- iOS

- Scala

- Ruby

- LISA

- Others

JavaScript dominates with a market share of 18% of the total Australia software development market in 2025.

JavaScript holds the biggest market share due to its versatility and widespread use in both front-end and back-end development. With frameworks like React, Angular, and Node.js, JavaScript enables developers to create dynamic and responsive applications, making it a top choice for businesses.

Moreover, JavaScript's ability to work across multiple platforms, including web, mobile, and desktop, has contributed to its popularity. Its extensive ecosystem, supported by a large community and numerous libraries, allows developers to build scalable and efficient solutions, driving its continued dominance in the market.

Demand Insights:

- In-house on Payroll

- Hired from Secondment Providers

- Hired Freelancers

- Fully Outsourced

In-house on payroll leads with a market share of 46% of the total Australia software development market in 2025.

In-house on payroll represents the largest segment owing to the desire for greater control over projects and enhanced collaboration. Having developers within the organization ensures alignment with company goals and a deeper understanding about specific business needs.

Additionally, in-house teams allow for faster response times and more effective communication, reducing the risk of delays or misunderstandings. This direct involvement fosters a culture of innovation and ensures that software solutions are tailored to the company’s requirements, making it a preferred choice for many businesses seeking long-term, customized development support.

Deployment Type Insights:

- On-premise

- Cloud

Cloud exhibits a clear dominance with a 61% share of the total Australia software development market in 2025.

Cloud leads the market, driven by its scalability and flexibility. It allows businesses to easily adjust resources based on demand, reducing infrastructure costs and ensuring that applications are accessible from anywhere, which enhances collaboration and operational efficiency.

Moreover, cloud offers robust security features and automatic updates, ensuring that software remains secure and up-to-date without the need for manual intervention. The robust security, automatic updates, and cost-effectiveness offered by cloud solutions, which are highly appealing for business agility, are dramatically enhanced by initiatives in 2025, such as the launch of Australia’s first ASIC-powered sovereign AI cloud by SouthernCrossAI (SCX) and SambaNova, providing high-performance AI infrastructure with national-level data assurance.

Business Size Insights:

- Small and Medium Business

- Enterprise

- Government

Small and medium business dominates with a market share of 54% of the total Australia software development market in 2025.

Small and medium business leads the market, supported by agility and adaptability. These companies are quick to adopt new technologies and solutions, enabling them to remain competitive and innovate faster, even with limited resources.

Additionally, Small and medium business is investing in cost-effective software solutions that streamline operations and improve efficiency. The availability of scalable, customizable software options allows smaller businesses to access powerful tools once reserved for larger corporations, making software development more accessible.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Banking and Financial Institutions

- Insurance Firms

- Media and Entertainment

- Government

- Defense

- Telecommunication

- Automotive

- Consumer Goods and Retail

- Healthcare

- Manufacturing

- Others

Banking and financial institutions leads with a market share of 14% of the total Australia software development market in 2025.

Banking and financial institutions dominate the market because of their reliance on advanced technology for managing transactions, customer data, and regulatory compliance. These industries require robust software solutions to ensure security, efficiency, and scalability in an increasingly digital landscape.

Additionally, the growing demand for fintech innovations, such as mobile banking apps, AI-driven risk analysis, and blockchain technology, is driving the need for specialized software development. The financial sector's need for tailored software solutions to modernize operations is strongly supported by successful collaborations, such as Nucleus Software's 2025 announcement of its partnership with the Bank of Sydney to transform digital lending using the FinnOne Neo® platform, which resulted in a 40% faster implementation and enhanced operational efficiency.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory and New South Wales are key regions for business and technology development. Sydney, the largest city, drives much of the economic activity, with a strong focus on innovation, finance, and technology.

Victoria, home to Melbourne, is a hub for culture, technology, and finance, while Tasmania is known for its natural resources and tourism industry. The regions are increasingly investing in sustainable practices and digital transformation to drive economic growth and innovation.

Queensland stands out for its diverse economy, ranging from tourism to resources and agriculture. Brisbane, the state capital, is rapidly developing as a technology and innovation center, attracting startups and fostering business opportunities in various sectors, including software development.

Northern Territory and South Australia focus on mining, energy, and defense sectors. Adelaide, South Australia's capital, is a growing center for defense technology and space exploration, while the Northern Territory emphasizes resource management and sustainable development in remote areas.

Western Australia is rich in natural resources, particularly in mining and energy, making it a crucial region for Australia’s economy. Perth, the state capital, is a major center for the resource industry, with growing investments in technology and infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Australia Software Development Market Growing?

Growing Focus on Cybersecurity and Data Privacy

With rising concerns over data breaches and privacy regulations, businesses in Australia are increasingly prioritizing the development of secure software systems to safeguard sensitive information. In response, software developers are incorporating advanced security features, such as encryption, authentication protocols, and compliance with industry standards, into their applications. The growing emphasis on cybersecurity is a key factor influencing the market by driving the demand for secure, resilient software solutions that protect sensitive data and ensure compliance with evolving regulatory requirements. According to the Cybercrime in Australia: 2024 report from the Australian Institute of Criminology, 47% of Australians experienced at least one form of cybercrime in the past year, further highlighting the need for robust data protection measures in software solutions.

Rising Adoption of Cloud Computing

Cloud computing is becoming a cornerstone of modern IT infrastructure in Australia, contributing to significant growth in the software development market. As businesses adopt cloud-based solutions for their scalability and cost-effectiveness, the demand for software that integrates seamlessly with cloud platforms is rising. In 2024, the Australian cloud computing market reached USD 12.7 Billion, as per the IMARC Group, reflecting the growing importance of cloud technologies. This shift is leading to the development of cloud-native applications and creating a demand for software developers skilled in cloud technologies, particularly those offering remote accessibility, data storage, and collaboration tools, essential for modern IT environments.

Support from Start-up Ecosystem and Venture Capital

The dynamic start-up ecosystem in Australia is influencing the market, supported by venture capital and government initiatives. This environment fosters rapid innovation across sectors like fintech, healthtech, and edtech. This focus on advanced technology is highlighted by a major collaboration in 2025, where OpenAI partnered with key Australian companies to enhance AI infrastructure, workforce skills, and the startup ecosystem. This initiative includes the establishment of a hyperscale AI campus, nationwide training programs, and direct support for startups. This strategic investment in AI infrastructure is set to intensify the competitive environment for cutting-edge software solutions and further solidify Australia's position in global tech innovation.

Market Restraints:

What Challenges the Australia Software Development Market is Facing?

Evolving Talent Availability and Skills Alignment

The software development market faces ongoing challenges in aligning talent availability with the specific skills employers require. While there is an adequate supply of software engineers, many lack the employability skills and hands-on experience needed for particular roles. This gap between the qualifications of candidates and employer expectations is a significant hurdle, making it difficult for organizations to fill roles with the right talent efficiently.

Cybersecurity Concerns and Data Protection Requirements

As digitalization accelerates, the risk of cyber threats and data breaches grows, creating an urgent need for robust security practices. Enterprises must allocate substantial resources to develop secure applications, ensure compliance with regulations, and implement effective data protection measures. This added complexity and cost can slow innovation and software development timelines, requiring a delicate balance between security, compliance, and growth within an organization.

Implementation Costs and Legacy System Integration

Many organizations face significant challenges in integrating modern software solutions with legacy systems. Existing data is often scattered across outdated infrastructure, leading to inefficiencies and disconnected workflows. Upgrading or replacing legacy systems requires substantial financial investment and careful change management, presenting obstacles for companies with constrained digital transformation budgets. This complexity can delay progress and hinder efforts to improve operational efficiency through new technologies.

Competitive Landscape:

The Australia software development market exhibits dynamic competitive intensity characterized by the presence of globally recognized technology companies alongside emerging local innovators competing across enterprise solutions, cloud platforms, and specialized vertical applications. Market dynamics reflect strategic positioning ranging from comprehensive full-stack development offerings to specialized solutions targeting specific industry verticals and technology domains. The competitive landscape is increasingly shaped by AI capabilities, cloud-native architectures, and the ability to deliver seamless digital experiences across multiple platforms and devices. Strategic partnerships between established enterprises and innovative startups continue to reshape competitive dynamics, while sustainability initiatives and remote work capabilities are emerging as important differentiators in attracting both users and talent.

Recent Developments:

- In December 2025, AWS launched three AI agents, including Kiro, AWS Security Agent, and AWS DevOps Agent, designed to automate software development, security, and operations tasks. These agents act as virtual team members, capable of handling complex tasks independently, from coding and vulnerability detection to infrastructure monitoring and incident management. Early adopters like SmugMug and Commonwealth Bank of Australia report significant improvements in efficiency, security, and operational reliability across enterprise systems.

- In May 2025, Svitla Systems officially launched operations in Sydney, Australia, marking its expansion into the Asia-Pacific region. The company will provide outstaffing, custom software development, AI solutions, and B2B commerce services, leveraging its global delivery model for flexibility and scalability.

Australia Software Development Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Languages Covered | JavaScript, Java, Python, SQL, Go, PHP, C/C++, PERL, Android, iOS, Scala, Ruby, LISA, Others |

| Demands Covered | In-house on Payroll, Hired from Secondment Providers, Hired Freelancers, Fully Outsourced |

| Deployment Types Covered | On-premise, Cloud |

| Business Sizes Covered | Small and Medium Business, Enterprise, Government |

| End-Use Industries Covered | Banking and Financial Institutions, Insurance Firms, Media and Entertainment, Government, Defense, Telecommunication, Automotive, Consumer Goods and Retail, Healthcare, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia software development market size was valued at USD 3.86 billion in 2025.

The Australia software development market is expected to grow at a compound annual growth rate of 18.14% from 2026-2034 to reach USD 17.33 billion by 2034.

JavaScript dominates the market with 18% revenue share in 2025, driven by its universal browser compatibility, extensive framework ecosystem, and widespread adoption across frontend and full-stack development.

Key factors driving the Australia software development market include the rapid technological advancements, particularly in cloud computing, AI, and ML. The 2025 Infosys-Telstra joint venture to advance AI-powered transformation highlights the growing demand for customized software solutions.

Major challenges include skills alignment gaps between available talent and employer requirements, cybersecurity concerns and data protection compliance requirements, legacy system integration complexities, and implementation costs for comprehensive digital transformation initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)